Melpomenem

I remember that I am here not because of the path that lies before me but because of the path that lies behind me.

Source: Morpheus on finally selling his mortgage REITs

Annaly Capital Management, Inc. (NYSE:NYSE:NLY) just got added to the midcap index and celebrated that news with a reverse split. The stock remains a popular income choice and one that we have generally avoided. We pick up from where left off our coverage and weigh in on the exceptionally poor returns in the last decade. We also tell you why 2023 may be the hardest test for this mortgage REIT.

What Did You Make Income Investor?

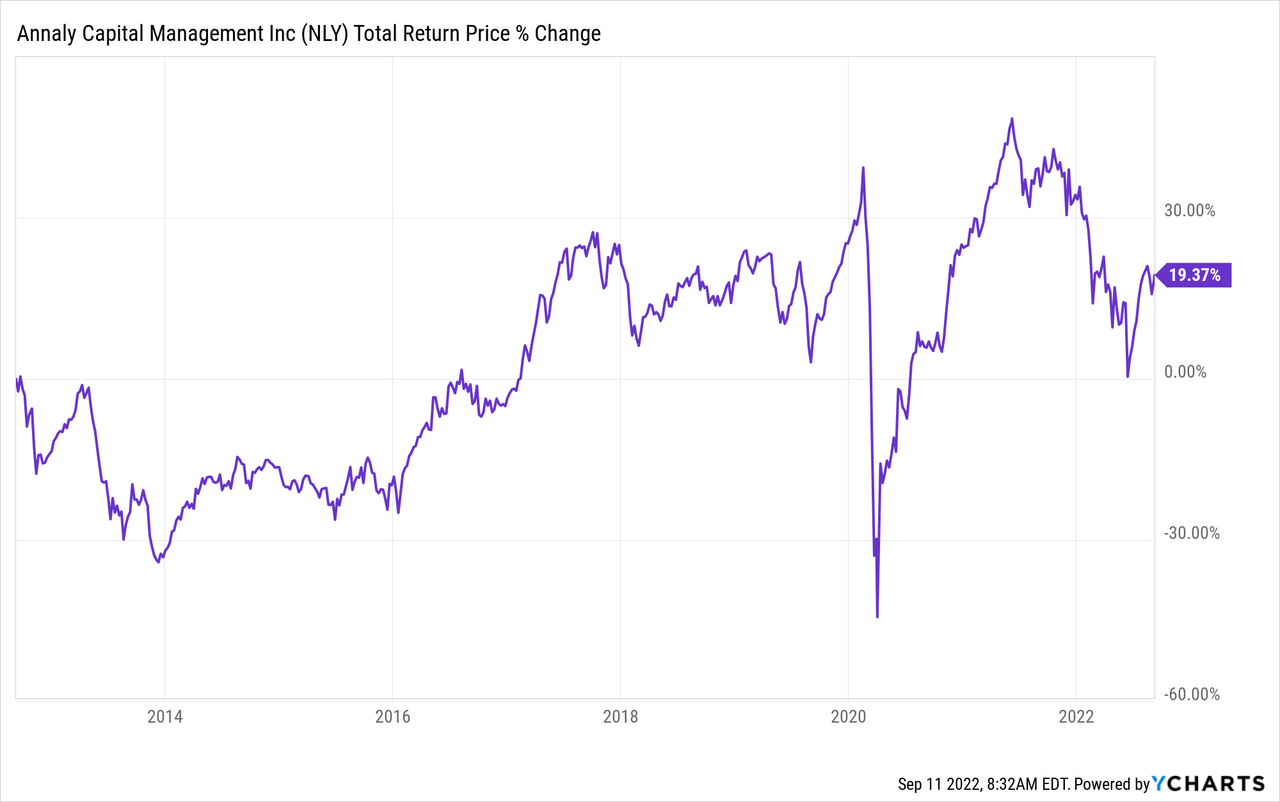

NLY’s total returns with dividends reinvested has been 19.37% over the last decade, or less than 2% a year.

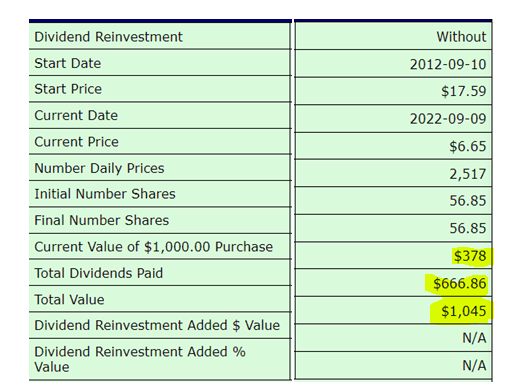

Of course this claim is disputed by people who just “love” the “fat dividends”. If you are investing for income, you are obviously not reinvesting the dividends. If you are consuming the dividends you actually did far worse with a total return of 4.5% over 10 years or less than 0.45% compounded annual returns.

