24K-Production

Introduction

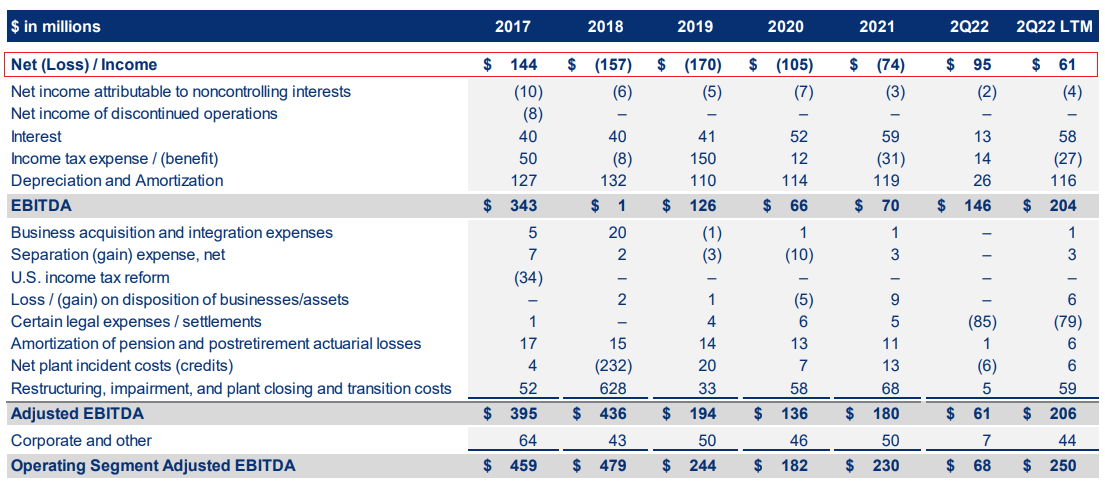

In June, I wrote a bearish article on SA about titanium dioxide producer Venator Materials (TROX) in which I said that a $85 million settlement with Tronox Holdings (TROX) seemed priced in and that the company was starting to look overvalued as its business hasn’t been doing well over the past few years.

Well, Venator Materials booked solid Q2 2022 as it managed to pass on cost inflation to its customers thanks to a strong titanium dioxide market. The company is in the black once again as the adjusted net income came in at $14 million. However, energy prices in Europe have been rising over the past few months due to the escalating conflict in Ukraine and I think that Venator is likely to struggle to pass on further cost increases to its customers as titanium dioxide prices in China have been falling rapidly since July. Let’s review.

Overview of the recent developments

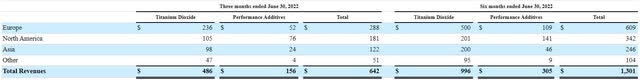

In case you haven’t read my previous article about Venator Materials, here’s a short description of the business. The company operates seven titanium dioxide manufacturing facilities and a performance additives business focused functional additives, color pigments, and timber treatment chemicals that includes another 13 manufacturing and processing facilities worldwide. About three-quarters of the revenues and EBITDA of Venator Materials come from the titanium dioxide business and the company is focused on the European market.

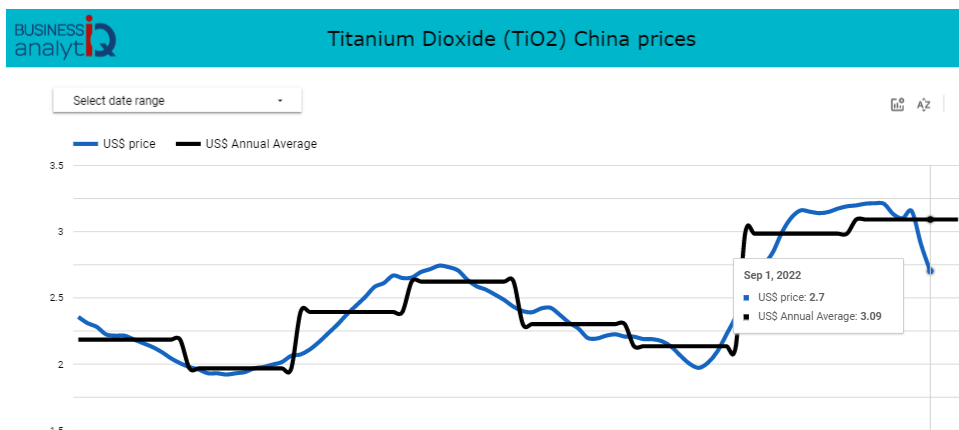

Venator Materials has been in the red over the past several years, but this changed in 2022 as the adjusted net income came in at $14 million and $6 million in Q2 and Q1, respectively.

Venator Materials Venator Materials

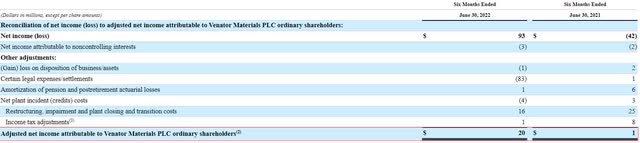

So, how did Venator achieve this turnaround? Well, there have been cost pressures from higher prices for feedstocks, and energy in 2022 due to supply chain issues and the situation in Europe is made worse due to the conflict in Ukraine. To mitigate this, Venator Materials decided to manage its margins by switching to monthly customer tailored price reviews and this has been working well so far thanks to strong titanium dioxide prices as demand has been strong in North America. In Q2 2022, the average selling prices of the company’s titanium dioxide business rose by 7% quarter on quarter and 31% year on year which helped it improve its EBITDA despite a lower production volume due to issues with the Scarlino facility in Italy.

Venator Materials

In Q2 2022, production at the Scarlino plant was reduced by a third as there is limited landfill capacity. The facility generates gypsum as a byproduct and Venator Materials is currently working with governmental authorities for the authorization of continued gypsum disposal. However, it seems that there has been little progress on this issue and the company revealed at its Q2 earnings call that it has now suspended two-thirds of titanium dioxide production there to preserve its remaining available landfill capacity. Unless there is a resolution of this issue soon, the Scarlino plant could be closed for good in the near future.

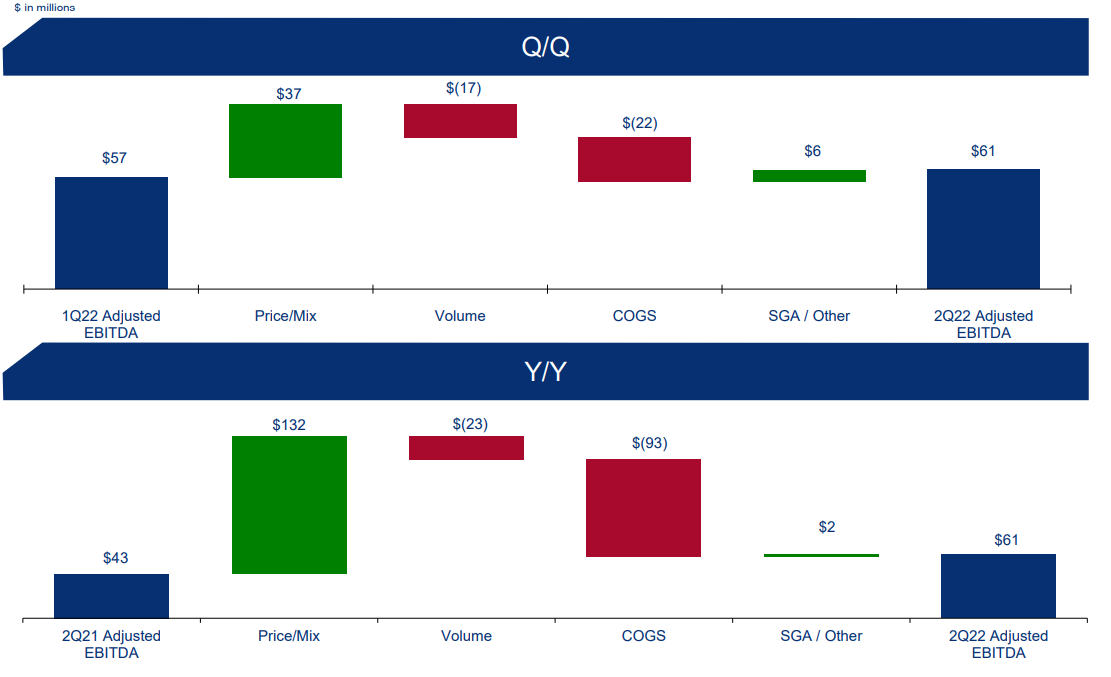

What’s even worse news for Venator Materials is that the company could soon face significant pricing pressure in Europe as titanium dioxide prices in China have been falling fast over the past few months. This should incentivize Chinese competitors to increase exports.

Business Analytiq

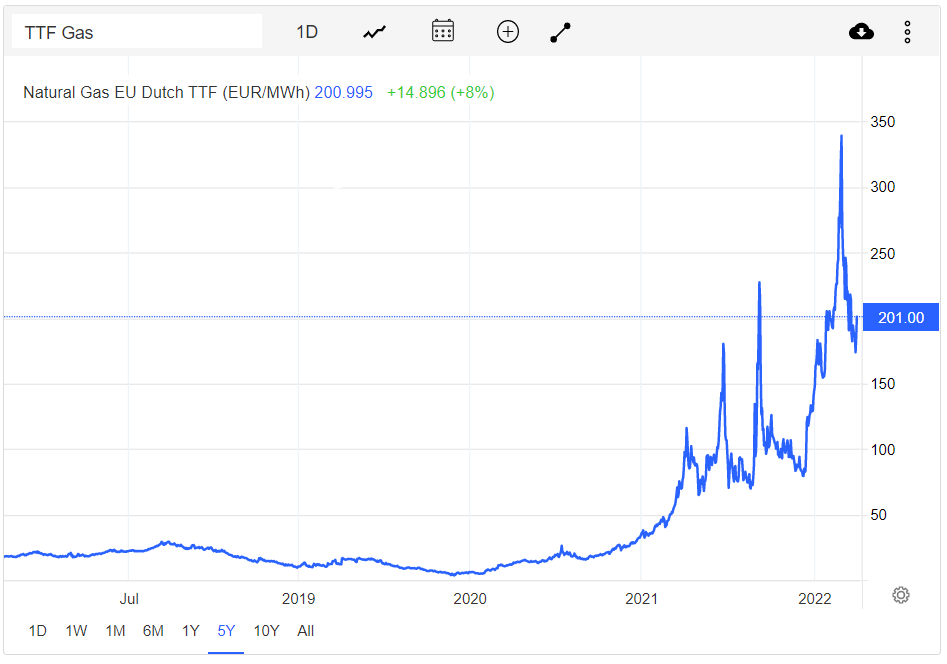

Meanwhile, energy prices in Europe keep rising as the Russian invasion of Ukraine is still escalating. The latest major event includes leaks from two Russia-to-Germany pipelines under the Baltic Sea and this decreases the chance of European gas prices returning to normal levels anytime soon.

Trading Economics

You just can’t have a competitive chemical industry without low energy prices, and it seems that the margins of Venator Materials could decline significantly in the near future. Looking at the Q3 results expectations, BMO Capital recently reduced its EPS forecast to $0.02 from $0.05. It seems that the company’s return to profitability could be short-lived.

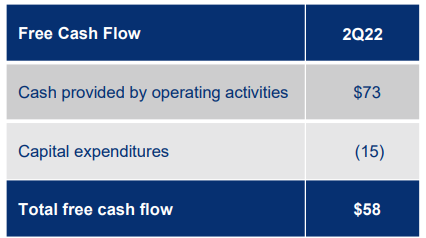

Turning our attention to the balance sheet, I think the situation doesn’t look good either. The net debt to equity ratio was 1.5x as of June as free cash flow for the quarter came in at just $58 million despite Venator Materials receiving the $85 million from the settlement from Tronox. Primary working capital was $54 million cash use due to timing of feedstock shipments and higher costs, and the company expects its cash use for the full year to be above $30 million. Considering that CAPEX for H2 2022 is expected to be around $60 million, the situation looks grim.

Venator Materials

Overall, I’m bearish but I think that short selling could be dangerous as the market valuation is down to $113 million as of the time of writing and sometimes the share prices of microcap companies can increase for spurious and unknown reasons. In addition, Venator Materials is currently trading at below 0.2x book value. In my view, risk-averse investors should avoid this stock.

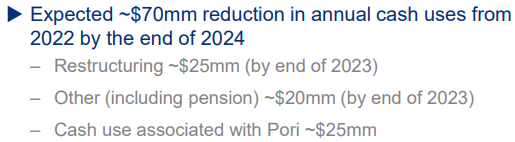

Looking at the long-term prospects of the company, I think a lot depends on how well it can achieve its cost-cutting goals. At the moment, Venator Materials plans to reduce its annual cash uses by around $70 million by the end of 2024.

Venator Materials

Investor takeaway

The European chemicals sector has been under significant pressure for the majority of 2022 due to supply chain disruptions and high energy prices, but some companies have been able to pass on cost increases to their clients in due to strong demand for their products. Venator Materials was among them, and it even managed to get in the black. However, titanium dioxide prices in China have declined significantly and I don’t think the company can keep this up.

I’m bearish on Venator Materials and I think the company’s adjusted net income could be back in the red by Q4 2022. Avoid this stock.

Be the first to comment