jiefeng jiang/iStock via Getty Images

Published on the Value Lab 29/6/22

GSI Technology (NASDAQ:GSIT) is one of many stocks that still relies on capital markets and has suffered as share reflexivity has taken its toll on the fundamental prospects for equity holders. The company is a long way from becoming cash positive again with its new APU endeavour dominating the cost structure, and more cash burn is to come as that mission matures, but since last time we have gotten more clarity on timelines. They are close to releasing a new platform for developers to better engage with the Gemini-I and test their algorithms, and they are also designing the Gemini-II which will be the production model. We get more clarity on business development, and how the company is only just beginning the transition to thinking about marketing the Gemini for customers. Finally, the legacy businesses is growing better than expected, and new contracts incoming help it to produce stronger cash flows to mitigate capital market needs for the Gemini development. Overall, GSIT remains speculative, but the stock is interesting and improving its ability to self-sustain their growth opportunity and limit capital markets and reflexivity risks. We continue to be long.

FY Updates: Commercialisation Far Off

In our previous articles on GSIT, we were developing our understanding of what the chip might be useful for, thinking about its various applications in search and recommendation but also beyond in the world of neural networks which are becoming more and more computationally intensive, concluding that its markets could be wider than just search and recommendation based on how neural networks are being structured these days according to some best practices. However, the focus of these articles has been on the markets, and it’s been a while since the company has given concrete information on its own business development. With important release dates just about to come up, it’s time to touch base and update the company’s financial picture as well, which is strengthening thanks to the legacy business improving its performance and creating more margin against needing to go to capital markets. This is important, since the GSIT stock has fallen 15% since last coverage and 30% YTD, and relies on equity and not debt financing in addition to operational cash flows.

The FY business updates focus on a few key things, and give us a much clearer timeline than we had before. First of all, the delays in the full release of the compiler stack have continued, pushed back about 6 months, with the current date as of May being a July release. According to management, the additional time taken was to make it available in Python (not originally part of the plan) which is a language that is much more widely used and includes non-computer scientists like data scientists and entities like university faculties that have less resources. Currently, dozens of integrators and other entities are using the chip for their experiments, mainly through the cloud hosted by Israeli and US-based data centers, and the release of this compiler stack should make the chip usable to a much broader range of entities.

Moreover, the chip continues to perform at the top in tests and competitions in order to win attention from organisations like the Department of Defense. The applications are in computer vision, unsurprising given the advantages of the APU, and in other applications that are matrix intensive. These tests work with datasets provided by reputable organisations like the MAFAT challenge from Israeli Defense Ministry and other major conferences. GSI is winning and leading competitions not only in its core markets of recommendation and search, but also more generally with AI applications based on neural networks for important and attractive markets like defense and security.

The company’s APU endeavour is just a software development team at this point, and is only just now beginning to put together a marketing force that can try court entities like the DoD as well as next-gen warfare agencies and of course corporations. This is being done in tandem with development of the next design for the Gemini APU, the Gemini-II, which will incur expenses for design towards the end of the calendar year. This next design will try to improve the price performance of the APU and get it more ready for production. But to be clear, there is no infrastructure in place yet for production, and getting foundries involved hasn’t even started yet. With the designs for the production chip not even out, and most of the engagement with the Gemini-I happening through the cloud (because there aren’t many Gemini-I models in existence), the commercialisation of the Gemini is still very far off.

Cash Burn & Financials

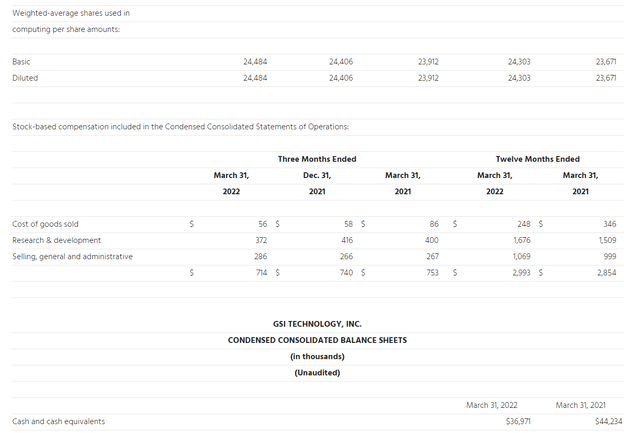

The company is expecting the cash burn to be similar in 2023 fiscal year as it was in 2022 at around $14 million. Cash fell by about $10 million YoY with net losses for the full year with the net change in stockholders equity indicating about $4 million in equity raisings (5% of market cap) which is not very much, and management expects that same rate of cash burn (of about $14-15 million) also including the one time expense related to the design of the Gemini-II which should be around $2.5 million. Cash balances cover annual cash burn for about 2-3 years assuming no further equity raising.

IS and BS Information (Q4 2022 PR)

The financial picture continues to be consistent with the company’s communicated story. The revenues are growing slightly with some growth in the revenue SRAM business, and gross profit is improving with better business mix with military and defense taking more share. This is offsetting a massive and growing R&D expense. R&D is about $24 million annually, with the next loss being around $18 million, and can be basically fully attributed to the Gemini APU efforts with the work on the stack compiler and also the Gemini-II design. Without the R&D expense the company would be at a profit and a pre-tax net margin around 15%. Improvements in the legacy business are giving GSIT a runway, and the dilution that is happening, about 5% of market cap, is being offset by the accumulation of net operating losses (NOLs) that constitute a cash tax asset for down the line. Currently they are around $14 million in value and can offset future tax liabilities.

Beyond 2023

However, the rate of cash burn, already mitigated by the current run-rate from the legacy business, could come down assuming the same rate of R&D expenditure due to new important contracts. The company is working towards a contract that will start with a prototype shipment in the Q1 2023 (current quarter), and the magnitude of the orders associated with this contract could rival the current total revenues and therefore increment sales meaningfully further. These contracts would be realised later on though, likely creating revenue a year from now if the prototypes are a success, and could continue to help the improving sales picture beyond 2023 which has already seen YoY growth of 20% as of the latest FY 2022 report. Moreover, down the line, there is also talk of synergy between their legacy business, which includes Rad-Hard, of which prototypes are being shipped to satellite contractors, and the Gemini APUs. The businesses therefore are not without cross-marketing opportunities, and the legacy SRAM business is actually performing like more of a growth area these days with further sales to military and defense. We thought it would be a plodder in terminal decline but it’s not, which changes the GSIT profile quite a lot as it shores up the operating cash flow streams for financing Gemini.

Conclusions

The company continues to develop its chip which is supposed to have bypassed key chip constraints, making it excellent in performance for certain applications which we’ve elaborated at length on SA. The specialization and value from this newly invented architecture is proving itself in challenges posted by reputable organisations, giving GSIT visibility to the likes of the DoD and Israeli defense. However, while the technology seems to be substantial, it is clear that they are very far from production of the APU, likely years away, where previously we worried about the current semiconductor shortages being a problem for their commercialisation. Those will likely resolve long before GSIT is in commercialisation phases of its Gemini. While this is a negative because it means the story lacks a catalyst, in the meantime, they accumulate NOLs that help deal with the fact that equityholders occasionally do get diluted due to high R&D, by about 5% per year it seems given cash burn projections, but likely less beyond 2023.

With improving revenues in the legacy business, the capacity to reduce the cash burn sustaining current R&D improves, and Rad-Hard and legacy products are performing surprisingly well already with new important contracts incoming. However, they still need to put a sales force to work, and there is more SG&A to be incurred which currently still lies at minimal levels. It will be years before this stock pays off, and as such, it is until further notice dead capital. The problem is the moment something changes, the value could pick up dramatically, so we are not leaving the position.

Far from Gemini production, and still only beginning to engage with entities who are interested in the Gemini and its uses with the compiler stack only being fully released next month, the APU story is still in early stages of proving concept, and the commercial opportunity is further off than we expected. However, we update our view with that the legacy business should deliver more to the GSIT coffers and to the Gemini effort, albeit one that will be longer and more arduous than we’d hoped, limiting the negative effects of reflexivity. Overall, an interesting stock, but the early-stage nature of it, mitigated financially by an increasingly profitable legacy business, means it’s at best a speculative exposure, but one with limited downsides compared to straight VC-style exposures or SPACs. Still a buy, but for the rather long-term.

Be the first to comment