Marko Geber

Initiating Coverage

We are initiating coverage on Rite Aid Corp. (NYSE:RAD) and recommending a “HOLD” as we do not see any near-term catalysts for any major stock price movements. We believe that the company’s low valuation and market multiples are reasonable based on its deteriorating financial position, and we remain vigilant on potential risks that may affect our thesis.

Company Overview

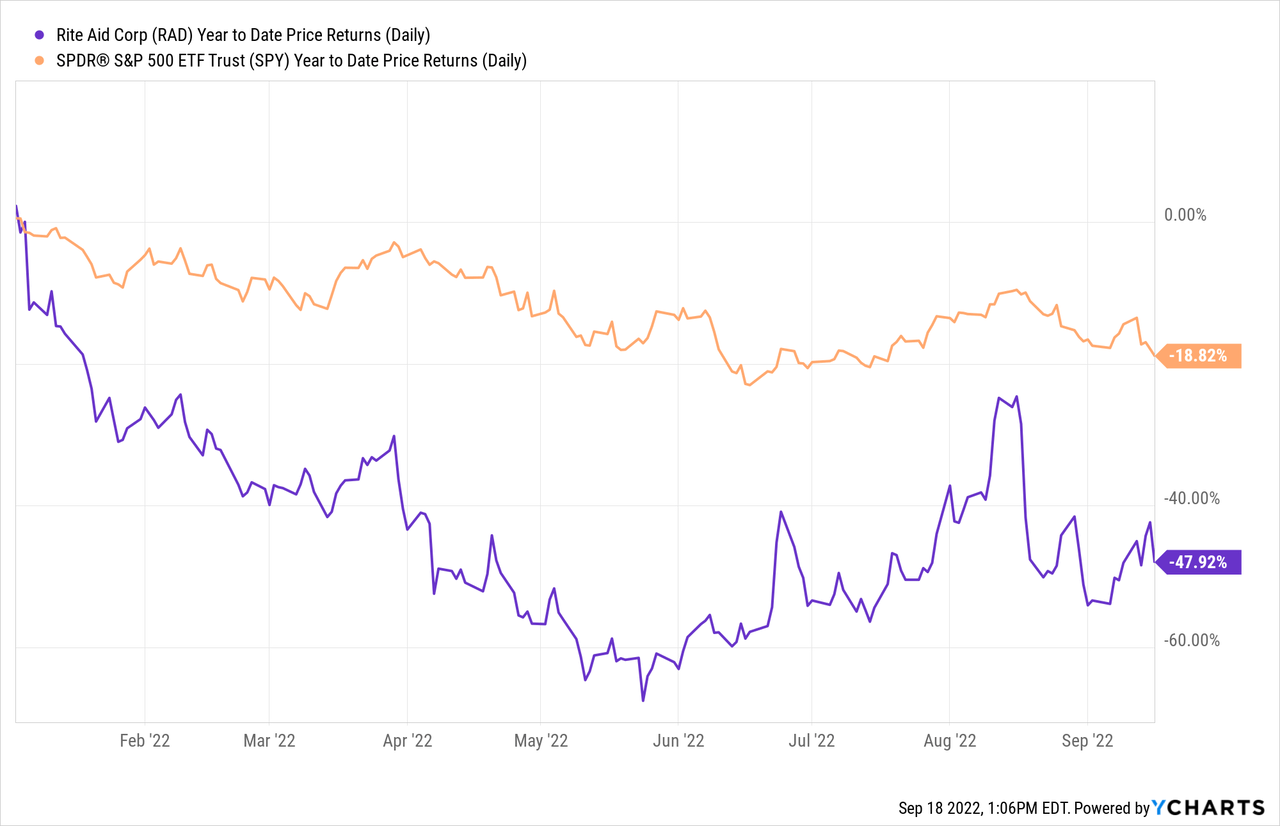

Rite Aid Corp is an American drugstore chain with a market capitalization of $425.5 million. According to management, Rite Aid has more than 2,350 store locations and manages over 3,600 pharmacists. The company also operates specialty pharmacies and pharmacy benefit management services. Year-to-date, the company’s stock performance has been well below the S&P 500 index. Rite Aid returned -47.92% year-to-date, compared to the S&P 500’s return of -18.82% in the same time frame.

