NicoElNino

Summary

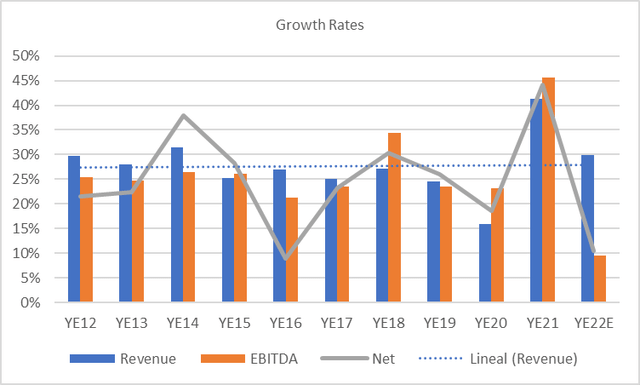

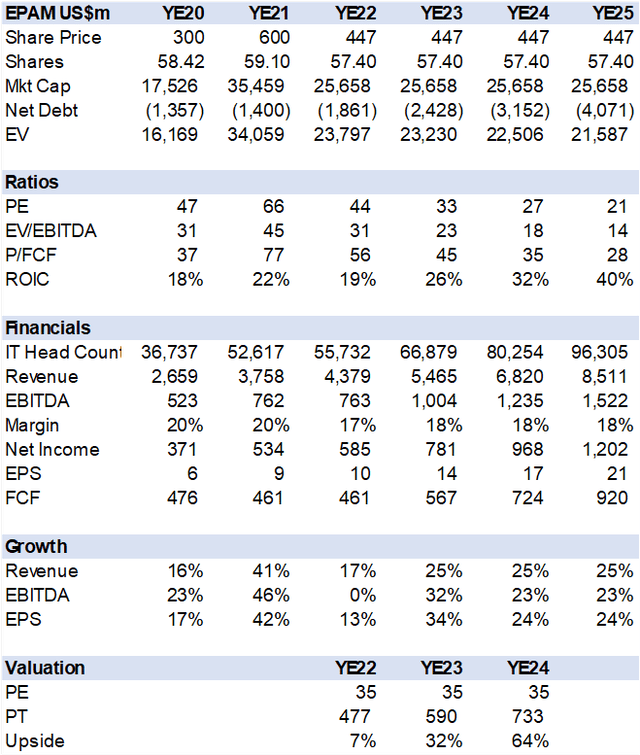

EPAM Systems, Inc. (NYSE:EPAM) is well on its way to retaking 25% growth in YE23 after successfully executing crisis management in the wake of the Russian invasion of Ukraine that threated the company’s viability. EPAM has relocated and hired IT personnel, kept clients, and increased revenue as seen in 2Q22 results. I estimate a return to 25% revenue growth and normalized margins in YE23 that drives a fair price target of US$600.

Existential Threat Avoided

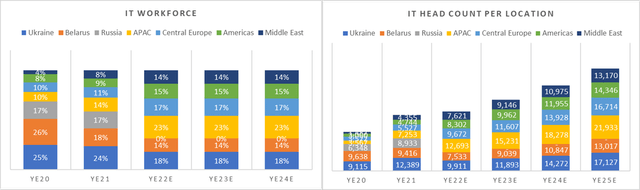

EPAM has successfully evaded a major disaster. The IT consultant had over 58% of its IT delivery staff in Ukraine, Russia, and Belarus when the Ukraine invasion began. This posed a major existential risk to operations. The stock dropped 50% in a few days as the company pulled guidance and began to execute personnel relocation and rapid hiring in other key IT software staffing markets such as India and Latina America. The key question at the time was how fast could it replace, at worst, 58% of its IT staff and would clients postpone or cease projects with EPAM, was the company viable?

EPAM IT head count breakdown (Created by author with data from EPAM)

The 1Q22 results appeased the worst case scenario as client hours continued to be delivered and personnel relocation began. 2Q22 results have further eased fears on the revenue front as EPAM has been able to expand IT workforce and maintain a high level of utilization as well as increase pricing. However, the rapid hiring across other markets and relocation related expenses has bit into margins.

