metamorworks/iStock via Getty Images

As growth stocks are for sale, I like to write a shopping list for high-potential growth companies. One name that I particularly like is AppLovin (NASDAQ:APP). AppLovin is already writing profits and expected to grow at a 5-year CAGR of approximately 20%. Moreover, the company’s current valuation, implies upside. I value AppLovin based on a residual earnings framework – anchored on analyst consensus estimates – and calculate a fair share price of $40.74/share.

About AppLovin

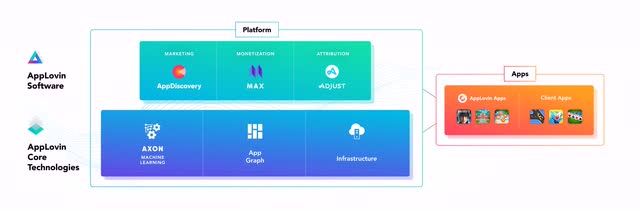

AppLovin is a technology company with a focus on mobile application software. The company operates two main business segments: a mobile gaming portfolio (1) and a studio that sells marketing/technology services (2) to help developers grow their mobile applications. The company’s gaming segment owns stakes in 12 gaming studios, having accumulated more than 200 games and approximately 150 monthly active users. AppLovin’s marketing/technology services for the mobile ecosystem are best understood as a platform that helps application monetize their application – supporting user acquisition, advertising technology, audience insights and in-app-purchases. AppLovin was founded in 2012 and first sold shares to the public in April 2021.

AppLovin‘s Opportunity

AppLovin’s value proposition is embedded in a highly attractive market as mobile applications have grown to claim a significant share of consumers’ attention and spending power – a trend that is very likely to continue. AppLovin estimates that the mobile application market will enjoy a >10% CAGR until at least 2024, reaching a market size of approximately $293 billion. Most notably, this would imply a x3 multiple as compared to GDP growth. The estimation is very conservative, in my opinion. Because, if we consider a mobile user base of approximately 5 billion, we can reverse engineer spending per user of only $60.

Moreover, AppLovin is likely to outpace industry growth thanks to an additional trend: outsourcing. The argument is simple: Many app developers do not have the capabilities, nor the ambition, to develop ad-technologies. That said, outsourcing will likely add an incremental tailwind to AppLovin’s top-line business growth.

Financials

Unsurprisingly, AppLovin has seen tremendous growth in the past few years. From 2016 to 2020, revenues have grown at a 76% CAGR. In 2021, revenues grew more than 90%. Moreover, the company is already profitable. For the past financial year, AppLovin recorded an operating income of $166.7 million (9.2% margin) and net income to shareholders of $31.7 million. I regard AppLovin’s financial position as slightly stretched, but healthy. As of Q1 2022, the company recorded $1.41 billion of cash and cash equivalents and $3.3 billion of total debt, implying a net debt position of about $1.89 billion. In 2021, cash from operation was $268.3 million.

How Analysts See It

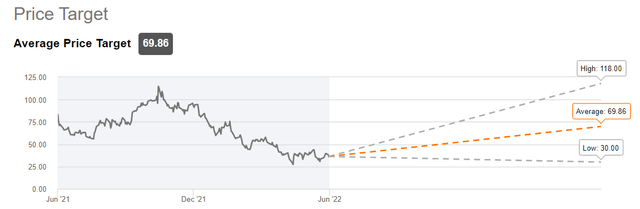

Analysts are very bullish on AppLovin. Based on 15 analysts who cover the stock, there are 10 strong buy ratings, 4 buy ratings and 1 strong sell rating. The average target is $69.86/share and the highest target stands at $118/share. Most notably, the average target would imply more than 100% upside, while the strong sell rating of $30/share only has approximately 10% downside.

According to the Bloomberg Terminal, as of June 2022, analysts see strong revenue and EPS growth for AppLovin. Revenues for 2022, 2023, 2024 and 2025 are estimated at $3.37 billion, $4.13 billion, $4.74 billion and $5.15 billion. This would equal a 3-year CAGR of approximately 19%, from 2022 to 2025. Respectively, EPS is estimated at $0.49, $1.35, $1.97 and $2.80. Usually, analyst consensus estimates are quite indicative of a company’s future performance (less so for target prices).

Residual Earnings Valuation

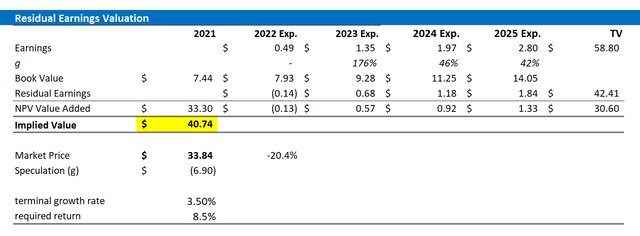

So, if analyst consensus is right about AppLovin’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal. As I mentioned, challenging analyst consensus is out of scope for this article.

- The estimate of the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of June 25, 2022. My calculation indicates a fair WACC of 8.5%.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5%. Although I think that growth equal to the estimated nominal long-term GDP growth is strongly understating AppLovin’s potential, I want to be conservative in my valuation. Investors might want to consider a 4.5% growth estimate as adequate.

- I do not model any share buyback – further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for AppLovin of $40.74/share, implying upside of about 20%.

Analyst consensus; author’s calculation

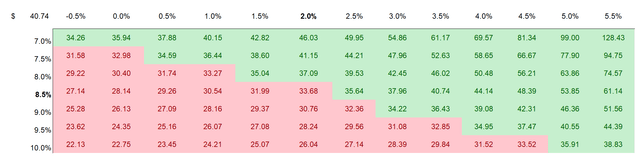

I understand that investors might have different assumptions with regards to AppLovin’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst consensus; author’s calculation

Risks

I would like to highlight the following downside risks that could cause AppLovin stock to materially differ from my price target. First, AppLovin is a growth company and buying growth is risky, as there is no guarantee that the company’s potential will be realized. Second, a worsening macro-environment including inflation and supply-chain challenges could negatively impact AppLovin’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly. Fourth, much of AppLovin’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though AppLovin’s business outlook remains unchanged. In addition, inflation and rising-real yields could add significant headwinds to AppLovin’s stock price, as the higher discount rates affect the net present value of long-dated cash flows.

Conclusion

AppLovin stock is down more than >60% and now trading at attractive risk/reward levels. Personally, I see 20% upside based on a residual earnings valuation – anchored on analyst consensus estimates.

Be the first to comment