olm26250/iStock via Getty Images

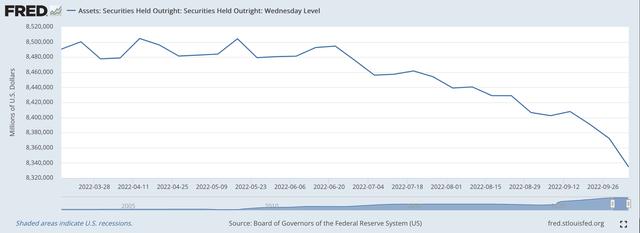

In the banking week ending October 5, 2022, the Federal Reserve reduced its securities portfolio by $36.0 billion.

Since, the banking week ending March 16, 2022, the Federal Reserve has reduced its securities portfolio by $156.1 billion.

March 16 is the day the Federal Open Market Committee made its first move this year to raise the Fed’s policy rate of interest.

So the Federal Reserve is on its way.

The reduction in the size of the securities portfolio is so important because it is a part of the Fed’s policy program, the way the Federal Reserve goes about carrying out its monetary policy now.

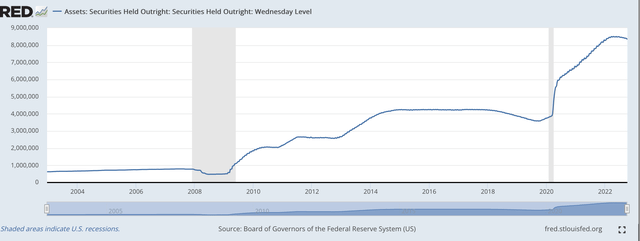

Following the Great Recession, Ben Bernanke introduced the policy practice of quantitative easing. During the economic recovery, the Fed conducted three rounds of quantitative easing where it bought, on a regular basis, a certain amount of securities every month to spur on the expansion.

Jerome Powell, in April 2020, led the Fed to add $120.0 billion in securities to the Fed’s portfolio every month to combat the impacts of the Covid-19 pandemic and the subsequent recession that hit the United States.

Securities Held Outright: Wednesday Level (Federal Reserve)

This program was begun in April 0f 2020 and was phased out beginning in March 2022.

Now, the Federal Reserve has begun to move in the opposite direction.

Rather than “quantitative easing,” the Fed is engaging in “quantitative tightening.”

After the first two months of the effort, the Fed will be attempting to reduce its securities portfolio by about $95.0 billion every month.

The plan is for this program to continue until 2014.

Here is a closer look at the start of the quantitative tightening.

Securities Held Outright–March 16, 2022, to October 5, 2022 (Federal Reserve)

Not a bad start. Seems right on the Fed’s schedule.

“Excess Reserves”

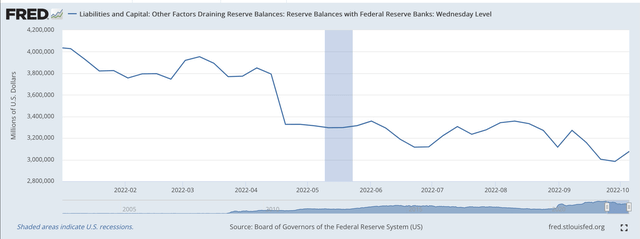

This reduction in the securities portfolio is the way the Federal Reserve is working to underwrite increases in the Fed’s policy rate of interest.

On the Fed’s balance sheet, “Reserve Balances with Federal Reserve Banks” is the line item that represents a proxy for “excess reserves” in the banking system. If excess reserves rise, that means that commercial banks are experiencing a rise in their liquidity, whereas if excess reserves are declining, liquidity is being reduced and this puts upward pressure on the Fed’s policy rate of interest.

Reserve Balances with Commercial Banks (Federal Reserve)

Here we can see that these “Reserve Balances” were in excess of $4.0 trillion at the start of the year.

Right now, “Reserve Balances ” are right around $3.0 trillion.

Things have tightened up.

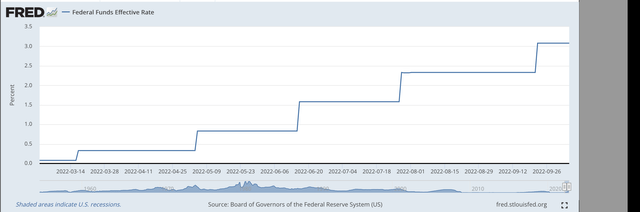

Beginning on March 16, 2022, the Fed has raised its policy rate of interest five times.

Effective Federal Funds Rate (Federal Reserve3)

Right now, the Fed has suggested that the Federal Funds rate will be raised twice more this year, once at its FOMC meeting on November 1-2 and again at its December 13-14 meeting.

It seems like we are in store for a 75 basis point rise in November and a 50 basis point rise in December.

This would take the effective Federal Funds rate up to 4.33 percent by the end of the year.

How Long?

The question is, how long will this policy continue?

Right now, the understanding is that policy will be continued until some time in 2024.

However, investors are not fully confident that the Federal Reserve will be able to maintain this reduction in the securities portfolio for that long.

The first two times the Federal Reserve pursued “quantitative easing,” investors in the stock market got on board early and participated in a rising stock market in each case. (I examine these two examples in my recent post, “Watching the Fed’s Securities Portfolio.”)

This is not the case in the current effort.

It seems as if investors are not convinced that the Fed will stick with the “quantitative tightening.” As a consequence, the downward movement in the stock market has been very volatile.

S&P 500 Stock Index (Federal Reserve)

Just the very volatile movement of stock prices this week is indicative of the attitudes that exist among investors.

This is why, to me, we need to keep a close watch on what the Fed does with its securities portfolio.

So far, the Fed is staying on target in reducing the size of its securities portfolio.

This is the key.

Keep your eyes on the Fed’s securities portfolio.

Be the first to comment