Feline Lim

Thesis

Apple Inc.’s (NASDAQ:AAPL) “Far Out” iPhone 14 launch event had led to several Apple bulls lifting their forecasts and lead time estimates on the order demand for its iPhone 14, particularly its Pro models.

Apple is leveraging the success of its iPhone 13 Pro series, which has captured 41% of iPhone 13 shipment share. It also follows the success of its iPhone 11 Pro, which accounted for 31% of shipment share. Therefore, Apple is pushing ahead more aggressively with its Pro line-up to capture the upgraders and switchers as it looks to lift its average selling prices (ASPs).

The central argument from Apple bulls is predicated on the ecosystem that Apple is building around through the success of its iPhone. Apple’s continued success with extending its hardware strategy to its AirPod and Apple Watch is a testament to Apple’s foundational iPhone ecosystem.

We agree that Apple has built a highly successful hardware strategy that’s almost impossible to replicate. Over the past two years, the supply chain malaise has demonstrated the execution prowess of CEO Tim Cook & team, even though it still faced significant headwinds in China. Furthermore, its MacBook has proved to be resilient against its Windows counterparts, corroborating the robustness of Apple’s hardware ecosystem.

Hence, we aren’t surprised that AAPL has outperformed the SPDR S&P 500 ETF (SPY) in 2022. It posted a YTD total return of -12.6% against the SPY’s -17.3% return.

However, investors need to consider that iPhone’s market share gains in the US and China could face significant impediments as its ASPs progress. Coupled with Android’s technological progress in higher-end smartphones, as QUALCOMM (QCOM) furthers its partnership with TSMC (TSM) moving forward, the gap with Apple could narrow further. Therefore, it could hinder Apple’s ability to keep pushing its ASPs higher without eroding its competitive edge over its higher-end Android peers.

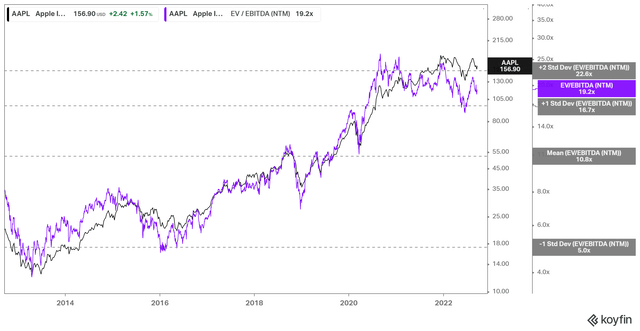

AAPL last traded at an NTM EBITDA multiple of 19.2x, well above its 10Y mean of 10.8x. Therefore, we believe AAPL is overvalued, with its near- and medium-term upside well-reflected. Notwithstanding, AAPL seems to be at its near-term support, as its momentum is oversold. Therefore, we urge investors to wait for a short-term rally before cutting exposure further and rotating.

As such, we revise our rating on AAPL from Sell to Hold for now.

Excess Optimism Over Apple’s iPhone 14 Pro

Famed Apple analyst Ming-Chi Kuo updated that his checks suggest that Apple’s iPhone 14 Pro models are tracking ahead of his previous estimates. Accordingly, its Pro range could account for up to 62.5% (midpoint) of shipment share in H2’22, up from 57.5% (midpoint). As a result, he postulated that Apple’s forward guidance at its upcoming FQ4 earnings release could surprise to the upside.

Street analysts have also been tracking Apple’s momentum in its Pro models as they are instrumental toward Apple’s game plan of continuing its ASPs uptick over time.

