OGphoto/iStock via Getty Images

Investment Summary

Here at HB Insights we are looking for geographic diversification within the medical technology space. With French medtech company EDAP TMS S.A. (NADSDAQ:NASDAQ:EDAP) we have just that, and close examination of the data reveals we have a stock with growth starting to materialize, both in operations and in share price.

We note the company’s expertise in the treatment of prostate cancer using high-intensity focused ultrasound (“HIFU”) as a differentiating factor. HIFU is aligns with the shift towards the minimally-invasive treatment of prostate cancer and benign-prostatic hypertrophy. Focal primary HIFU is well supported in clinical data with adequate safety and efficacy (Bakavicius et al. 2022). Studies indicate benefits in maintaining urinary continence, no progression to 2nd-line treatment, and avoidance of medication. Based on complications after prostatic surgery, these are enormous benefits to patients in our estimation.

There are now 27 Focal One systems installed in the US market at present, and the company is on pace for 30 as we speak. Net-net, we’re constructive on EDAP with its fundamental and technical momentum in mind. Rate buy, eyeing a price range of $15–$16.50.

EDAP Q3 numbers positive despite Europe headwinds

Starting with its Q3 numbers, EDAP beat expectations on revenue and EPS in what was a strong quarter. The French company recorded top-line growth of c.30% YoY with a €12.2mm revenue print [all figures to be quoted in euros from hereafter unless otherwise stated]. It continues at a sound run-rate, with ~31% of YTD revenue booked in the third quarter.

Our key focus points from the quarter:

1). Revenue growth was underscored by 81% expansion in turnover from the HIFU division. It sold 341 machines during the quarter, versus just 1 machine the year prior. Three Focal One placements were finalized at centres in New Jersey, New York and Louisiana respectively. Speaking of the distribution business, it sold 12 ExactVu units versus 5 units a year ago. In total, distribution revenue came in strong at 31% YoY growth.

2). Another tailwind for the sector were the updated CMS outpatient system rules for FY23 in November.

For EDAP, this “increases reimbursement to a hospital performing an outpatient HIFU prostate ablation procedure on a Medicare patient to ambulatory payment classification Level 6, up from Level 5 currently“, per the Q3 earnings call.

3). The above changes equal a 90% YoY increase to US$8,558 per procedure [currently US$4,506 per procedure]. As such, management predict that facility payments won’t be an adoption hurdle for Focal One looking ahead.

It’s worth noting that changes in CMS reimbursement rates often carry through to commercial rates as well, given commercial payers tend to follow the CMS numbers over time. This is another tailwind we expect to observe in EDAP’s numbers in periods to come.

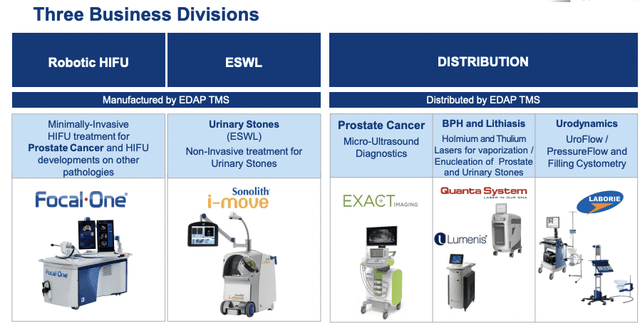

EDAP Core Business Divisions

Data: EDAP Investor Presentation

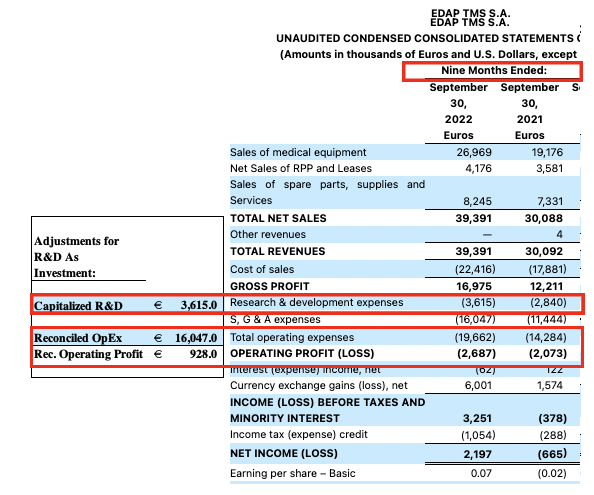

It was also nice to see TTM ROE creeping up to 4.7%, helped by FX gains of €6mm. Looking at its YTD numbers [the first 9 months of 2022], NOPAT loss deepened to €1.81mm from negative €493,000 by this time in 2021. This stemmed from tax impacts due to increased comprehensive FX income.

R&D investment ramped up to €16mm or 40% of turnover, up from a 38% margin. We like this margin, as we view R&D as an investment versus a capital expense for maintaining operations. GAAP rules say it must be expensed, however.

Importantly, if we capitalize the R&D expense as an intangible investment, EDAP’s total cumulative OpEX narrows to just €16mm in 2022, and the company actually recognizes €928,000 in YTD operating profit versus a YTD operating GAAP loss of €2.6mm [Q3 gross profit of $€16.98mm – €16.05mm =~€930,000; Exhibit 1].

