Patrick Jennings/iStock via Getty Images

Introduction

Tractor Supply Company (NASDAQ:NASDAQ:TSCO) has long been on my watch list, but I never managed to pick it up. Having just returned from the US, I came across a couple of stores, and naturally felt inspired to have a closer look at this niche retailer, who consistently posts strong economics but also, more often than not, trades at a valuation premium.

Who is Tractor Supply Company?

Tractor Supply Company was founded in 1938, 84 years ago, and has served its niche of farmers, ranchers and those enjoying the rural lifestyle, ever since. The company operates just above 2000 physical Tractor Supply stores across 49 states and is by far the most significant retailer in its niche in the US, focusing on meeting the needs of customers within home improvement, agriculture, livestock as well as lawn and garden maintenance. Stores typically contain 10,000+ different products, showing the range and possibilities to satisfy customers, also operating a number of exclusive brands. Beyond its 2000+ Tractor Supply stores, the company also operates 178 Petsense stores in 23 states, where the core segment is meeting the needs of pet owners. Overall, Tractor Supply’s presence is largest in Texas, North Carolina, Pennsylvania, Tennessee and Georgia, while smallest amongst Nevada, Montana, Idaho, Wyoming and Iowa when excluding states with a very small geographical footprint.

The company itself states that its target group is home, land, pet and livestock owners, who generally have above average incomes and below average living expenses. The company has experienced a shift in demand since the onset of Covid-19 as customers focused on the care of their homes, land and animals, resulting in growing demand towards Tractor Supply Company.

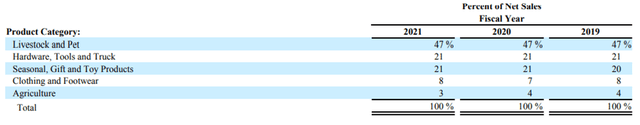

Tractor Supply Product Category Sales (Tractor Supply 10K 2021)

A testament to Tractor Supply’s growing business, is the current construction of a new 900,000 square feet distribution center in Ohio, with an additional distribution center planned for Arkansas, expected to be completed during 2023. During 2020, the company opened eighty new Tractor Supply stores, as well as nine new Petsense stores. Similarly, in 2021, an identical number of Tractor Supply stores were opened, as well as seven new Petsense stores. To little surprise, the company is expecting to have launched 75 to 80 new Tractor Supply stores during 2022, supported by an expected ten new Petsense stores. All these new stores are the equivalent of expanding the selling square footprint of the company by 4% annually. Of all these stores, roughly 57% are freestanding buildings, with the rest being located in shopping malls, while 95% of the stores are leased, meaning the company owns the remaining 5%.

While we typically categorize retailers as either staple or discretionary, my conclusion is that Tractor Supply is situated somewhere in between. Many of the products are belonging to staple spending (as they support livestock and otherwise), while others are discretionary in nature (equipment and machinery as existing assets may be able to last an additional season if maintained). Further, that customers may opt out of going for the pricier and exclusive brands during hard times. Besides that, Tractor Supply is exposed to similar risks as other retailers covering from competitors, supply chain, brand damage, data security, failed acquisitions and otherwise. However, it’s important to keep in mind that Tractor Supply isn’t a novice in its field of operations. It’s been around for ages and has continued to secure a profitable business since.

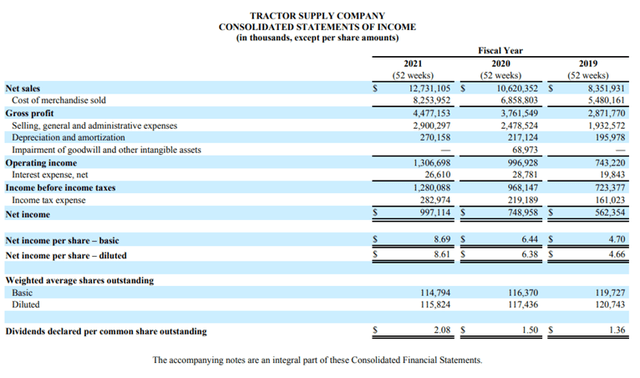

Tractor Supply Income Statement (Tractor Supply 10K 2021)

If we turn to the actual economic performance, it quickly becomes evident that the company has indeed flourished in recent years, with strong top- and bottom-line development as also mentioned earlier concerning managements own observations during the Covid-19 period.

