choochart choochaikupt/iStock via Getty Images

I wrote Beam Global: A Product, Not a Project, in April. I explained that Beam (NASDAQ:BEEM) is not a story stock like many companies involved with the EV market but has a finished product in production and that it is available for sale.

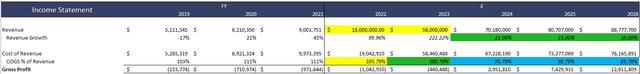

That product is the EV ARC. I said in the first article that if the product sells, and I believed it would, Beam would be worth far more than its current value. I presented a revenue forecast that suggested that Beam might hit $40 million by 2023. After the most recent earnings call, I am increasing that forecast to $60 million

The EV ARC is a simple idea: A solar-powered EV charger, but it is unique with considerable patent protection.

The EV arc (Beam website)

The ARC can charge 6 EVs at a time, and each one can reach 12 car parking spaces. The ARC will fit inside a standard car parking bay, requires no construction or permits, no electrical work, and does not need an electrical grid. The Arc is held in place by gravity, not bolted to the ground. Cars can park on the Arc, so they do not take up any parking spaces. It is the fastest deployable, most scalable, and lowest total cost of ownership EV charging system available. Each Arc has a 4.3kW solar array that provides average 265 e miles per day. (source Beam website)

Shares have collapsed since my first article.

In the months following the article, Beam shares fell from $25.37 to less than $10. I lost ($716) 30% on my investment, exiting to my regular stop-loss; however, on September 20th, I re-entered the position (and put a comment on the previous article explaining the reasoning) since then, the shares have recovered somewhat to $17.76 an increase of 20%.

Share value followed sales volume.

During Covid, sales collapsed in the key non-governmental sales channel.

It made sense; corporates don’t need to charge employees’ vehicles if they work from home.

The Return of sales

Since the end of Covid, sales have come roaring back, bigger and better than before. In this article, I will look at the new deals, estimate their repeatability, and use a revenue estimate to calculate a fair value for Beam.

Kathy McDermott (CFO) explained, in the Q3 2022 earnings call, that revenues for Q3 2022 came in at $6.6 million, a 227% increase on the Q3 2021 figure.

Desmond Wheatley (CEO) discussed orders received and the backlog.

He said:

During the last three months, we’ve sold more EV ARC systems than we’ve sold during our entire ten years in existence.

After discussing several fundamental orders, including a sale of 367 Arc units to the US army, he said this.

The total value of all these sales is about $62.2 million. And all of it, with perhaps some immaterial exceptions, is to be deployed within the next 12 months.

Revenue in 2021 was $9 million, so we have a staggering increase of 591%. Adjusting my Mathematical model gives this top line. (Yellow is company guidance, Green is my estimates, and Blue is historical averages)

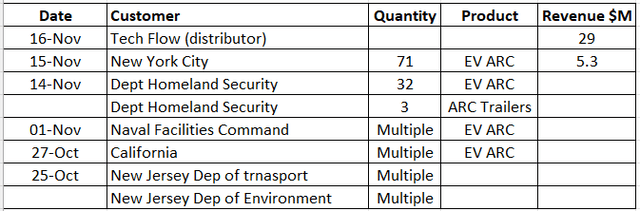

Since the earnings call, a further flood of orders has been announced. (Source SA news)

We do not have exact revenue forecasts but just using the information and extrapolating this probably accounts for a further $40 million since the earnings call.

Sales to Corporates

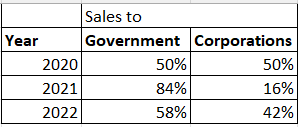

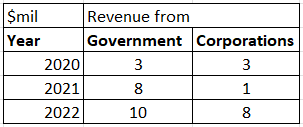

Beam does not publicize sales to non-governmental organizations, so we have to dig a bit to estimate what those sales may be. Before the covid collapse, 50% of revenue was from the private sector. As I have already mentioned, these sales disappeared (evaporated was the word Wheatley used). Since the end of covid, this revenue has begun to return.

Beam Sales Mix (earnings call)

Applying these percentages to total sales gives

revenue by sector (author)

Geographical Sales

The EV Arc is a viable product where the sun shines. Initially, that meant California. That is no longer the case; in 2022, sales to California have continued to become a smaller percentage of total sales, falling from 56% to 34% (actual revenue grew just as the proportion fell). California is not the only place where the sun shines, and Beam is making a big push into other areas. The Beam sales team is now active in southern Europe and the Middle East with plans to move into North Africa. These areas have abundant sun, and their governments actively encourage the EV market. Europe is even talking about banning internal combustion engines in 2035. The revenue looks set to continue its upward trajectory over the medium term.