Major Headwinds

Poor Financial Results

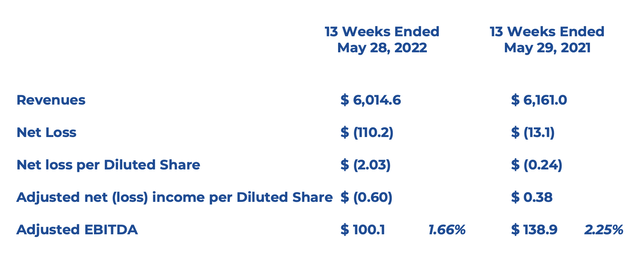

Rite Aid reported financial results well below the expectations of investors, reporting a YoY decline in quarterly revenue and a widening net loss. The company reported a quarterly revenue of $6.01 billion in FY 2023 Q1 compared to $6.16 billion in FY 2022 Q1, which is a YoY revenue decline of 2.4%. Net loss widened by more than 8x, with net loss widening from -$13.1 million to -$110.2 million in the same time frame of comparison. The company’s deteriorating top line and bottom line on a YoY basis can be attributed to many factors, such as increased competition, rise of e-commerce, and other factors. Regardless of the specific factors, based on continued store closures (~145 stores planned this year) in major cities and regions across the U.S., the company’s fundamentals aren’t moving in a positive direction.

Rite Aid FY 2023 Q1 Earnings Presentation

Competition

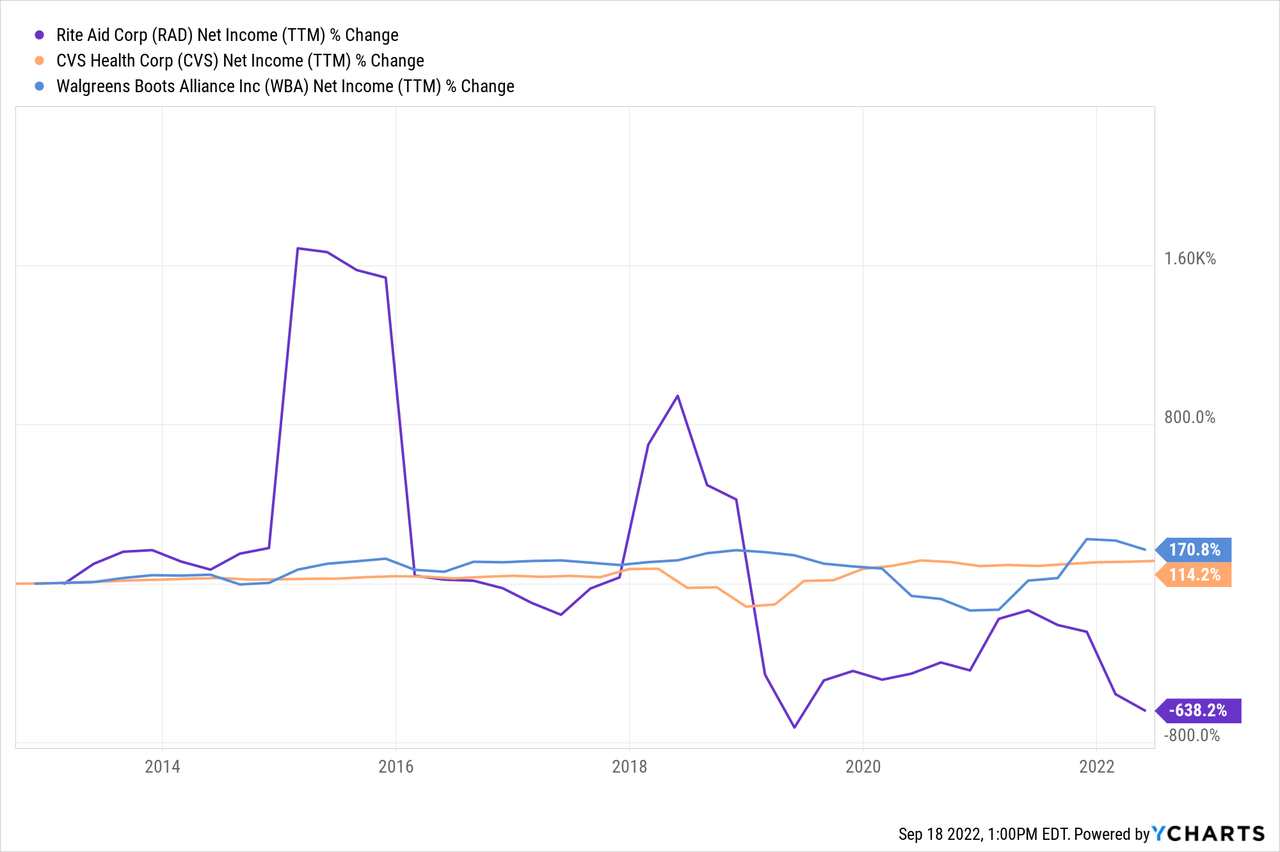

Rite Aid is an industry with other large competitors, such as CVS Health Corp. (CVS) and Walgreens Boots Alliance, Inc. (WBA). CVS is a huge healthcare behemoth as a result of major acquisitions and mergers, with a market capitalization of ~$130 billion. Though smaller than CVS, Walgreens Boots Alliance is also a big company compared to Rite Aid, with a market capitalization near ~$30 billion. Just based on Rite Aid’s size alone, the company is at a disadvantage in terms of scale, access to capital, and brand recognition, and such disparity can largely be seen in the company’s ability to grow its earnings. In the last 10 years, while CVS and Walgreens have been able to grow net income by more than 100% in a span of ten years, Rite Aid has not, falling well into the net loss territory in recent quarters. Based on the size and strength of the competition, we believe Rite Aid will continue to be at a disadvantage against its competitors.

Weakening Economy

At the forefront of Rite Aid’s business model is consumption by day-to-day consumers, who would open up their pocket books to purchase products from the pharmacy and other goods that are commonly sold at a drugstore chain. Due to the rising interest rate environment and high inflation, consumer sentiment has decreased significantly and there are already signs that consumer spending is slowing down. Given the company’s unprofitability, we believe that the economic conditions will likely derail the company’s long-term hope of returning to positive free cash flow, and it is our view that the stock will continue to struggle as the economy weakens.