- Revenue grew 27% during 2020 and 20% during 2021.

- Both years, net income outpaced revenue as it expanded 33% in both years.

- This has allowed for some strong dividend hikes to the tune of 10% and 38% respectively.

Forward consensus estimates for FY2022 however, are well below what shareholders have gotten used to in the recent couple of years, with revenue expected to reach $13.98 billion, corresponding to a 9.8% increase. For FY2023, the expected revenue growth is 6.34%. EPS growth is expected to slightly outpace revenue at 11.4% and 8.8% respectively.

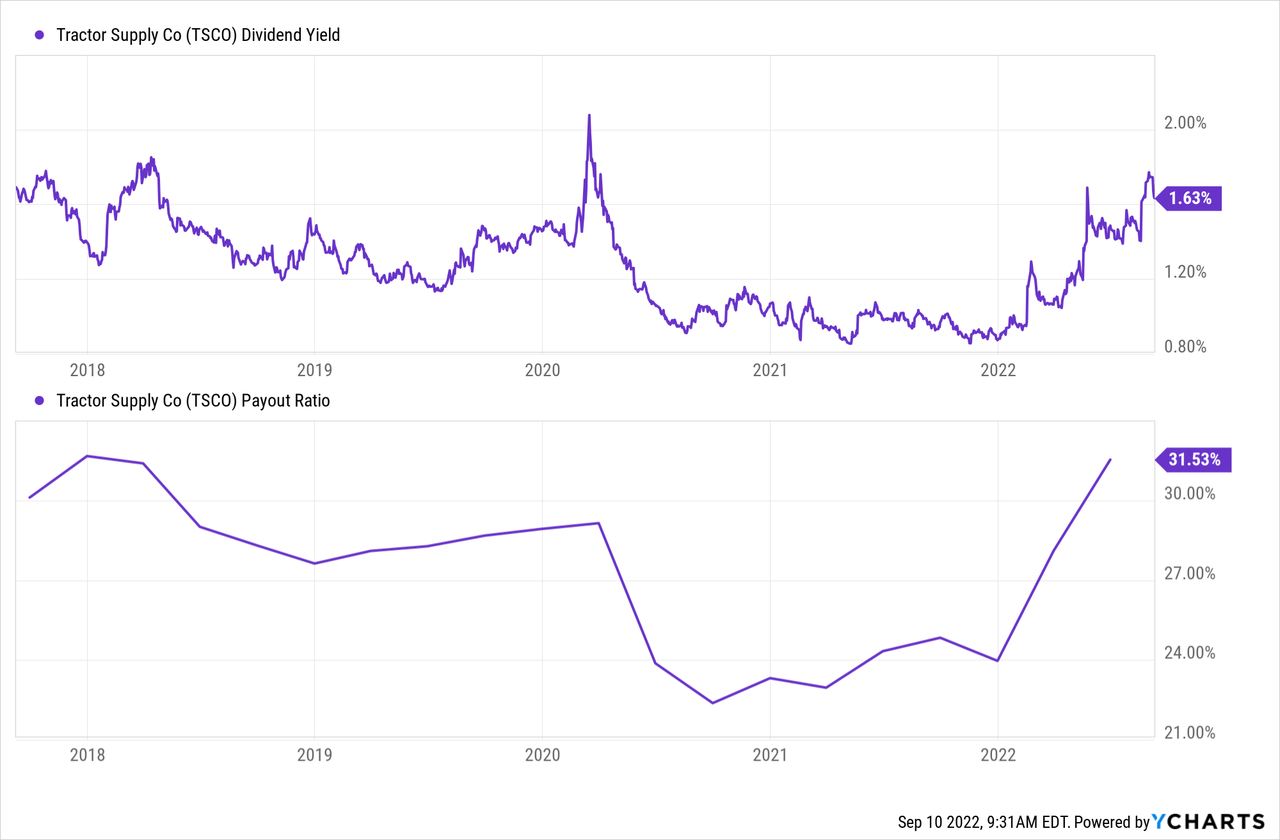

I’m a dividend growth investor, and here Tractor Supply holds much promise. However, my own threshold for when a company is worth adding to the portfolio from a dividend growth perspective, isn’t met in the case of this company. Such matters are individual, but I strive to add companies with a 2.5% starting yield, with a payout ratio below 60%. Naturally, I deviate from