cemagraphics

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 25th, 2022.

The Cushing NextGen Infrastructure Income Fund (NYSE:SZC) has been an interesting investment to watch over the last couple of years. They transformed their fund from being a more pure-play energy fund to incorporating a broader, more flexible approach. That includes “NextGen” infrastructure plays that are commonly associated with renewable energy sources. They’ve also branched out into some real estate investments too.

They aren’t the only fund that transformed themselves in the wake of the 2020 COVID crash. Tortoise Energy Infrastructure (TYG) and Kayne Anderson NextGen Energy & Infrastructure Inc (KMF) also made their own transition to similar flexibility. Today, I view these three funds, in particular, as peers. They have sizeable investments in fossil fuel-related energy plays – primarily natural gas – but they also offer a more flexible approach to pivot to heavier renewable allocations over time.

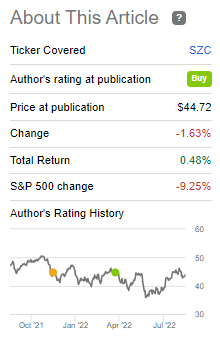

I cover SZC rather regularly. The last time was earlier this year, in April. The fund has done quite well on a total return basis since that period relative to the broader market.

SZC Performance (Seeking Alpha)

Today, I wanted to take a look at a performance comparison between several peers, including looking at a comparison of their valuation.

While I’m long SZC and TYG and was long KMF until earlier this year, SZC is continually the cheapest in terms of valuation in this space. It has been a bit perplexing as they’ve also tended to put up the best performance relative to the space as well. One thing that it comes down to, which seems to have a direct impact, is the actual distribution yield that each of these funds sport. All three funds are discounted, but SZC is the lowest of the trio.

I believe that upping the distribution rate would have the single greatest impact. However, there is another catalyst that could spark this name higher. That is the interest that Saba has been having with the Cushing funds. Cushing also offers the Cushing MLP & Infrastructure Total Return Fund (SRV). This fund also trades at a larger discount relative to its own peers.

The Basics

- 1-Year Z-score: -1.43

- Discount: -19.42%

- Distribution Yield: 5.72%

- Expense Ratio: 1.84%

- Leverage: 28%

- Managed Assets: $200 million

- Structure: Perpetual

SZC will “seek high total return with an emphasis on current income.” To achieve that objective, the fund will “invest at least 80% of its net assets, plus any borrowings for investment purposes, in a portfolio of equity and debt securities of infrastructure companies, including: [i] energy infrastructure companies, [ii] industrial infrastructure companies, [iii] sustainable infrastructure companies, and [iv] technology and communication infrastructure companies. The Fund will invest no more than 25% of its Managed Assets in securities of energy master limited partnerships (“MLPs”).”

The fund is limited in its capacity to hold MLPs to 25% since they are a regulated investment company [RIC]. This wouldn’t be a restriction if they were structured as a C-corp as several other infrastructure/MLP funds. Overall, the fund can invest in quite a vast amount of holdings that pertain to the infrastructure space.

A negative of the fund for some larger investors is the size. It is a smaller fund, and that often translates into lower liquidity as daily volume is low. Some investors who want to get in and out in large chunks of shares quickly could run into issues.

The fund’s expense ratio comes to 1.84%. This comes to 2.38% when including leverage expenses. This figure also includes the 0.25% management fee waiver they have in place. They had announced this in a press release with their latest distribution announcement that it would be in place for another twelve months. Their borrowings are based on a variable rate; as interest rates rise, this will add some costs going forward.

That’s on the high side for expense ratios, but for whatever reason, this is rather normal for this space of funds. TYG and KMF were even higher because they also pay taxes on the fund level. TYG has positioned its portfolio to now qualify as a RIC and no longer pay C-corp taxes.

Excluding those tax expenses for TYG, operating expenses were 1.49%, and leverage expenses were an additional 1.34% for a 2.83% expense ratio. The higher leverage expenses are consistent with the utilization of more expensive forms of leverage in senior notes and preferred stock.

Performance Comparison

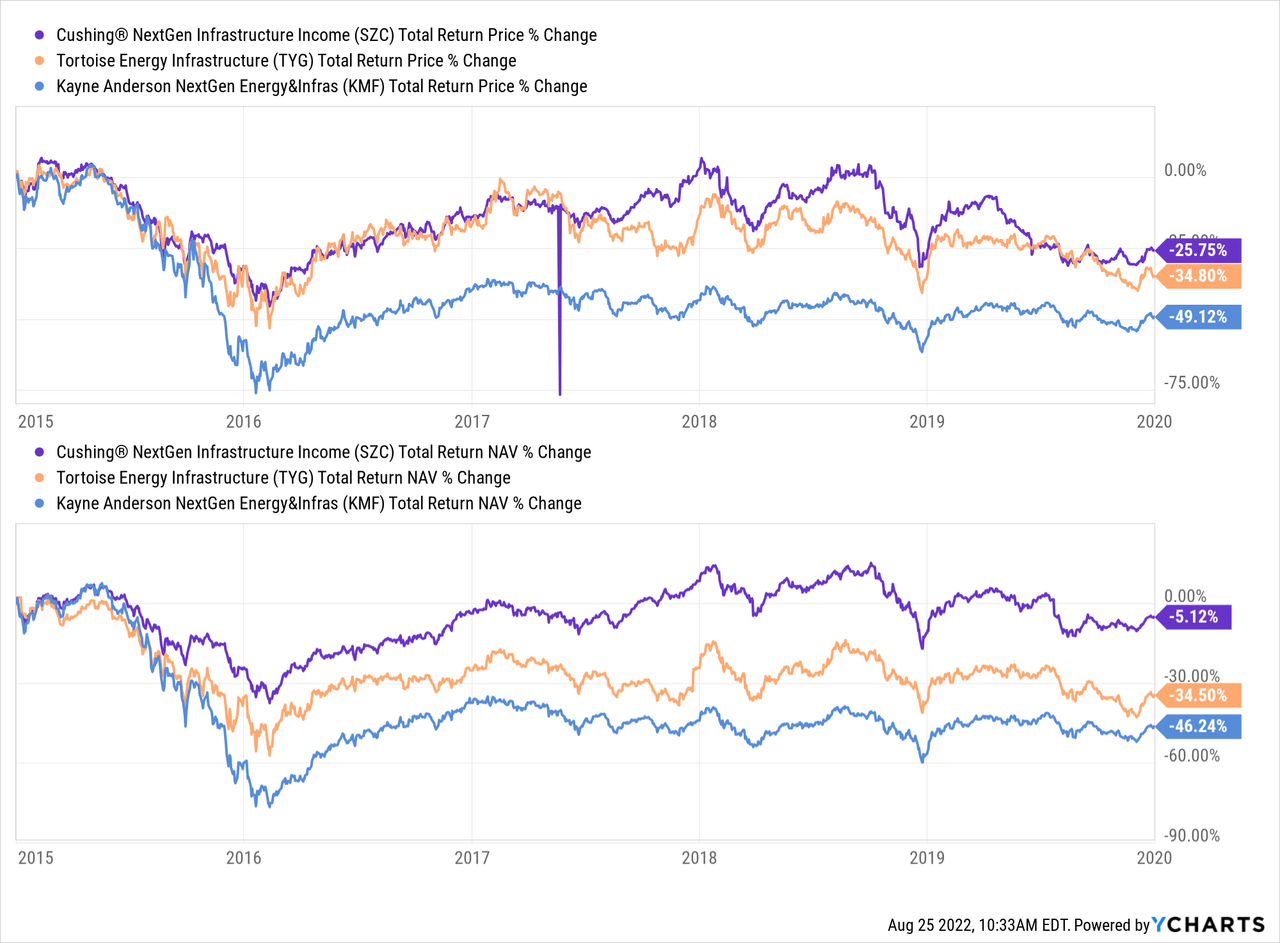

As I mentioned, the fund gets traded at the largest discount but has been a relative outperformer of its peers. We all know that energy got absolutely demolished in COVID 2020. Even between 2015 and 2020, energy investments did pretty terribly. So the returns here aren’t anything to brag about, but they have shown a fairly consistent track record of investing in the right spot in a bad neighborhood.

Here is the performance of the trio between 2015 and 2020. We can see that all produced negative returns. However, SZC did significantly better during that time. TYG also did a fair bit better than KMF.

Ycharts

SZC isn’t quite ten years old yet. Going to the “max” chart showed a similar story that we see below with the last five-year period of total NAV return performance.

Ycharts

SZC led this trio with their results. We can see that TYG performed the worst during this period. In particular, the COVID crash had disproportionately hurt the fund. They had to deleverage significantly. They went from $623.9 million in borrowings/notes/preferred to ~$133.5 million. Fun fact, that amount of pre-COVID borrowings is more than the net assets today.

I’m a holder of the shares after the crash – where they’ve done incredibly well – I’m pretty happy that they haven’t seemed to ramp up their leverage to the hilt again. They’ve kept it at a more moderate level these days, in addition to the other shareholder-friendly moves they’ve put into place that I’ve covered previously.

