Cavan Images/iStock via Getty Images

Introduction

I have been keeping an eye on Bonterra Energy (OTCPK:BNEFF) for the better part of the past year as I enjoyed how the strong oil and gas price allowed to company to rapidly reduce its gross and net debt. This will obviously also have a positive impact on the interest expenses and that will play an important role to mitigate the impact of lower oil and gas prices.

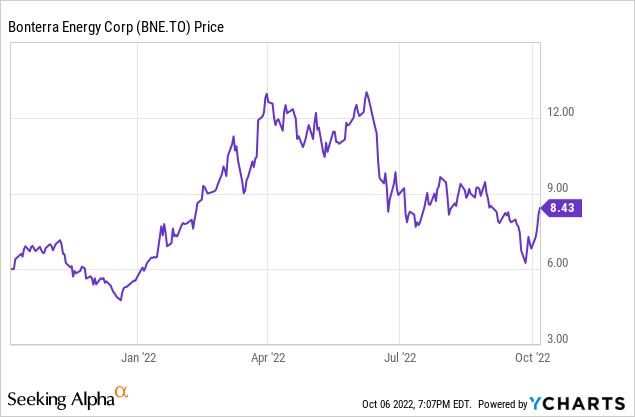

Bonterra’s most liquid listing is the TSX listing where it is trading with BNE as its ticker symbol. The average daily volume on the TSX comes in at around 150,000 shares per day, clearly making it the most liquid listing for this company. The current market capitalization hasn’t change much compared to July, as the company’s equity is still valued at approximately C$300M.

Bonterra’s H1 result bodes well for the entire financial year

In a July article, I argued Bonterra’s Q2 sell-off which saw the share price decrease from in excess of C$12 to just around C$8 was undeserved as the company was taking all the right steps.

While the second quarter was obviously excellent, oil and gas prices have retreated from their highs so perhaps it is a better idea to have a look at Bonterra’s first semester (rather than just the second quarter) to avoid being carried away by what could very well be one of the best quarters on record.

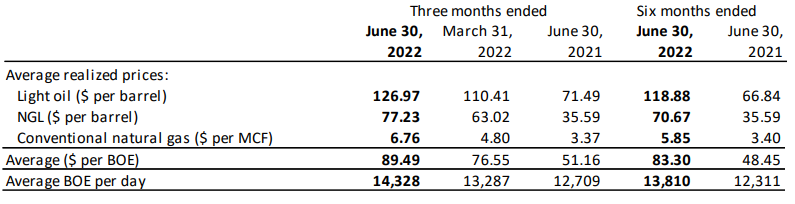

Bonterra Energy Investor Relations

The average oil price during the entire first semester was just under C$119/barrel while the NGL prices also remained strong: Bonterra received almost C$71 per barrel of NGL which is almost twice the C$35.59 received in the first half of last year. And of course, the natural gas price was also still very strong due to the C$6.76 average price in the second quarter of the year. Granted, using the H1 results is still an optimistic approach given where the oil and natural gas prices are currently at, but at least it is more realistic than solely focusing on Q2.

With an average production rate of almost 14,000 barrels of oil-equivalent per day and an average realized price of C$83.3 per barrel of oil-equivalent, the net cash netback increased to almost C$44/barrel. That’s despite the higher loss on hedges and the higher royalty payment per barrel of oil-equivalent due to the gliding scale nature of the royalty structure.

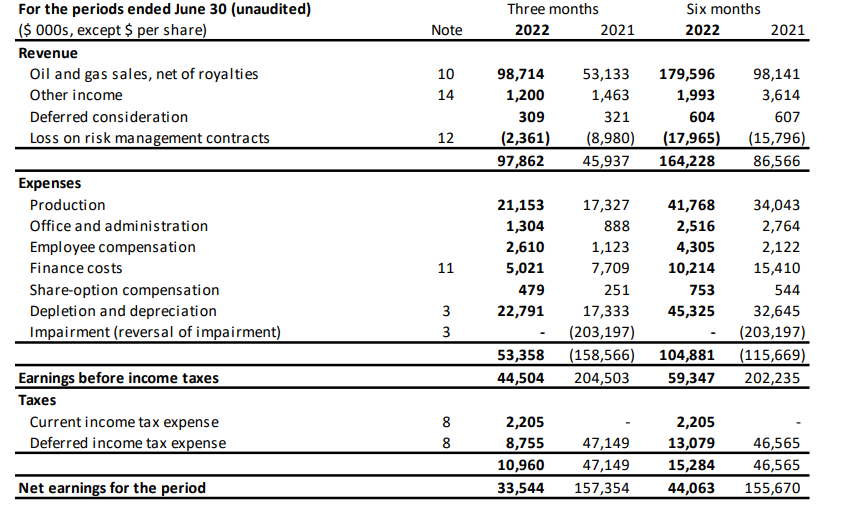

The reported net revenue came in at C$164M in the first semester, and this already includes the royalty payments as well as a C$18M loss on hedges. With a total operating expense of just under C$105M (of which about 40% is represented by non-cash depreciation and amortization expenses), the pre-tax income was a very enjoyable C$59M resulting in a net income of C$44.1M.

Bonterra Energy Investor Relations

Based on the current share count, the EPS was C$1.24 in the first semester and as you can imagine, it was predominantly the second quarter that boosted the net result thanks to a C$0.93 EPS. That being said, the majority of the hedging losses was incurred in the first quarter and that makes the Q2 result look disproportionally better than the first half of the year.

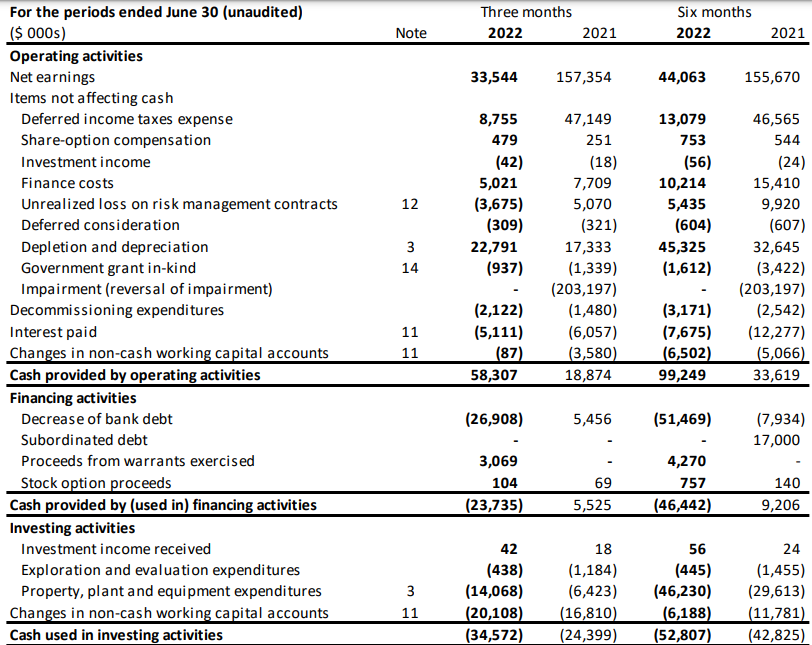

The reported operating cash flow was C$99.2M but this includes a C$6.5M working capital investment so on an adjusted basis, the operating cash flow was C$105M. This includes approximately C$13M in realized hedging losses as about C$5.4M in unrealized losses were added back to the cash flow result. And seeing how the oil and gas prices turned south, those unrealized losses may actually be converted into realized gains before too long.

Bonterra Energy Investor Relations

The total capex was just C$46M resulting in an underlying free cash flow of almost C$60M, and that is including almost C$13M in realized hedging losses.

The cash flow statement above shows Bonterra is still rapidly reducing its net debt as it repaid about C$51.5M in debt during the first semester. This reduce the net debt to approximately C$207M (Bonterra’s corporate presentation mentions C$211M but the sum of C$111.5M in bank debt, C$47.3M in subordinated debt and C$48.5M in subordinated debentures is just around C$207M).

A look at the full-year guidance

Bonterra did not hike its full-year capex of C$70-75M any further after the initial inflation-related hike, and this means about 65% of the full-year capex has already been spent in the first half of the year. This means that despite the lower oil and gas prices in the second half of the year, the free cash flow should remain pretty strong as the lower operating cash flow will be mitigated by a lower capex requirement.

This means Bonterra’s official guidance to generate C$128M in free cash flow is still valid although we should perhaps be a bit more conservative. An average WTI oil price will likely result in a full-year free cash flow result of C$120M or C$3.31 per share.

Using an average WTI oil price of US$80 for next year, and applying an AECO natural gas price of C$4, I anticipate a free cash flow result of approximately C$2.5/share assuming the company can continue to use a chunk of the C$261M in tax pools. As the hedge book is slowly rolling off, I don’t anticipate any sudden swings in hedging losses or gains.

Bonterra Energy Investor Relations

Investment thesis

It looks like Bonterra has its priorities straight by rapidly reducing its net debt. I think the company has a good chance at ending this year with a net debt level of just around C$150-160M (depending on how the working capital requirements are fluctuating during the second semester) and this will surely help Bonterra to refinance its bank facility (the company has already agreed to four monthly stepdowns of C$10M per month) and perhaps that will give the market more confidence in Bonterra’s ability to execute on its plans.

I still don’t have a long position in Bonterra Energy, but the value proposition is getting more tempting by the day. While the market capitalization hasn’t moved at all since July, the company has likely generated an additional C$30M in free cash flow since my previous article was published.

Be the first to comment