that rule from time to time, such as in the case of when I picked up Visa (V) back in 2016. I deviated from the rule, because Visa has a clear growth runway ahead of it on a global scale, meaning that initial 0.7% dividend yield, over decades may compound strongly. Tractor Supply also has ample room to grow its dividend for many, many years, but only being able to expand one’s square feet sales footprint by roughly 4% annually, naturally gives some limitations over time. Therefore, requiring the initial yield to be higher, in order to meet the inevitable penny hikes down the road with a strong current yield. As such, Tractor Supply’s historical yield doesn’t please me.

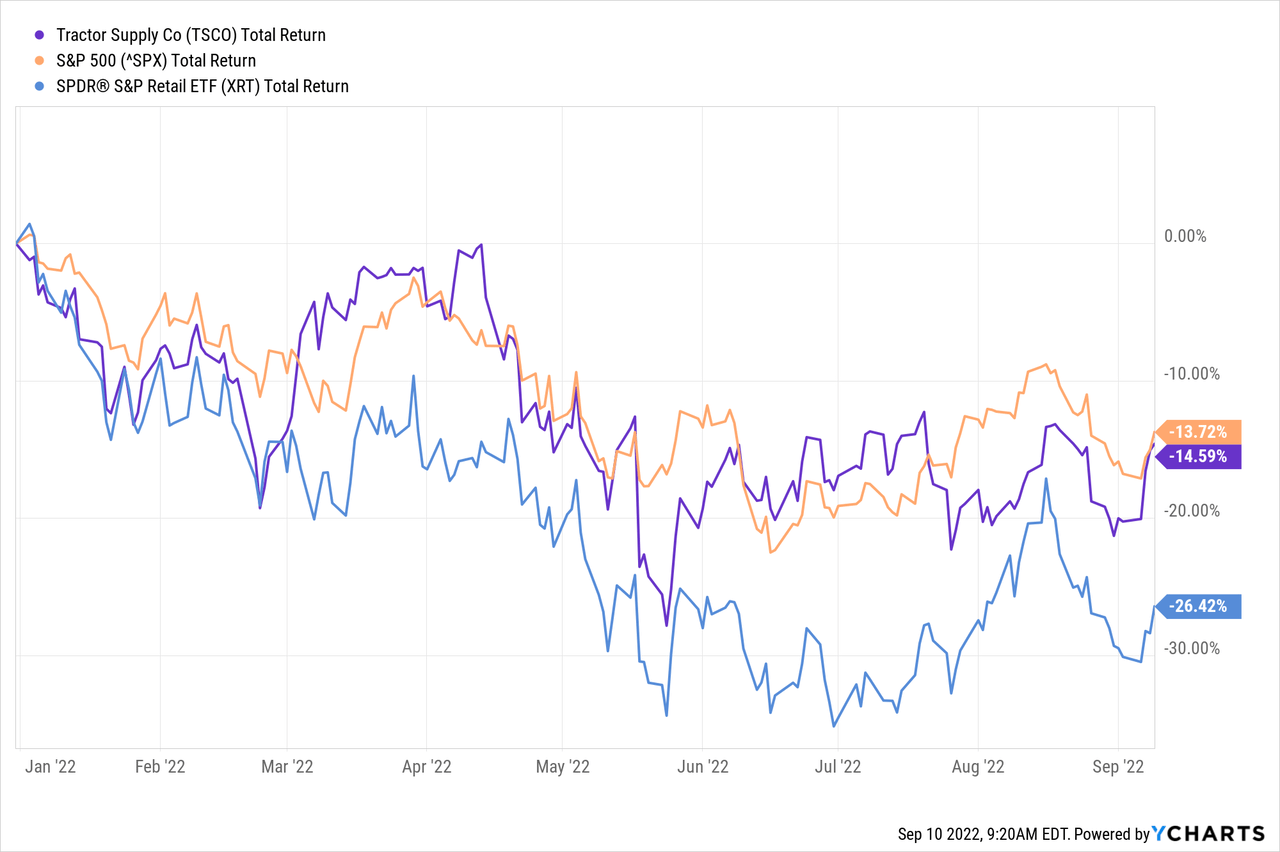

Just to round off this section, there can be no doubt that having held Tractor Supply in recent times, has been a great addition to one’s portfolio. While retail is down 26.4% YTD, Tractor Supply and the S&P 500 is down almost the same amount, at roughly 14%.

Strong Q2 Performance And A Raised FY22 Guidance

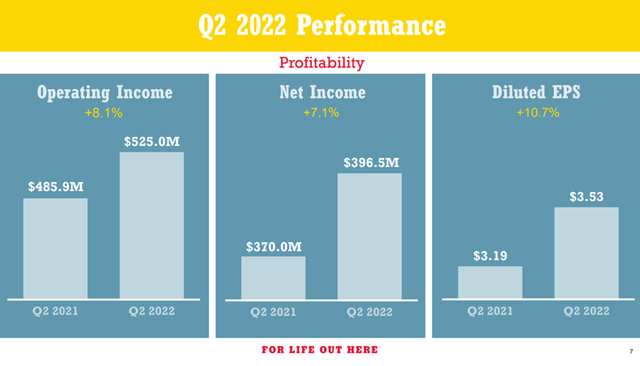

The company delivered a very satisfactory Q2-2022, narrowly beating Wall Street expectations.

- Revenue for Q2-22 of $3.9 billion, compared to $3.6 billion YoY resulting in an 8.3% revenue growth.

- EPS came in at $3.53 compared to $3.19 a year ago, a 10.7% growth.

- First half of 2022, revenue totals $6.93 billion compared to $6.39 equalling 8.5% growth.

- Comparable store sales grew 5.5% down from 10.5% a year ago, but still satisfactory.

On a revenue basis, management increased the FY22 guidance to an expected $13.95B – $14.05B, with a Wall Street consensus expectations of $13.79 billion. Operating margin for the first half of 2022, stands at 11.1% with management expecting full year operating margin to land at 10.2%. If that turns out to be the case, it will mean the operating margin for 2022, is higher than both the 3Y and 5Y median at 10.1% and 9.6% respectively.

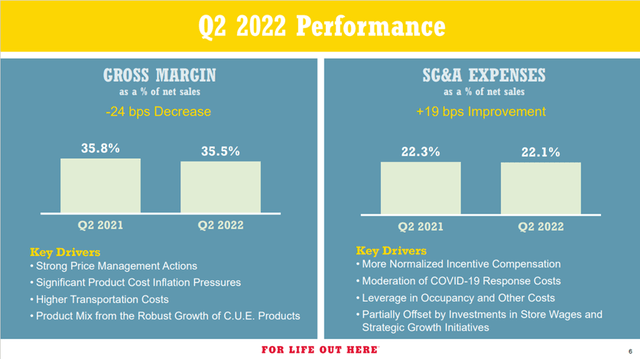

Tractor Supply Q2 2022 Cost Development (Tractor Supply Q2 Financial Performance)

Quite impressive, showcasing how management has been able to combat inflation through means of both efficiency and price adjustments, not the usual picture we’ve seen out of the retail segment. However, we might still have the most difficult quarters ahead of us in this year, but the company is impressing so far in 2022.

Tractor Supply Q2 2022 Profitability Development (Tractor Supply Q2 Financial Performance)

Valuation – The Hair In The Soup

Management is running a tight and very profitable ship and I don’t see Amazon (AMZN) swinging by and stealing the business from underneath Tractor Supply Company. Tractor Supply’s neighbor’s rewards club grew its tally 24% YoY to 26+ million members. There is a big and loyal cohort of customers out there, who want the presence and insights provided by Tractor Supply staff, which doesn’t cater to the business model of a company such as Amazon. Similarly, Tractor Supply has its own digital strategy and channel, catering to customers who expect that kind of interaction.

The return on invested capital comes in at an astounding 35.6%, never having gone below 22% in the past decade. Remember, this is a retailer with inventory and real assets, not your internet software selling giant that can print software licenses like it was nothing, with sky high gross profit margins as a result. From a financial standpoint, Tractor Supply has very strong control over its niche, showcasing a company who is deeply relevant for its customers.

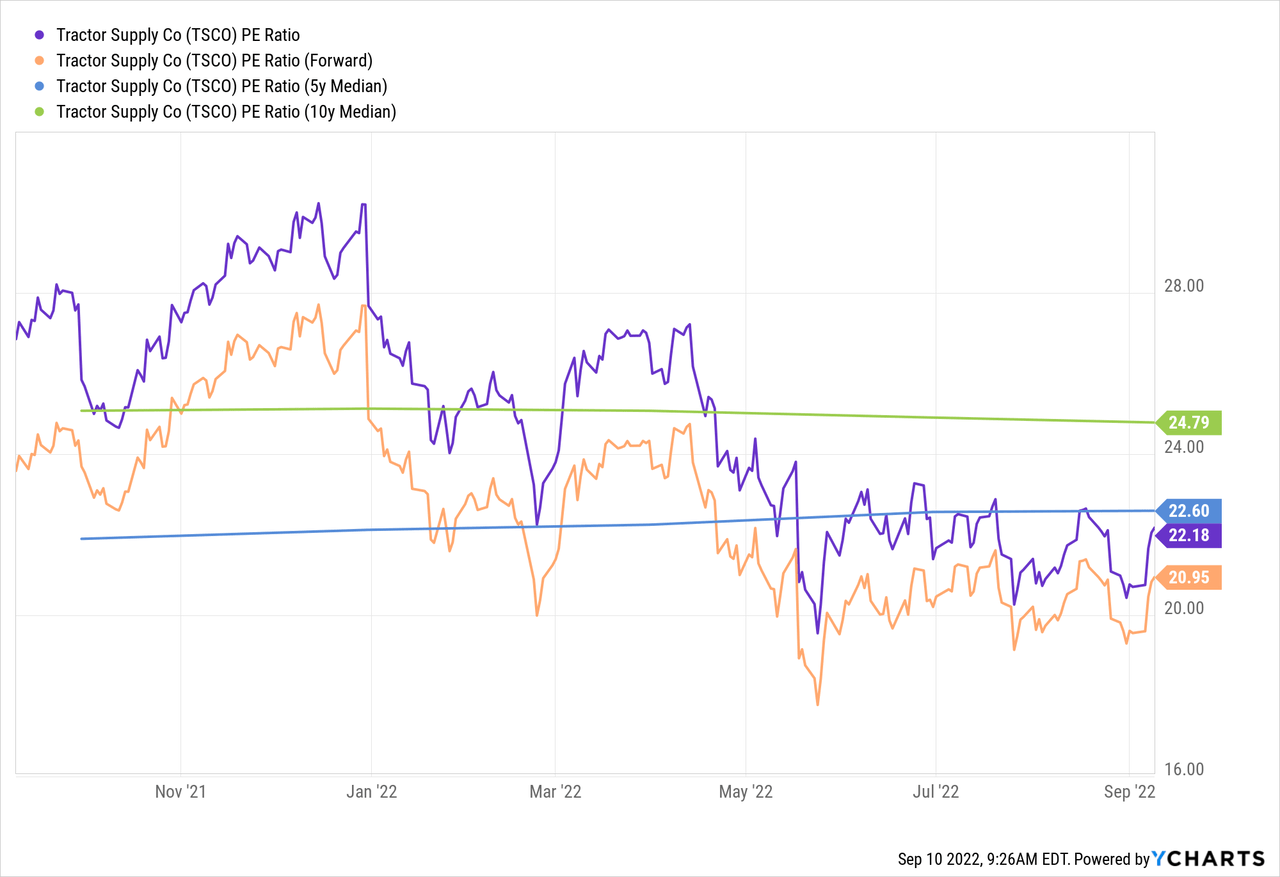

Quality is never cheap, and that is also the case for this company.

Above is the reason why I never managed to pick up Tractor Supply, it rarely trades at a discount, with a 5Y and 10Y mean P/E of 22.5 and 25.1 respectively. Quite high for a retailer, who’s revenue used to grow to the tune of GDP until Covid-19 arrived, and with a forward consensus estimate of revenue once again, growing by mid-single digits. That is still very good for a retailer, but also one who’s presence is quite big across its marked, allowing it to expand sales square feet by roughly 4% annually. Even today, starring into a potential recession, the stock keeps outperforming its peers, and fairly so, given the company performance YTD, but there doesn’t appear to be baked much stress into the current valuation.

