Bertlmann/E+ via Getty Images

Over the past month, stocks across the market have fallen amidst a swell in volume and concerns over the macro situation turning for the worse. Several headwinds have appeared on the horizon for container shipping, with a seemingly stark drop in import volume. Alongside actual container shippers like ZIM Integrated (ZIM) seeing their shares sink, container ship lessors, like Danaos Corp. (NYSE:DAC), have been pulled down as well. This is entirely unwarranted since not only are container shippers going to brave these choppy seas (as I covered with ZIM) but Danaos is even better sheltered from the macro storm in the safe harbor that is long-term charters.

Oh! And they also have millions in buyback authorizations to purchase their shares while the sale lasts.

Swept Up In The Wrong Storm

Container shipping has gotten a bad knock from the concerns over imports and the decline in freight rates over the past few weeks. However, despite container ship chartering companies sounding similar in name, short-term import numbers have little-to-no effect on their profitability. The reasons here are two-fold:

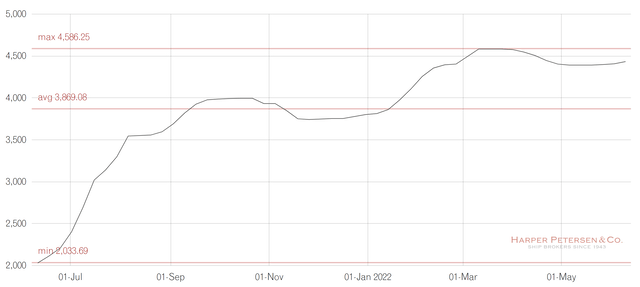

- The charter rates for container ships have actually been rising for the past four rates, despite freight rates per twenty-foot equivalent unit (TEU) falling on most routes:

1-Year HARPEX (Harper Petersen)

This is good news for anyone who might be fixing new buildings, such as Atlas Corp. (ATCO), or rechartering existing vessels, like Danaos, Global Ship Lease (GSL), and Costamare (CMRE)

2. Container ship lessors have long-term contracts.

Danaos has billions in forward contracts already locked in ($2.7 billion to be exact). It simply has to collect the cash. Danaos similarly has 99% coverage in 2022 followed up with 78% coverage in 2023—dropping to 57% in 2024. With such high coverage from both of these companies on their near- to mid-term cash flows, the prescient concerns for their futures are not over import data and its monthly fluctuations, but broader questions of newbuildings and pending environmental regulations.

Finally, A Buyback!

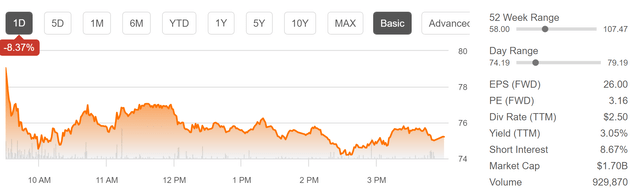

Danaos Corporations has been one of my highest conviction buys since 2019, and I was mildly surprised to see it drop as precipitously as it did last Wednesday (June 8):

Seeking Alpha

Shares then continued to slide before jumping sharply on June 14.

Now, why did shares jump like that? Glad you asked. Well, when I last updated my Danaos thesis, the main complaint about the company from those commenting (and most analysts covering the company – though J also wrote an insightful piece detailing how buybacks are likely to come soon and Danaos’ management remains prudent) was that the company did not raise its dividend or initiate a massive buyback.

Well now, after shares have fallen a further 14% since my article on May 19, and more than 36% from their 52-week-high, the company has done just that!

On June 14, Danaos announced a $100 million buyback, equivalent to nearly 8% of its market cap. This is excellent news for the company, which is already massively improving its balance sheet this quarter. To further take advantage of its strong free cash flow and buyback shares at what I see as a near 44% discount to their current value is very wise. Investors should be pleased and take advantage of the sale to buy the company they would have bought before if only it had had a buyback—because it sure has one now!

The Risks Haven’t Changed

Despite the selloff, the risks facing container ship lessors haven’t changed. Rising inflation and shifting demand patterns do have an impact, but it is far from extreme because, as I mentioned earlier, charters help these companies ignore short-term fluctuations. The larger question for container ship lessors surrounds the orderbook, which still stands at reasonable levels, especially in a context where most ships are already chartered upon delivery (as opposed to being speculative newbuilds hoping to snag a charter later, thus over-saturating the market). Additionally, new environmental rules coming soon are expected to help container shipping companies by further reducing supply through slower steaming and scrapping older vessels. Danaos is also uniquely well-positioned here with smart newbuilds in its niche size of around 7,000 TEU to replace its aging 2,200 TEU vessels and an otherwise fairly new fleet with scrubbers already fitted.

And The Valuation Is Still Strong

I don’t think we need to do much adjustment to my Danaos valuation. My valuation estimate for the company’s shares is still in the realm of $125 for this year. And I think it is worth remembering I am using conservative estimates of $640 million in EBITDA, which basically ignores any improvement from the first quarter’s numbers (despite the fact that the company has renewed several charters at higher levels) and any new ZIM dividends we can expect the company to receive. In short, even trying to be very careful with our valuation, we see that shares are grossly undervalued.

EV/EBITDA Chart

|

EV/EBITDA Ratio |

Share Value |

Upside (From June 17 Close) |

|

4.5 |

$122.7 |

82% |

|

6.5 |

$184.5 |

174% |

|

7.0 |

$200 |

197% |

|

10 |

$292.6 |

333% |

Thus, The Takeaway

The recent shipping selloff has spooked a lot of investors, especially in container shipping. While it is true that a long-term downturn in freight rates may affect companies’ ability to pay charterers and, in turn, depress charter rates; we are nowhere near that level of a downturn yet and there are few signs of one on the horizon. In the near/mid-term, Danaos’ strong charter backlog fully insulates the company from changes in market rates. Additionally, charter rates continue to climb even as freight rates have dropped off. To cap off this situation, Danaos’ recently announced $100 million is what many investors have been waiting for and shows management is willing to reward shareholders when it sees such a move as advantageous. Danaos waiting and announcing its buyback after shares fell so far is, to me, a great sign and inspires further confidence in the company’s management; Danaos remains one of the best shipping stocks out there.

Be the first to comment