Exhibit 1. Reconciled OpEx and operating income with R&D capitalized as intangible investment on the balance sheet

Data: HB Insights, EDAP Q3 FY22

Technical data equally encouraging

With strengthening fundamentals we checked to see the connection with market data.

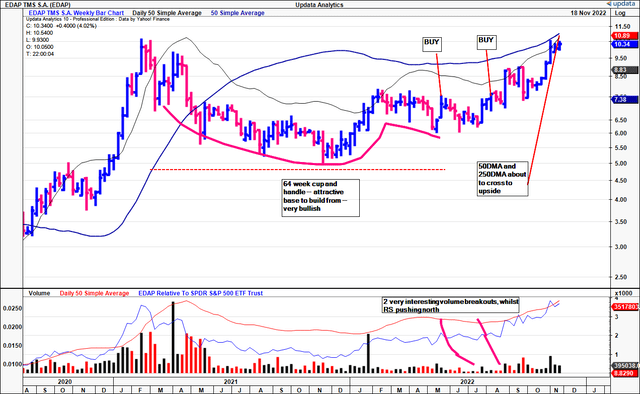

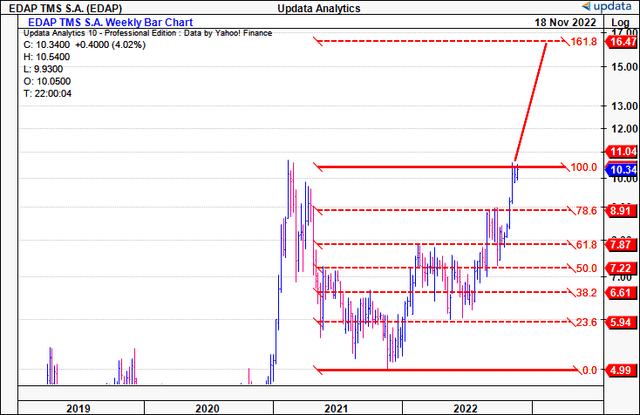

Note the 64-week long cup and handle formed from the February 2021 high to the May 2022 bounce off the support line. After two weeks the stock then broke-out above its previous highs and this was supported by the volume reversal and breakout on the week of May 13. This is a very bullish setup in our view.

Here we entered at a $7.20 limit with a moderately sized long [0.05% of NAV; see Exhibit 2, first ‘BUY’ tab].

The stock then consolidated for 8 weeks before another volume breakout above range. Just in prior successful moves, volume dried up before the breakout, so it was good to see this happen again.

The stock closed to new highs after ascending of 3 lows. With the broad market rally, we sized up the position at $7.30 the week of 29 July [we prefer to size up into strength after covering, versus buying on weakness and averaging down that way]. This is important information that bodes in well for further upside capture.

Exhibit 2. 64-week cup and handle finished with break above previous highs, 2x entry points at $7.20 and $7.30

Data: HB insights, Updata. Image from Updata.

We are using market data to gauge price visibility into the coming months for EDAP. With the market still evaluating its allocation to fundamentals, we are more confident in understanding the stock’s next moves this way.

EDAP bottomed in November FY21′ and so it’s now completed a 12-month long up-cycle and reclaimed 100% of the losses from its drawdown [see Exhibit 3, below].

It is now testing the 100% retracement on the fibs and if it breaks through here the next target is a rally to $16.50.

Exhibit 3. If it breaks this level next objective to $16.50.

Data: Updata

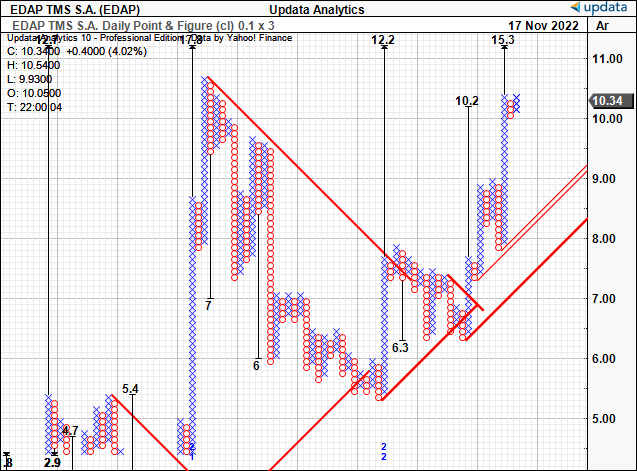

There’s supporting technical data that suggests a lift to $15 is a reasonable expectation, based on point and figure charting [Exhibit 4]. It has already taken out the prior target of $10.20 as further validation. This gives us confidence around a price range of $15–$16.50.

Exhibit 4. Upside targets to $15.30 after previously taking out $10.20 objective

Data: Updata

In short

We’re constructive on EDAP shares and note building fundamental and technical momentum to confirm our buy thesis. We are eyeing targets of $15–$16.50 based on various studies presented here.

Be the first to comment