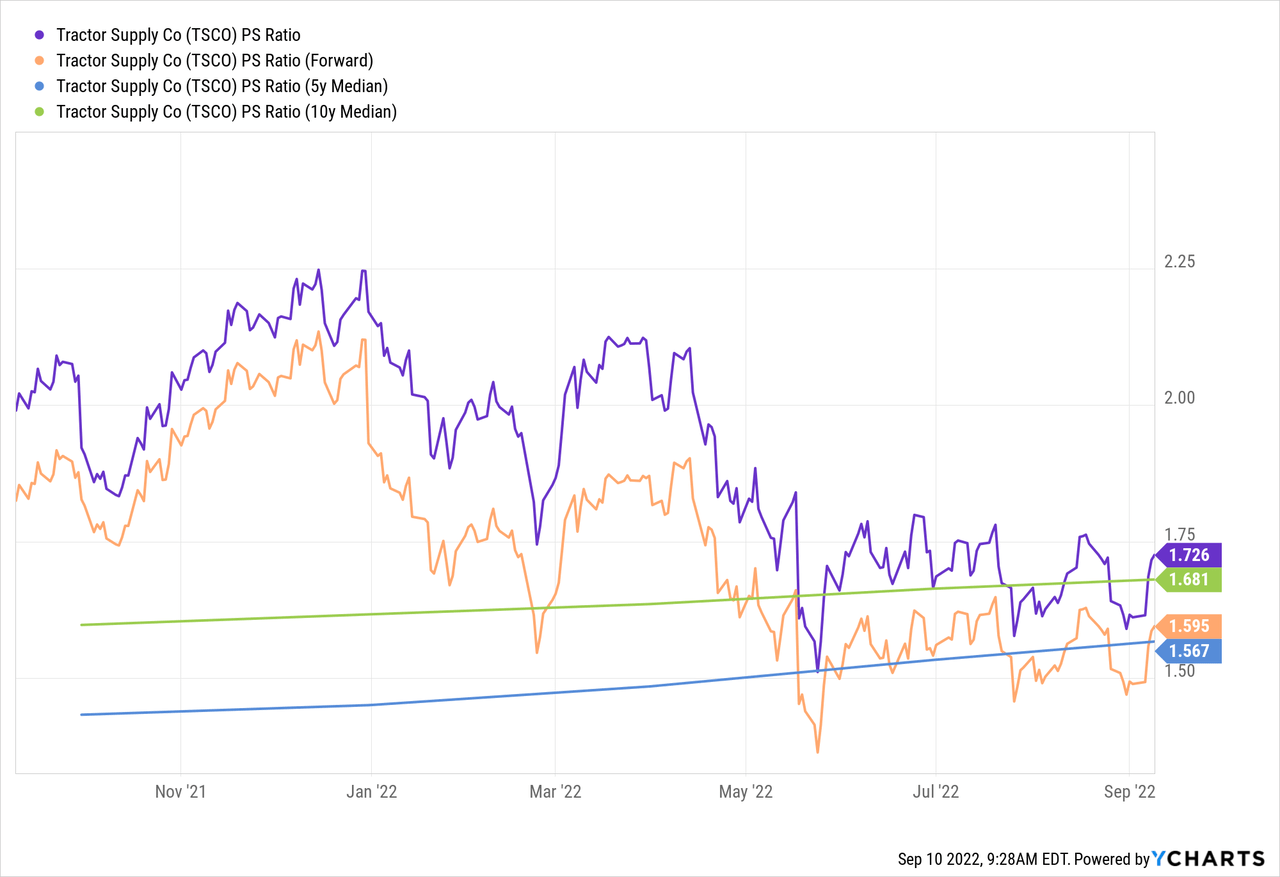

Observing the stock from a price to sales ratio standpoint, and we observe a similar situation. The stock finding itself just about its long-term median in a forward perspective.

Conclusion

Tractor Supply will report its Q3-2022 results on October 19th, having received 6 upwards revisions and 16 downwards revisions in the past 90 days. The company is doing great, but I do believe it will not escape feeling the impact should the current economic hardship continue, eventually impacting its customers, causing them to withhold their spending.

Tractor Supply is a great company worth owning, but as investors, we must separate the business from its stock, and in my perspective, the stock doesn’t reflect the current economic environment in which the world finds itself.

For now, I’ll stay patient and see if a better opportunity presents itself during the later parts of the year.

Be the first to comment