ronniechua

The S&P 500 is on the edge of a bear market once again as the recovery from mid-June to mid-August proved to be no more than a bear market rally, in my opinion. In the last thirty days, the index plunged around 9% and is currently only a few percentage points higher than its mid-June lows. I believe the broader market index, as well as related ETFs such as the Vanguard S&P 500 ETF (NYSEARCA:VOO), are likely to hit new lows in the coming months, and the bear trend might last longer than the recent routes. What’s more concerning is that global GDP growth and corporate earnings are projected to fall further in the next year. In addition, historical trends suggest that the market has a lot more room to fall. Therefore, buying the latest dip doesn’t look like a prudent strategy to me.

Demand Destruction Pushing Economies into Recession

True_insights (Bloomberg)

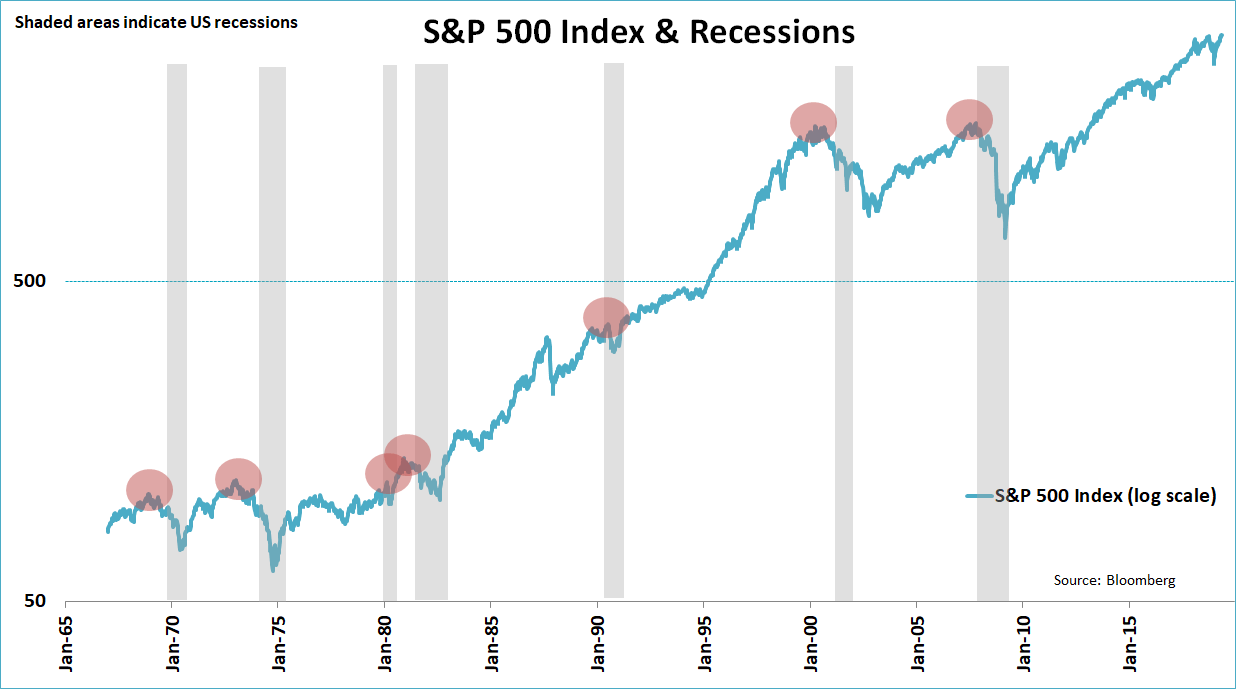

Economic and monetary policy directly affect stock market performance. Historically, the US stock market has faced challenges when economic numbers drop, but bull markets usually occur when monetary conditions are easy and economic growth is stable. There have been 10 official U.S. recessions since 1957 and the stock market has lost 29% on average after each recession. In economics, high prices or limited supply guides demand destruction. A number of factors are contributing to demand destruction at the moment, including high inflation, tightening monetary policies, the Russian war, and the Chinese economic slowdown.

Rating agencies and the World Bank are cutting their GDP growth forecasts for 2022 and 2023 due to the negative impact of demand destruction on business activities. Fitch, for instance, slashed its 2022 global growth forecast for the third time in nine months to 2.4%, down by 0.5% from its June forecast. For 2023, it expects the global GDP to grow by only 1.7%. It also projects the eurozone and UK will enter recession in the December quarter of 2022, and that the recession will last longer. Fitch also predicts a mild recession in the United States in mid-2023.

Earnings Revisions

As it appears that economies will fall into recession from the December quarter, analysts and companies are cutting earnings expectations faster. For example, FedEx (FDX), one of the world’s largest air freight and logistics companies, missed earnings expectations for the first quarter by a greater margin. Additionally, the company expects the situation to worsen in the next quarter.

Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, Q1 results are below our expectations, CEO Raj Subramaniam said.

It’s evident from FedEx’s earnings miss that the market environment is worse than many had predicted. In the quarters ahead, industrial, materials, and real estate sectors could face massive earnings reductions as a slower economic activity directly impacts their revenue generation capacities. This trend is also reflected in Seeking Alpha’s poor quant grades for a large number of key industrial stocks. In contrast, mega-cap tech stocks including Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Tesla (TSLA), Meta Platforms (META), and Nvidia (NVDA) have seen an average earnings estimate drop of 21.4% over the last 90 days, while projections for 2023 have declined 11.3%. In the case of VOO, the majority of its top 10 stock holdings, including Apple, Microsoft, Alphabet, and Amazon have seen a large number of downside earnings revisions for 2022 and 2023.

Valuations

The S&P 500’s forward price-to-earnings ratio eased to around 16.9 at present, down from 1.84% in the previous quarter and 8.76% in the year-ago period. When stocks hit their 2022 low in mid-June, the forward PE was around 16.

S&P 500’s forward PE ratio could fall below its June lows if the bear trend intensifies in the coming months. Historically, PE ratios have fallen between 13 and 14 during recessions since 1990, with the exception of 2008 when the PE fell below 10. Further, a significant amount of earnings revisions in the coming quarters would put additional pressure on valuations. Any rally in stocks without earnings growth would make them expensive, and it appears that investors might not be willing to pay premiums ahead of a recession and tough monetary conditions.

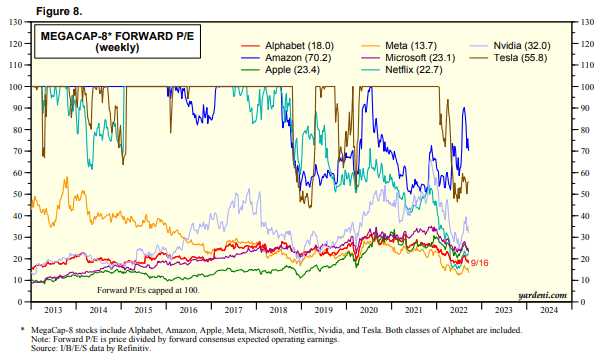

yardeni.com (8 tech mega-caps forward PE)

There is also a big difference between the forward earnings ratio of the S&P 500 and that of mega-cap tech stocks. Tech giants like Apple, Microsoft, Alphabet, Amazon, Tesla, Meta Platforms, Netflix (NFLX), and Nvidia account for almost a quarter of the overall weight of the S&P 500 index and almost half of the S&P 500 growth index. These mega-cap tech stocks have on average a forward 12-month price-to-earnings ratio of around 25. These stocks received either a D or F Seeking Alpha quant grade on valuations. S&P 500 might face steep losses in the days ahead if sentiments turn against paying a premium for big tech stocks due to recession and earnings revisions.

Capitulation Phase

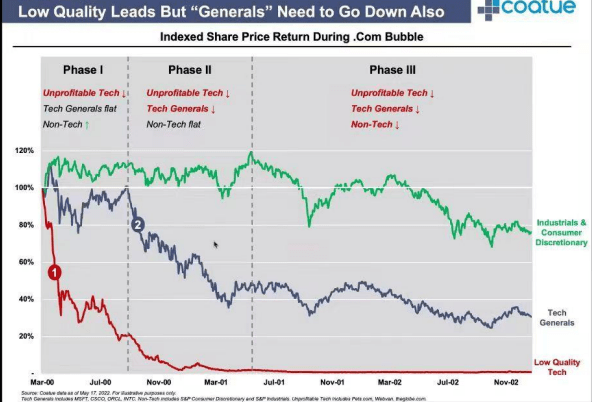

After hot CPI data and increasing prospects for recession, it appears that investors are selling stakes in fear of more losses, a situation known as a capitulation phase. In general, capitulation occurs during bear markets.

Coatue Management (Investor Presentation)

Coatue Management’s investor presentation also hinted that the markets are in a capitulation phase where the entire stock market will fall before reaching its bottom. Philippe Laffont’s investment firm held 80 percent of its portfolio in cash as of June 2022 following a large number of sales in the first half. Like the dot-com bear market, the firm says non-profitable tech stocks fell in the first phase of 2021. In the second phase, both non-profitable and profitable tech stocks plunged in the first half of 2022. In the third phase, which is called the capitulation phase, the firm predicts the entire public sector is likely to face a downtrend and this phase is likely to last longer than the first two.

Conclusion

It is not the right time to buy ETFs such as VOO that track the performance of the S&P 500 index in my opinion. As several indicators are sending bear market warnings, the ETF is likely to suffer more losses in the months ahead. FedEx’s poor results and lower outlook have raised concerns over significant earnings revisions for the full year and 2023. Sentiment would also be impacted by the worsening economic situation, as major economic regions are likely to enter recession in the fourth quarter. Furthermore, lofty valuations and historical trends indicate downside movement.

Be the first to comment