Tom Pennington

Plains All American (NASDAQ:PAA) reported strong third-quarter results, with Adjusted EBITDA coming in at $623 million, 9.5% above consensus expectations of $569 million. Adjusted EBITDA surged 20% from the year-ago quarter.

Management also raised full-year 2022 guidance by $75 million. When combined with previous quarters’ increases, guidance now stands at $250 million above the initial guidance issued in February.

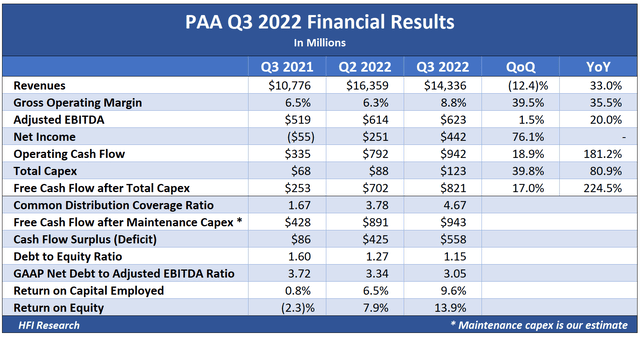

PAA’s impressive third-quarter financial performance is shown below. PAA’s gross operating margin and free cash flow results were its best since the 2020 downturn.

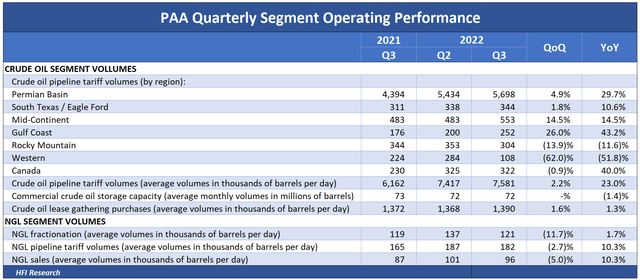

Our initial PAA investment thesis revolved around the company’s significant operating leverage in its Permian gathering and processing system. Our thesis was clearly borne out during the quarter, as a 23% year-over-year surge in Permian crude oil pipeline tariff volumes boosted revenues without a commensurate increase in expenses. This operating leverage accounted for most of PAA’s outstanding gross operating margin performance.

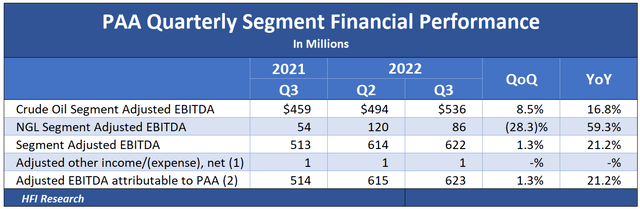

Breaking out PAA’s performance by segment shows the outsized impact of its Permian segment on companywide results.

Aside from Permian volume growth, the crude oil segment benefitted by taking advantage of price differentials in its Canadian operations.

PAA’s NGL segment also posted a strong year-over-year performance, but lower commodity prices in the third quarter versus the second quarter negatively impacted quarter-over-quarter results, as shown in the table below.

PAA’s Impressive Cash Flow Generation

Operating cash flow in the third quarter increased by 18.9% from the second quarter, though the second quarter result benefitted from a $154 million working capital build. Operating cash flow increased by 181% over the year-ago quarter.

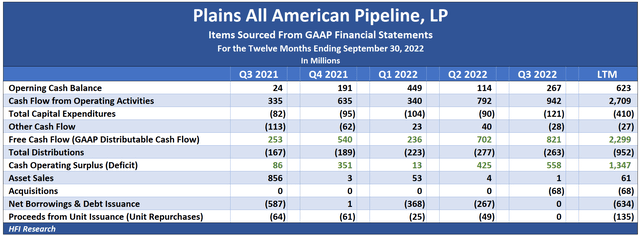

PAA’s quarterly cash flow results are shown in the following table.

Third-quarter free cash flow increased by 17% from the previous quarter and was up a whopping 225% from the third quarter of 2021. The year-over-year result was attributable to the company’s operating leverage, which was also behind the 36% year-over-year increase in the gross operating margin. During the quarter, PAA’s $821 of free cash flow covered its total distributions by a comfortable 3.1 times.

Management allocated $68 million of PAA’s $558 million cash flow surplus toward increasing its stake in the Cactus II pipeline by an additional 5%. The purchase from Western Midstream Partners (WES) was made in concert with PAA’s Cactus II partner, Enbridge (ENB). The deal strengthens PAA’s relationship with ENB, which has a significant downstream presence that could provide PAA with an important outlet for its gathered crude volumes.

PAA didn’t pay down debt or repurchase units during the third quarter, so most of its cash flow surplus remained on its balance sheet. However, year-to-date capital allocation remains positive, as the company has reduced debt by $634 million and has repurchased $135 million of units.

PAA’s balance sheet at the end of the third quarter was the strongest it has been since 2019. Management’s target leverage ratio was achieved ahead of expectations, with PAA’s leverage ratio ending the quarter at 3.7 times, below the targeted range of 3.75 to 4.25 times. The comfortable leverage position, as well as the company’s more than $1 billion annual cash flow surplus and $3.3 billion of liquidity, provides significant financial flexibility and ample safety for unitholders.

