imaginima/E+ via Getty Images

Landsea Homes Corporation (NASDAQ:LSEA) is a relatively new player in the USA’s extensive and established homebuilding industry. It has made its mark by focusing on high-performing homes for millennials and first-time buyers in targeted regions. The small-cap stock of $219.90 million went public early in 2021, entered new markets through strategic acquisition, and obtained funding to reduce debt and invest in future growth. However, the market has yet to react well to the stock, which initiated at $10.15 and has since dropped to $5.68 per share.

Stock price trend since IPO (SeekingAlpha.com)

LSEA has grown its top and bottom-line performance every quarter this financial year. LSEA has a solid asset-light business model and strong cash generation, maintains a healthy cash balance sheet, and has a solid backlog going into the final quarter. However, the housing market is facing strong headwinds with spiked mortgage rates, a slowing economy with a recession predicted for 2023, and the company is delivering low profits compared to its peers on top of a downward trending stock since going public. Although the company has a solid business model, I recommend that investors take on a hold rating as market conditions become increasingly unfavorable.

Overview

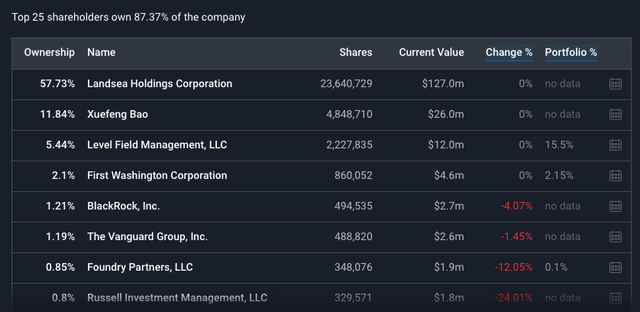

LSEA was established in 2013 by CEO John Ho as the U.S. subsidiary of China’s Landsea Green Properties Co. The year 2021 was a turning point year for the company, which went public in January 2021 on Nasdaq after merging with shell company LF Capital. LSEA closed off 2021 with $1 billion in revenue and expanded into new geographies of Florida and Texas through the acquisition of VE Homes for $54.6 million while obtaining $500 million in financing to refinance debt and for future expansion. It takes on the entire house-building scope of design and construction to selling urban and suburban homes now in five states aimed at millennial and first-time home buyers. The company was ranked 47th in the top 100 U.S. homes; however, the VE Homes acquisition would bring it to the 37th spot. It is a young player in a large, well-established, and competitive market. Below we can see the makeup of the shareholders of the LSEA.

Shareholder ownership (Simplywall.st)

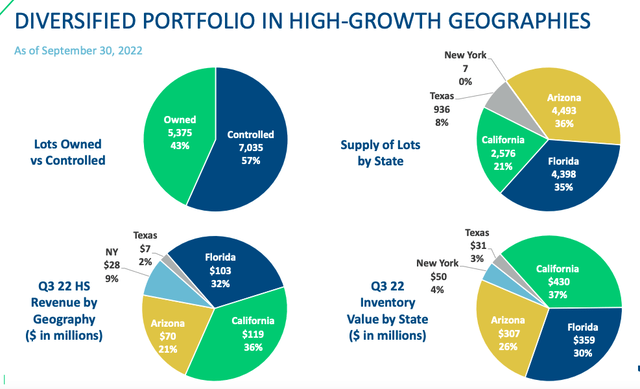

The company has 12,410 lots, of which 57% are controlled, with most of the lots located in Arizona. California is its most extensive geography by revenue at 32%, and California has the most significant value of inventory, accounting for 37% of the value.

Portfolio of Geographies (Investor Presentation 2022)

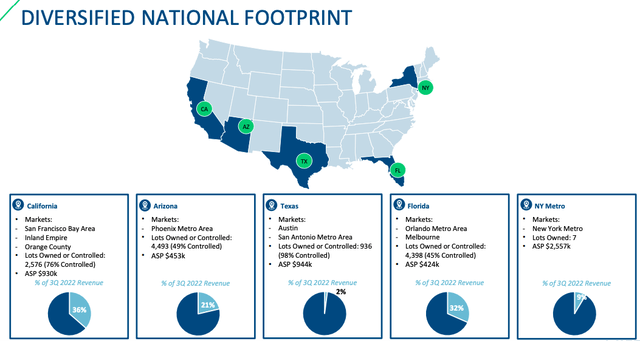

Below, we can see a map of the company’s diversified national footprint in further detail. California, followed by Florida, account for 68% of total revenue.

Map of geographies (Investor Presentation 2022)

The company differentiates itself from its more prominent and better-established peers by focusing on sustainability. Ho and his team focus on High performing homes (HPH), a holistic approach focused on four pillars, including not only sustainability but energy saving, automation through Apple Homekit, energy saving, and healthy living.

Financial Results

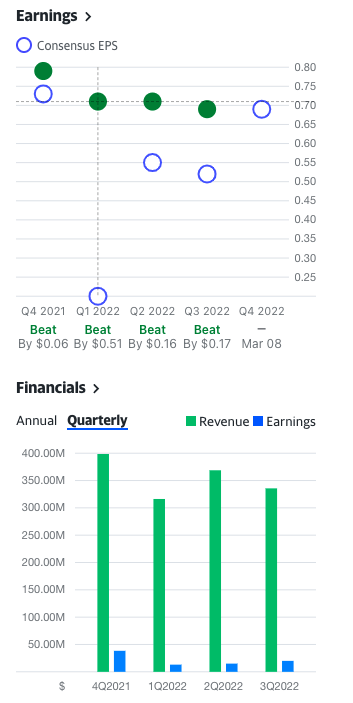

Although the home building industry is facing strong headwinds from a slowing economy and mortgage rates that are at record highs, which is having an immediate impact on people’s decisions to purchase housing, LSEA has been improving its top and bottom line performance for all three consecutive quarters of this financial year.

Quarterly Financials (Finance.yahoo.com)

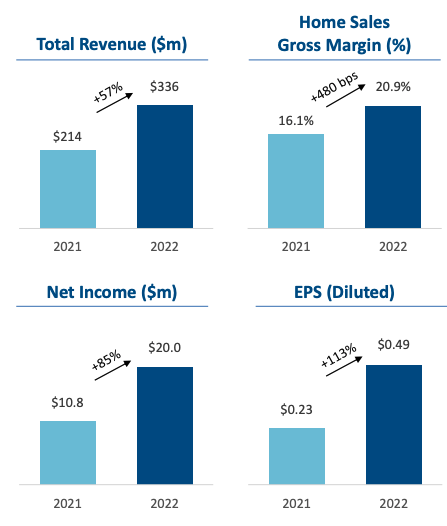

In Q3, the company produced total revenue of $335.6 million, a year-on-year increase of 57%. The net income in Q3 2022 was 28.2 million, more than three times the value increase from the year prior. On top of that, adjusted EBITDA was $ 47.4 million, more than double what it was in Q3 2021. vs. $19.3M. The diluted EPS increased by 113% year on year to $0.49. It also improved its home sales growth margins from 16.1% to 20.9%. Below is an overview of the growth between Q3 2022 and Q3 2021.

Q3 2022 vs Q3 2021 (Investor Presentation 2022)

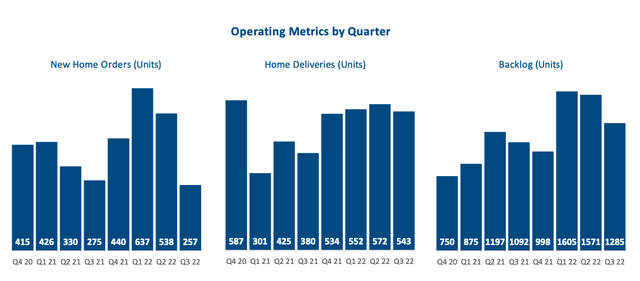

Below we can see the company’s key operating metrics per quarter, indicating new home orders, home deliveries and backlog. One primary concern is the number of new home orders, only 257 at a value of $165.5 million. We can see that this is the lowest number of new home orders since 2020, before LSEA acquired VE homes. On the positive side for the next quarter, the backlog in homes has increased by 18% to reach 1,285 homes worth $741.1 million at an average sales price of $577,000.

Operating metrics per quarter (SeekingAlpha.com)

If we look at the balance sheet, LSEA had liquidity of $198.1 million, which was made up of $117.4 million in cash and equivalents and $60.7 million in credits from the $675 million that the company has in its unsecured revolving credit facility. Total debt increased to $585.1 million, giving debt to capital ratio of 46.1%.

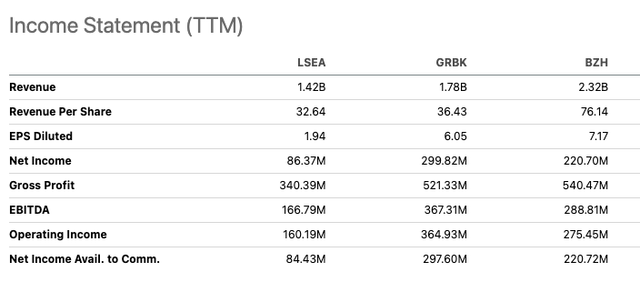

I have compared LSEA to public home-building peers who have closed under 5300 homes in 2021. LSEA incredible pace of growth is quickly pushing it up the ranks amongst more prominent home builders. Firstly, Green Brick Partners (GRBK), a Texas-based company incorporated in 2006, has had a solid financial performance this year but an increasing number of cancelled home orders and a severe reduction in backlog. Secondly, Beazer Homes (BZH), a Georgia-based home-building company founded in 1985, comparably had a strong performance in the past quarter but a significant decrease in new house orders. On top of that, this company has a very high debt.

Below is a comparison of their income statements. Although LSEA has grown quicker than the companies below, it is the smaller of the three, bringing in the least revenue, in line with the least number of house deliveries. It also has a much lower net income and EBITDA. This is one concern, although the company has had impressive growth year-on-year.

Peer Comparison (SeekingAlpha.com)

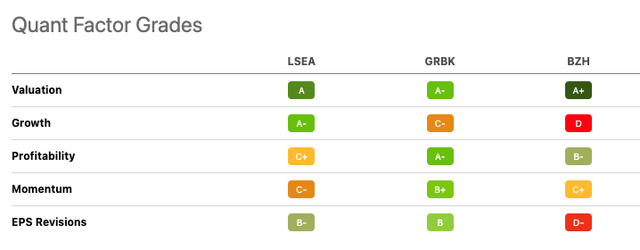

If we look at Seeking Alpha’s Quant Factor Grade rating, we see that LSEA does well on the valuation and growth factors with an A and A-. However, profitability is graded below its peers.

Quant Peer Valuation (SeekingAlpha.com)

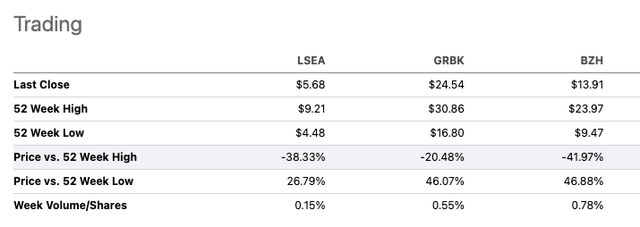

One attractive aspect is that LSEA trades at a lower price than its peers. However, the stock has yet to deliver much in returns for its shareholders, although it has trended positively for the last month. There may be a potential upside in the future as the company continues to grow and improve its profit margin.

Trading comparison (SeekingAlpha.com)

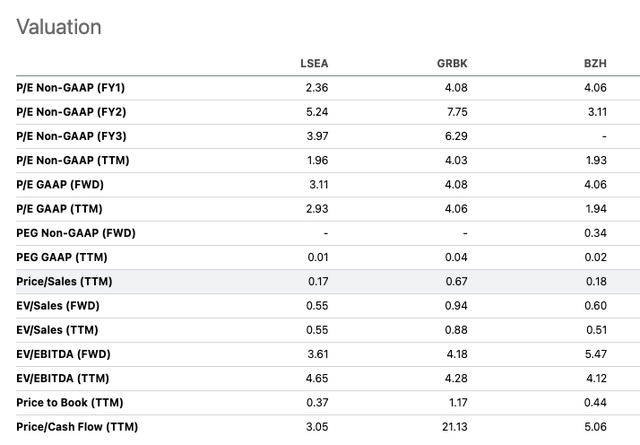

LSEA may be undervalued compared to its peers across several important ratios by taking on a relative peer valuation. One indicator is its price-to-earnings ratio of 2.23. Furthermore, it has a price-to-book ratio of 0.35, well below its peers and under one, indicating that the current market price is relatively low.

Relative Peer Valuation (SeekingAlpha.com)

Final Thoughts

We cannot deny the big red flags facing the housing industry. Mortgage rates are skyrocketing to record highs. There is already a significant slowdown in houses sold, interest rates continue to rise along with inflation, and the economy is in decline. 2023 will be a challenging year for housing companies. However, for the short term, the company has a healthy backlog and the financial backing to continue looking for opportunistic acquisitions and growth alternatives. Although the company has delivered solid results and has made impressive growth moves since its IPO in 2021, the market’s headwinds will impact Landsea Homes Corporation’s growth in the coming months, and, therefore, it gets a hold recommendation.

Be the first to comment