andresr

Medical Properties Trust, Inc. (NYSE:MPW) is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. Year-to-date, the company has lost almost 50% of its market value and as a result the stock is currently yielding more than 9% annually. For this reason, we have decided to take a look, how much you should actually pay for the stock, if you are a dividend or dividend growth investor. We will also be elaborating on the Q3 results and the main risks that you need to consider if you are planning to invest.

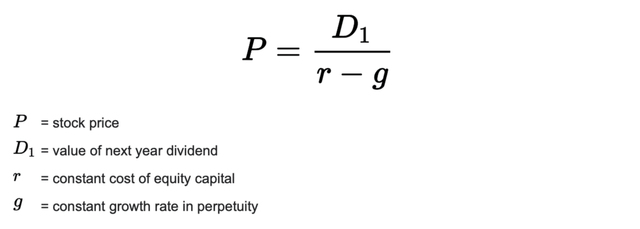

To answer the valuation question, we will be using the Gordon Growth model.

Valuation

Gordon Growth Model

The Gordon growth model (‘GGM’) is a simple and well-recognized dividend discount model, used to value the equity of dividend paying firms. The main assumption of this model is that the dividend payment grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

So, is it suitable to value MPW?

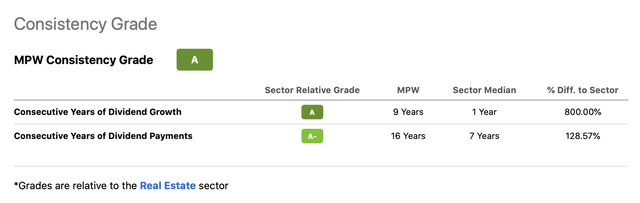

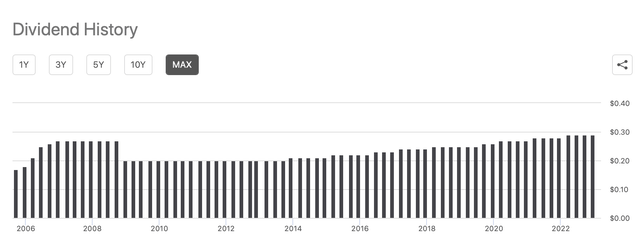

While MPW may be sensitive to business cycles, we believe that its strong track record of dividend payment makes it an ideal candidate to be valued by the GGM. The firm has been paying quarterly dividends each year since 2008 and they have managed to increase the payments each year in the last 9 years.

Consistency grade (Seeking Alpha) Dividend history (Seeking Alpha)

To have a better understanding about the valuation, the following formula shows the mathematics behind the model:

In order to make a meaningful evaluation of the fair value of MPW’s equity, we have to establish a few assumptions:

1.) Required rate of return

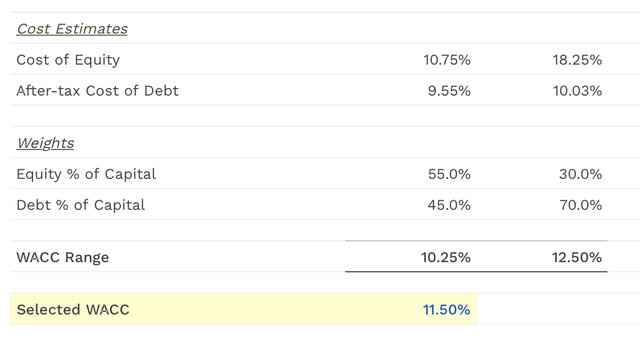

We normally prefer to use the WACC as the required rate of return. In MPW’s case this is estimated to be 11.5%.

2.) Dividend growth rate in perpetuity

A reasonable long-term trend can be often defined using the firm’s historic dividend payments and their growth. Important to highlight that the assumed growth rate has a significant impact on the calculated fair value. Assuming unrealistically high growth rates can lead to a significant overestimation of the fair value. For this reason, we rather like to stay on the conservative side.

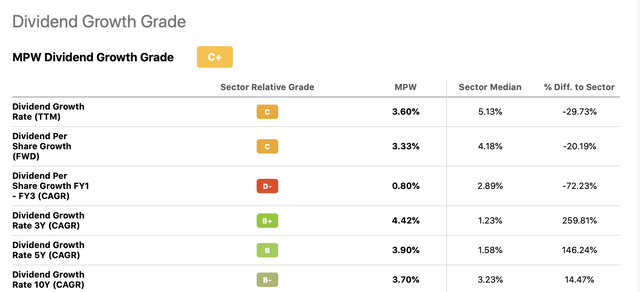

Dividend growth (Seeking Alpha)

Based on these figures, we believe that a conservative range of dividend growth rates could be 1% to 3%.

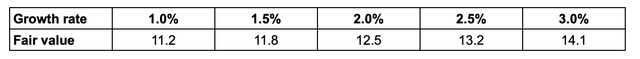

The following table shows the results of our fair value calculation (in USD per share) using an 11.5% required rate of return and the above defined range of constant sustainable dividend growth rate.

As MPW’s stock is currently trading around $12.2 per share, at the lower end of our conservative fair value range, we believe that there is substantial room for upside, based on this dividend discount model.

For this reason, based on the valuation, we find MPW’s stock an attractive option.

Q3 results

To understand whether these dividends are sustainable in the near term, we also have to look at the operations and financial results of the firm. In this section, we will summarise the key takeaways from MPW’s latest quarterly earnings report.

Operating results

The firm’s net income and NFFO for Q3 2022 have by as much as 30% and 3.4%, respectively. MPW has also announced that they are raising their expectations for 2022 per share net income to $1.99 to $2.01, accounting for the year-to-date gains on sales of about $537 million, while they are also narrowing their estimate of 2022 per share NFFO, towards the higher end of the range, to $1.80 to $1.82 from a prior range of $1.78 to $1.82. As of now, estimates for 2023 have not been provided These figures are expected to be announced along with the Q4 results.

In our opinion, despite the challenging macroeconomic environment and all the risks that MPW faces, they have delivered strong results in the third quarter. The 2022 estimates are also promising. We believe that based on these figures, the returns to shareholders in the form of dividend payments and share repurchases are likely to remain intact in the near future.

Changes to the portfolio

During the previous quarter, MPW’s portfolio has also gone through a substantial transformation. Through these transactions, MPW has been able to source a material amount of cash, which is planned to be used to reduce debt, potentially repurchase stock and fund selective investments.

Inclusive of total proceeds received from its first quarter real estate partnership transaction with Macquarie Asset Management, proceeds from third quarter asset sales and loan repayments and other transactions, MPT has sourced approximately $1.8 billion in cash from capital recycling transactions year-to-date. In addition, as previously announced, the Company expects to receive more than $650 million in proceeds in 2023 from other binding agreements.

Further, important to developments have taken place in the third quarter with regards to Steward:

Steward completed the accelerated repayment of amounts due related to approximately $450 million in COVID-related advances and collected approximately $70 million of past due reimbursements under the Texas Medicaid program. With these cash drains now in the past, positive revenue trends, significant declines in contract labor utilization and anticipated annual savings resulting from adjustments to Steward’s cost structure are expected to result in positive and sustainable free cash flow.

We were pleased to read about this development as Steward is one of the largest tenants of MPW, and its financial health can have significant impact on MPW’s financial performance. We also believe that this development may give somewhat more confidence to the shareholders that the dividend is likely to be safe and sustainable in the near future. This statement is also in line with MPW’s recent announcement of the authorisation of a share repurchase program of $500 million.

Bank of America analysts have also recently upgraded MPW’s stock to buy from neutral.

Risks

Of course, the valuation and the latest quarterly results alone do not help much if we do not understand the underlying risks and their potential consequences on the business and on the investors. We will highlight some of the risks that we find the most crucial to understand. An exhaustive list of the risks can be found in the 10-K of the firm.

1. Revenue is dependent on the relationship with and success of tenants, particularly the largest ones, including Steward, Circle, Prospect, Swiss Medical Network, and HCA.

As of December 31, 2021, these tenants – Steward, Circle, Prospect, Swiss Medical Network, and HCA – represented 18.5%, 11.1%, 7.3%, 5.8%, and 5.6%, respectively, of MPW’s total pro forma gross assets.

Needless to say that the default of any of these tenants could have far-reaching consequences. In case of a default, FFO could take a significant hit directly leading to a potential dividend cut. If it was to occur, our assumption regarding the perpetual growth rate of the dividend payments would also no longer be valid and the calculated fair value would be an overestimation.

But what if the worst happens and the default of one of these tenants becomes reality? Well, MPW has to likely replace the tenant with a new one, who is able to pay. And this takes us to our second risk.

2. It may be costly to replace defaulting tenants and we may not find suitable replacements on suitable terms.

A few important points to mention with regard to this risk as underlined in the firm’s 2021 10-K report.

The process of terminating a lease with a defaulting tenant and repossessing the applicable facility may be costly and require a disproportionate amount of management’s attention.

Plus, litigation could be initiated by the tenants against MPW in connection with the lease.

The transfer of healthcare facilities is highly regulated, which may result in delays and increased costs in locating a suitable replacement tenant. The lease of these properties to non-healthcare operators may be difficult due to the added cost and time of refitting the properties.

In case no suitable new tenant is found, the property will likely need to be sold, which may result on a loss depending on the sale price of the property. In fact, this risk is not only valid in case a tenant defaults, but also when a fixed term lease comes to an end and the parties fail to renew the lease.

3. Facilities located outside of the United States

While having a larger geographic footprint can have advantages, now we will highlight some of the risks associated with it.

About 40% of MPW’s total pro forma gross assets are located outside the U.S. Locations outside of the U.S. include: United Kingdom, Germany, Italy, Spain, Portugal, Switzerland, Australia, Colombia.

Currently the macroeconomic environment in Europe is challenging due to the ongoing geopolitical conflict between Russia and Ukraine. The energy supply of the continent is also quite uncertain in the near future. The relative weakness of the Euro in relation with the USD is creating headwinds for the firm. The recent changes in British politics have been also having substantial impact on the relative strength of the British pound, also negative impacting MPW.

For these reasons, we believe that the uncertainty related to the European operations should be considered before considering investing.

Conclusions

MPW’s stock appears to be attractive from a valuation point of view. In our opinion, there is substantial upside potential.

On the other hand, one should understand the main risks associated with MPW’s business before starting a new position. These include, but are not limited to: large dependency on the 5 largest tenants, replacement of defaulting tenants may be costly and the facilities located in Europe may be impacted by the ongoing energy crisis and geopolitical tension in the Eastern European region.

Currently, we believe that the risk-return profile is attractive, and therefore we rate MPW’s stock as a “buy”.

Be the first to comment