Management’s Capital Allocation Plan

In its third-quarter earnings conference call, management laid out its 2023 capital allocation plan. The plan is positive all around for unitholders. Management’s favored means of returning capital to unitholders is through distributions, and its priority will be to increase the annual common distribution from the current $0.87 per unit to $0.97 per unit in 2023. The units currently trade at an attractive 8.2% on the new distribution. Repurchases will also be part of the capital allocation mix but will be opportunistic, based on PAA’s cash flow and the units’ market price.

PAA’s capital allocation plan for 2023 is on the timid side, as the company will still generate a massive cash flow surplus. If PAA’s free cash flow and unit count were to remain constant at 2022 levels, the $1.13 billion of total distributions expected to be paid out in 2023 could comfortably increase by more than $1 per unit. This reflects the company’s huge free cash flow yield on its equity that is likely to be allocated to unitholders in increasing increments over the next few years.

Unitholders’ fortunes are poised to improve further after 2023. Each year, management intends to increase the annual distribution by $0.15 per unit until distribution coverage falls to 1.6 times. Management targeted 1.6 times coverage, so PAA can fund capital expenditures organically and still generate a small cash flow surplus. We like this approach because it reduces the chance of PAA having to issue equity to fund management’s capital allocation priorities.

Flat to Low-Single-Digit Adjusted EBITDA Growth in 2023

For 2023, we expect PAA’s Adjusted EBITDA to increase in the low-single-digit range. The company will face numerous headwinds to an improved performance relative to 2022.

On the operational front, PAA will lose the benefit it had in 2022 of selling excess linefill acquired at lower commodity prices. In addition, its Permian operating leverage will be less impactful in 2023 than it has been throughout 2022. We, therefore, don’t expect the large year-over-year improvements in gross operating margin that its Permian crude operations generated in 2022. NGL prices could also be lower in 2023 than in 2022, which will provide an additional headwind for 2023 Adjusted EBITDA.

Meanwhile, PAA’s financing cash outflows are set to increase in 2023 as its Series A and Series B Preferred units reset to higher levels. For the full-year 2023, the resets are likely to cost the company an additional $55 million in increased preferred distributions. This will reduce free cash flow and eat into the common distribution coverage, though not by a meaningful amount relative to the $1.9 billion of free cash flow available to the common units in 2022.

Between the Series A and Series B units, PAA has $2.2 billion of preferred units outstanding. The units will be callable in 2023. However, despite PAA’s ample liquidity, management would rather pay down long-term debt than repurchase the preferred units, so they’re likely to remain outstanding through at least 2023.

Offsetting the operational and financial headwinds in 2023 will be continued growth in PAA’s Permian crude oil volumes. PAA is among the companies best positioned to gauge Permian production growth over the coming quarters. Management’s estimate of 600,000 bpd of growth for 2022 was spot on when first made in February, despite being significantly below market expectations at the time. For 2023, management forecasts a 650,000 bpd increase in Permian production. Permian production is poised to end the year at 5.5 million bpd, so a 650,000 bpd would represent a 12% increase.

PAA’s vast crude gathering system is likely to capture a large portion of Permian growth, which we expect will offset the 2023 headwinds and generate flat to low-single-digit growth in Adjusted EBITDA.

Our Valuation and Price Target Remain Unchanged

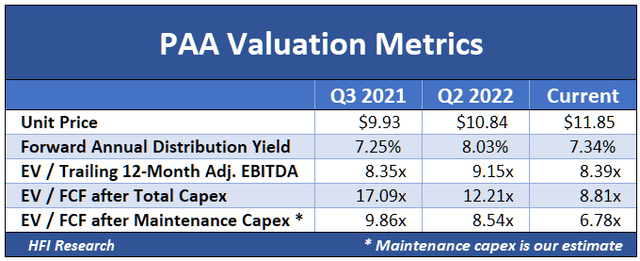

We’re keeping our PAA value range and our $13.50 price target unchanged. The units currently trade at an 8.4-times EBITDA multiple, which is lower than the midstream average and PAA’s own historical multiple of more than 9.0-times.

PAA’s low trading multiple reflects a discount that applies for crude-weighted midstream operators relative to natural gas-weighted operators, but given PAA’s dominant position in the Permian, its multi-quarter trend of improving return on capital, and the reasonable chance that its return on capital improves further in a sustainable manner, we don’t believe a significant discount is justified. Even a slight re-rating to a higher multiple would significantly increase PAA’s unit price. Depending on how the company’s operating performance plays out in 2023, we may increase our valuation of PAA units to reflect a higher multiple.

Conclusion

We’re pleased to see our PAA thesis playing out as expected. We’re also gratified that unitholders stand to make out well next year, despite the company’s slowing Adjusted EBITDA growth rate. We reiterate our Buy rating on PAA units and believe significant distribution hikes lie in store for unitholders over the next few years. Patient income-seeking investors seeking exposure to the bullish energy commodity outlook should consider making a long-term investment in PAA units.

Be the first to comment