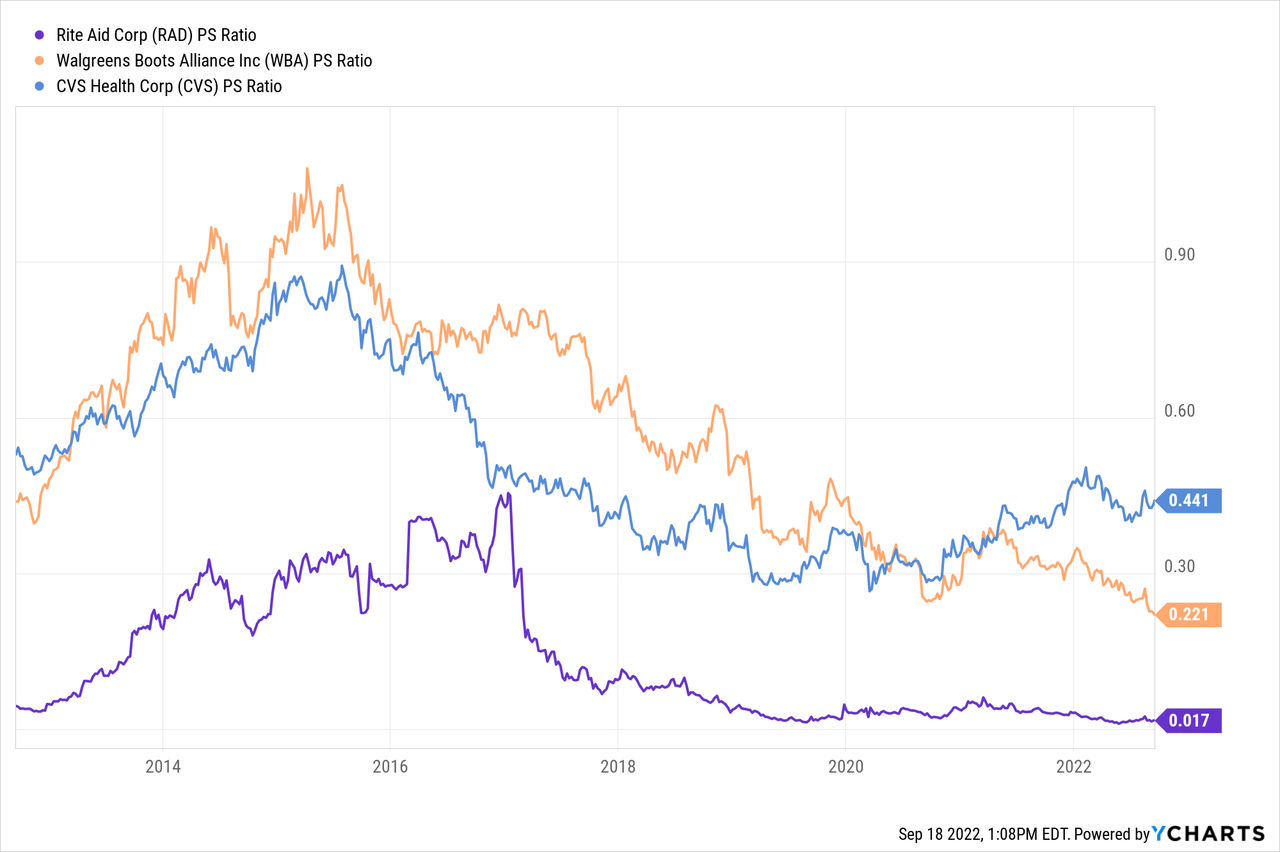

Valuation

Valuation for Rite Aid remains low compared to competitors for many of the reasons outlined above. Compared to WBA and CVS, the P/S ratio of Rite Aid is magnitudes lower than that of the company’s competitors. While we do not contend that the shares are expensive compared to peers, we also do not believe that the shares are undervalued. Based on the uncertain financial future and the continued unprofitability, we believe the current valuation is reasonable.

Upside Risks

Based on the currently low valuation, we believe there remain major upside risks that prevent us from recommending a “Sell” position on the shares. For one, Rite Aid has an extremely high short interest ratio of ~16% which increases the likelihood of a “short squeeze” in the event that the stock price was to rise for whatever reason. It is our principle to avoid stocks with a short interest ratio near 10% given that a ratio over that amount can increase the likelihood of a “short squeeze”. Given the recent trends in brick-and-mortar acquisitions, we believe that another upside risk could be from potential rumors or news of acquisitions and mergers related to Rite Aid.

Conclusion

Rite Aid is a stock that has poorly performed in the past few years, and we do not see any catalysts that can turnaround the company’s fortunes. The stock is already beaten down with a low market multiple, and we do not see the company’s stock price rising any time soon given the competition and declining macroeconomic environment. In addition, given the potential upside risks unrelated to the company’s fundamentals, we believe that investors should wholly avoid taking positions in the stock in either direction.

Be the first to comment