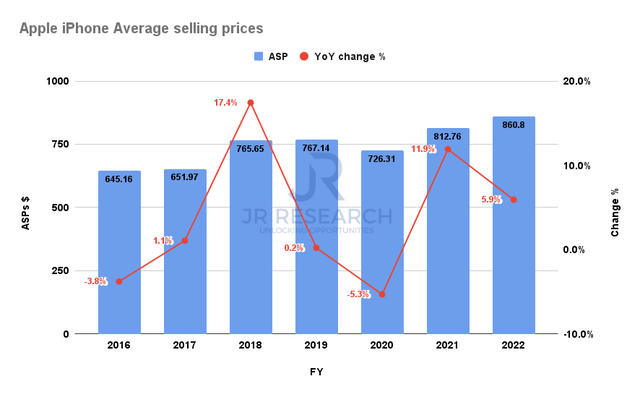

Apple iPhone ASPs trend (WSJ)

As seen above, Apple’s ASPs have increased from $645.16 in 2016 to $860.8 in 2022, representing a CAGR of 4.92%. Therefore, we believe the Cupertino company has proved the sustainability of its price hikes, as it built up its installed base of 1B users over time.

However, we urge Apple users and investors to consider how much more the company can continue to gain market share, even as its Pro series become more influential over its iPhone shipment share.

Counterpoint Research highlighted in a recent note indicating that “Apple’s installed base crossed the 50% threshold in the US during Q2 2022.” However, it added that “the room for further Apple penetration is quite small in the US, and Apple will rely on upgrade cycles to continue selling its mobile hardware.” Therefore, the focus will inevitably be turned to Apple’s ability to extend its hardware strategy through AirPod and Apple Watch while further monetizing its services business. Nevertheless, we believe Apple’s robust execution has proved that it remains in pole position to continue delivering for investors.

Notwithstanding, we also believe that its Android peers are not standing still as they look to compete further against Apple in the premium segment. Apple remains TSMC’s preeminent customer, with 3nm process orders reserved for its A17 chip for 2023.

However, Ming-Chi Kuo highlighted that Qualcomm’s further reliance on TSMC as its foundry partner to fab its handsets SoC should narrow the competitive edge with Apple silicon moving ahead. Moreover, MediaTek (OTCPK:MDTKF) is also making solid progress in its premium chipsets, as it drove revenue growth in Q2. Notably, MediaTek is expanding its focus beyond the lower-end smartphone SoC segment into high-performance computing, IoT, and premium smartphones to diversify its revenue base further. Hence, we believe Apple could face robust competition in its premium segment moving ahead as its Android peers up the ante.

AAPL Remains Expensively Configured

AAPL NTM EBITDA multiples valuation trend (Koyfin)

As seen above, AAPL’s buying upside has faced significant challenges moving past the two standard deviation zone above its NTM EBITDA multiples mean. Hence, we are increasingly confident that AAPL’s near- and medium-term upside has been reflected accordingly at its current levels.

We believe Apple could face significant challenges in extending its iPhone dominance over the next few years, given its share gains. Hence, its current valuation doesn’t justify the execution risks that could face Apple moving forward. Moreover, given its revenue exposure, we don’t expect a growing services segment to untether the market’s focus on its iPhone challenges.

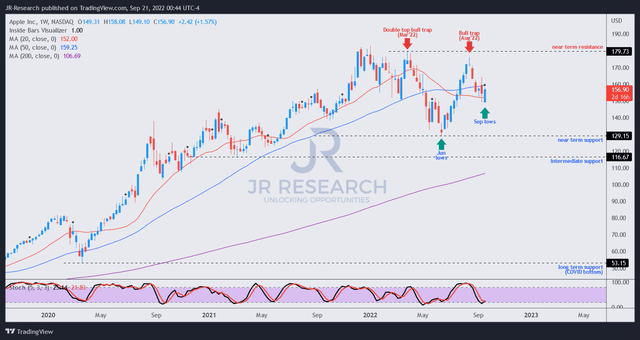

AAPL price chart (weekly) (TradingView)

AAPL is likely at a near-term bottom, given oversold technicals. However, we gleaned that its near-term resistance ($180) has rejected its buying momentum decisively over the past year. Coupled with AAPL’s overvaluation, we believe the reward-to-risk profile is not attractive at the current levels.

Hence, we urge investors to use a potential short-term rally to cut exposure further. Hang on to your iPhone if you wish to, but not to AAPL, especially if you are heavily exposed.

Given its near-term bottom, we revise our rating from Sell to Hold for now.

Be the first to comment