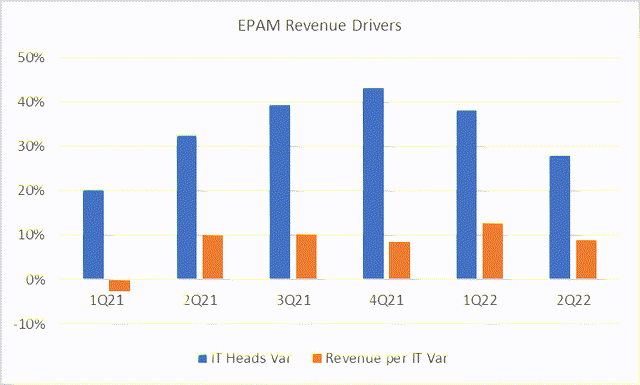

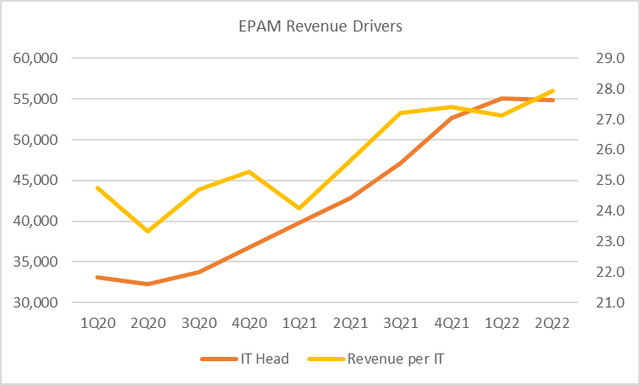

IT head count growth reached record levels during YE21 and then declined to an under 30% year over year pace in 2Q22. However, from 1Q22 to 2Q22, the impact of the Ukraine invasion is seen with a flat IT workforce at 55k. This is extraordinarily positive given that about 41% of IT staff was in Ukraine and Russia and subject to sever disruption. A further positive driver, revenue per IT employee is still growing at a 10% pace.

Growth YoY for EPAM IT staff and revenue per person (Created by author with data from EPAM)

EPAM IT staff and revenue per worker (Created by author with data from EPAM)

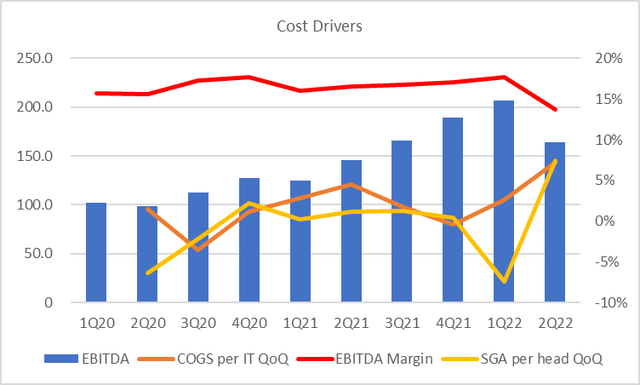

However, EPAMs ability to maintain its IT workforce functioning came at a cost. The company relocated much of the Russian staff and provided extra assistance to Ukraine and accelerated hiring in other markets, all of which resulted in higher costs and lower productivity. The net result was a 389-basis point reduction in EBITDA margin to 13.8% or about US$47m in additional costs. This margin pressure should continue in 2H22 before normalizing in YE23 as indicated by management guidance.

EBITDA margin impact in 2Q22 (Created by author with data from EPAM)

