Rawpixel/iStock via Getty Images

Norwegian Cruise Line Holdings (NYSE:NCLH) is a U.S. entertainment cruise giant that has struggled to stay afloat since the onset of the pandemic. Travel and leisure stocks have been hammered for the better part of the last three years with the cruise industry specifically drawing the short end of the stick. NCLH has been hit hard in the markets and lost 77.7% of its value since the initial restrictions were imposed, and almost 40.1% of its value year-to-date after the company failed to mount a substantial recovery alongside the rest of the entertainment cruise industry.

In light of all of this, the Miami-based cruise operator held its 2022 Investor Day presentation on Thursday, the 6th of October. Management stepped in front of analysts and investors alike showcasing the best version of themselves while trying to explain why NCLH should be the perfectly positioned candidate to weather the ongoing storm in the cruise industry. This happened only days after the company disclosed it has pulled all pandemic-related health and travel restrictions in a clear sign the company aims to restore normal day-to-day operations over the course of the next two quarters.

NCLH 1-Year Return vs S&P500 (Seeking Alpha)

Investor Day Highlights

After an arguably weak market response to the second-quarter results released on the 9th of August and given the growing concerns over how a recession would reflect on the broader cruise industry, management took the opportunity and in our view attempted to deconstruct several bear arguments about the company turnaround prospect during the presentation. At the time, Norwegian missed both top and bottom-line estimates while delivering some troublesome guidance for the rest of the year.

Response to today for somewhat different. Management seems to have been focused on conveying several key messages to the market:

- Overall resilience of the cruise industry

- Unexpected tailwinds from a recession

- Strength of its fleet and its relatively unique position

To a certain extent, we can conclude that the market seems to have liked what it saw given that NCLH shares ended the day trading in the green, contrary to the S&P 500 (SPY), which just saw another day of extended losses.

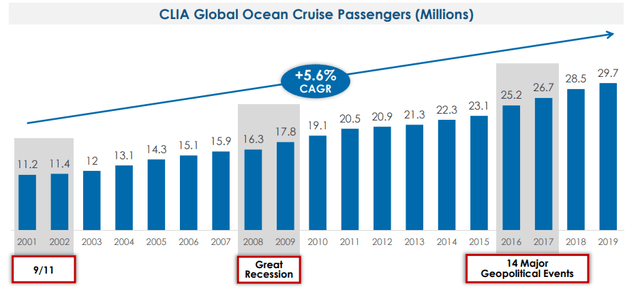

Starting from the top, this is not the first point in history that the cruise industry has encountered rough seas ahead. It delivered results above reasonable expectations both during the early 2000s when the dot-com bubble burst and after the 2008 financial crisis ensued. Not only has it shown resilience but the industry experienced growth throughout both periods, growing passengers from 11.2 to 12.0 million in the first case and from 16.3 to 19.1 million in the second case.

Industry Resilience (NCLH Investor Day Presentation)

Overall, demand for global cruise passengers saw a 5.6% CAGR throughout the past two decades, which was only interrupted by the offset of the pandemic.

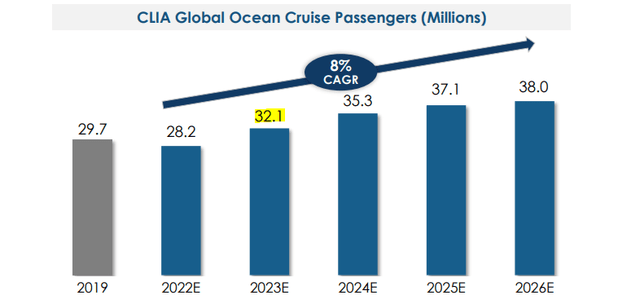

According to CLIA studies, cruise demand should be back to normal as early as next year. The year is supposed to see 32.1 million cruise passengers, outshining the 29.7 million cruise passengers record, which was set in 2019 and putting the industry back on a decade-long path of growth.

Cruise Demand 2022-2026 (NCLH Investor Day Presentation)

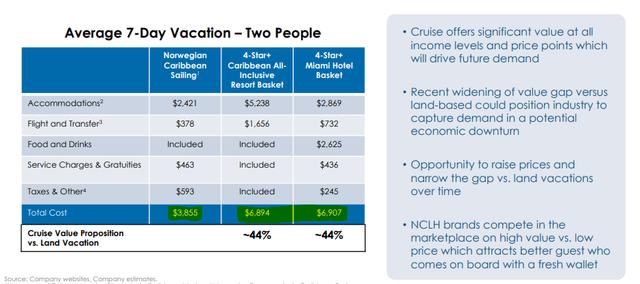

Another bear argument that seems fairly reasonable on the surface of things is that with the economy slowly but surely heading into recession, which could see demand for cruises weaken as tourists rain in on their discretionary spending habits. The relatively unique and niche experience that a cruise offers within the tourism industry combined with the strong value proposition should, in management’s view serve, to negate this effect.

In fact, they believe that it might by itself serve as a tailwind during the recession. So the theory goes that a cutback in discretionary spending could lead to a percentage of tourists opting out of their traditional “land-based” vacations that would eventually find their way onto NCLH’s value to mid-price cruise offering.

Vacation Prices (NCLH Investor Day Presentation)

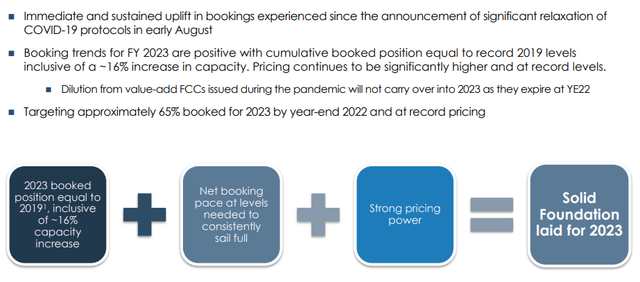

The Miami-based cruise operator has already seen some strong booking trends in the third quarter almost immediately after the restrictions have been fully lifted. NCLH is currently targeting 65% bookings by the end of the full-year 2022.

Bookings are strong. Frank touched upon it, but our booking trends for FY ’23 continue to be, whether you want to call it equal or in line, it’s not historical average. In line has been interpreted that it could be this wide band from left to right. We’re telling you that it is equal to our 2019 record levels. But more importantly, pricing is significantly higher, and it’s still that way today. You’ll get more color on our upcoming earnings call, but the booking and the booking pace today is at a level that we need the booking paces at a level that will get us to that — back to that historical capacity starting in the second quarter of next year and beyond. Those 2 factors are going to really set a tremendous foundation for excelling in 2023.

Mark Kempa, CFO – Investor Day Shareholder/Analyst Call

In other words, the company believes it is setting itself up for a successful year that parallels or even exceeds its record year 2019, but on a slightly higher (~16%) total capacity.

Bookings Update (NCLH Investor Day Presentation)

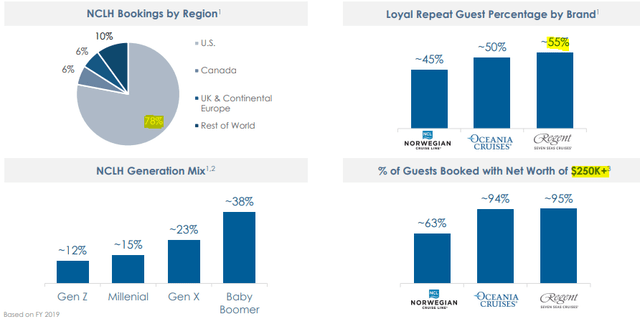

For its last “normal” year of operations, Norwegian Cruise Line had almost 78% of its customers booked from the United States. In the face of the ever-growing strength of the U.S. dollar, a very high concentration of U.S.-based guests might prove as a short-to-mid-term tailwind for Norwegian.

Guest Demographics (NCLH Investor Day Presentation)

Let’s talk about guest demographics. We are a U.S.-centric company. Now maybe someday that will come invite me in the ask, not today. Not with a strong dollar, not with the rest of the world having economic concerns, especially Europe probably a recession, the U.S. is still the best place to do business. American consumers are the best cruise customers. They book the earliest, gives me greater visibility. Greater visibility means I can raise prices because I have confidence I’m going to go full. That is key. You’ll see our booking curve in a minute. They book higher cabin categories and they spend the most money on board. So we like American consumers. Now we don’t only live by American consumers. You can see roughly 80% U.S., 20% rest of the world. I like that balance. And then the generational mix. We don’t rely just on the old baby boomers, although they are the dominant at nearly 40%. But depending on the itinerary, depending on the ship, depending on the brand, we go down to Gen X, millennials even Gen Zs.

Frank Del Rio, CEO – Investor Day Shareholder/Analyst Call

Other companies might be forced to additionally raise prices or otherwise just take the forex hit directly. Just on the basis of the U.S. Dollar’s recent rise, cruises are roughly 12-17% more expensive for the average European, Brit, or Australian, not counting anything else in. For a direct comparison, Carnival (CCL) reported only 50% of U.S. guests in 2019, while approximately 55% of its revenues were generated in North America. As for Royal Caribbean (RCL), the same year saw 61% of its revenues generated from North America and 65% of its revenue tickets originating from the U.S.

So the bottom line here is that the company lays down some pretty sound reasoning as to why the cruise business itself might prove much more resilient to a recession than many would think, as well as why they believe they are somewhat better positioned that the publicly traded competition. We tend to largely agree on this point, however, there is a huge sinking boat to be turned around.

Back to financials

Even going as far as the second-quarter results, the market has been left largely disappointed with the lack of a more substantial post-pandemic recovery, which truth to be told has been endemic across the cruise industry and can be clearly noted from the share price as well. However, the company went a long way from having its entire cruise fleet consisting of 29 ships being docked for more than two years to finally being allowed to sail and generating some positive operating cash flow numbers.

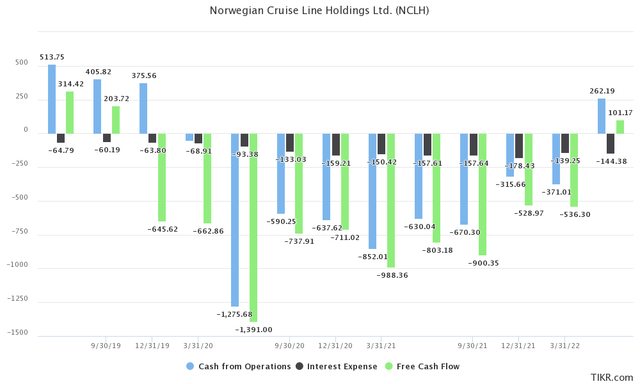

CFO, FCF, and Interest Expense (TIKR Terminal)

In fact, an argument can be made that the Norwegian Cruise Line is also slightly ahead of the herd being the only one to generate positive free cash flow for the second quarter, which even comes close to covering the interest expense.

After ten consecutive quarters of posting negative cash from operations and free cash flow numbers, or otherwise, burning through billions of dollars, NCLH finally showed some cash statement strength and generated $262.19 million in CFO and $101.17 million in FCF for the second quarter of 2022.

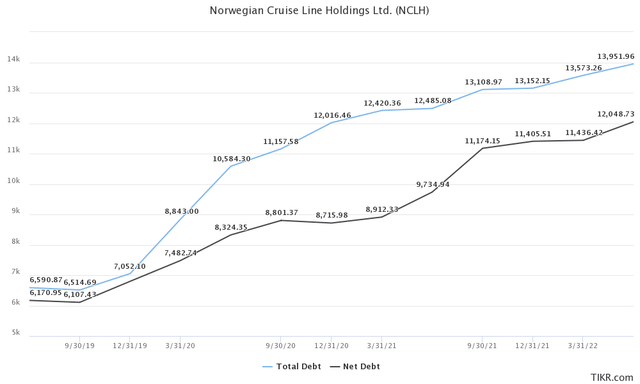

It is not truly possible to discuss Norwegian Cruise Line Holdings without addressing the elephant in the room, which similarly to the other cruise companies, is none other than the question of leverage and dilution. During the pandemic era, with no actual cash-generating potential, the company had no reasonable way to cover its expenditures other than to resort to debt and equity financing. This led to irreparable damage taking place to Norwegian’s balance sheet. NCLH burned through more than $2 billion dollars during the last twelve months alone, at which point it was allowed to have limited operations.

Effect of Debt Financing (TIKR Terminal)

Management’s main priority is to find a way to service the outstanding debt the company has incurred in the period over the last three years. As per the latest quarterly filing, NCLH had $13.95 billion in total debt and $12.04 billion in net debt. In the second half of 2019, prior to being levered up, the company reported only $7.05 billion in total debt and $6.79 billion in net debt. In other words, the company had to raise close to $7 billion in debt in order to stay afloat during the pandemic, effectively doubling its pre-pandemic debt.

To be fair, due to the situation, Norwegian has a strong liquidity position, currently sitting at around $2.2 billion in cash. It consists of $1.2 billion in cash and a $1 billion undrawn credit line. Prior to the closure of operations, the cruise operator rarely felt the need to hold more than $400 million in cash on their balance sheet.

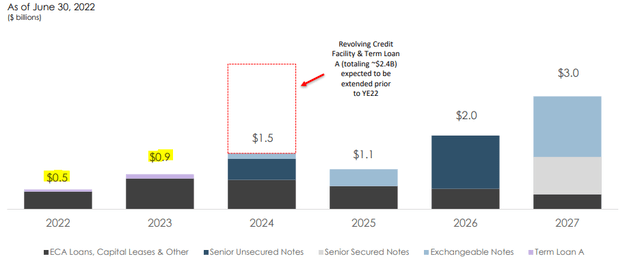

The company expects only $1.4 billion of debt to mature over the course of the next six quarters. Considering the cash position, the voyage up until that point should be relatively safe. However, 2024 will see $3.9 billion maturing, including a revolving credit facility that is likely going to be extended prior. Further to the point, close to 75% of NCLH’s debt is fixed, a number that is supposed to get to high as 80% by the end of 2023, which alleviates a lot of the pain concerning rising interest rates. The weighted average cost of debt is set at around 5%.

Debt Maturity Profile (NCLH Investor Day Presentation)

But beyond that, we have a relatively clean tower leading up to — as we continue to generate cash flow and leading up into 2026. And another phenomenal fact, pro forma for the Prima delivery, our fixed debt 75% of our debt is fixed, and that’s at a weighted average cost of debt of about 5%. Fast forward to the end of 2023, that 75% goes to 80%. So in a rising rate environment, again, we are well positioned from an interest and debt standpoint, given our overall cost of debt.

Mark Kempa, CFO – Investor Day Shareholder/Analyst Call

In terms of short-term liquidity, NCLH went from a current ratio of 0.25x and a quick ratio of 0.14x at the end of 2019 to a current ratio of 0.62x and a quick ratio of 0.50x at the end of Q2. And in terms of long-term solvency, the company went from a pre-pandemic Total Debt/Equity of 103.8% to a Total Debt/Equity of 1547.1% at the end of the second quarter.

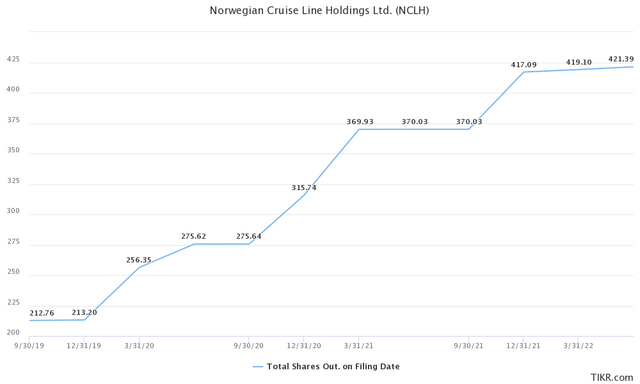

As was pointed out earlier, Norwegian was burning through significant sums of cash and it needed to find a way to pay its bills. On one end, it took up large amounts of debt, but management has also resorted to raising capital by issuing new shares of the company. This led to some catastrophic dilutions taking place.

Effect of Equity Financing (TIKR Terminal)

The rather tragic part of all of this was the fact that management was known for executing well-coordinated share buyback programs in the pre-pandemic 2014-2019 period. During the five-year period, NCLH has bought back some 7% of the float, lowering the outstanding shares to 212.7 million. That number has increased to more than 421.39 million shares during the company’s endless pursuit of capital during the pandemic. This means that the shares outstanding have increased by 98.11% or that the average shareholder has been diluted to the point at which he owns one-half of what he used to. Still, the management team once again reiterated that this is the last of equity dilution to be seen at NCLH and that unlike some of their competitors in the space, they will no longer rely on that source of financing in order to meet obligations.

Closing arguments

Once again, this entire situation with the cruise operator and the pandemic was largely out of anyone’s hands and, in general, what has happened to an otherwise good business is a real tragedy. Norwegian Cruise Line Holdings was a brilliant company with stellar financial results on a path of consistently rewarding its shareholders prior to what happened. However, we cannot change time as management and shareholders alike have to deal with the consequences of something they have not caused. In our recent article about Carnival Corporation titled: “Sailing Into The Unknown“, we have discussed how the company managed to generate respectable operational results during the third quarter but that they largely failed to translate that well over into the financial side.

We believe that a similar, but at a smaller scale development awaits Norwegian as well. We are much more enthusiastic about NCLH prospects of turning the boat around, believing it benefits from a set of factors that elude Carnival and Royal Caribbean. Ultimately, the smaller scale of the company and its fleet, a focus on the U.S. customer, all together combined with the “upper class” appeal of their brands might prove as a saving grace. We still remain unconvinced as to the successful recovery for the cruise giant, at least as far as the common shareholder is concerned, opting in to wait for a clearer plan on deleveraging as well as a “show of force” in the cash-generating potential. Still, if any of the big three manage to fully turn the boat around and avoid a restructuring, we believe it might be Norwegian Cruise Line Holdings and will henceforth keep a keen eye on how things develop in the future.

Be the first to comment