xavierarnau/E+ via Getty Images

Another Inflation and Recession-Resistant Idea

In my search for inflation and recession-resistant ideas, I’ve turned up another commercial REIT opportunity with BrightSpire Capital (NYSE:BRSP). It’s trading just 2.99% off of its recent new 52-week lows and has started trading away from its peer group for no clear fundamental reasons that I can see. Their lending book is at 100% floating rates and earnings will benefit from rising interest rates; meanwhile, management has been conservatively building a cash position to navigate the uncertain macro environment.

The stock is trading at a P/B of 0.62x with peers trading at an average 0.88x. I think in a base case it’s likely that BRSP will trade at least back to parity with peers which would imply a 42% return at current levels. BRSP currently has a well-covered dividend yield of 11.5%. I think buyers at current levels could see a one-year total return of 53.5%.

In a worst-case scenario the company’s $313m in real estate ownings plus $318m in cash provides a downside floor at $631m or 29% lower than current prices. With the dividend factored in that would equal a total return of -17.94%.

BrightSpire Capital’s History

BrightSpire was formerly known as Colony Credit and traded under the ticker CLNC. At that time, the company was an externally managed REIT run by Colony Capital which is now known as DigitalBridge Group (DBRG). On April 5th, 2021 the company announced an agreement to end its external management and internalize the company’s operations. This move was part of a strategic review process managed by a special committee of the board and marked a new chapter for the company after losses in 2020.

The move to be self-managed was expected to generate permanent savings between $14 – 16m a year or $0.10 – 0.12 per share on expenses. And it gave management the space to run the company how they saw fit. Current CEO Michael Mazzei was brought on just a year before the internalization process in 2020 and likely helped to shape the strategic shift. Mazzei works alongside President Andrew Witt who has been with the company since 2019. Witt previously worked directly for Colony Capital but has since transitioned to focusing exclusively on BrightSpire.

BRSP Investor Presentation

Mazzei previously served as a board member at peer Ladder Capital (LADR) from 2017-2020 and President of LADR from 2012-2017. He’s been trading commercial mortgages professionally since 1984 and took no time at all to redesign BrightSpire’s book. Four main changes have occurred:

-

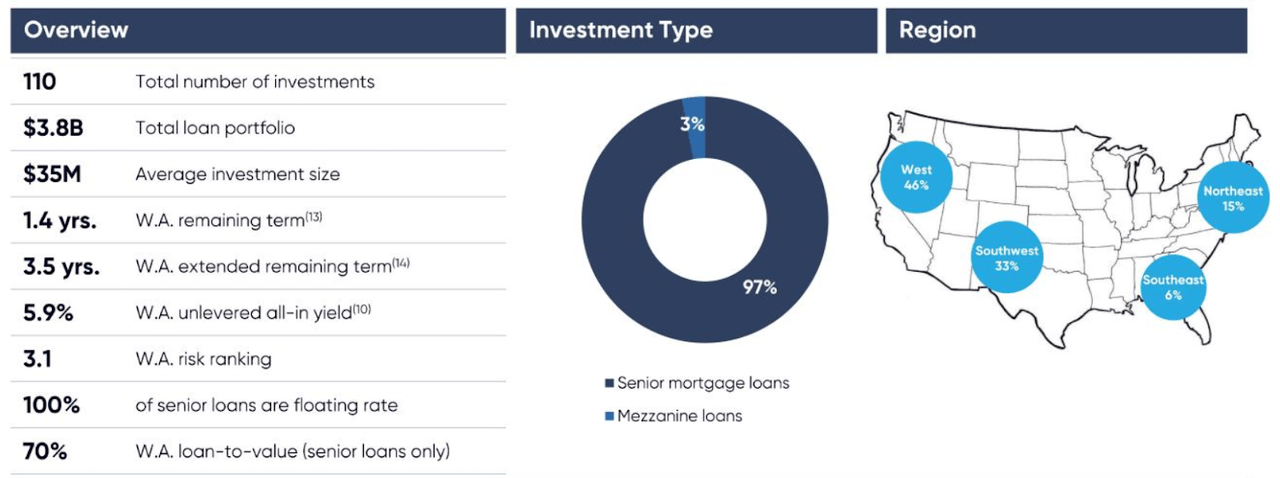

The book has shifted away from riskier mezzanine loans to senior secured loans. Senior secured loans make up 97% of their Q2’22 loan portfolio as compared to 85% in Q2’20.

-

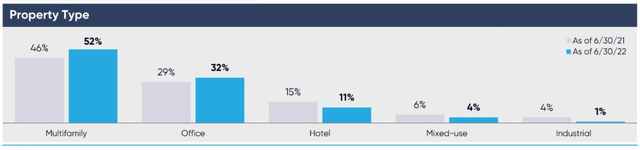

Multi-family properties represent 52% of the book in Q2’22. Back in Q3’20 multi-family was at 31%.

-

Average investment size has decreased from $49m to $35m since Q3’20. This has allowed the company to diversify its base of loans which reduces risk. They did this while also increasing the weighted average unlevered yield from 5.8% to 5.9%.

-

The overall weighted average risk rating for the portfolio has decreased 18% from 3.8 in Q3’20 to 3.1 today. Theoretically this means the book is less risky than it was.

While these changes have been significant, I think the market still hasn’t fully appreciated the change BrightSpire has made. There’s likely some overhang in the stock as a result of their past though the transition seems near complete.

BrightSpire Investment Thesis and Valuation

A theme in the market I have been tracking is commercial real estate (CRE) debt as it is typically both inflation and recession-resistant. Howards Marks and Oaktree Capital made a case for investing in private CRE back in November 2020 given a wall of maturities between $400-450b in debt that will need to be refinanced in the years leading up to 2026.

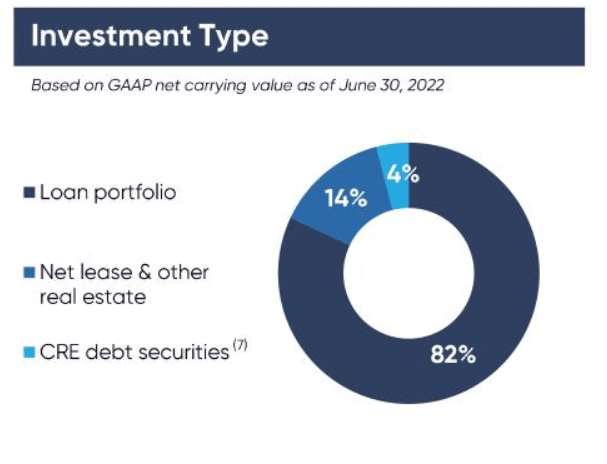

BrightSpire fits this theme. They self-describe as a “a commercial real estate credit real estate investment trust” with 86% of their $3.8b loan portfolio focused on CRE debt according to their most recent investor presentation. This is a combination of their CRE debt securities and their loan portfolio.

Q2’22 Investor Presentation

The debt is primarily focused on multi-family (52%) and office (32%) properties. Recently management has focused on growing the multi-family portion of the book which was only 30% of the book in Q3’20.

Q2’22 Investor Presentation

Multi-family properties have done well recently with Fannie Mae predicting resilient market demand going into the end of this year. Inflation is driving rental prices higher and interest rate increases are making home purchases more expensive which additionally drives more rentals. The net result for REITs like BrightSpire which are invested in the senior debt of multi-family CRE is that the value of these properties seems well supported. Rising rents aren’t likely to continue forever though, so it’s something operators and underwriters need to be mindful of.

A separate report in August from NAREIT suggested that CRE saw “continued solid fundamentals reflect an ongoing healthy demand for commercial real estate across most sectors, even as concerns about a slowing economy dominate the outlook.” This backdrop provides a beneficial macro-context for BRSP.

The loan portfolio consists of 110 loans 97% of which are senior mortgage loans. All of these loans are at floating rates which means the unlevered all-in yield of 5.9% from June 30th is likely to rise with rates. If we consider that the Fed raised rates in mid-June and again in mid-September by 0.75% each time it’s possible the yield could be near 7% next time it is reported. And this is with additional interest rate hikes expected moving forward.

Q2’22 Investor Presentation

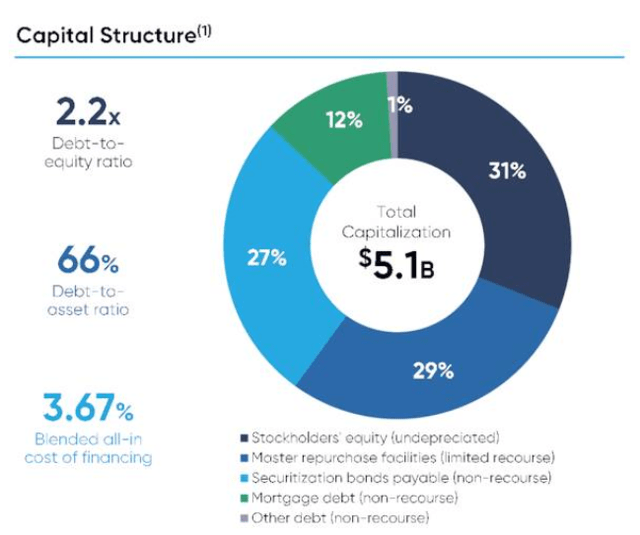

The blended all-in cost of financing for BRSP is reported at 3.67% which implies a net interest margin of around 2.23%.

Q2’22 Investor Presentation

Geographically we can see that the focus is in the West and Southwest overall as it makes up 79% of their portfolio. On their most recent Q2’22 earnings call CEO Michael Mazzei said this of their strategy “Our middle market lending program targets higher population growth regions, drive to work markets, and value add asset level strategies.”

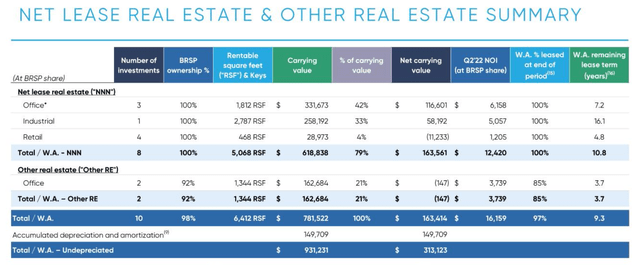

The company manages 10 properties as owners with an undepreciated carrying value of $313.123m. The value of these properties alone represents 36% of the current market cap of BRSP. These properties are 97% leased up currently with an average remaining lease term at 9.3 years.

Q2’22 Investor Presentation

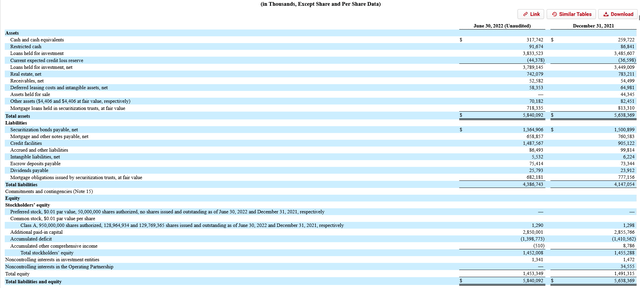

Owning BRSP would give exposure both to senior debt in commercial real estate as well as direct ownership of around $300m in fully leased CRE. The company currently holds $317.742m cash on hand which if we add together with their real estate holdings, we get $630.865m. With market capitalization around $894m this means that their real estate holdings and cash position alone represent 71% of that.

Q2’22 10-Q

I think that this $631m real estate and cash holdings value is likely a floor for the stock price and represents a 29% decrease in current prices. This is our bear case scenario.

If we look at BRSP amidst peers we can see some of the disconnect in its pricing.

|

Ticker |

Market Cap (m) |

NTM P/E |

P/B |

|

72 |

5.65 |

0.16 |

|

|

874 |

6.72 |

0.6 |

|

|

2350 |

9.21 |

0.95 |

|

|

1190 |

9.13 |

0.79 |

|

|

1230 |

9.1 |

0.82 |

|

|

6200 |

9.22 |

0.97 |

|

|

Average |

1986 |

8.17 |

0.72 |

Many of BRSP’s peers are trading above BRSP’s P/B of 0.62x. The only one trading below that is ACRES Commercial Realty Corp. (ACR) which is another turnaround story that I wrote up in July. If we exclude ACR’s and BRSP’s P/B multiples the peer group average is 0.88x. A reversion of BRSP to the peer average would imply a 42% return.

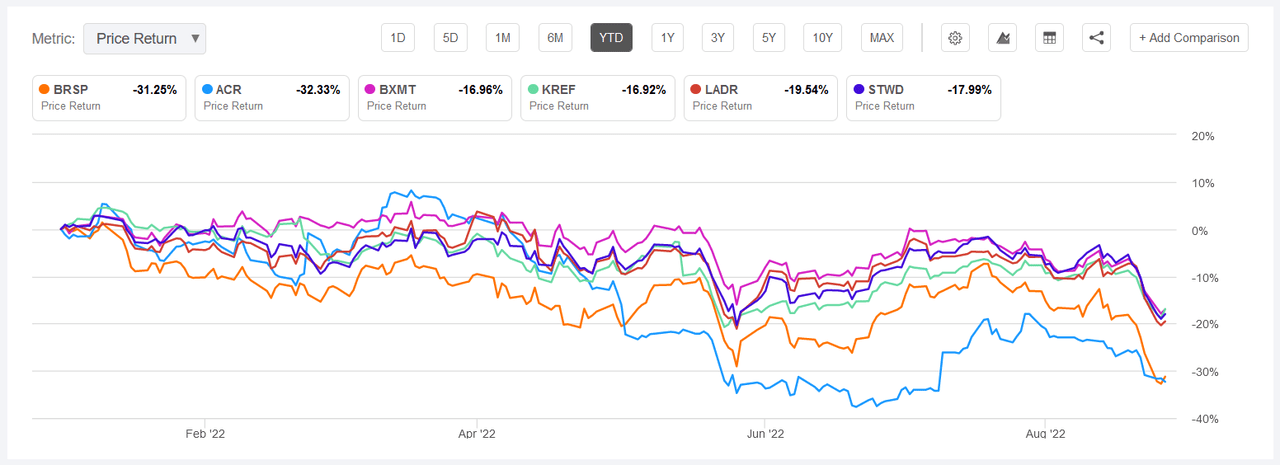

We can also see in price charts that BRSP YTD has performed similarly to ACR with a -31.25% return.

Seeking Alpha

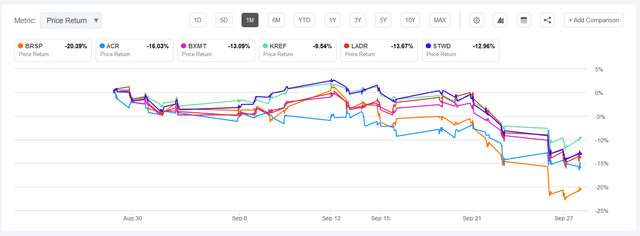

And if we look more closely, we can see that BRSP’s stock price decline has outpaced all peers in the last month. It’s declined -20.39% as compared to an average -13.06% decline amongst peers.

Seeking Alpha

The stock price decline has driven the dividend yield to 11.5% with the company most recently announcing a $0.20 quarterly dividend this month. Net income for the quarter was $0.26 per share meaning earnings covered the dividend by 130%. Earnings over the last four quarters totaled $0.99 and paid out $0.77 in dividends; this implies dividend coverage of 129%.

Management suggested in their Q2’22 call that earnings run-rate moving forward should be around $0.23 per share. That would suggest that a $0.20 dividend is at least sustainable from earnings alone. The cost of the dividend per quarter is around $25.79m so with BRSP’s $318m in cash they could pay the dividend for twelve quarters.

If we annualize $0.23 per share earnings, we can estimate $0.92 in earnings. This would imply a P/E of 7.53x for BRSP. Peers are trading at an average of 9.17x (if we exclude ACR and BRSP again) and if BRSP reverts to this level that would imply a return of 28.95%.

Using the returns implied on P/E and P/B reversions I’ve averaged the two together for a base case price target of $9.39 with a 35.44% implied return.

|

Current |

Target |

Return |

Price Target |

|

|

BRSP P/B reversion to peers |

0.62 |

0.88 |

41.94% |

$9.84 |

|

BRSP P/E reversion to peers |

7.53 |

9.71 |

28.95% |

$8.94 |

|

Average |

35.44% |

$9.39 |

I think it’s reasonable that the stock could trade back to these levels within the next year. If we estimate an annual dividend yield of 11.5% that would mean a total annual return of 46.94%.

A Bullish Case for BrightSpire Capital

There are a few elements in place which may imply a more bullish scenario for BrightSpire Capital moving forward: interest rates, share repurchases, and an upcoming CLO.

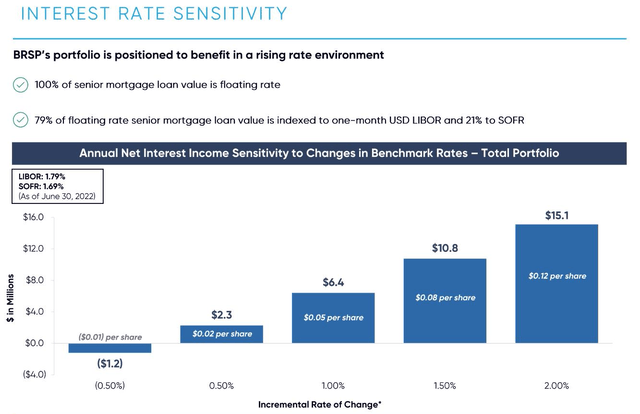

As mentioned, all of their senior loans are at floating rates. As the Fed continues to increase rates to fight inflation the income BrightSpire is generating will grow as well. Below is a slide from their most recent investor presentation regarding interest rate sensitivity.

Q2’22 Investor Presentation

This slide had SOFR at 1.69% and as of September 27th SOFR is at 2.98%. This is a 1.29% increase in rates already with future hikes likely. Using the chart’s data we can estimate an increase in earnings of $0.065 due to the increase in rates alone. If we apply this to the $0.23 run-rate EPS that would imply next quarter’s earnings may come in at $0.295 which translates to a 28% increase.

In May 2022, BrightSpire announced a $100m stock repurchase program open until April 2023. As of their Q2’22 10-Q they still had $81.7m set aside for buybacks which the company could use. If fully used at current prices the repurchase program could eliminate 11.77m shares. That would bring the share count down to about 117m and would increase EPS to $0.25 or 8.7% from $0.23.

Yet it is possible that the repurchase program is not executed given these comments on the Q2’22 call:

So just to the buyback, look, I think is, we said, Eric, there’s just a bias around the cash right now. And as we have clarity in the coming quarters, we’ll look to be opportunistic as far as buying back our stock, but nothing planned at the moment beyond kind of where we are.

Management’s approach is to be conservative amidst an uncertain economic context overall which is where their bias to cash is coming from. CEO Mazzei outlined on the call, “If the market improves, stock price improves and we’re going to risk on, we’d much rather put the money out in loans.” The stock price closed at $8.62 on the date of the call so suffice to say the stock price has not improved. So perhaps they are buying back stock at these levels.

Regardless, the repurchase program may serve as a catalyst to earnings over the next year.

The last detail which may provide further growth is an upcoming CLO which management has been discussing. In their Q1’22 call management indicated a preference to execute their third CLO in Q3. But given unfavorable CLO market conditions they announced in the Q2 call that they would be delaying financing another CLO.

Delay likely means they are still looking to finance a CLO sometime in the next year. We can reference some details that fellow Seeking Alpha author Brad Thomas included about BRSP’s second CLO to get a window into how this benefits the company:

Also, in July, BRSP successfully executed on its second CLO, for $800 million and collateralized by an interest in 31 floating rate mortgages secured by 41 properties with an initial advance rate of 83.75% and a weighted average coupon at issuance of L+149 before transaction costs.

This transaction further diversifies funding sources and reduces the company’s cost of capital while generating approximately $49 million of liquidity or new originations opportunities.

The mechanics of a third CLO will allow BRSP to similarly reduce the cost of capital and generate further liquidity for new originations. Currently only 43% of their loan collateral is in CLOs with 54% on their warehouse lines so they have plenty of collateral which could be securitized. If the CLO markets become more favorable and opportunities exist to originate more loans the company could issue their third CLO to grow earnings further.

In a perfect storm where all of these elements work in tandem together earnings could grow to over $0.30 per quarter. If we use that for an annualized estimate of $1.20 that would imply that BRSP is trading currently at a P/E of 5.78x. A reversion to the 9.71x peer average would imply a return of 68%. If earnings grew in this way it is likely that the dividend yield would increase beyond 11.5%, yet we can conservatively estimate a total return of 79.5%. That’s a price target of $11.64 per share.

And in less complicated times it is not uncommon for CRE focused mREITs to trade at a slight premium to book value. I think in a bullish case we could reasonably argue a 1x P/B valuation of BRSP. Book value per share was $11.26 in Q2. If we average the P/E and P/B price targets together we get a bullish price target of $11.41 which implies a 64.65% return. One-year total return with an 11.5% dividend yield would be 76.15%.