Valuation

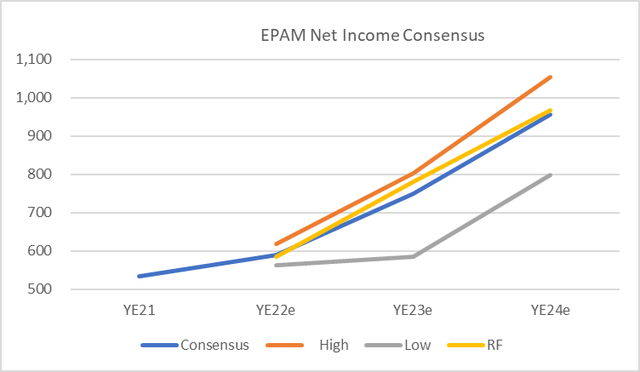

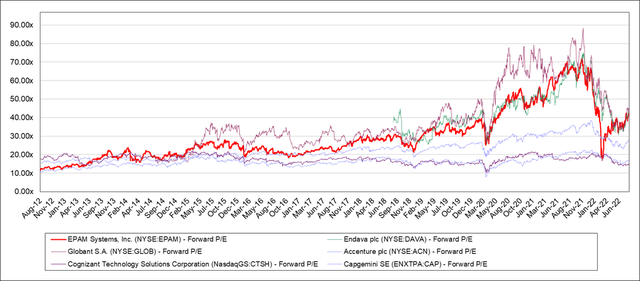

In my view, EPAM is out of danger and back on track to resume growth and recuperate margins in YE23 as it greatly diversifies the IT delivery base as well as maintains and grows its customer contracts. Under my estimates, which are a bit higher than consensus and at a target P/E of 35x, in line with historic levels (excluding the YE20-YE21), the stock could reach US$600 by YE23.

EPAM Consensus Estimates vs Author (Created by author with data from Capital IQ) Historic PE valuation for EPAM and select peers (Created by author with data from Capital IQ)

Peer Comps

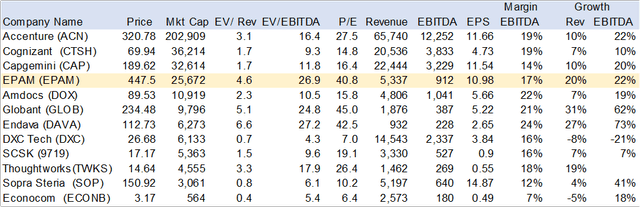

Some very large and recognizable peers include Accenture (ACN) and Cognizant (CTSH). The primary difference in valuation is due to growth, smaller companies like EPAM, Globant (GLOB) and Endava (DAVA) have room to grow faster, at least for the next 5 years.

EPAM peer comps (Created by author with data from Capital IQ)

What is EPAM

The company provides businesses with software engineering, design and consulting to digitize front end sales/customer interactions and back-end production/administration as well as implement SAP, Big data and Machine Learning etc. It’s a growing US$1 trillion market and essential capex for all sectors and companies.

EPAM has a human-capital intensive operating model where IT engineers, of all disciplines, execute customer projects on a contact bases. Clients usually have a 6 months or longer contract time frame, which provides for a good forward view of revenue and earnings. The industry charges by manhours required to meet project needs while costs are predominantly wages. The key margin drivers come from sourcing human capital in lower cost markets, i.e., the developing world such as Eastern Europe, India and Latina America that have solid pools of talent at lower wages. Operating leverage comes from higher utilization of this work force, i.e., the level of engagement in a client project vs down time.

EPAM’s growth is driven by customer satisfaction, repeat and enlarged contract work as well as winning new clients. It’s a very competitive business and one may view it as a sector with low barriers if entry. However, to grow and thrive in this market a company needs to have the manpower, manage 50,000 IT engineers and deliver results, not an easy feat. In addition, companies like EPAM look to smaller scale M&A on a regular basis. They acquire niche software providers that have developed some core competencies that can be rapidly assimilated into EPAMs larger ecosystem of services.

EPAM Growth Rates (Created by author with data from Capital IQ)

Financial Estimates and Valuation

Financial Estimates and Valuation Summary (Created by author with data from EPAM)

Conclusion

EPAM is one of a few IT consultants/software enterprises that can grow over 25% a year for the next 5yrs, in my view. Its 30yr track record of successfully adding global clients, managing millions of man hours and delivering productivity and innovation while achieving solid cash flow is proof of concept and execution. Dealing with the invasion of Ukraine, that threatened 41% of its IT delivery work force, is another testament to management execution. As operating results move back to trend, the stock price should recover to US$600 level during YE23.

Be the first to comment