I didn’t include total share price performance in the chart above because Ycharts data was incorrect, as is Morningstar’s data. They appear not to have properly adjusted for the reverse split for SZC. Although, they did properly adjust for TYG’s reverse split, interestingly enough. CEFData did appear to provide the correct total share price return data.

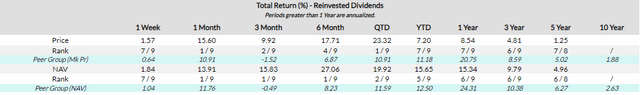

For what it’s worth, I would ignore the “peer group” data provided in this case. I don’t believe that the funds listed are relevant to how the fund is positioned today.

SZC Annualized Returns (CEFData)

All of this isn’t to highlight how poorly any of the funds did either. It was expected when you mix negative energy prices with leveraged investment vehicles. I’m happy to see that leverage has been reduced and has stayed relatively minimal.

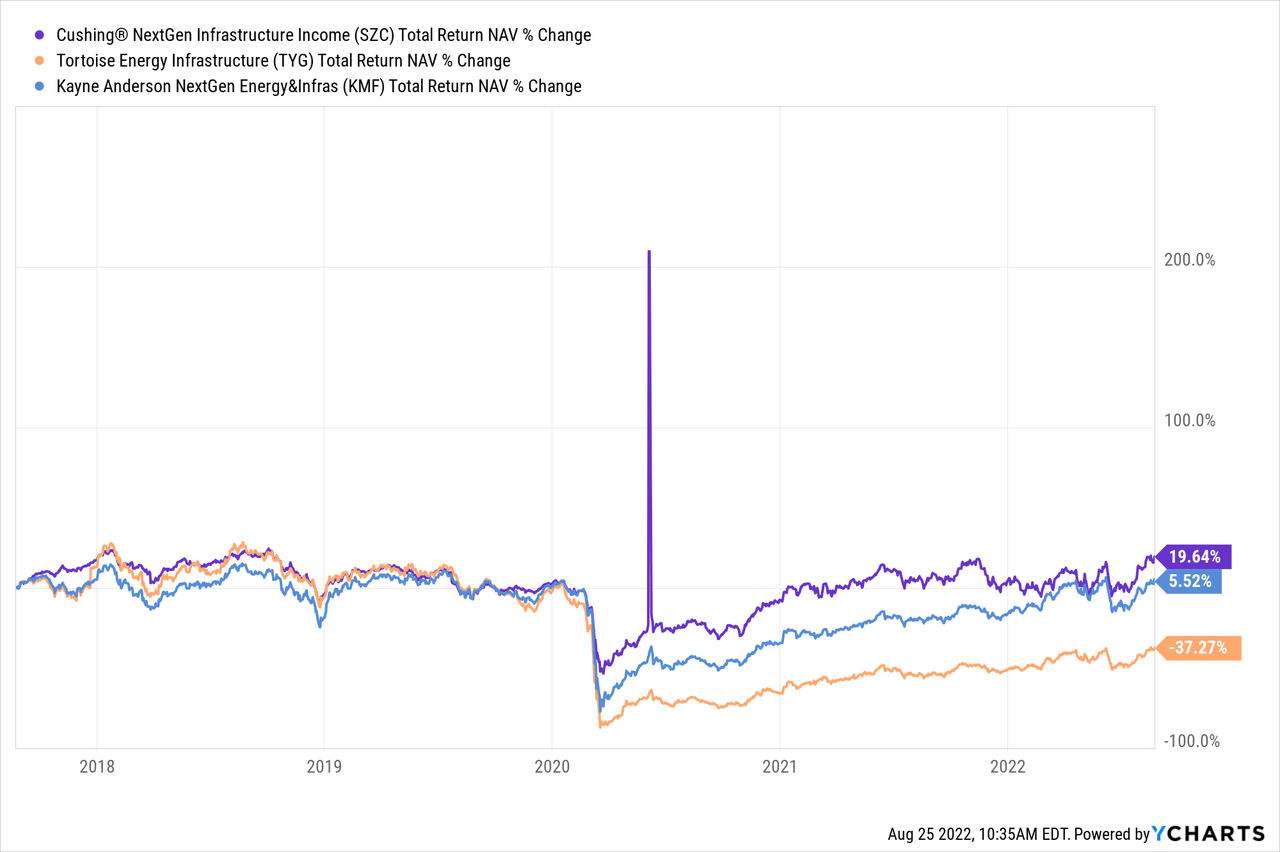

