Domepitipat/iStock via Getty Images

In my personal view, many small-cap growth stocks have been unfairly punished year to date. The collapse in valuations that we’ve seen across the board, broadly speaking, is completely disconnected from the fundamentals that the companies have delivered.

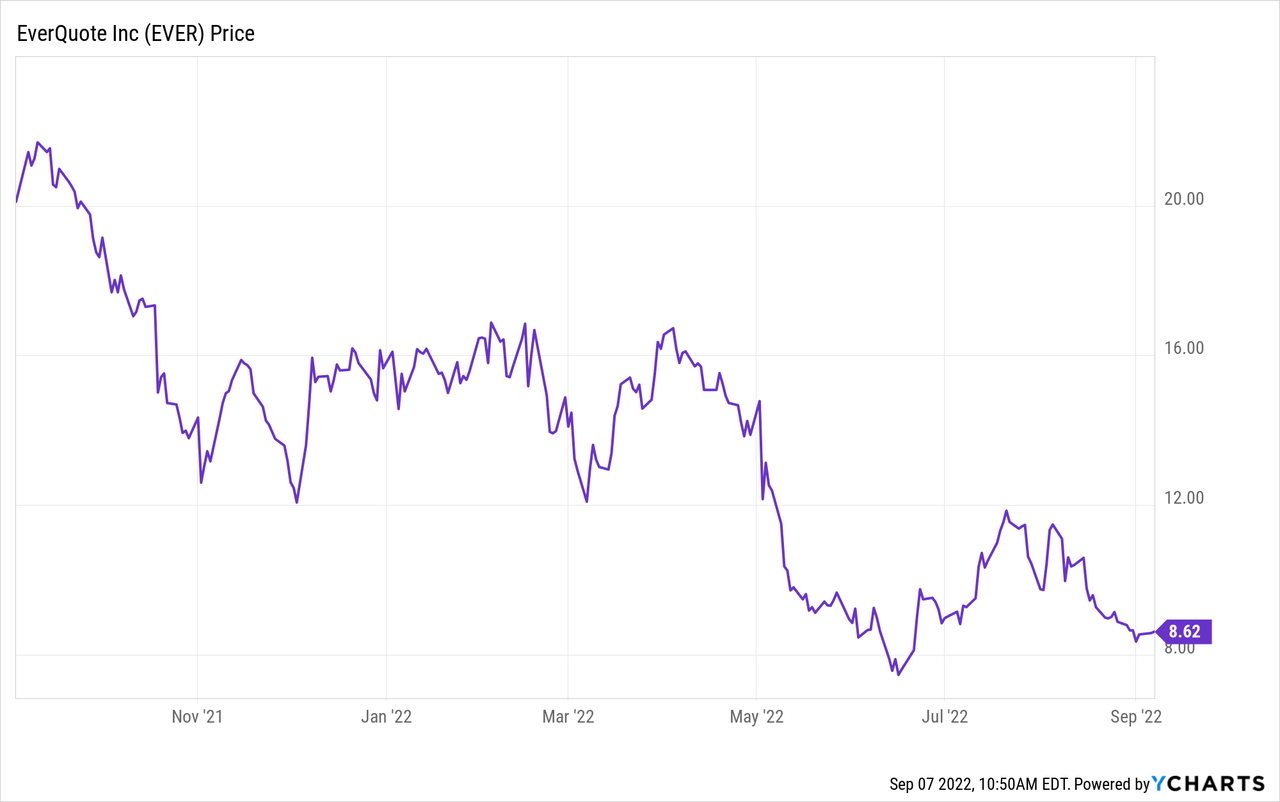

In the case of EverQuote (NASDAQ:EVER), on the other hand, I think this stock’s massive YTD fall is fully justified, if not even behind the company’s 180-degree turn in performance. EverQuote, a company that has long been criticized by consumers for being a low value-add lead-gen platform that bombards consumers with marketing emails once they request a quote on the platform, has seen its share price decline by nearly 50% year to date. And in my view, there’s more pain to come.

EverQuote enjoyed a brief bear market rally in early August when it reported Q2 results that came in slightly better than feared. That enthusiasm didn’t last long, however, when investors digested the fact that EverQuote’s outlook remained dim and its commentary on the near-term future of the auto insurance industry (which fuels the lion’s share of EverQuote’s revenue) is still bearish.

Accordingly, I remain bearish on EverQuote as well. The main factors here that investors should consider:

- Auto insurance industry dynamics remain bleak. Auto insurers have been hit with a number of unfavorable conditions, namely inflation – which has dramatically increased the cost of covering claims. This, in turn, has sapped insurance carriers’ zeal to spend aggressively on marketing to acquire new customers, which has directly impacted EverQuote.

- Non-auto categories have stalled. EverQuote has expended major efforts over the past few years to expand into renters, home, life, and health insurance marketplaces as well – yet these categories have also seen heavy deceleration in growth that is not enough to offset the declines in auto insurance.

- Thin liquidity. EverQuote’s revenue compression has led to diminished profitability and larger cash burn, which is a dangerous position for a small-cap company with very limited resources to be in. With a diminished share price and climbing debt rates (especially for speculative plays like EverQuote), raising capital will be very difficult for EverQuote in this environment.

Continue to steer clear here: this is a company with no clear path to fundamental recovery. With so much volatility in the markets, investors are looking for solid, stable plays – everything that EverQuote isn’t.

Q2 download

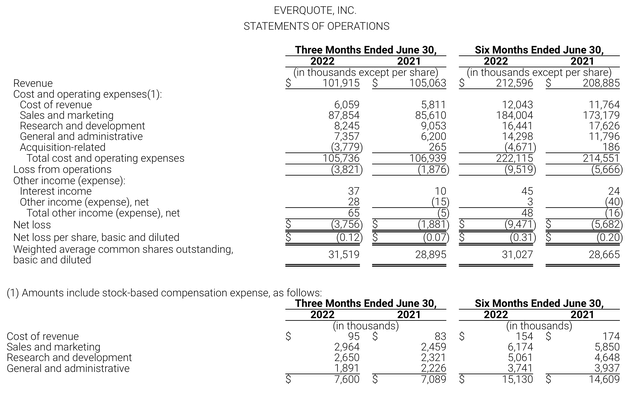

Let’s now go through EverQuote’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

EverQuote Q2 results (EverQuote Q2 earnings release)

EverQuote’s revenue in Q2 declined -3% y/y to $101.9 million. To EverQuote’s credit, this is a better result than the company had initially estimated, as it had initially guided to a decline of between -8% y/y to -12% y/y. Underlying the weak revenue trends from lower advertiser/carrier demand, EverQuote notes that consumer quote requests and website traffic remain strong with 28% y/y growth.

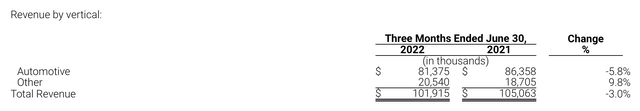

The insurance carrier side of EverQuote’s marketplace, however, remains quite weak. As seen in the disaggregation of revenue below, EverQuote’s auto insurance revenue declined -6% y/y to $81.4 million in the quarter.

EverQuote Q2 revenue by vertical (EverQuote Q2 earnings release)

To me, an equally big concern is that EverQuote’s revenue from other insurance verticals also saw tremendous declaration in revenue, down to 10% y/y growth. In Q1, “other” revenue had grown at 19% y/y. Note as well that Q2 “other” revenue is also down by -11% sequentially versus Q1. EverQuote’s big push over the past few years has been to diversify away from the lumpiness and concentration of the auto insurance industry – but now it seems that these other insurance categories are also moving at a snail’s pace and are unable to offset declines in auto.

Management’s outlook for the near term is also dire. The company is guiding to $90-$95 million in revenue for the third quarter, which represents a -16% y/y to -12% y/y decline. Now as we’ve seen with the example of Q2, EverQuote does tend to guide conservatively – but it’s not unreasonable to assume that, with the Q3 guidance decay coming in steeper than what was guided in Q2, that Q3 will end up decelerating yet again from Q2.

The company is noting that so far in July (the first month of Q3), trends have weakened, and the recovery in auto insurance fundamentals that the company had originally expected in the back half of 2022 now won’t occur until 2023. Per CEO Jayme Mendal’s prepared remarks on the Q2 earnings call:

Meanwhile, the direct carrier channel continues to exhibit significant volatility. Throughout the quarter carriers exited unprofitable states and segments. As a result in Q2, direct carrier channel monetization reached new trough levels below the lows last seen in Q4 of 2021.

July demand from auto carriers shows continued deterioration and we are not expecting this dynamic to change meaningfully within Q3. We also expect to experience lower health demand in Q3, reflecting the seasonally slower locking period ahead of cue Ford’s open enrollment period.

Turning to the broader environment, auto carriers are now citing the uncertainty caused by surging inflation as a key factor limiting their pace of recovery. While we have seen loss and combined ratios improving for certain carriers, we believe that Q3 demand will likely remain significantly depressed, and that a rebound previously expected to begin in the second half is unlikely to occur before 2023.”

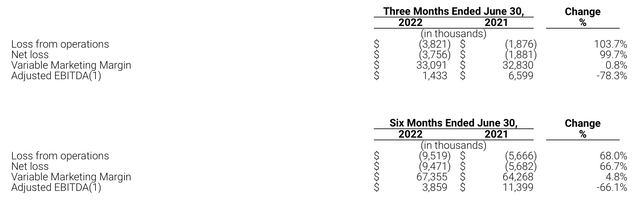

These weakening dynamics have also had a significant impact on profitability. As seen in the tables below, Q2 and YTD adjusted EBITDA have fallen by -78% y/y and -66% y/y, respectively:

EverQuote adjusted EBITDA trends (EverQuote Q2 earnings release)

Meanwhile, cash burn in the quarter widened to -$3.8 million, versus a gain of $3.5 million in the year-ago quarter. The company has only $46.1 million of cash left on its books (plus $35 million on an undrawn revolver) – so as fundamentals are expected to worsen, the company’s liquidity will continue to get stretched.

Key takeaways

In my view, there is no reason to stay invested in EverQuote as it faces a very uphill battle against unfavorable trends in the auto insurance industry. Revenue diversification efforts into other insurance categories aren’t producing sufficient growth, and profitability is faltering. Steer clear here.

Be the first to comment