Buy Upside

One point here is that a lot of those shareholders have these shares in taxable accounts and then your total return goes real bad when you account for Uncle Sam.

Why Did You Make So Little?

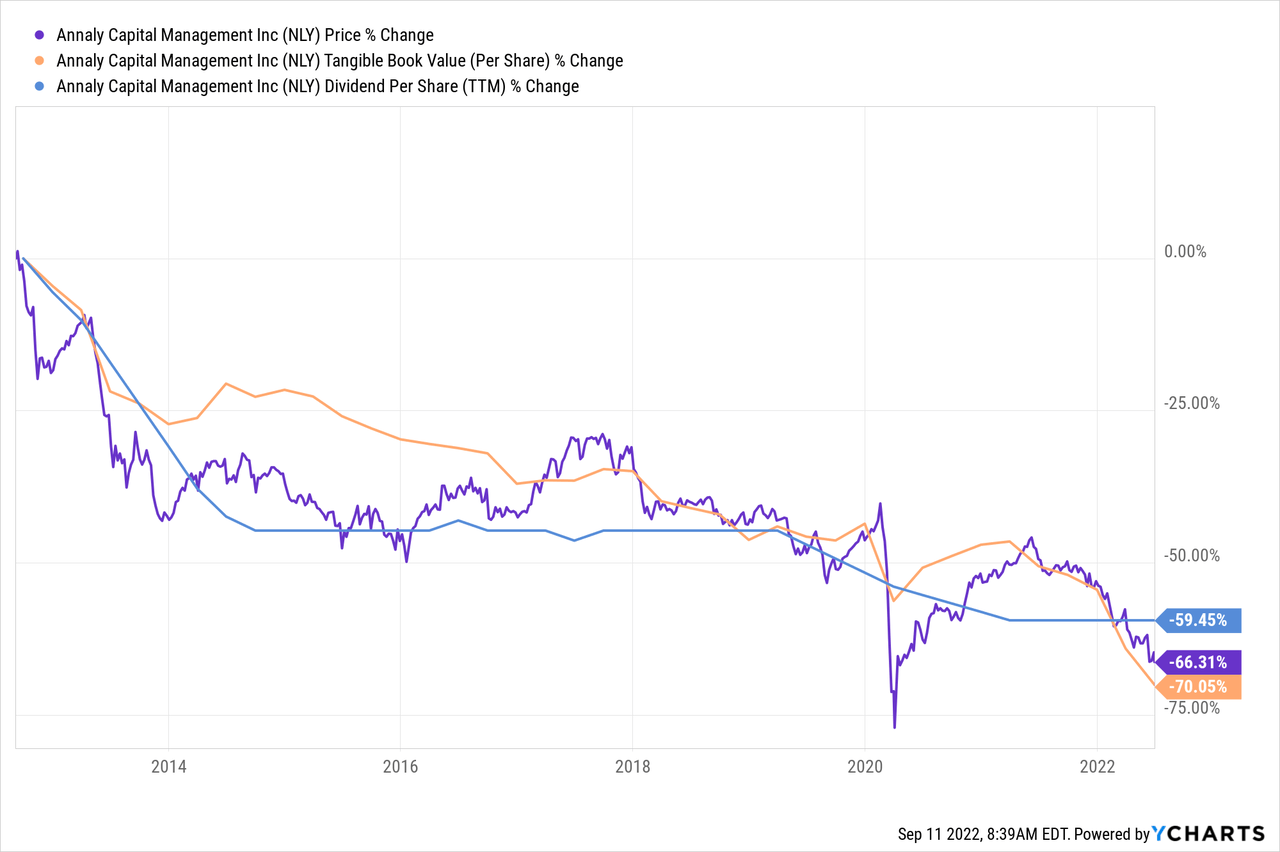

You cannot squeeze blood from stone. Mortgage REITs can only make money on tangible equity. Most sophisticated investors know that and they laugh at the idea of chasing a dividend stream without paying attention to tangible book value. While Price, Tangible Book Value and Dividend Per Share can deviate from each other, over longer time frames they are buxom buddies.

So guess where that light blue line is headed?

Challenges In 2023

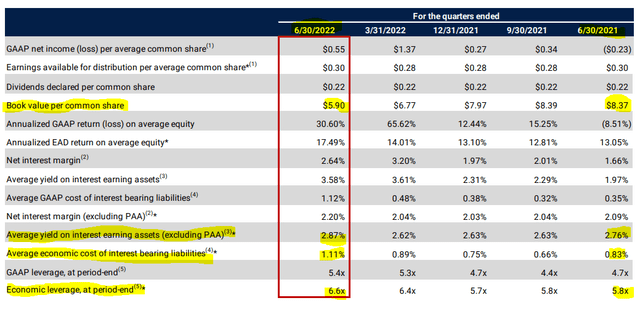

Over the last 12 months we have seen some substantial book value erosion in NLY.

NLY Q2-2022 Presentation

NLY has also dialed up leverage and this is essentially a function of selling less assets than they should have to maintain constant leverage. This is a useful exercise for investors and one should start with the $8.37 of book value with a 5.8X leverage. That works out to about $56.92 of total assets per share supported by $8.37 of equity per share. If you decline that equity to $5.90, then your economic leverage moves up to 8.64X. So you sell assets to bring leverage back down and that is what NLY did. But they stopped quite a good distance ahead of the original leverage mark. In the case of NLY, there was also a secondary equity offering done that allowed them to hold on to a larger portfolio.

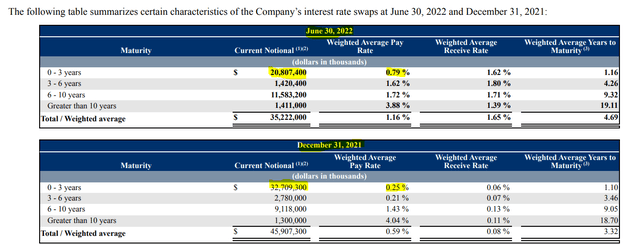

Through all this turmoil, the interest rate spread has remained relatively unimpacted. NLY’s hedge book has helped heavily here by locking in low rates when the going was good. That hedge book is rolling over and the rates are moving up with it.

