alvarez

Business

Cheniere Energy Partners, L.P. (NYSE:CQP) is a publicly traded Delaware limited partnership (the “Partnership”) formed by Cheniere in 2006. It is the general partner of Cheniere Energy, Inc. (LNG), a leader in LNG and natural gas marketing.

Liquified Natural Gas (“LNG”) is predominantly methane in liquid form. The liquefaction process is basically removing certain compounds and cooling them to approximately −162 °C (−260 °F). It takes up about 1/600th the volume of natural gas in the gaseous state.

CQP produces and shipped LNG all over the world. Customers turn it back into natural gas (“regasification”) and then transport it via pipeline to homes and businesses. It is used as an energy source that is essential for heating, cooking and other industrial purposes. Natural gas is a cleaner-burning, abundant and affordable source of energy than coal and petroleum, producing significantly fewer carbon emissions.

CQP’s natural gas liquefaction and export facility is at Sabine Pass, Louisiana (the “Sabine Pass LNG terminal”) and is one of the largest LNG production facilities in the world. The facilities consist of six operational Trains, for a total production capacity of approximately 30 mtpa of LNG.

The Sabine Pass LNG terminal also has operational regasification facilities and five LNG storage tanks. Its regasification capacity is approximately 4 Bcf/d. CQP also owns a 94-mile pipeline that interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines. CQP holds a significant land position at the Sabine Pass LNG terminal, which provides opportunity for further liquefaction capacity expansion.

CQP’s customers are generally required to pay a fixed fee with respect to the contracted volumes, regardless of whether they cancel or suspend deliveries of LNG cargoes. CQP has contracted approximately 75% of the total production capacity, with approximately 16 years of weighted average remaining life as of December 31, 2021.

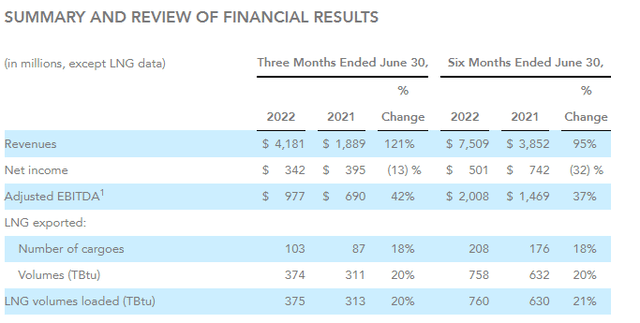

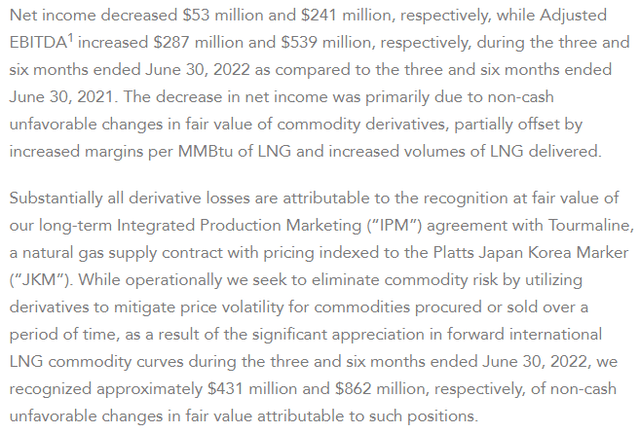

CQP’s financial results for the first two quarters of 2022 show that the Partnership’s revenues increased substantially over 2021, but net income declined, primarily as a result of losses in derivatives.

CQP’s volumes of LNG loaded during the first and second quarters of 2022 were almost identical, 375 TBtu and 372 TBtu, respectively, from the SPL Project. During the six-month period ended June 30, 2022, approximately 13 TBtu of commissioning LNG was exported from the SPL Project.

CQP’s business strategy is:

“To develop, construct and operate assets supported by long-term, fixed fee contracts by maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows,” among other things described in the Annual Report, including “maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows.”

CQP’s 2021 Annual Report states:

The development of these sites or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we can make a final investment decision (“FID”).

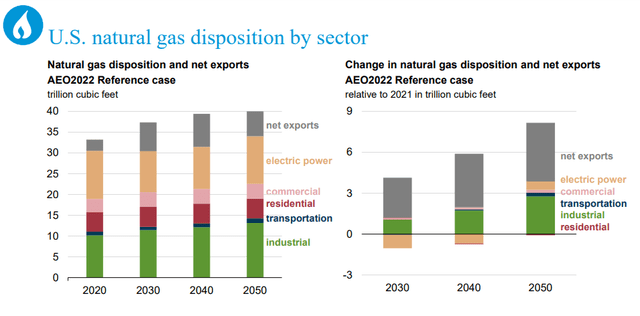

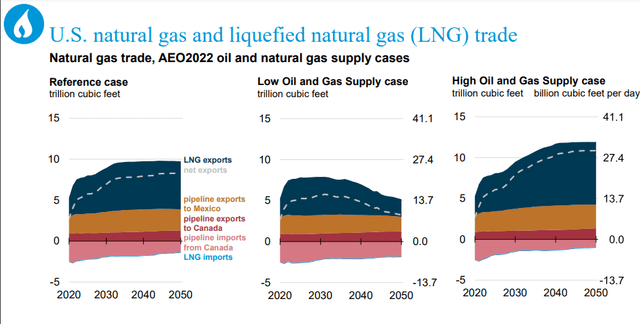

Even without the disruption of natural gas imports to Europe from Russia, the EIA has forecasted a robust increase in the demand for net exports of natural gas. Its 2022 Annual Outlook provides the following projections:

That implies strong growth in LNG trade looking out to 2050.

That growth outlook is supported by the Paris Agreement, which is intended to strengthen the global response to the threat of climate change. Reducing carbon emissions is a key strategy. The projected growth in renewables is too slow to displace fossil fuels by 2050, and so natural gas substitution for coal and oil is key to the mitigation of emissions.

Examples of gas projects include India’s commitment to invest over $60 billion to create a gas-based economy, around $100 billion for Europe’s gas infrastructure buildout, and hundreds of billions are needed in China for its natural gas value chain.

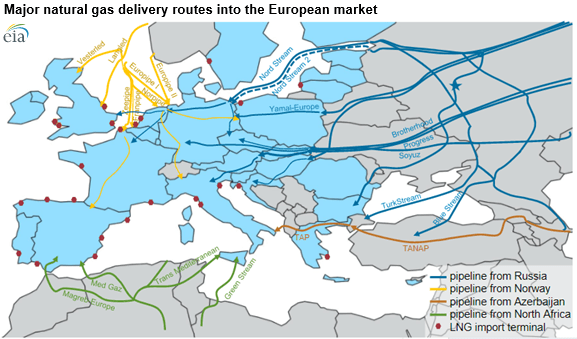

All of that was in development plans prior to Russia’s invasion of Ukraine and reduction of natural gas pipeline exports to Europe. Given Russia’s threat to use its natural gas exports as a political tool, European nations are planning to divert their imports away from Russia, as possible, the future.

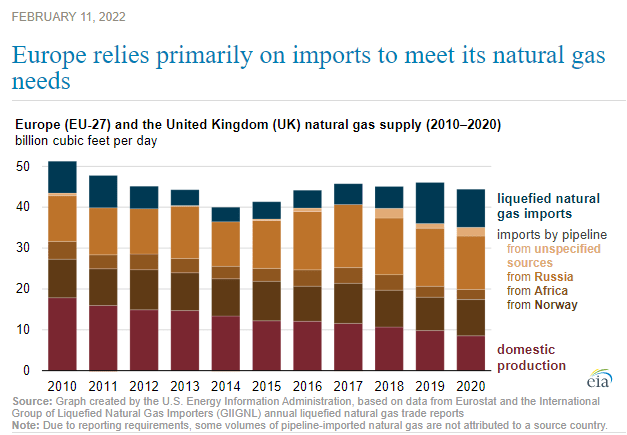

European Consumption/Imports

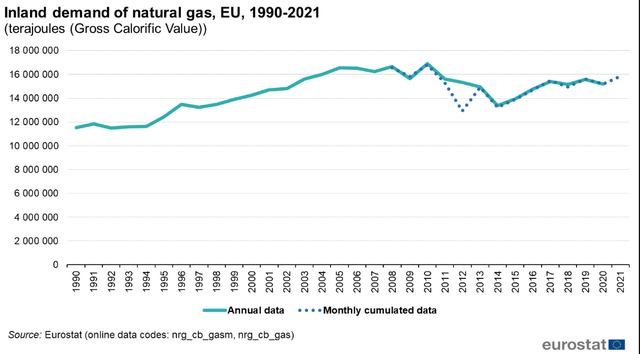

Monthly consumption of natural gas in the EU has peaked and levelled-off.

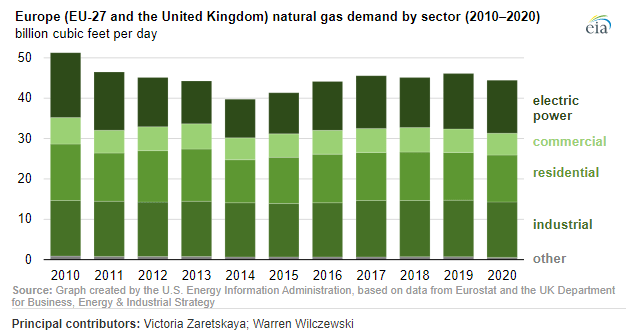

However, the imports of natural gas by pipeline and LNG provided more than 80% of the supply in the EU and UK in 2020, up from 65% a decade earlier. In 2020, imports of natural gas by pipeline accounted for 74% of all imports, while 26% was from LNG.

EIA

Russia has been the largest supplier of imports, about 13 Bcf/day in 2020. Imports from Norway were about 9 Bcf/day in 2020, as North Sea fields have matured.

According to its website:

Gazprom PAO is a Russia-based operator of gas pipeline systems. The Company’s principal activities include exploration and production of gas; transportation of gas; sales of gas within the Russian Federation and abroad; gas storage; production of crude oil and gas condensate; processing of oil, gas condensate and other hydrocarbons, and sales of refined products, and electric and heat energy generation and sales.

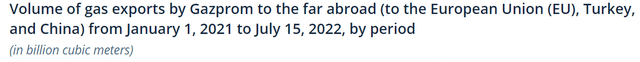

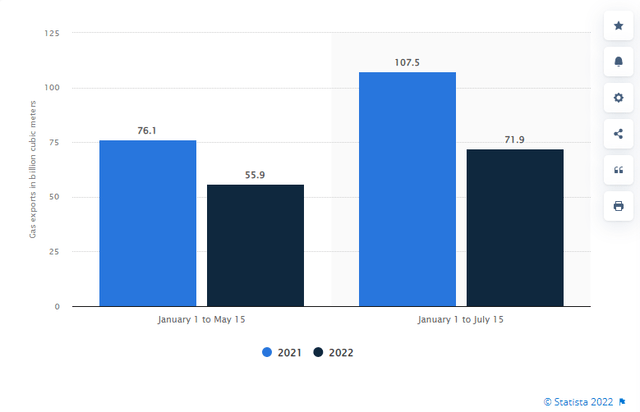

Gasprom’s (GAZP.MM) pipeline exports to the EU, Turkey and China have dropped in 2022.

Russia has drastically reduced natural gas supplies to Europe in recent weeks, with flows via the Nord Stream 1 pipeline currently operating at just 20% of the agreed-upon volume” as reported by CNBC on August 22, 2022. “Gazprom said it would shut down Europe’s single biggest piece of gas infrastructure for three days from the end of the month.”

Holger Schmieding, Chief Economist at Berenberg Bank, said,

It highlights two grave risks: (i) Russia may falsely claim that it cannot re-open the pipeline afterwards because of a ‘technical issue’ that could only be resolved if Western sanctions were lifted, and (ii) Russia may also shut down its other pipelines to Europe later on.

Gazprom has warned that European gas prices could spike by 60% to more than $4,000 per 1,000 cubic metres this winter, due to its own export and production continue to fall amid Western sanctions. The EU has agreed to cut natural gas consumption by 15% in order to reduce its member states’ reliance on Russia for energy.

The White House had announced a task force to reduce Europe’s dependence of Russian fossil fuels:

“American exports of LNG will continue to grow through 2030, by which time the U.S. plans to be sending 50 billion cubic meters of gas to Europe annually. This build-out will occur in a way that is consistent with, not in conflict with, the net-zero climate goal that we’re shooting for,” President Biden said during a meeting with European officials.

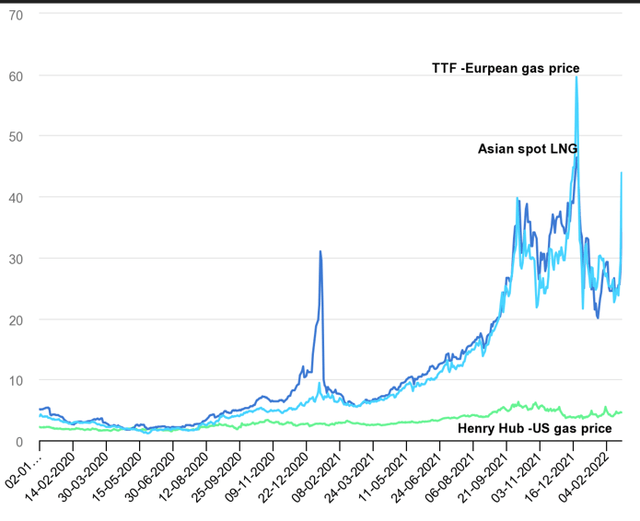

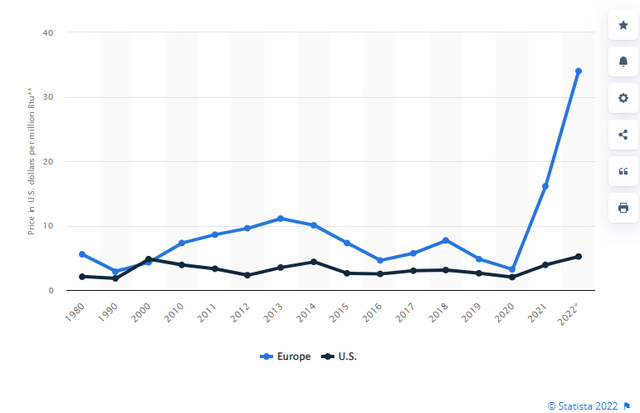

Natural gas prices in Europe and Asia have soared far beyond U.S. prices over the first half of 2022.

And natural gas prices in Europe are forecast to be substantially higher than U.S. prices for all of 2022.

North American liquefied natural gas (LNG) developers and producers this year have struck deals to sell 48 million tonnes of LNG, which will eventually pump up exports 60% from current levels. – Reuters reported

But that has also created demand for new construction and export facilities across the U.S., Canada and Mexico. “Due to the lack of available capacity, some recent deals have involved facilities whose construction has not yet received financial approvals. Those agreements ‘reinforce our conviction in the long-term role’ for LNG in global energy markets, said Tim Wyatt, a Cheniere senior vice president.”

Performance

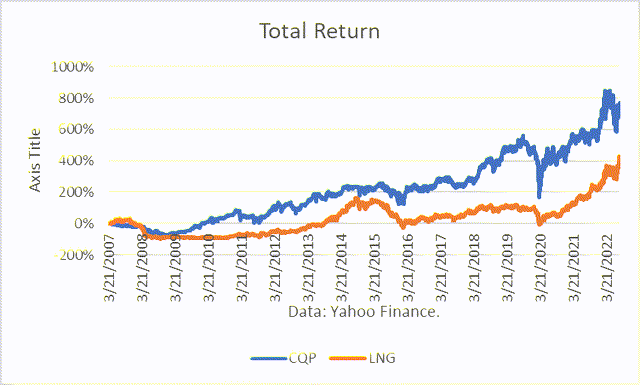

Since CQP’s inception in early 2007, it has experienced a total return of 768 %. The total return of LNG over the same period was 421%.

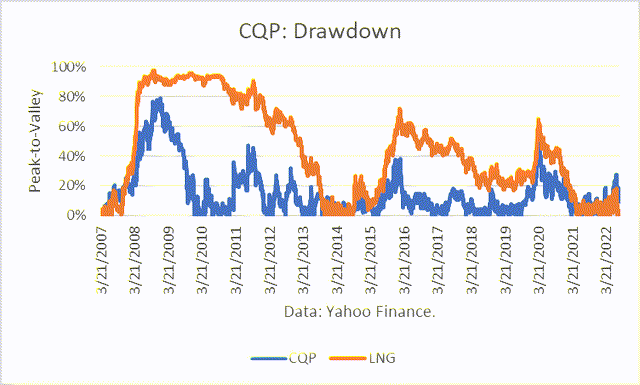

The Maximum Drawdown (“MD”) in CQP was 78 %. For LNG, it was 98%.

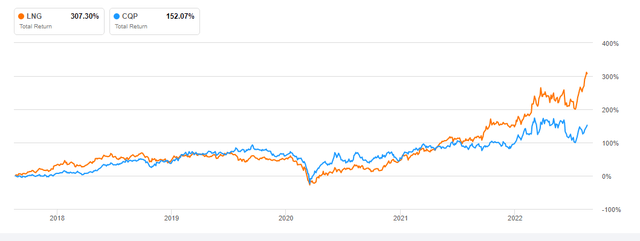

More recently, the 5-year return for CQP was 152 %. For LNG, it was 307 %.

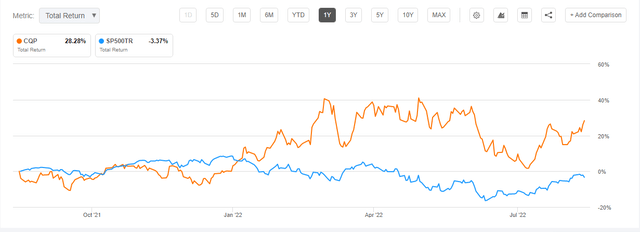

Over the past year, CQP had a return of 28.28 %. That compares favorably to a loss of 3.37 % in the SP500TR.

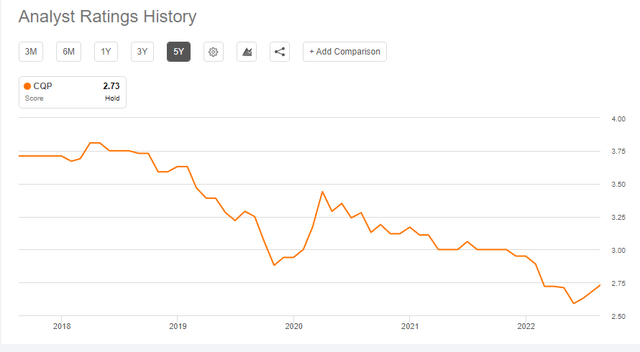

Ratings

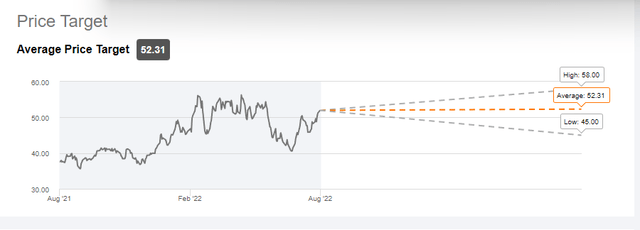

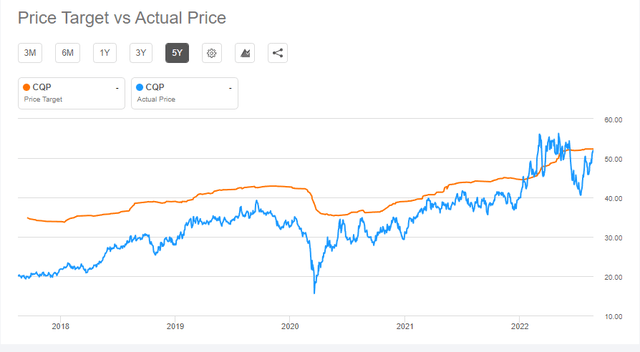

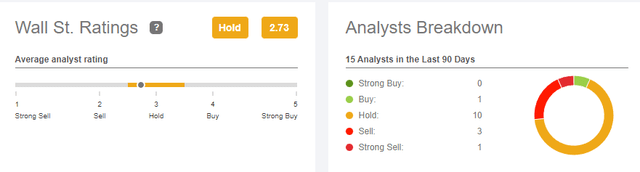

Wall Street analysts rate CQP as a “hold.”

The price of $54/share is close to its price target.

Seeking Alpha Seeking Alpha Seeking Alpha

Most recently:

- Barclays raised their target price on shares of CQP from $45.00 to $48.00 and gave the stock an “underweight” rating on August 16th.

- Evercore ISI raised its assessment of CQP shares to an “outperform” rating and raised their target price for the stock from $54.00 to $55.00 on August 11th.

Conclusions

The outlook for growth in the future global demand of LNG appears to be solid, especially since Western buyers want to shift their purchases away from Russian sources.

However, CQP has contracted approximately 75% of the total production capacity at fixed fees, with approximately 16 years of weighted average remaining life. And so its ability to prosper in a strong price environment is somewhat limited. In addition, as seen in its financial results for the first half of 2022, its derivative hedging activities, while prudent, also limit the upside.

CQP can add to its profitability through the construction of new plants and export facilities and has “significant land position at the Sabine Pass LNG terminal.”

For the above combination of factors, I believe it is a solid long-term investment.

Be the first to comment