VioletaStoimenova

Given current economic conditions, you might not think that the staffing and risk consulting services space would be particularly appealing. Having said that, some of the companies in this market seem to be thriving. One great example can be seen by looking at Robert Half International (NYSE:RHI). Even as recently as the latest quarter, the company had demonstrated strong revenue growth and a rise in profits and cash flows. On a forward basis, shares look very cheap at this moment in time. But it’s also true that concerns over the broader economy could lead to some weakening moving forward. In the event that this transpires, shares go from looking very attractive to looking more or less fairly valued. And given the risk of such an eventual downturn, I do still believe that it’s appropriate to rate the business a ‘hold’ until the picture clears up.

Great performance as of late

Back in June of this year, I wrote an article about Robert Half International wherein I recognized the company’s strong revenue and profit growth but also, I stressed that I was concerned about the current economic environment. Given how shares were priced at the time and the risk that fundamental performance could eventually weaken if economic fears turned into something more tangible, I felt as though a ‘hold’ rating on the company’s stock was appropriate. This kind of rating is my way of saying that I feel the company should generate returns that more or less match the broader market for the foreseeable future. Since then, however, the company has performed slightly worse than I would have anticipated. While the S&P 500 is up by 3.9%, shares of Robert Half International have generated a loss for investors of 3.6%.

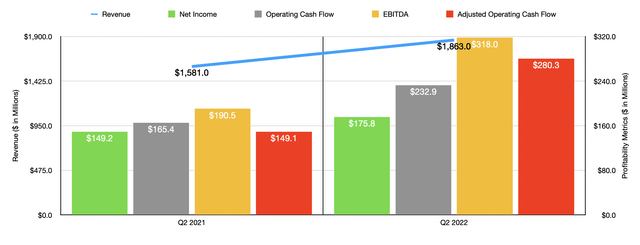

Based on this return disparity, you would be excused for thinking that the fundamental performance of the business was weakening. However, that couldn’t be further from the truth. In the second quarter of the company’s 2022 fiscal year, which is the only quarter for which data is now available that was not available when I last wrote about it, revenue came in strong at $1.86 billion. This rise in sales, amounting to roughly 17.9% year-over-year compared to the $1.58 billion generated the same period of 2021, was driven largely by a 20.2% increase in revenue associated with operations in the US market. More specifically, the company benefited from a 19.2% increase in contract talent solutions due largely to an increase in the number of hours worked by the company’s engagement professionals and by an 8.2% rise in weighted average billing rates. Under the permanent placement talent solutions portion of the enterprise, revenue shot up by 39.3%, Thanks to strong demand for candidate placements and higher average fees earned per placement. And finally, under the Protiviti portion of the enterprise, revenue rose a more modest 8.4%, driven largely by a rise in billable hours.

Profitability for the company followed a similar trajectory. Net income in the second quarter came in at $175.8 million. This represents an increase of 17.8% over the $149.2 million generated the same time last year. Operating cash flow rose from $165.4 million to $232.9 million. If we adjust for changes in working capital, the increase would have been even more impressive, with the metric climbing from $149.1 million to $280.3 million. Meanwhile, EBITDA for the company also improved, rising from $190.5 million to $318 million.

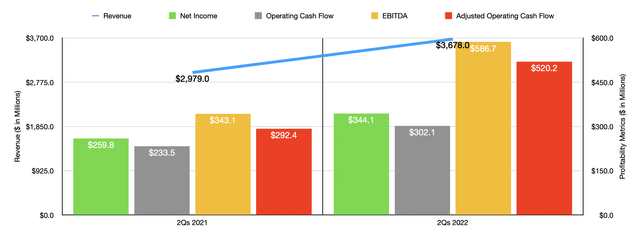

Thanks to the strong second quarter performance, performance for the first half of the year as a whole has also come in rather strong. Revenue of $3.68 billion represents a year-over-year increase of 23.5% compared to the $2.98 billion experienced one year earlier. Net income rose from $259.8 million to $344.1 million. Operating cash flow grew from $233.5 million to $302.1 million, while the adjusted figure for this increased from $292.4 million to $520.2 million. And finally, EBITDA for the company also expanded, climbing from $343.1 million to $586.7 million.

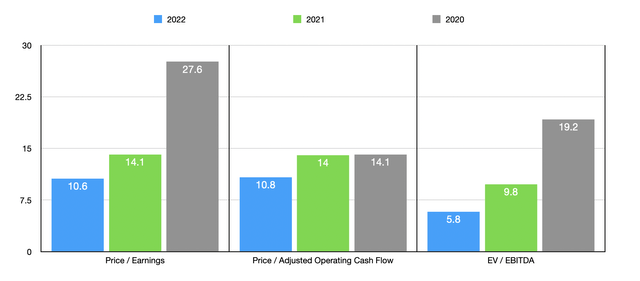

At this time, we don’t really know what to expect for the rest of the fiscal year. The simple approach is to annualize results experienced for the first half of the year. Following this route, we can estimate net income for the company of $792.8 million. Operating cash flow should come in at around $780.3 million, while EBITDA should total roughly $1.36 billion. Based on these figures, the company is trading at a forward price to earnings multiple of 10.6. The price to operating cash flow multiple is 10.8, while the EV to EBITDA multiple of the company should be 5.8. By comparison, these figures for 2021 would be 14.1, 14, and 9.8, respectively. And using data from 2020, these figures would be 27.6, 14.1, and 19.2, respectively. As part of my analysis, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.1 to a high of 29.3. Using data from 2021, we can see that four of the five companies are cheaper than Robert Half International. Using the price to operating cash flow approach, the range is between 6.1 and 36.3. In this case, three of the five prospects are cheaper than our target. And using the EV to EBITDA approach, we end up with a range of 4.4 to 15.9. Three of the five companies in this group are cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Robert Half International | 15.4 | 15.3 | 10.9 |

| ManpowerGroup (MAN) | 9.0 | 8.1 | 5.6 |

| ASGN (ASGN) | 11.1 | 36.3 | 10.5 |

| Korn Ferry (KFY) | 8.1 | 6.1 | 4.4 |

| TriNet Group (TNET) | 13.3 | 9.4 | 7.7 |

| Insperity (NSP) | 29.3 | 14.9 | 15.9 |

Takeaway

Fundamentally speaking, Robert Half International seems to be a solid prospect at this point in time. On a forward basis, shares look very cheap right now. Having said that, we are dealing with uncertain economic conditions and a deep recession, if it comes to fruition, could prove painful for this kind of enterprise. Should that come to pass, shares would look more or less fairly valued if financial performance word to revert back to what the company achieved last year. But if we go back to data from 2020, shares start to get a bit pricier. Because of the high probability of a slide backward, economically speaking, I do think a wait-and-see approach might be the best in this case, leading me to rate Robert Half International a ‘hold’ for the present moment.

Be the first to comment