Why Does This Opportunity Exist?

BrightSpire Capital likely is still experiencing some overhang in the stock price due to investors who were burned by the previous Colony Credit management. Importantly, back in the Colony Credit days the company suspended its monthly dividend to protect liquidity back in April 2020. The dividend was reinstated in February 2021 at $0.10 meaning dividend growth has been 100% in the last year. Folks that invest for yield do not soon forget when a dividend is suspended though so I suspect yield investors are likely slower to return here than normal. This has deprived the company of one of their natural investing bases which should likely return over time as confidence rebuilds.

Two different REIT analysts on Seeking Alpha have written about REITs being heavily pressured lately. Dane Bowler wrote an article evaluating three different bear theses regarding REITs and evaluating their validity. Here’s the summary table of Dane’s analysis:

|

Theory |

True/False |

Reasoning |

|

REITs are high debt |

FALSE |

REIT debt levels are in-line with broader market |

|

Rising rates will hurt REIT earnings |

FALSE |

Interest expense will be offset by rising rental revenues, which kick in sooner than debts roll off their fixed rates |

|

Capital is flowing out of REITs due to similar constituency to bonds |

TRUE |

It makes sense rationally, and there is some preliminary data showing outflows from REIT ETFs. |

If we apply the bear theses to BRSP directly we can say that the first two theses are not applicable. BrightSpire has a manageable debt load compared to peers and will benefit from rising rates. It is possible though that the constituency of income investors may be drawn to other vehicles with rising rates. This also compounds with BRSP’s historical dividend difficulties.

Colorado Wealth Management Fund wrote an article about plunging mortgage REIT values which declined 14% in a week. The article gives an explanation for the macro context driving mortgage REITs downward though the impact is more for residential focused REITs as opposed to commercial REITs. There is a possibility that BRSP is trading in sympathy with residential focused REITs which would represent a market inefficiency. Part of what leads me to say this is given the disconnect of BRSP stock price decline compared to its commercial peers.

The dividend yield being as high as it is may be actually scaring investors off as they believe it is risky. With rising rates there are a plethora of high yielding options available to investors which may fit their risk tolerance more than a company with a recent dividend suspension and turnaround in progress. That is each investor’s prerogative. Yet an investigation of the fundamentals suggests that the dividend is not only covered but may actually grow in the coming year.

Overall, I suspect this opportunity exists due to volatility in the markets causing investors to lose the thread on BrightSpire’s turnaround. With many turning to a risk-off attitude it’s possible that BRSP is seen as too risky given its history. And with a natural base of yield seeking investors BRSP has to rebuild trust in their dividend before they attract a loyal investing base again.

BrightSpire Capital in Summary

In a market with continued volatility and uncertainty I’ve been looking to capitalize on CRE debt investments as a way to benefit. Rising interest rates due to the inflationary environment stand to drive interest income on the debt while real estate is traditionally recession resistant. Commercial real estate nationally has seen positive macro factors over the last year and is expected to continue to see strength into the back half of this year.

BrightSpire Capital is another company which fits within this macro strategy of CRE debt investments and currently seems undervalued. After experiencing losses in 2020 triggering a strategic review and internalization of management, BrightSpire has been executing diligently which has resulted in a de-risked lending portfolio. The overhang of these changes is likely broadly behind us as the company expects run rate earnings to be at $0.23 per share moving forward.

Based on an analysis of peers it seems that BRSP is undervalued and particularly has experienced more pressure on its stock price in the last month. I do not believe there is any particular good reason for BRSP to be trading so distinctly and expect it to trade closer in line with the peer averages.

In the course of the article I laid out a bear, base, and bull case for stock. Here’s a summary of those one-year price targets:

|

Current |

Target |

Return |

Total 1-year Return with 11.5% Yield |

|

|

Bear Case: Owned real estate and cash value |

$6.93 |

$4.89 |

-29.44% |

-17.94% |

|

Base Case: Peer average P/E & P/B reversions |

$6.93 |

$9.55 |

37.81% |

49.31% |

|

Bull Case: Growing earnings and peer average P/E & P/B reversion |

$6.93 |

$11.41 |

64.65% |

76.15% |

Be the first to comment