Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 7.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of November.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

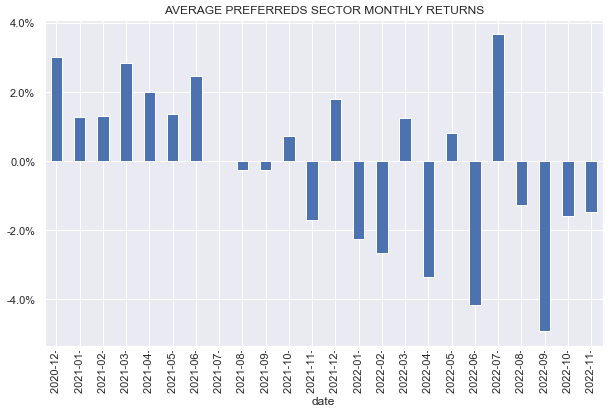

Preferreds were down once again on the week with November so far shaping up to be the fourth down month in a row. Higher Treasury yields and lower stocks were the key headwinds.

Systematic Income

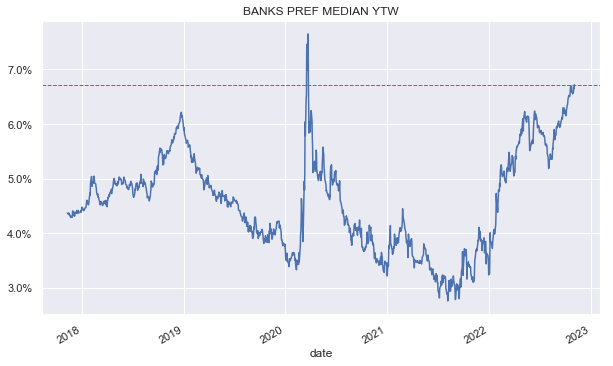

Retail preferreds yields continue to move higher and stand at the highest level over the last 5 years outside of a handful of days during the COVID crash. The sector remains an attractive place for new allocations in our view.

Systematic Income

Market Themes

Over the past year we have seen a significant increase in variable-rate preferred issuance linked to longer-term rates. Historically, retail i.e. exchange/traded preferreds were issued as either fixed-rate or linked to 3-month Libor after the initial 5-year fixed-rate period.

The ongoing transition away from Libor has pushed issuers to make a choice of sticking with a short-term variable rate like SOFR or adopt a longer-term rate like the 5Y Treasury yield (i.e. 5Y CMT) as the anchor for the variable-rate after the initial fixed-rate period.

Recent issuance has been focused primarily on the 5Y CMT with SOFR being less common. This makes sense since most institutional preferreds are also linked to 5Y rates, though most are also linked to the 5Y par interest rate swap rates in addition to the 5Y CMT rate. It may seem surprising but par interest swap rates are a more common benchmark of “interest rates” in the institutional space than Treasury rates.

That said, 3M Libor legacy preferreds still dominate in the sector. In our database that powers our investor Preferreds Tool on the service we count 134 variable-rate preferreds linked to short-term rates such as SOFR and 3-month Libor and we count 26 linked to longer-term rates such as 5Y Treasury yields i.e. 5Y CMT. So, how should investors think about allocating to one or the other?

The following factors are important to consider in our view. First, there is the simple question of diversification. It is very likely that most investors are allocated primarily to Libor-linked stocks so having some allocation to CMT-linked stocks provides another source of diversification in the portfolio.

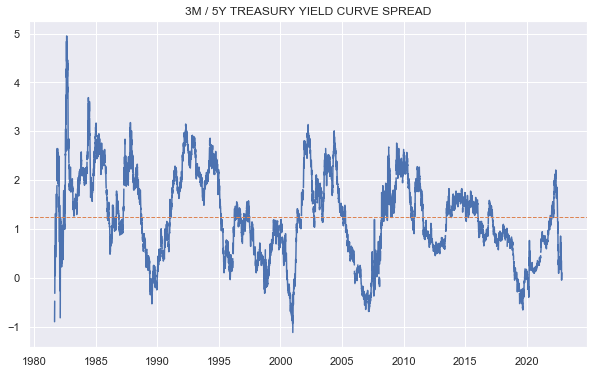

Secondly, it is important to consider the shape of the yield curve. Today, the yield curve is pretty flat which is fairly unusual as the following chart shows. The historical average differential between 5Y Treasuries and 3M T-Bills is a bit over 1%.

Systematic Income

What this means is that recent 5Y CMT issuance has been done at very favorable rates relative to historic levels. In other words, if the yield curve reverts back towards its historic level, the 5Y CMT linked stocks will gain an additional 1% relative to Libor/SOFR linked stocks. Therefore, the current flat yield curve provides an asymmetric risk profile which favors CMT-linked stocks.

Finally, another reason to take a closer look at CMT-linked stocks is that the Fed has much less control over the longer-end of the yield curve. In other words, if the Fed decides to suppress short-term rates, its ability to suppress longer-term rates will be limited in the absence of new and unusual measures such as yield-curve control.

The risk for CMT-linked stocks is that the Fed instead decides to keep the policy rate elevated through a prolonged recession. In this scenario, which is partly already reflected in the yield curve, short-term rates may continue to be well above longer-term rates which will benefit Libor/SOFR-linked stocks. In our view, this is possible but it’s unlikely to be sustainable. In other words, it is unlikely for there to be a multi-year recession with the Fed keeping the policy rate elevated throughout.

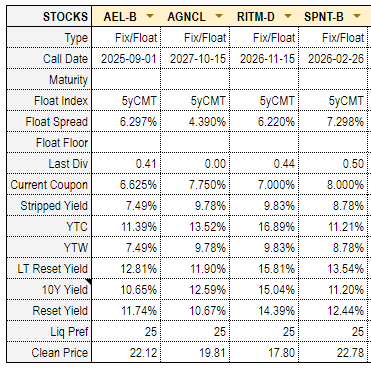

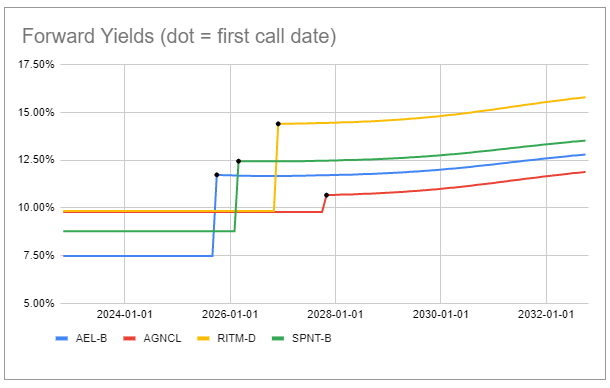

5Y CMT-linked preferreds worth a look are the following:

- American Equity Invest Life Holding Co. 6.625% Series B (AEL.PB)

- AGNC Investment Corp. Dep Shares Ser G Reset Rate Preferred (AGNCL)

- Rithm Capital Corp. Reset Rate Series D Cumulative Preferred (RITM.PD)

- SiriusPoint Ltd 8% Resettable Fixed Rate Series B (SPNT.PB)

The key details of these stocks are shown below. The stripped yield is what these stocks are yielding today and the reset yield is what these stocks are expected to yield on their switch to a variable rate.

Systematic Income Preferreds Tool

This is how the yields of these stocks are expected to evolve over time.

Systematic Income Preferreds Tool

Market Commentary

The new 5Y bond (SAJ) from BDC Saratoga started trading at a yield of 8.2% which looks pretty attractive. The asset coverage of the company’s debt was a strong 184% as of Q-end and this would have fallen marginally with this new issuance. The NAV of the company has moved higher over time which is good to see as it shows its underwriting is strong which should protect the debt. The bonds are not rated by a major agency but would likely be around a BB level conservatively. They are trading around 0.9% above a typical BB corporate bond yield.

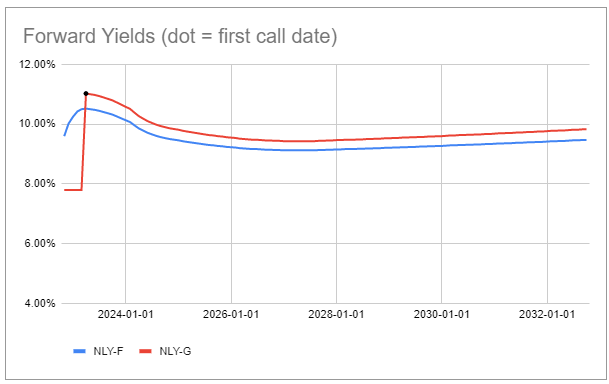

In case you missed it, NLY.PF was rotated into (NLY.PG) across all taxable Income Portfolios. G has a lower yield until Apr-2023 but then it steps up to a yield that is around 0.7% higher than F over the longer term (i.e. LT Reset Yield). The two series are trading at the highest price differential with F having risen to a high premium over G as it recently floated and jumped out to a higher yield. However, once G floats, F will have a significantly lower yield.

Systematic Income Preferreds Tool

Be the first to comment