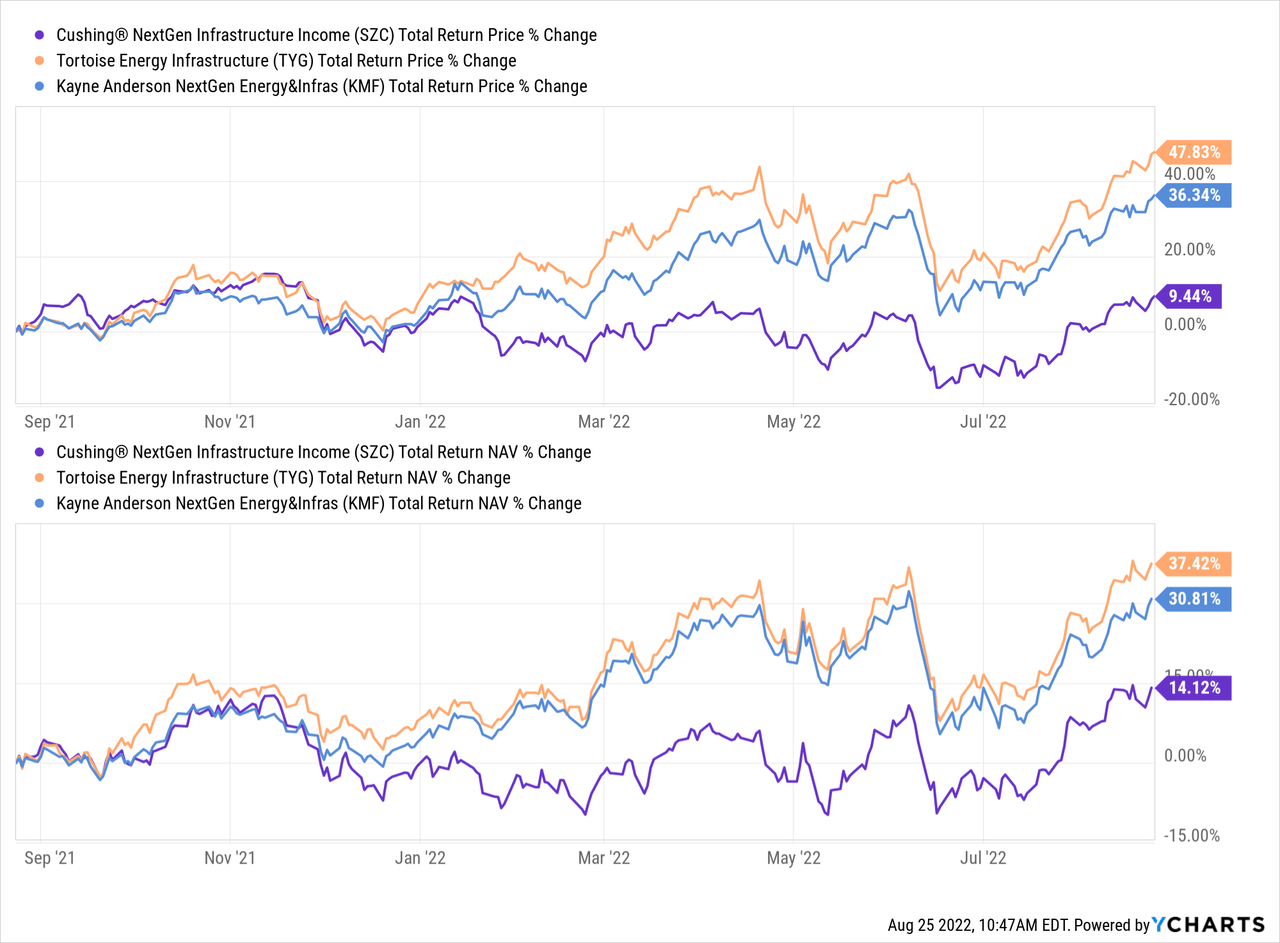

More recently, people would probably point out that SZC has been underperforming the group. In the last year, SZC has been the underperformer. It has been by a fairly significant amount too.

Ycharts

However, I believe there is a reason for this. All three of these funds have started incorporating more flexibility, but SZC has branched out even further than the other two. At one point, I highlighted that they even owned Microsoft (MSFT), which they still have exposure there at 2.9% of the portfolio. I think that highlights just how flexible they will be in the digital infrastructure space.

They also own several data centers and tower REITs, such as Equinix (EQIX) and Crown Castle (CCI). These are all solid investments over the longer term. For 2022 though, it’s those types of allocations that have made the fund underperform relative to TYG and KMF.

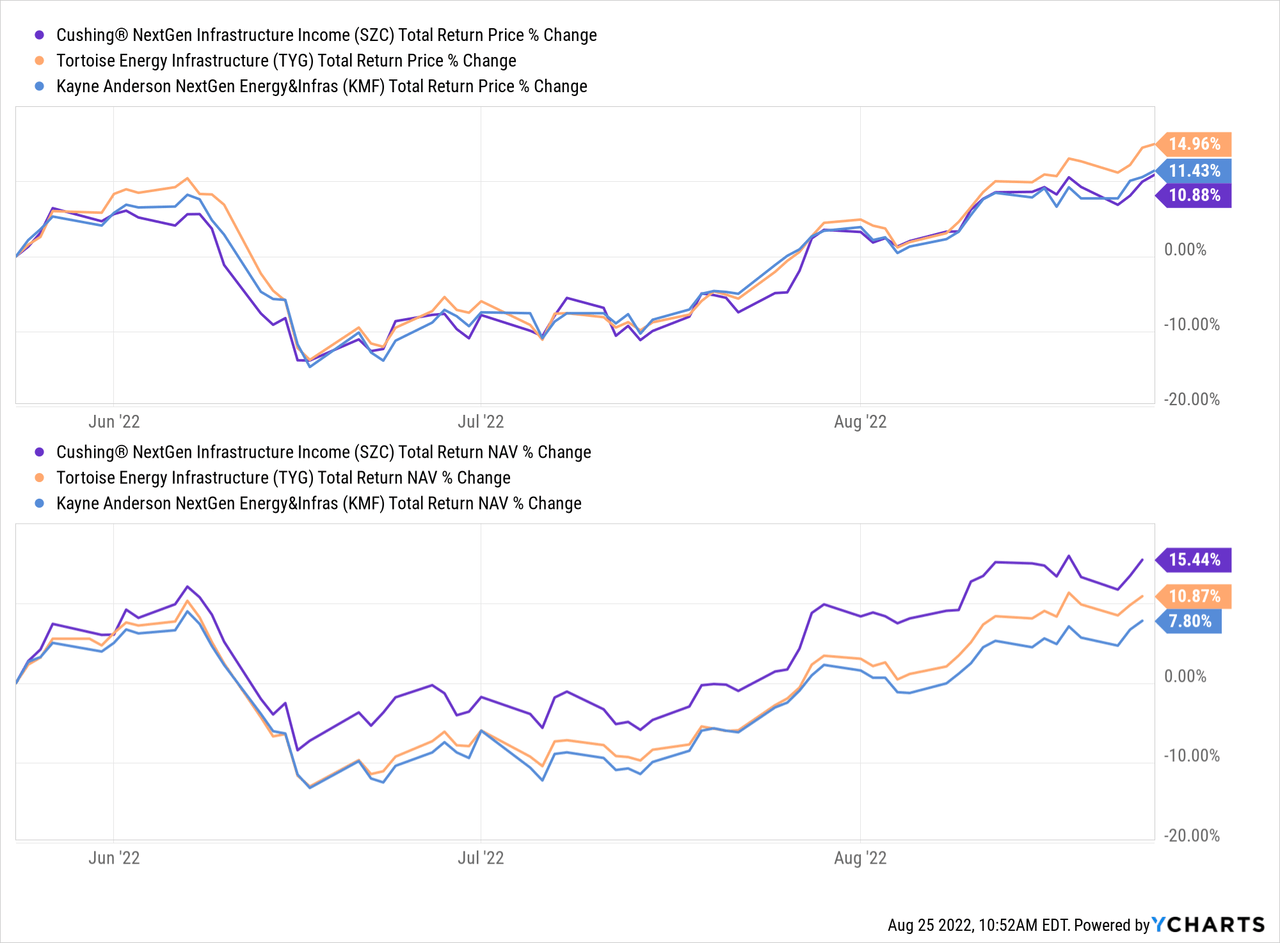

We can highlight this if we look at an even shorter period. In the last three months, energy had joined the bear market along with the rest of the market. There was a subsequent bounce in the broader investment space, and we can see that SZC, in the three-month period, had bounced higher on a total NAV return basis.

I believe this clearly highlights their more diversified approach to infrastructure. On a side note, it also represents why I didn’t mind holding all three at one point and still don’t mind holding SZC and TYG. While I suggest they are peers. There are material differences here. We are seeing this play out.

Ycharts

Valuation Comparison

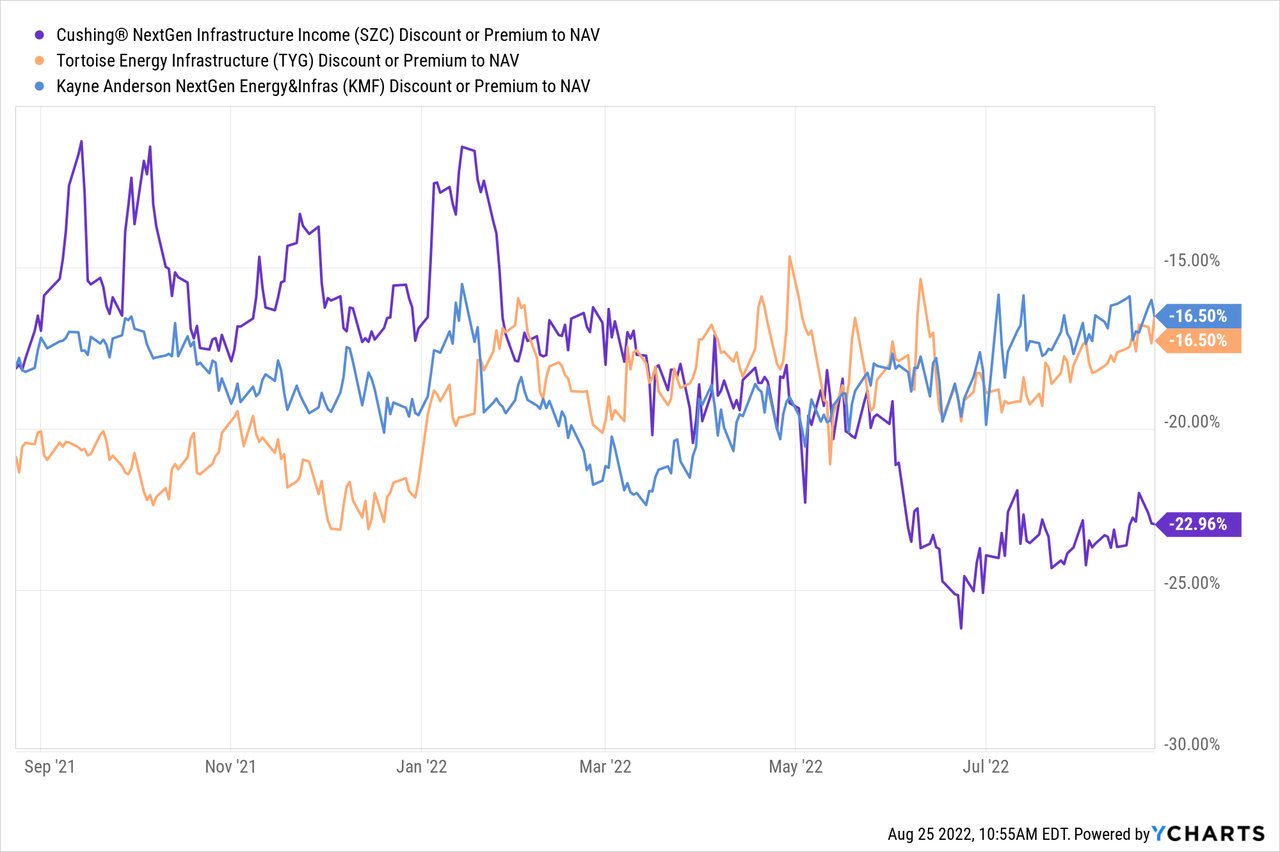

Despite being a better performer through these various periods, the fund is rewarded with the biggest discount. In fact, more recently, this had only widened out even further. Earlier in this period, we can see that they had a relatively reduced discount.

Ycharts

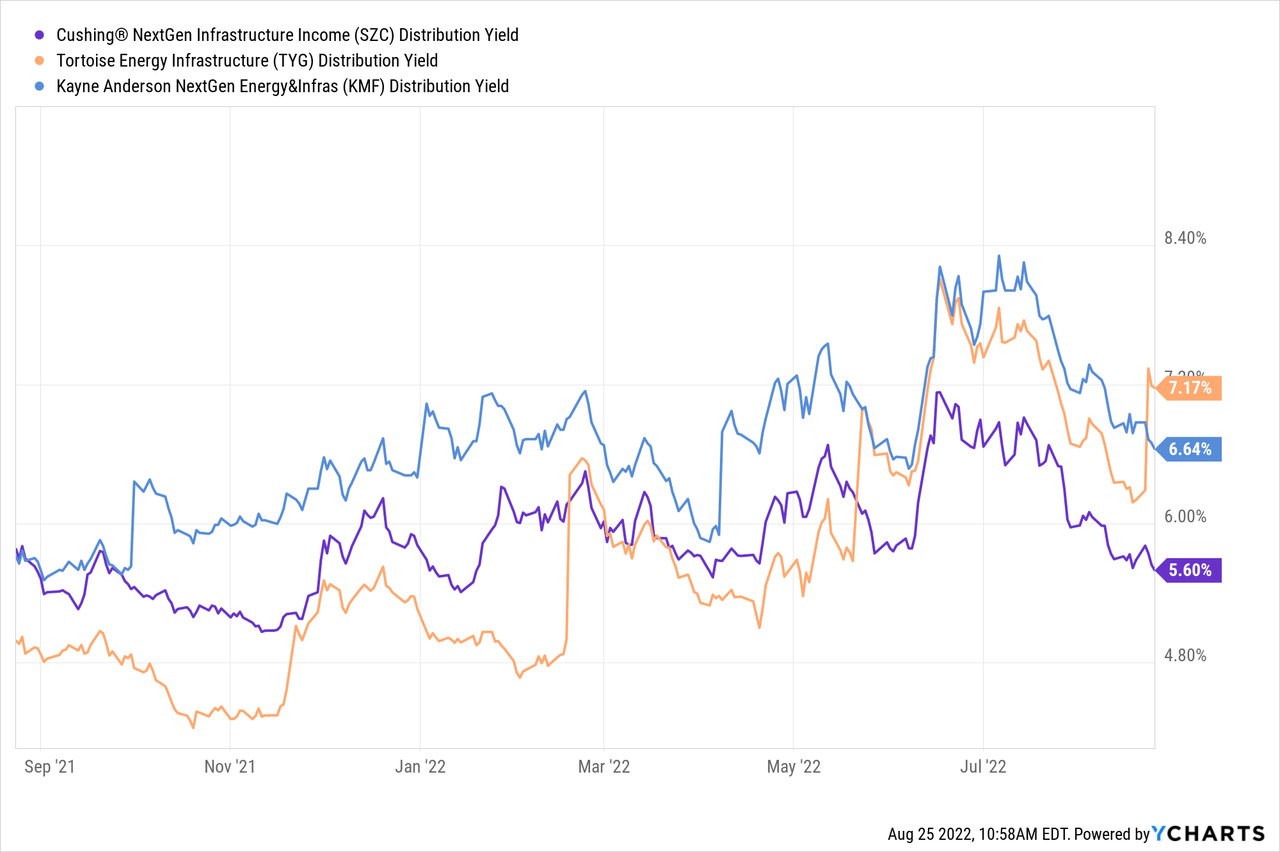

Besides the underperformance we’ve seen lately, I believe it also has to do with the fund’s distribution yield. It is the lowest of this group and is even lower than most CEFs. I understand what they are doing. They are choosing the more sustainable distribution route. That generally leads to even better performance over the longer term, as we already saw-however, income investors like seeing higher single-digit and double-digit headline rates.

Ycharts

TYG has been doing a nice job raising their distribution as they put a target rate of between a 7 and 10% distribution yield on NAV. KMF has also been working towards upping its distribution slowly but surely. As the higher yielder in the last year, they’ve been able to get away from being overly aggressive.

The Saba Opportunity?

Here is another opportunity that should potentially be kept in mind: Saba is an activist group pushing into SRV, SZC’s sister fund.

Since the original publication, SRV announced a 200% increase to their distribution. It went from $0.15 to $0.45 per month.

They filed a 13D last year. That’s the filing that means they intend to engage the Board in discussions.

The Reporting Persons acquired the Common Shares to which this Schedule 13D relates in the ordinary course of business for investment purposes because they believe that the Common Shares are undervalued and represent an attractive investment opportunity.

The Reporting Persons may engage in discussions with management, the Board of Trustees (the “Board”), other shareholders of the Issuer and other relevant parties, including representatives of any of the foregoing, concerning the Reporting Persons’ investment in the Common Shares and the Issuer, including, without limitation, matters concerning the Issuer’s business, operations, board appointments, governance, performance, management, capitalization, trading of the Common Shares at a discount to the Issuer’s net asset value and strategic plans and matters relating to the open or closed end nature of the Issuer and timing of any potential liquidation of the Issuer. The Reporting Persons may exchange information with any persons pursuant to appropriate confidentiality or similar agreements or otherwise, work together with any persons pursuant to joint agreements or otherwise, propose changes in the Issuer’s business, operations, board appointments, governance, management, capitalization, strategic plans or matters relating to the open or closed end nature of the Issuer or timing of any potential liquidation of the Issuer, or propose or engage in one or more other actions set forth herein.

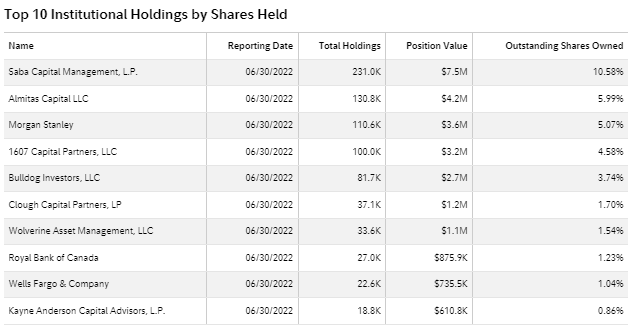

Saba owns nearly 10.6% of SRV. In addition to that, we have well-known fellow activist Bulldog also holding a sizeable position.

SRV Ownership (Fidelity)

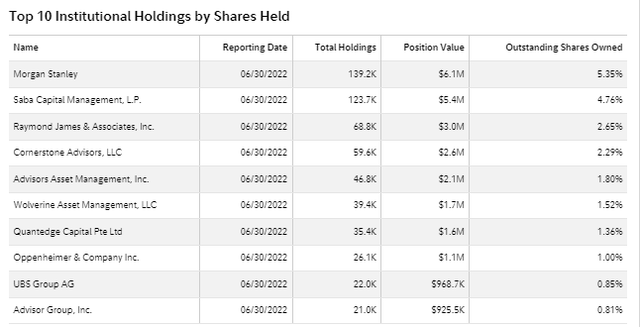

For SZC, we have no filing of a 13G or 13D, but that could be simply because they’ve held their ownership to just under the 5% trigger level. Morgan Stanley (MS) is the largest holding at this time, and while they aren’t activists, they would certainly go with anything Saba proposes.

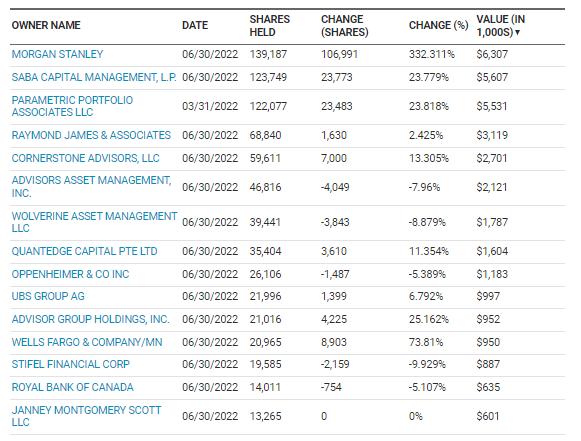

The ownership there isn’t that high, but they did increase the position in quite a meaningful way with the latest update.

SZC Change In Institutional Ownership (Nasdaq)

Interesting to note here is that MS reported most of their position coming in the latest update, but Parametric Portfolio Associate also had increased their position. MS had closed its deal to buy Eaton Vance last year, which is actually Parametric’s parent company.

It isn’t unusual for investment banks or money managers to pick up funds. I think MS is listed as one of the top owners of almost every CEF I run across. What is different is the size, timing and these two entities being related. Essentially, the same entity has bought up a meaningful amount of shares since Parametric is now a part of MS.

For what it’s worth, Saba and MS have also increased their positions in TYG and KMF. Saba was quite aggressive, with a ~66% increase in TYG. MS was less aggressive there. They were both very aggressive with picking up more shares in KMF, with an increase of around 285% for MS, and Saba took their position up 912.46%. That being said, that took the ownership of Saba to 4.66% on KMF and MS’s portion to 5.59%.

The trusty tool of activists such as Saba and Bulldog is going the tender offer route. Being that Saba is getting involved with both funds, it would seem they are maybe trying to play this at a different angle. It will certainly be interesting to see if anything comes out of this.

One thing that I would be in favor of that could be interesting is if they even pushed them to merge. It wouldn’t provide an immediate benefit that activists like to see, but a larger fund could provide some greater liquidity and fund visibility. I know some investors simply see a small fund and pass on it due to that alone.

I’d also not like to see a tender offer, personally. Simply because these funds are already pretty small, to begin with, meaning that reducing AUM even further could dry up interest and liquidity. Basically, the opposite of what a merger could provide. Of course, we could also play a tender offer to our benefit. Such as I plan to with the TYG offering that is coming down the pike.

Conclusion

SZC has taken its new strategy and continues to be a more broadly positioned infrastructure fund. There is a considerable amount of exposure to energy still here, so I wouldn’t go running and trying to compare it with Cohen & Steers Infrastructure Fund (UTF) just yet. I continue to find the relative valuation compelling of the more appropriate trio of SZC, TYG and KMF. It has also put up respectable results relative to those funds. That’s coming from someone who is also optimistic about TYG. An activist in these funds could provide another potential catalyst in the future that would ultimately be a kicker and nothing to rely on specifically.

Be the first to comment