Douglas Rissing

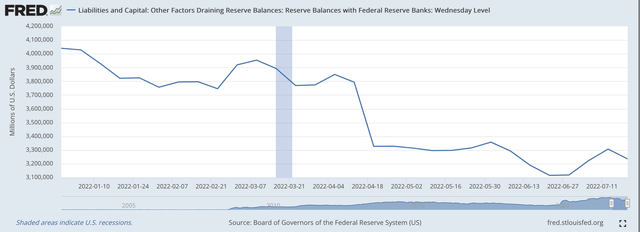

Reserve balances with Federal Reserve banks, the cash balances that the commercial banking system holds with the Fed, dropped by $71.3 billion this past banking week. This account is something of a proxy for excess reserves in the banking system.

Since March 16, 2022, when the Federal Reserve really began to “tighten up” on its monetary policy, reserve balances have dropped by almost $660.0 billion.

It is this drop in the “excess reserves” in the banking system that has supported the Fed’s efforts to raise its policy rate of interest, the Federal Funds rate.

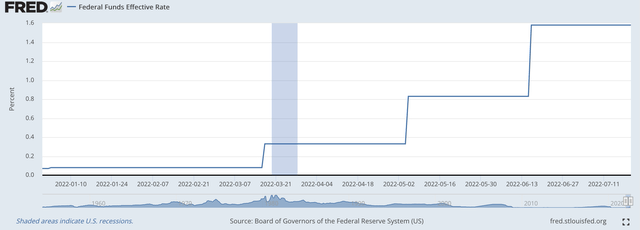

As can be seen in the following chart, the Fed has raised its policy rate three times in this period.

Effective Federal Funds Rate (Federal Reserve)

Coming into 2022, the effective Federal Funds rate was 0.08 percent. Beginning on March 16, the rate moved to 0.33 percent. On May 5, the rate jumped once more to 0.83 percent. And, on June 15, the rate was raised to 1.58 percent.

One can see how the Fed has moved reserve balances downward in order to reduce the liquidity of the banking system and support the rise in the effective Federal Funds rate.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

Note that, although the decline in reserve balances began in January, the real drop did not take place until late in March as the Fed moved to encourage the increase in the policy rate.

So the first part of the Fed’s effort to tighten up its monetary policy is pretty much on track.

Another increase in the policy rate is expected at the Fed’s meeting of the Federal Open Market Committee this month. The basic bet is on a 75 basis point rise in the range of the policy rate.

But, with the very high rate of inflation for June, some people are suggesting that the policy rate could be increased by a full 100 basis points.

The July move will be watched very closely to see just how intent Federal Reserve officials are in showing the investment community that it is very, very serious in combating the current rate of inflation.

The Second Policy Goal: The Securities Portfolio

The other part of the Fed’s effort to tighten up on monetary policy is really just getting off the ground.

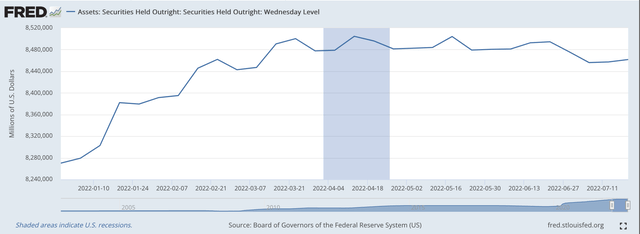

The second goal of the Fed is to reduce the size of its securities portfolio.

The effort to reduce the size of the securities portfolio was not supposed to start at a very high rate and is supposed to be achieved, not by outright sales of securities but by allowing securities to mature off the Fed’s balance sheet without all of them being replaced by the Fed.

The current reduction really appears to have started in June.

Since the end of the banking week of June 22, the amount of securities on the Fed’s balance sheet has declined by just under $33.0 billion.

This is taking place, given the Fed’s operating procedure with the purchase of securities outright to put on the Fed’s balance sheet, at a slow, but relatively steady pace.

After the first two months of relatively small reductions in the portfolio, the decline will be increased.

The decline in the securities portfolio is expected to continue into 2024.

Securities Held Outright (Federal Reserve)

As can be seen from this chart, the Federal Reserve continued to maintain its securities portfolio at a high level until June of this year.

So, the Fed has begun the second part of its effort to tighten up on monetary policy, but it has not gotten very far into the execution of the move.

The Future

The Federal Reserve is moving along as it has indicated that it would.

The investment community now believes that the Fed is actually now fighting inflation.

The dilemma now is to determine just how tight the Fed will actually execute on its “tighter” monetary policy.

Looking at the behavior of the stock market and the bond market in recent weeks it seems as if there are a goodly number of investors that believe that the Federal Reserve will actually be “tight” only for a minimal amount of time and that over the next six- to twelve-month period, the Fed will be able to “back off” from its “tight” policy and move into a more accommodative stance.

There seem to be enough of these investors around that the stock market appears to be reluctant to decline, and the inflationary expectations built into the yields on government bonds seem to reflect the movements that appear in the economic projections of the Federal Reserve’s FOMC.

There still is another group of investors that believe this picture to be too soft.

These investors think that inflation will remain a serious problem, that it will not be brought under control in the very near future, and will require the Federal Reserve to keep its foot on the pedal for an extended period of time.

This group sees a lot more pain moving forward.

But, as mentioned above, the group that sees an easier path ahead of us, is the group that seems to be dominating the markets right now.

This is one reason, I believe, for the increased volatility in the stock and bond markets right now.

Which narrative do I lean to right now?

I am in the latter group, and I have been in the latter group all during this period of rising inflation.

The economy, I believe, is in substantial disequilibrium.

It is going to take some time and some effort to get the U.S. economy back to a “more normal” condition, and, unfortunately, I believe that there will be a lot of pain in getting there.

Therefore, I believe that the Fed must stay on a tighter path through the next year or so.

Be the first to comment