RealPeopleGroup/E+ via Getty Images

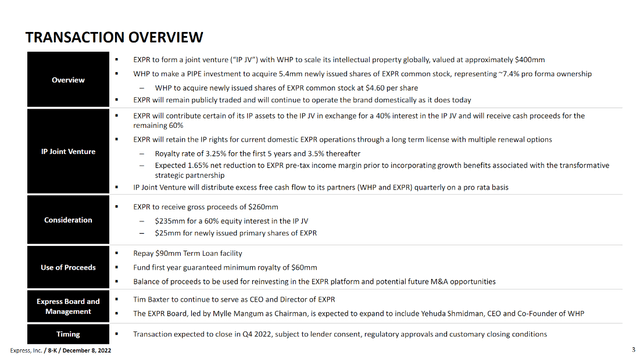

On December 8th, Express (NYSE:EXPR) announced a Strategic Partnership with WHP Global, which includes a $260M cash investment along the following terms:

This is a transformative deal for Express, repairing their balance sheet and helping grow their IP with an established partner. Optically, Express would take a $60m hit to operating income (the minimum annual royalty payment), but the Company benefits from negated interest expense ($10m+), and close to $20m of the royalties are returned via their 40% JV stake.

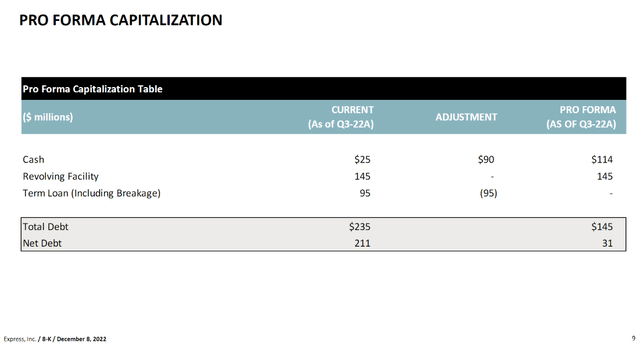

Express’s pro forma balance sheet was provided as follows:

Express will pre-fund FY23 minimum royalty payments of $60m, providing runway until Q1-24 before an actual cash impact to their earnings.

Express has additional balance sheet tailwinds unaddressed in the above:

- A $52m tax refund is due from the IRS under the CARES Act.

- Express is carrying $423m of inventory at the end of Q3-22. They should work this down to ~$300m by the end of Q4, still higher than pre-Covid when they had a larger store base (607 in Feb-20, 558 expected in Feb-23). I expect this inventory normalization to be accompanied by a decrease in accounts payable, but still providing a positive cash contribution in Q4, and should be an additional source of cash in FY23.

- The “Accounts Payable to Inventory” ratio sits at a historic low, suggesting Express is not getting the vendor financing they previously enjoyed. Actually, I understand this is mostly due to stale inventory being worked through in Q4 that was already paid for, which should help this ratio recover in FY23.

- Express’s 40% stake in the JV is being valued today at $160m based on the terms of the deal.

I expect Express should finish Q4 with a net cash position prior to the tax refund.

What Will it Take for This Deal to Work?

Our friends over on Twitter, Clark Square and EagleFang, highlighted the type of deal WHP could land for Express to break even on the JV arrangement:

-

$200M of international wholesale, run out of Express’s owned inventory, would produce wholesale margins ($60-80m @ 30-40%) and pay net royalties of 8.5%*60%=5.1% ($10m) to the JV. Assume another 10% SG&A growth ($20m) to service this international business, and Express nets $60-80m – $10m – $20m = $30-50m of earnings growth, offsetting the 2% drag on operating income margins pre-deal.

Without any incremental deals from WHP, Express would need the following in FY23 to break even on a cash flow basis:

-

$2.0B of sales at 30% gross margin: $600m Gross Profit

-

Less $575m SG&A

-

Plus $60m D&A

-

Less $50m CapEx

-

Plus $10m Stock Compensation

-

Less $40m net royalty (pre-funded)

-

Less $5m interest on ABL

-

No cash taxes

-

Net $0 FCF

-

This is almost exactly the current FY23 estimates for sales and margins, and a reasonably possible outcome as inventory should be less expensive in FY23 with lower inputs and freight, and discounting should cause less pressure without bloated inventory.

I don’t believe WHP would make this investment and sit on their hands, hopefully, they have deals already in mind. If they invest $260m and return ~$325m over the initial 10-year term (minimum royalty payments), it’s not a very compelling investment assuming their average cost of capital should be higher than 6%. Howard Marks at Oaktree has sunk $350m equity (not debt) into WHP, a good sign of smart money being present. Additionally, the minimum royalty would complicate a bankruptcy process, as exiting many store leases would reduce topline sales and make the royalty less sustainable. WHP appears well-incentivized to support Express going forward.

Despite product issues, Express consistently adjusted to trends, generating solid cash flow in every year prior to Covid. The company hired Tim Baxter to fix the business right before Covid, and he’s laid out a plan (that got delayed a bit by Covid) to shift sales from malls to outlets and e-comm. Baxter’s scenarios didn’t anticipate WHP expanding international sales, but their FY24 target of mid-single digit operating margin leaves plenty of room for royalty payments to WHP, and Express has liquidity to pursue these targets. On $2.0B of sales, this would be $80m+ of operating margin before any benefit from international or payments into the JV.

Lastly, Express is a Covid survivor. Their FY19 proxy identified a “peer group” of which, Tailored Brands, Ascena, and RTW Retailwinds filed for bankruptcy in 2020, as did J. Crew, J.C. Penney, True Religion, Brooks Brothers, Forever 21, Lucky Brand… the list goes on. Some, like Tailored Brands, announced the planned closing of up to 500 of their ~1,400 stores. Forever 21 filed in 2019 and has closed about 250 of their 790 locations since. The thinning out of peers gives Express more runway.

Risks

The main risks are (1) Express’s ability to fix their core business, (2) a poor acquisition in the name of growth, or (3) macro conditions run them over. I hope you haven’t read this far with the belief Express is a healthy risk-free investment. Rather, it is a brand with a new liquidity infusion to fix business issues that want to go do M&A. You need to believe in a basic level of execution for this investment to work. The most glaring business headwind has been fashion missteps in their women’s segment. Conversely, their men’s segment has posted six consecutive quarters of positive comps. Express will need to address their fashion misses to stop leakage in same-store sales.

For other risks, feel free to peruse some negative takes from this past weekend’s spirited Twitter discussion.

Express mentioned M&A multiple times in their announcement of this deal. While many retailers are trading at attractive multiples, I expect investors will be more concerned with Express fixing their own issues before acquiring another business. Given their tone, I would expect an acquisition announcement from Express sooner rather than later after the deal is closed, though I’d rather first see them exhaust their $34m buyback at current prices before spending a dime on M&A (~50% of the outstanding shares).

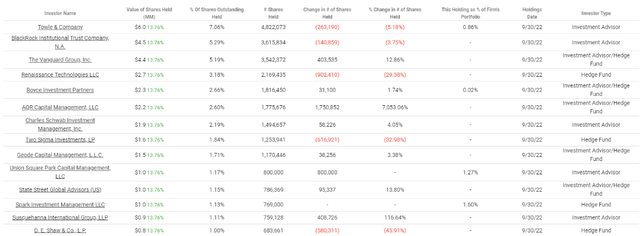

Negative market reaction since the deal was announced suggests the market is skeptical. My discussions about the deal have indicated very few investors understand it, and the shareholder ledger leaves a lot to be desired:

There is a risk the stock will continue to trade poorly until they can execute and prove this deal has real value, and attract active funds back into the fold. The lack of meaningful insider ownership also will raise concerns until Management puts their money where their mouth is and buys shares in the open market.

Valuation

If Express can execute on their FY24 goal of mid-single digit operating income, their stock will likely trade near the double digits, about a 10x return from here. The WHP deal provides Express time and a partner to help expand sales internationally with less risk, hopefully paying for itself via increased sales. If Express can’t fix their declining sales in the women’s segment and spends their cash on a bad acquisition, shareholders will likely lose their full investment.

Illustrative M&A

As an example of how I expect future M&A to work:

-

Express could announce they are acquiring a business, I will use the example of Vera Bradley (VRA). The stock trades at a $150m market cap, so assume Express buys it for $200m.

-

VRA does $500m of annual sales (1/4th Express), so valuing the IP like Express, a new JV could be formed on the same terms as Express with a $100m implied value, with WHP contributing $60m for their portion of a ~$15m annual royalty stream to the JV.

-

WHP would then work to add licenses, and Express would run the acquired business like they do with their current brand. For a net investment of $140m, Express would be getting a ~$50m EBITDA stream that would now be closer to $40m with the JV, before any operating synergies.

If Express can find deals like the above, future M&A would be accretive. Considering Express was trading under a $100m market cap and just valued their IP at $400m, they might find deals and sell the IP for more than the cost of the acquisition.

Conclusion

Execution will be required to stabilize the Express topline declines, but they now have significant runway to do so. FY23 tailwinds give the business a chance to return to cash generation and reward long-suffering common shareholders. The transaction proposed by Express and WHP Global appears to be a fat pitch, valuing the business at multiples of where the equity currently trades. If Express can execute on their stated targets, I see 10x upside on the stock by 2024.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment