Gonzalo Marroquin

Nordstrom (NYSE:JWN) just delivered its Q2 results, and despite delivering a strong quarter, guidance for the second half of the year was horrible, and that is making the share price go down significantly. The company is reducing guidance because they saw demand decelerating significantly in late June, predominantly at Nordstrom Rack and with their lowest income customer cohorts. The fact that the deceleration was more pronounced in the lowest income customer segments makes us think that a significant part of the pullback is due to the macro-economic environment of high inflation and recessionary winds putting pressure on discretionary spending. Nordstrom is probably doing better than Rack because its more affluent customer base can better deal with these economic headwinds.

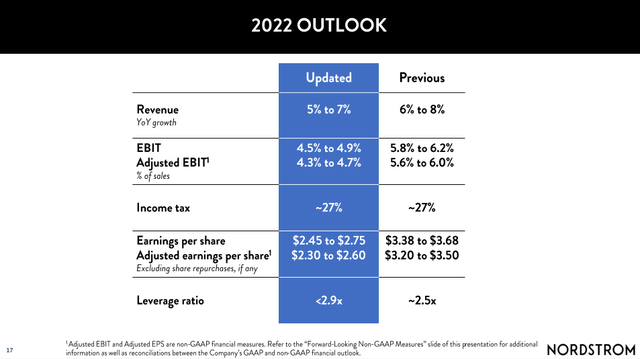

Not everything in the disappointing guidance can be attributed to macro factors, however, given that the company saw its private label product under-perform, leaving the company with a portion of that inventory to clear in the third quarter. The disappointing outlook for the balance of the year is therefore the result of a combination of softening trends and the actions the company will have to take to reduce its inventory levels. Nordstrom expects clearance activity and the associated markdown pressure will reduce second half gross profit by approximately $200 million. By taking these tough measures the company expects to exit the year with a cleaner and more current inventory, and be much better positioned for a successful 2023.

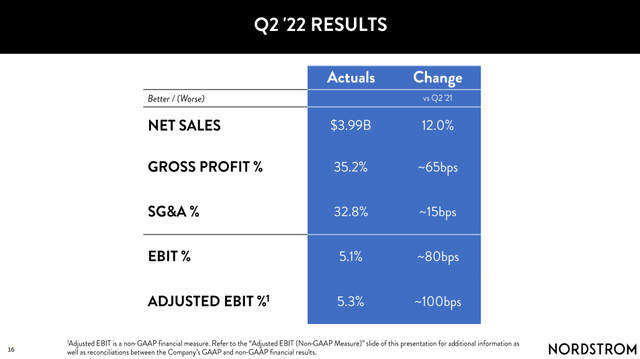

JWN Q2 2022 Results

Net sales increased 12% over last year, which includes a benefit of approximately 200 bps from one week of the Anniversary Sale shifting into the second quarter. Total digital sales grew 6%, and Nordstrom banner sales and gross merchandise value each increased 15% over last year, while Rack sales grew only 6%. In general profit margins had a nice improvement over Q2 2021.

Earnings for the second quarter were $0.77 per diluted share. After excluding charges related to the wind-down of Trunk Club, adjusted EPS was $0.81.

Nordstrom Investor Presentation

Balance Sheet

Nordstrom ended the second quarter with $1.3 billion in available liquidity, including $494 million in cash and the full $800 million available on its revolving line of credit. The company is committed to an investment grade credit rating and expects its leverage ratio to be below 2.9 times by the end of 2022, with the target still being to have a leverage ratio below 2.5 times.

Competitors

To be fair to Nordstrom, it is not the only company bracing for a much tougher second half of the year. Companies like Kohl’s (KSS) and Macy’s (M) have made similar comments, where they expect a much more promotional H2, with increasing competition, and with the companies trying to right-size and improve the quality of their inventories.

Macy’s shares had gotten so cheap that it rallied despite cutting its guidance and sharing that it sees industry-wide levels of excess inventory and a slowdown in consumer discretionary spending. It updated its guidance for the year to an adjusted diluted EPS in the range of $4 to $4.20 from $4.53 to $4.95 previously.

Meanwhile Kohl’s was even more drastic, with EPS guidance dramatically cut by more than half to an expected EPS of $2.80 to $3.20 from the prior outlook of $6.45 to $6.85.

All of this to say, that even if there are some real issues with Nordstrom, like its under-performing private label business, most of the disappointment is industry wide, and reflective of a very tough macro-economic environment for consumers.

Valuation

While guidance for the second half of the year is indeed horrible, we believe this might actually present an opportunity to buy the shares cheap. We expect the economy to eventually recover, and that should help restore Nordstrom’s profitability.

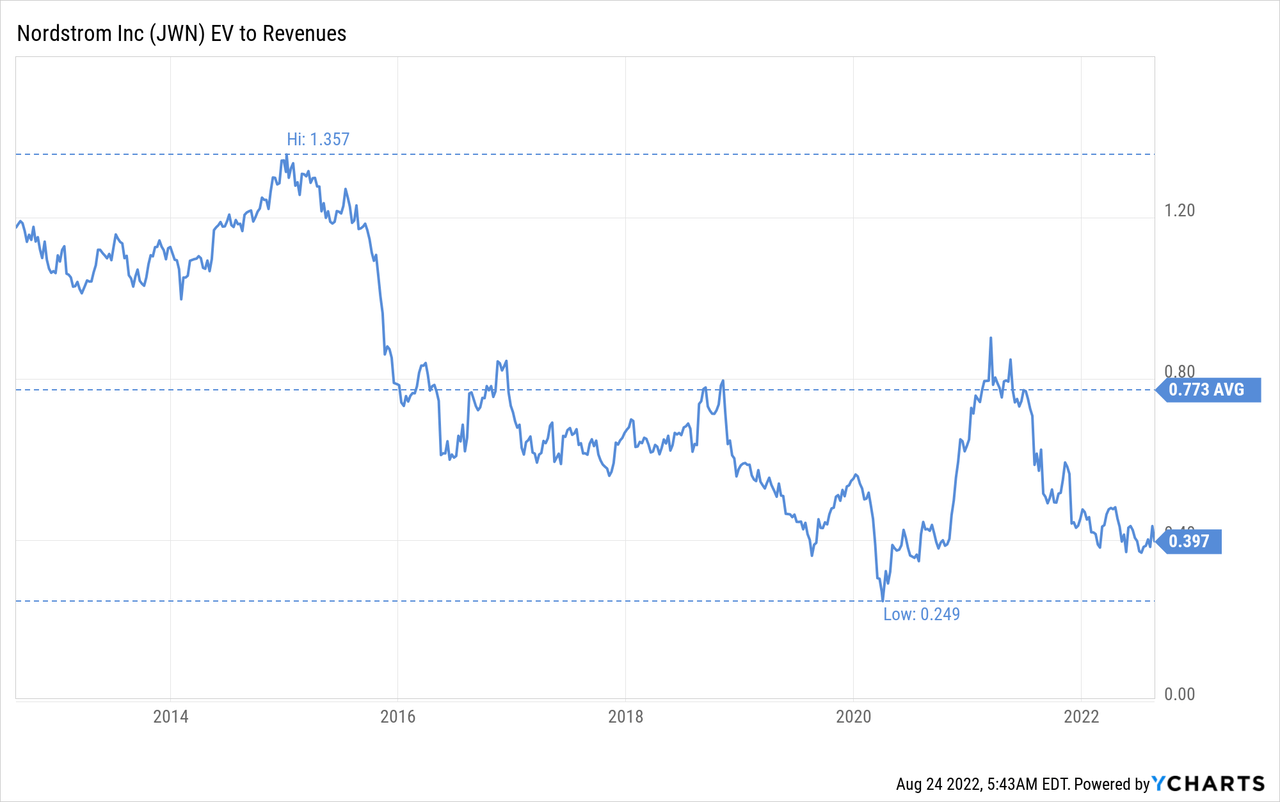

Shares are looking incredibly attractive at almost half the ten-year average EV/Revenues multiple. Shares were only cheaper during the worst of the COVID crisis, and we would argue there is less risk to buying now than there was during the incredible uncertainty of that period. While shares might go lower, especially in the short term, we do believe the current weakness offers long-term investors with a very attractive entry point.

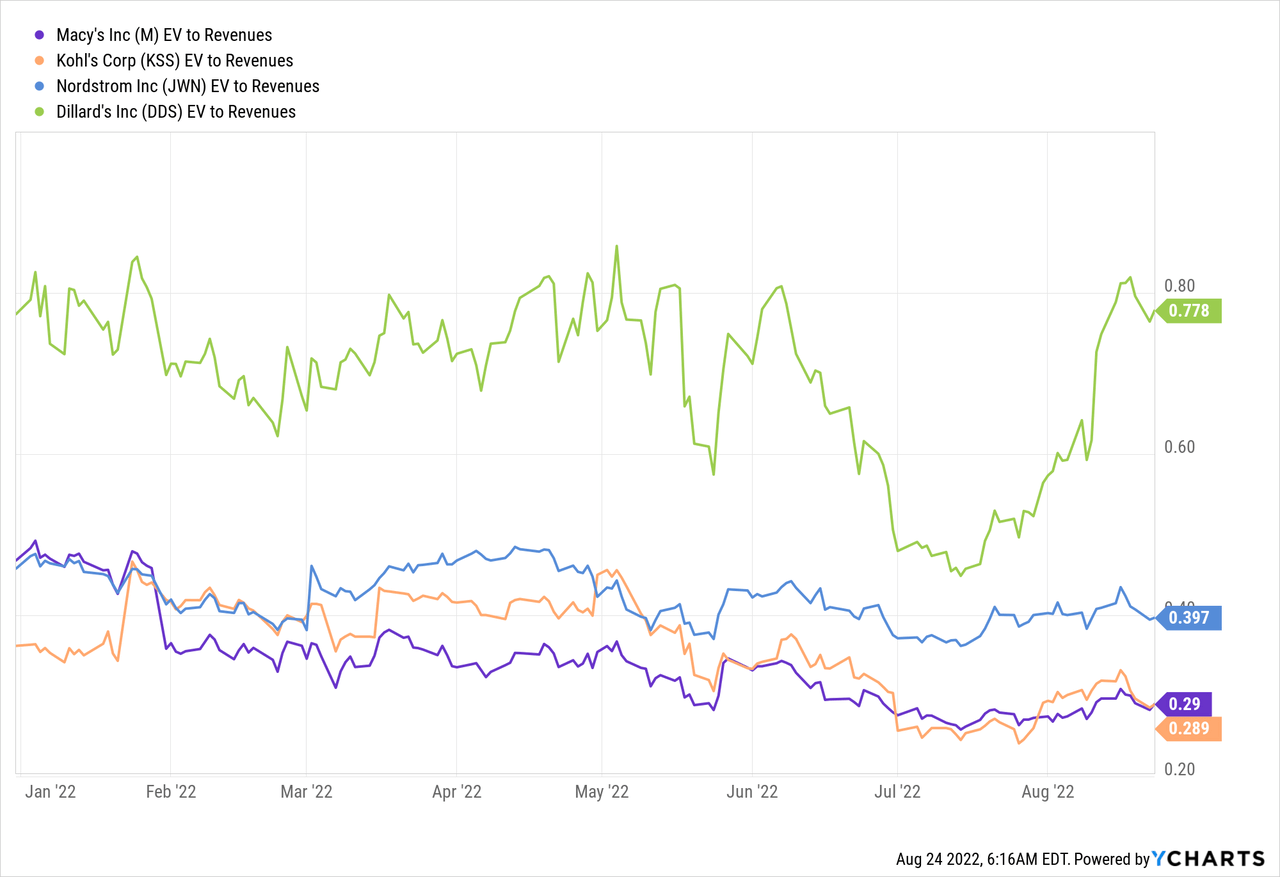

Most of its department store competitors are similarly trading at very attractive multiples, with perhaps the exception of Dillard’s (DDS), which is trading at a much higher EV/Revenues multiple. While Macy’s and Kohl’s are trading at lower EV/Revenues multiples compared to Nordstrom, and do appear to be cheaper in general, we would argue that Nordstrom is a much higher quality business with better growth prospects and a customer base that is more affluent on average.

As we write this, Nordstrom shares are trading at ~$20, that means the forward price/earnings ratio based on the company’s new guidance is ~9x. We view this multiple as very cheap, considering that 2022 is going to be a tough year and profitability is expected to be higher in the future.

Nordstrom Investor Presentation

Risks

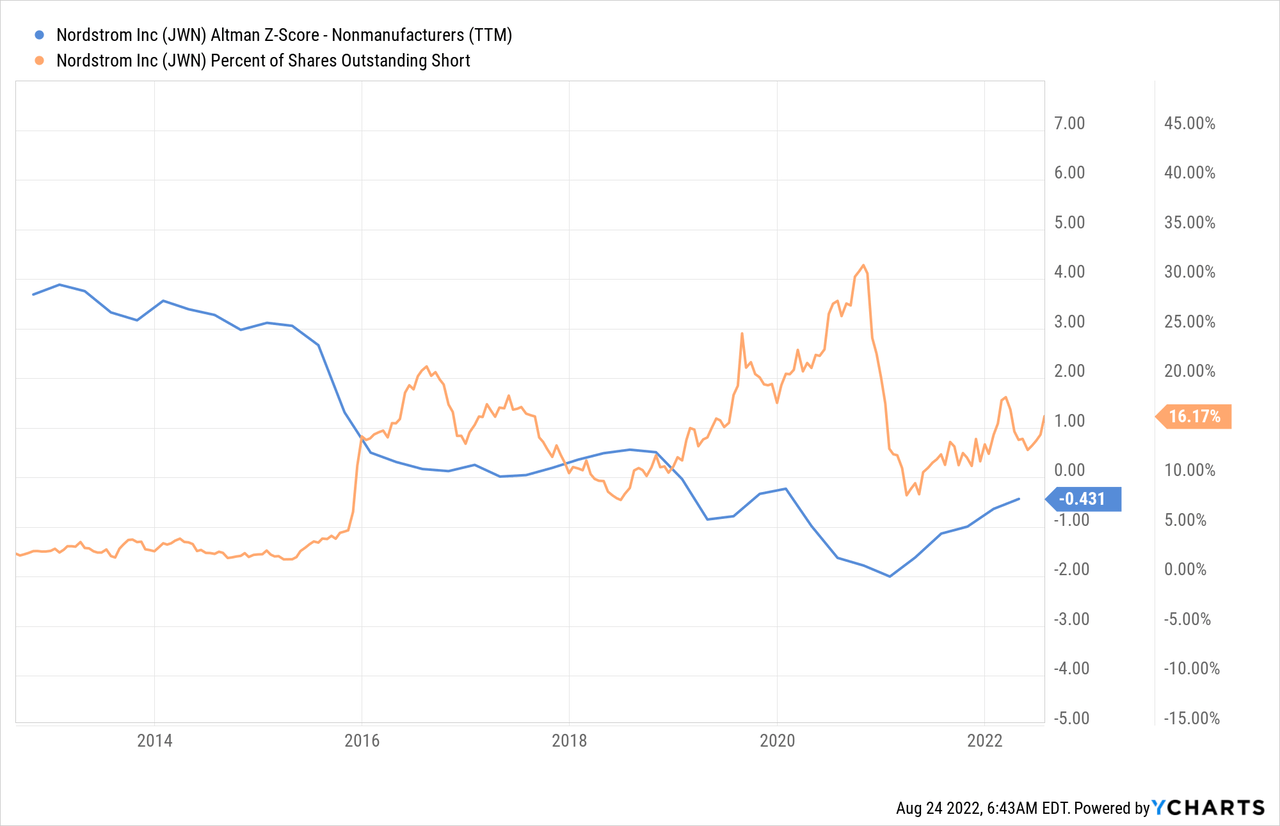

We view Nordstrom as an above average risk investment, given the volatility in its earnings and low Altman Z-score, which is below the critical 3.0 threshold. The company also has a very significant percentage of its shares outstanding sold short.

Conclusion

Despite the strong Q2 2022 results that Nordstrom delivered, there is little to celebrate as guidance for the rest of the year looks dim. There are several reasons to believe that this is not Nordstrom specific, as some of its competitors are similarly guiding for a very tough second half of the year, and the company saw the most weakness with its less affluent customers. Despite the disappointing outlook, shares remain incredibly cheap, with an EV/Revenues multiple of almost half the ten-year average, and a forward p/e ratio based on the lowered guidance of only ~9x. Nordstrom is an above average risk investment, but at these prices there is also a big potential reward.

Be the first to comment