Profitability

Beam is still loss-making; I mentioned in my previous article that in 2021 Beam invested in its production facility, reducing a bottleneck at final assembly. The investment in tooling and equipment, staff training, and increased headcount meant that capacity increased from 1 EV Arc per shift to 6. 6 EV ARCS per shift corresponds to 1,350 per year (on a single shift schedule). Actual production in 2021 was 124 ARCS; in 2023, production will be approaching 800. That increase will have a material impact on profitability as the economies of scale (sharing fixed costs over more units) begin to take effect.

WIP is showing a significant increase; Wheatley said that Beam decided to increase inventories of items at risk of supply chain disruption in advance of the orders we have now seen. I think WIP could fall by more than $10 million in the next 12 months as these increased inventories become revenue and supply chain issues lessen.

The Battery Division

In my first article, I discussed Beam’s acquisition of ALLCELL, a Chicago-based Battery company. Batteries make up more than 10% of COGS and are in high demand. Beam has continued to invest in the Chicago site adding automation of parts of the battery cell production process; as a result, battery Kwh production has increased by 38% this year. The battery division continues to sell batteries to companies involved in drones, material handling, and robots (amongst others). In the earnings call, Wheatley discussed re-valuing the assets bought from ALLCELL (not writing down goodwill which is far more typical) and that the company is running ahead of earn-out payments, which will add extra liabilities but show that the takeover is exceeding expectations.

Margins

Beam reported a 27% increase in bill of material costs since covid, and they described this as a hyperinflationary environment. Despite this, Beam reported a 5% improvement in gross profitability over the last 12 months and a drop in costs per unit. This must be due to the economies of scale discussed earlier and ongoing efficiency savings in the factory.

The Cash Position

At the end of the recent quarter, Beam reported $4.7 million in cash (September 30th), down from $21.9 million at the end of December 2021. That looks like a cash burn of $17.2 million, potentially catastrophic. However, the loss of cash was driven primarily by the aforementioned planned increase in WIP ($10.5 million), and pre-payment to ensure delivery of battery cells ($1.4 million). Adjusting implies that the cash burn was $5.3 million. The accounts also have a $5 million contingent consideration for the earn-out payments for the ALLCELL acquisition. I spread this over the three quarters arriving at a cash burn of around $7 million.

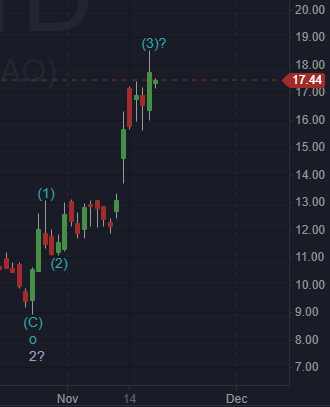

The Technical Chart

When I re-bought Beam in September, I shared a chart that I interpreted to mean Beam had finished its downward move. I use a kind of biased Elliot Wave. That means I used classical Elliot wave rules and theory but only look at counts that agree with my fundamental analysis. As long as my fundamental analysis is correct, it is an excellent way to time the entry and exit of trades.

Beam Daily EW count (author)

This daily chart shows the beginning of a motive wave higher from the previously identified low. I think the waves (1)-(2)-(3) are the beginning of the first of 5 waves higher that will take Beam to a value over $40.

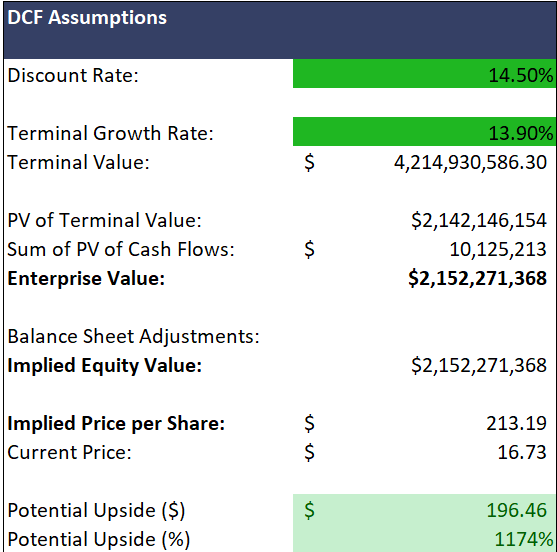

At the beginning of this article, I shared the top line of my Mathematical model. The output of the model is below.

Beam Model Output (Author)

That figure agrees with the long-term (monthly) Elliot Wave chart.

I have taken a full-size position in Beam at $14.75 and set a target of $40.

Be the first to comment