NLY Q2-2022 Presentation

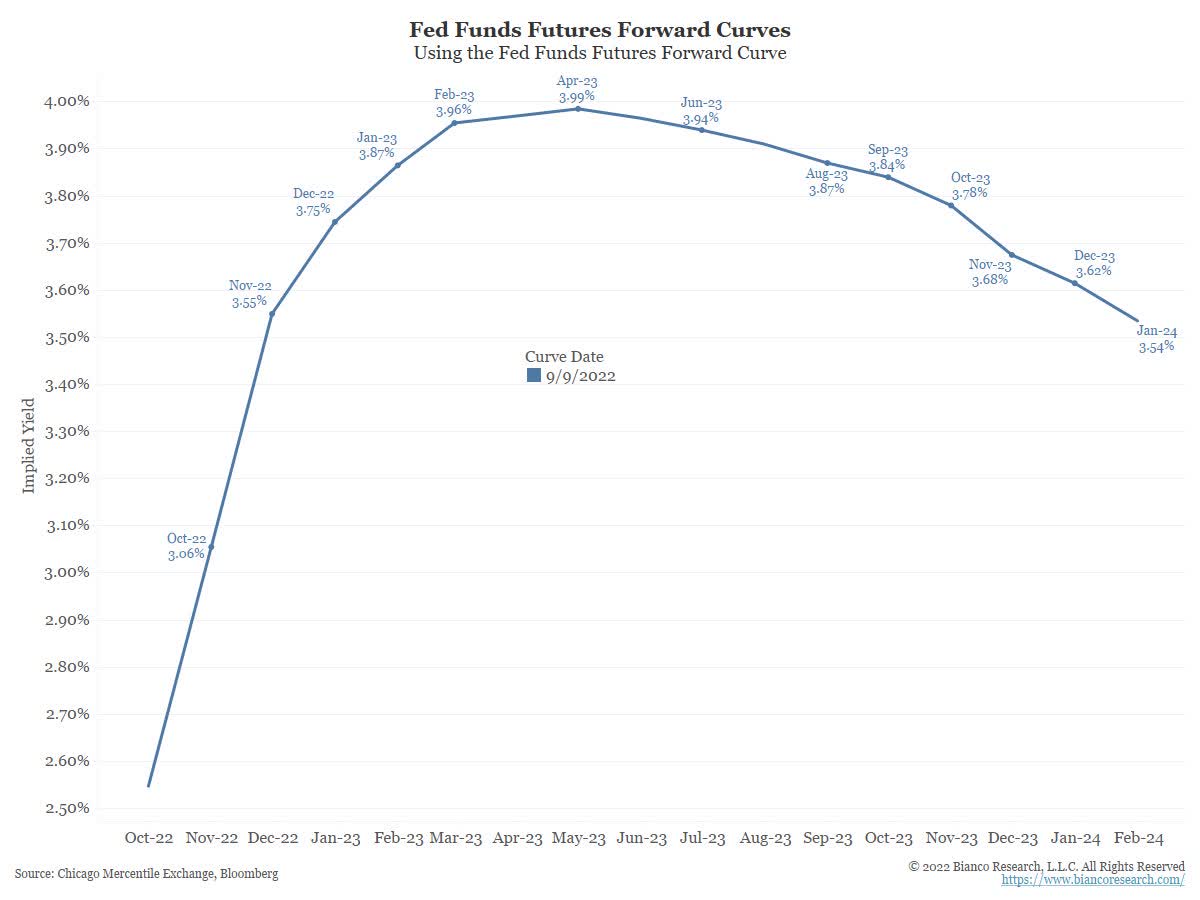

Funding costs in 2023 will be completely different and we are likely to see a remarkable spread compression as we get into Q2-2023.

Bianco Research-Twitter

NLY still has a few months of 2022 where it will likely be tested on mortgage backed security or MBS, spread blowouts. But the real test will come in 2023 as the yield curve inverts and its shorter term hedges run out or get repriced far higher.

New Dividend

We project that based on forward curves, it will be very difficult for NLY to make money in 2023 and a new dividend, likely around 15 cents a share a quarter will be implemented in Q2 or Q3. This would be 60 cents a share based on the reverse split that comes into effect soon.

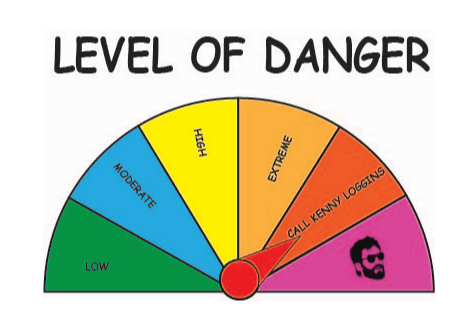

NLY gets the following dividend safety rating on our proprietary Kenny Loggins Scale.

Kenny Loggins Danger Zone Scale

A “Call Kenny Loggins” rating implies a 90% plus probability of a dividend cut within 12 months. This is of course our prediction and has nothing to do with NLY’s current commentary.

Verdict

NLY’s common share is likely going to prove to be another value trap over the next 12 months, much like the last decade. Of course investors can trade in and out of these and perhaps make money.

All other things being equal though, you will make more money from the long side, in stocks which slope upwards rather than those that slope downwards.

Source: Tapping Value’s Razor

Keep that in mind if you decide to trade NLY.

The preferred shares of NLY are a different matter and they have tended to present opportunities from time to time for the yield seeker who cares about total returns. NLY has three classes outstanding currently.

1) Annaly Capital Management, Inc. 6.95% PFD SER F (NYSE:NYSE:NLY.PF).

2) Annaly Capital Management, Inc. 6.50% PFD SER G (NYSE:NYSE:NLY.PG)

3) Annaly Capital Management, Inc. 6.75% PFD SER I (NYSE:NYSE:NLY.PI)

NLY.PF is the most interesting as it floats end of this month at LIBOR + 4.993% and that should put its yield close to 8.5% pretty soon. This is a big jump from the coupon, so it is likely NLY will try and redeem this. This might be a safe issue as an aggressive Federal Reserve will guarantee this one’s redemption. AGNC Investment Corp. (AGNC) offered a new preferred share recently and NLY may try and tap the market for one as well.

NLY.PG floats at the end of March 2023 at a slight smaller LIBOR spread (+4.172%). We think that is a fairly priced issue currently and NLY will not call this one.

NLY.PI call date is in June 2024 and has a LIBOR + 4.989% yield when it floats. We think this is the most expensive issue relative to choice available. We had previously described two preferred issues, one from Dynex Capital, Inc. (DX) and one from PennyMac Mortgage Investment Trust (PMT). We think both issues are superior to this one.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment