Vepar5/iStock via Getty Images

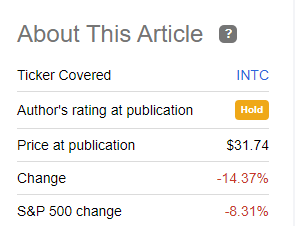

When we last covered Intel Corporation (NASDAQ:INTC), we recognized it as a value trap and gave it a pass once again. Specifically, we identified what held us back from going in as…

It pays to be a contrarian, but it pays more to wait for fundamentals to be better aligned with the contrarian stance. Here, we have rightly stayed out of this name for a long time as we just saw a plethora of risks with poor upside. The lower the price goes, the better, as every dollar down improves your return prospects. We don’t think we are there yet and the analyst community needs to project reality into earnings before we take a dive. For now we stay out and rate Intel as a hold/neutral.

Source: The Value And The Trap

Working in favor of that thesis was the fact that the price did indeed go lower.

Returns From Last Seeking Alpha Article

But we before dust off our mouse and hit the buy button, we have to deal with the elephant in the room. Advanced Micro Devices’ (AMD) preannouncement and how that impacts things.

AMD’s Woes

AMD’s announcement underscored once again that semiconductors are cyclical and not secular. Those who paid the top $150 for AMD (greater than 10X sales) are likely to find out how much of those earnings are about to evaporate. AMD’s revenues will be close to $5.6 billion in the coming quarter and that missed consensus by over $1.0 billion.

Third quarter revenue is expected to be approximately $5.6 billion, an increase of 29% year-over-year. AMD previously expected revenue to increase approximately 55% year-over-year at the mid-point of guidance. Preliminary results reflect lower than expected Client segment revenue resulting from reduced processor shipments due to a weaker than expected PC market and significant inventory correction actions across the PC supply chain.

Revenue for the Data Center, Gaming, and Embedded segments each increased significantly year-over-year in-line with the company’s expectations.

Gross margin is expected to be approximately 42% and non-GAAP gross margin is expected to be approximately 50%. AMD previously expected non-GAAP gross margin to be approximately 54%. The gross margin shortfall to expectations was primarily due to lower revenue driven by lower Client processor unit shipments and average selling price

Source: Seeking Alpha

There is a lot to unpack there. First issue here is that the original guidance was on August 6, so AMD had 37 days of the quarter in the bag when it spoke of its expected run-rate. The general idea in these, is to under promise and over deliver, so there is no doubt that AMD was being conservative at the time. A $5.6 billion quarter implies that the two latter months of the quarter ran at close to a $5.0 billion a quarter, run-rate. We get this by assuming that at least the first month was above the $6.75 billion implied guidance. $20 billion in rolling 12-month sales is likely going to come true for AMD very soon and the street is not prepared for this.

To that, we would add that the gross margin drop was a relative bright spot. Non-GAAP gross margins only dropped by 4% and this likely limits the earnings per share damage. Earnings will still be coming in under $3.00 per share and this will act as a ceiling on the stock.

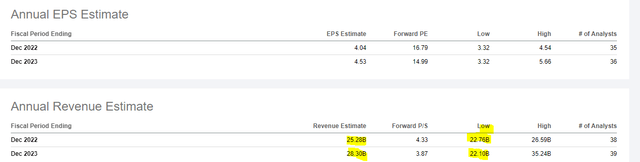

What This Means For Intel

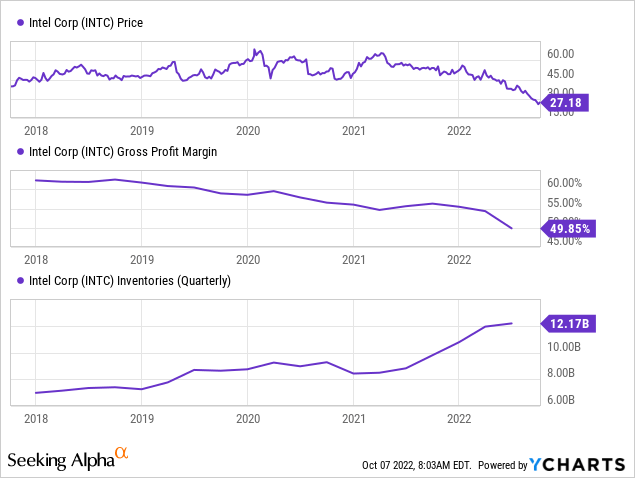

The weakness in AMD is not company specific. Extreme shortages in 2021 caused double ordering and double bookings, just in time to run into the monumental slowdown. This will take time to work out and in the interim, INTC’s numbers are likely as optimistic as AMD’s. We expect revenues to disappoint and come in below the lowest on the street. The lowest revenue estimate for INTC we could find for 2023 was $61.5 billion and we would be looking at the mid-50s as a good starting point. Working out the gross margins is harder, but under no circumstances can one have a rosy outlook with inventories at over $12 billion.

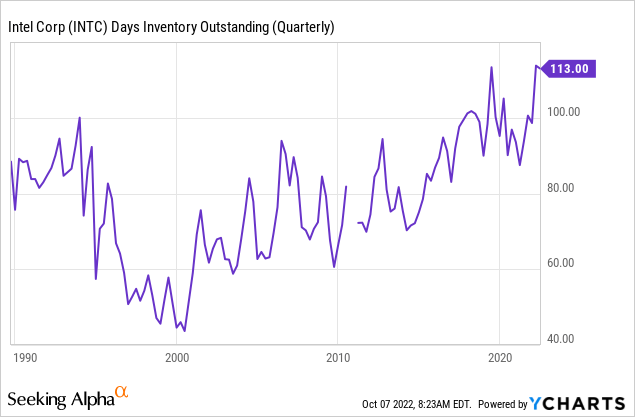

That $12.17 billion translates into the highest ever days-of-inventory figure.

Our extrapolation of these facts is that INTC will have a loss making year on a rolling 12-month period. Now, some of this may come down to a “special charge” on inventories and may dodge the non-GAAP results. Booking revenues from the Chips Act also acts as a small offset, but realistically, we do not expect owners of the company to make a profit over the next 12-18 months.

Verdict

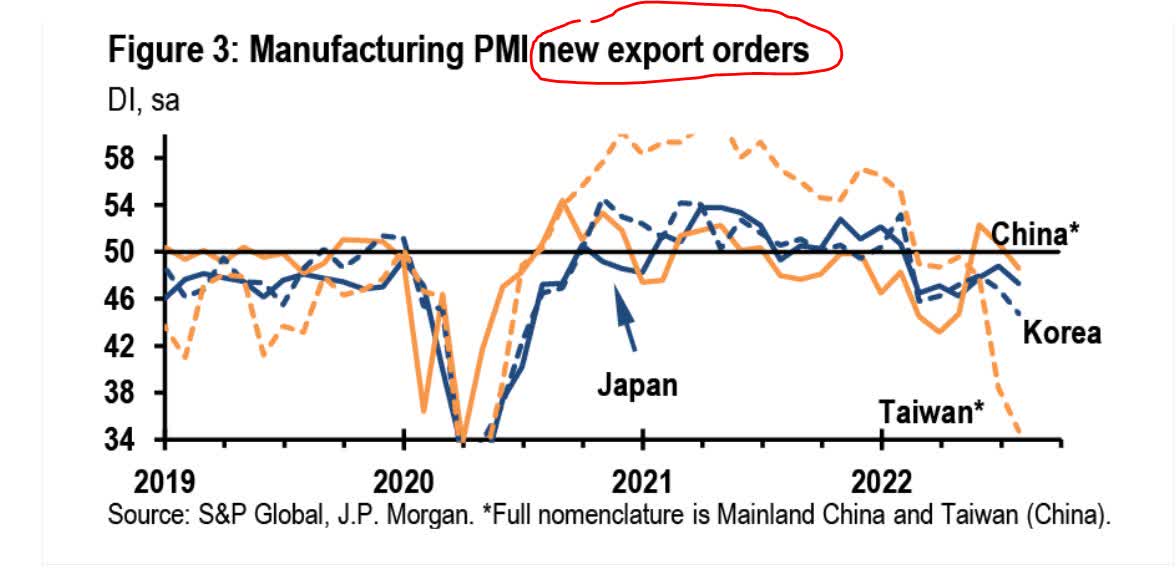

Our last article had a warning based on the macro picture. Taiwan’s export order was ominous and the chips were about to fall.

JP Morgan

None of our leading indicators have improved since then and a couple have deteriorated. Yes, we get the idea of buying when things are down, but this is not a time for heroics. You are looking at likely zero profits for INTC and this is being coupled with the most massive capex cycle we have ever seen. Analysts are still hopelessly out of touch and that dividend looks completely unsustainable. At a minimum, consider buying this when the Federal Reserve is at least easing, rather than trying to collapse asset markets to reduce inflation. We think that point is far lower.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment