The Good Brigade/DigitalVision via Getty Images

Q2 has proven to be a real gut-check for many companies. After years of strong economic tides, many investors have forgotten what macro chills and broad-based guidance revisions felt like. Companies are racing to adjust expectations downward, and YETI (NYSE:YETI) is no exception.

YETI, best known for its hard coolers that are prominently featured during football tailgate season, is a high-growth consumer brand that is facing similar hiccups to other consumer-products companies. Consumers are reining in spending, and especially with the stronger dollar, international expansion and growth plans have been compromised as well.

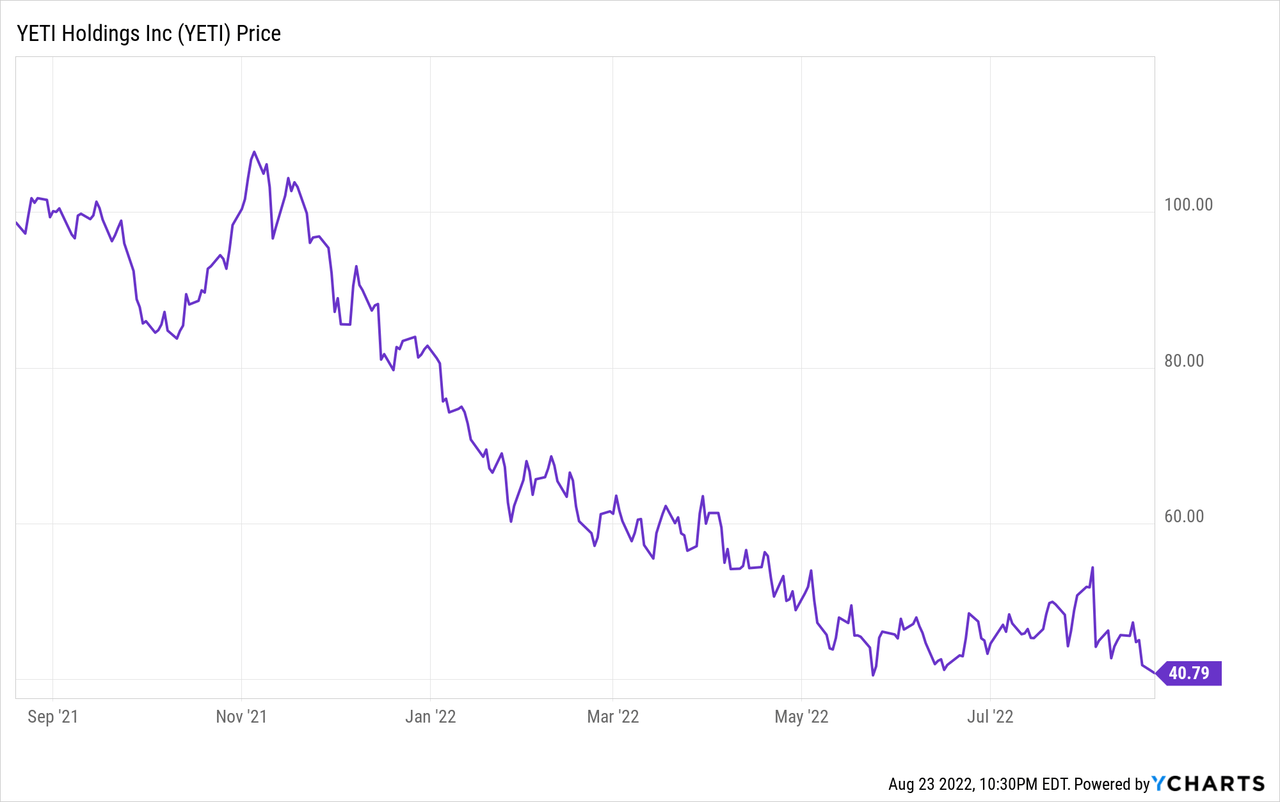

YETI just released Q2 results, and predictably the business slowed down. Shares are down ~25% since the early-August release, bringing YETI’s year to date losses to roughly 50%.

