gece33

It pays to have a buy and hold portfolio of moat worthy, income generating stocks, especially in a taxable account. That’s because selling triggers capital gains tax that can eat into an investor returns. For those who have held onto a stock with a lot of built-in appreciation, even the long-term capital gains tax can be substantial and not welcomed for those wishing to minimize their taxes.

That’s why it’s nicer to have income generating stocks that pays an investor for holding on to them, thereby lessening the desire to sell. This brings me to Lockheed Martin (NYSE:LMT). While the stock is no longer cheap, I highlight why it could be a solid holding for any income portfolio.

Why LMT?

Lockheed Martin is a global defense company that’s strategically headquartered in Bethesda, Maryland, sitting just north of Washington D.C. It has a leadership position in high-end military aircraft, including the signature F-35 fighter jet program. Beyond fighter aircraft, LMT’s other businesses include mission systems, including Sikorsky helicopters, missile defense, and space systems. Over the trailing 12 months, LMT generated $65 billion in total revenue.

Defense contractors are great companies to hold over the long term for both income and growth. In some ways, they are similar to utility companies, considering that they have regulated margins, moat-worthy IP with barriers to entry, and a long line of sight when it comes to their revenue streams. Lockheed is no different, considering its signature F-35 program, which comes with a very long line of sight, as noted by Morningstar below in its recent analyst report:

Thankfully for defense investors, many programs are procured and maintained over decades. For instance, the F-35, which accounts for about 30% of Lockheed’s revenue, will be maintained through 2070. Regulated margins, mature markets, customer-paid research and development, and long-term revenue visibility allow the defense primes to deliver a lot of cash to shareholders, which we view positively because we don’t see substantial growth in this industry.

Meanwhile, LMT saw encouraging 3.4% YoY revenue growth during the third quarter, and EPS bounced back to $6.71, up from $2.21 in the prior year period. Importantly, LMT maintains a strong A- rated balance sheet and is generating a substantial amount of cash, with operating cash flow and free cash flow coming in at $3.1 billion and $2.7 billion, respectively.

This enabled LMT to stay true to form with aggressive shareholder returns, including $2.1 billion of share repurchases and dividends during the third quarter alone. Also encouraging for income investors, LMT recently raised the quarterly dividend by 7% to $3.00, and it’s well-covered by a 42% payout ratio. As shown below, LMT has a decent track record of share repurchases, reducing its float by 18% over the past decade.

LMT Outstanding Shares (Seeking Alpha)

Looking forward, Lockheed Martin is well positioned with a backlog of projects that’s been increased to $140 billion, backed by recent wins, including the recent $765 million Naval Air Systems contract that it secured this month. Moreover, management provided an update on increased defense spending next year as well as supplemental funding for Ukraine, as noted during the recent conference call:

Turning to budgets, both chambers of Congress have advanced Appropriation bills in support of fiscal year 2023 Department of Defense budgets. We have seen strong bipartisan support for increased defense funding in congressional authorization and appropriation committees. Final legislation approving these funds has yet to be passed, and the federal government is currently operating under a short term continuing resolution for FY23, limiting DOD funding to prior FY 2022 levels.

As part of the continuing resolution, Congress did approve additional supplemental spending to support efforts in Ukraine for the defense of their country. The CR added $3 billion in funding for Ukraine Security Assistance Initiatives, a program to provide equipment, weapons, and military support to Ukraine, bringing the total amount appropriated for this effort to $9 billion.

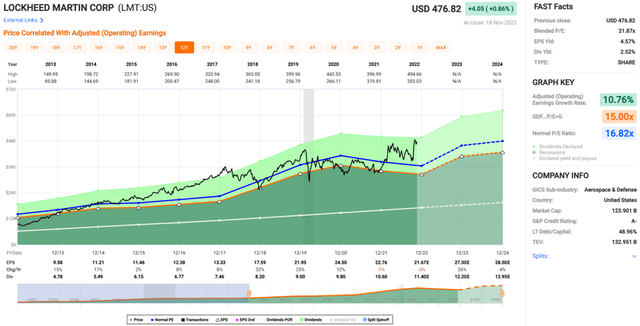

Turning to valuation, I see the LMT’s shares as being fully valued at present, with a forward PE of 17.7, sitting slightly above the normal PE of 16.8 over the past decade. Morningstar has a fair value estimate of $447 and analysts have a consensus Hold rating with an average price target of$463.

Investor Takeaway

In conclusion, Lockheed Martin remains a solid investment for investors seeking a high-quality defense stock with long-term revenue visibility, strong balance sheet and aggressive shareholder returns in the form of repurchases and dividends. While its shares do appear to be fully valued at present, I believe LMT is a good example of a “set it and forget it” type of stock that can be an anchor of a long-term income and growth portfolio.

Be the first to comment