In spite of the less optimistic tidings, I remain bullish on YETI for the long haul. Two things are driving that outlook: 1) many of the factors holding YETI back right now are macro-driven and not company-specific; longer term, I continue to view YETI as a differentiated brand with quite a lot of expansion room; and 2) in particular, many of the margin-related pressures including elevated freight costs may subside as global demand decreases.

The company still continues to execute on all of its key priorities (shown in the chart below), boosting its DTC channel marketing through social media acquisition channels, growing its retail store fleet, and emphasizing international expansion.

YETI strategic priorities (YETI Q2 earnings deck)

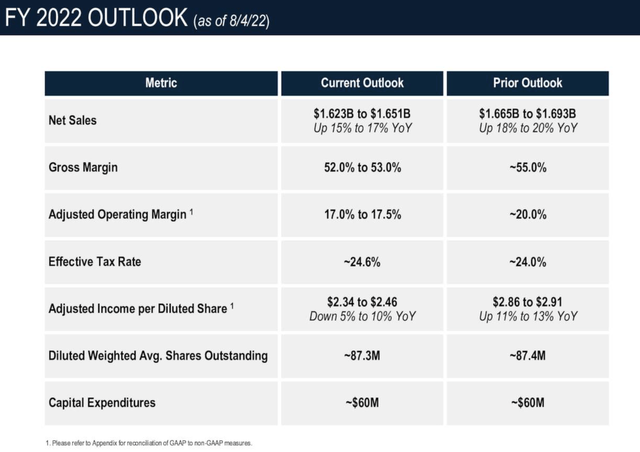

It’s true that YETI, like many other companies did this quarter, cut its guidance for the year. It’s now expecting 15-17% y/y revenue growth (a three-point y/y reduction from its prior outlook), while also slashing the midpoint of its pro forma EPS guidance by ~17%.

YETI outlook (YETI Q2 earnings deck)

Near-term valuation multiples don’t make much sense here. At current share prices near $41, YETI trades at a P/E ratio of 17.1x versus current-year earnings – not much of a value proposition to be had. This being said, investors who are able to look past near-term volatility and anchor on YETI’s long-term prospects have a great chance to buy this stock on a major dip.

Here’s a refresher on what I consider to be the key bullish drivers for YETI:

- The company is extending its immensely popular brand into new products. Drinkware and coolers are still the bread-and-butter categories for YETI, but the company is now taking advantage of its rising brand profile to roll out new products. Last year, the company announced a new collection of bags, backpacks, duffels, and luggage – another high-margin category that can fuel further growth. A rollout of more women’s apparel is another area for planned expansion in 2022.

- Continued strong direct channel execution. Thanks to YETI’s focus on social media advertising and digital sales, the company has seen growth index stronger in its direct channel than in resellers, and direct is now more than half of YETI’s overall revenue mix.

- Tremendous margin gains thanks to direct channel mix shift. For consumer products and retail-oriented companies, gains in gross margins are equally as important to investors as overall growth, and the company’s DTC growth has pushed margins into the 50-60% range. This indicates that YETI’s revenue stream is much richer in profitability and scalability than other typical retail names.

- Regional and international expansion. YETI has been primarily popular in the South and Midwestern regions of the U.S., but brand penetration on the West and East coasts as well as internationally is still low and provides YETI with plenty of room for growth. The company’s recent tilt toward online and social media marketing also makes it easier for the brand to flower in new places.

Stay long here and buy YETI on the dip.

Q2 recap

Let’s now cover YETI’s latest Q2 results in greater detail. While the company certainly did suffer from macro-related headwinds (which were largely expected, given read-through from the rest of the market), it continued to execute well and had bright spots in the quarter.

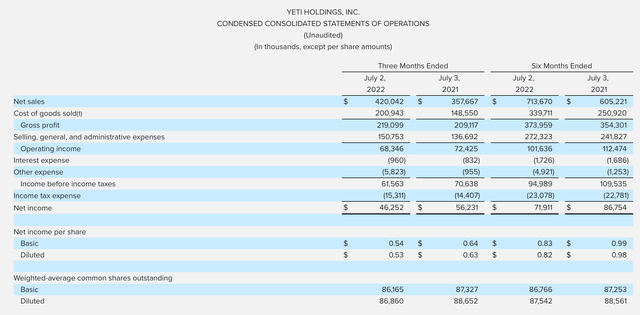

The Q2 earnings summary is shown below:

YETI Q2 results (YETI Q2 earnings deck)

YETI’s revenue grew 17% y/y to $420.0 million in the quarter, slightly missing Wall Street’s expectations of $422.9 million (+18% y/y). Revenue growth also decelerated two points versus 19% y/y growth in Q1.

Perhaps more concerning to mainstream investors is that DTC channel revenue growth slowed to 14% y/y, indexing below channel sales growth of 21% y/y (which can be impacted by inventory loading and not true end-customer demand) and decelerating from 23% y/y growth in Q1. The company cited lower website traffic as well as lower-than-expected customer acquisition trends as the key drivers here.

Here’s some helpful commentary from CFO Paul Carbone on how the company is incorporating these softer demand trends into its outlook, taken from his prepared remarks on the Q2 earnings call:

We now expect full-year sales to increase between 15% and 17% compared to fiscal 2021. The range reflects prudent expectations for the back half of the year as we factor in impacts of a more constrained spending environment.

We continue to expect coolers and equipment growth to outpace drinkware, while we now expect balanced channel growth between DTC and wholesale. By quarter, we currently plan for third quarter growth to modestly outpace the fourth quarter, incorporating greater overall uncertainty into our historically highest DTC mix period.”

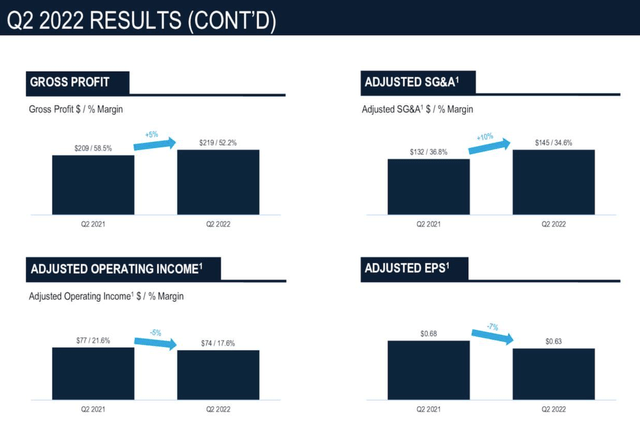

Alongside revenue deceleration, Yeti also suffered 630bps of gross margin contraction to 52.2%:

YETI key profit metrics (YETI Q2 earnings deck)

This was driven by a number of factors, including raw material cost inflation, elevated transportation rates, and the more unfavorable channel mix (leaning out of DTC compared to last year) versus last year, and only partially offset by YETI’s recent price increases. The good news here: A) gross profit dollars still grew 5% y/y, with revenue growth still offsetting margin losses, and B) the company reduced operating expenses as a percentage of revenue by 220bps, helping to defray part of the gross margin loss. Overall, adjusted operating income declined -5% y/y to $74 million and saw a 400bps reduction in margin, while pro forma EPS declined -7% y/y to $0.63.

There is a light at the end of the tunnel here, however, on margins. The company cited that the 630bps reduction in gross margins owed to:

- -630bps from higher transportation costs

- -150bps in product cost increases

- -40bps from unfavorable channel mix

- -20bps from other miscellaneous headwinds

- +170bps from price increases

The company is noting that transportation costs (the biggest headwind to margins by far) are beginning to ease up, which is consistent with a softening global demand landscape. Per Carbone’s remarks:

Looking at margin components, the overall freight headwind is now expected to be slightly less than 500 basis points impact for the year, driving the majority of the overall year-over-year decline.

While now a large and near-term challenge, we remain encouraged that the ongoing signs of softening ocean rates can be a positive gross margin driver as we look ahead to 2023.”

This is yet another reason to look past YETI’s current pain and invest for growth in 2023.

Key takeaways

The challenges that YETI is facing right now are hardly unique to the company – decelerating growth, FX headwinds, cost inflation and high transportation costs. I view these factors as largely macro-driven, and some, like high transportation costs, may not be long-lived. Stay long here and use the dip as a buying opportunity.

Be the first to comment