Hailshadow

Fennec Pharma (NASDAQ:FENC) is based in Durham, NC.

This article will focus on an upcoming catalyst for the company’s stock: PDUFA for Pedmark (sodium thiosulfate) in treating platinum chemotherapy-induced cytotoxicity (ear toxicity) in children 1 month to <18 years age on September 23 this year.

Cisplatin and other platinum chemotherapy agents are widely used as first-line treatments for various pediatric solid cancers like CNS, neuroblastoma, hepatoblastoma, osteosarcoma, etc. However, these compounds cause bilateral, progressive, irreversible, dose-dependent, neurosensory hearing loss. The mechanism of cytotoxicity is the production of reactive oxygen species in target tissues in the inner ear. The average incidence of cytotoxicity with cisplatin is over 60%. The only treatment for ototoxicity due to these agents is hearing aids or inner ear implants. Currently, no treatment is available to prevent ototoxicity in children receiving platinum-based chemotherapy.

Pedmark is a small molecule, unique formulation of sodium thiosulfate. It is administered 6 hours after the completion of cisplatin infusion. It acts by inhibiting oxidative stress, which is the mechanism behind platinum-induced ototoxicity.

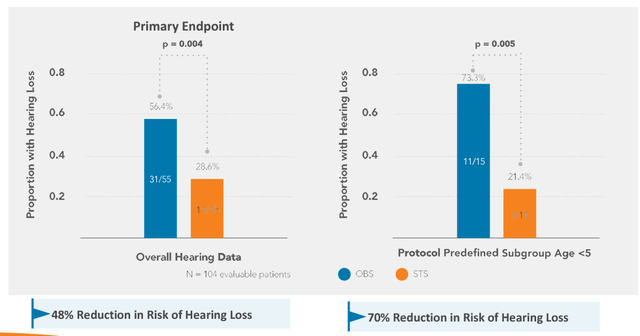

Pedmark has shown clinical efficacy in preventing platinum-induced ototoxicity in two randomized studies: COG ACCL0431 and SIOPEL 6. The results of the pivotal SIOPEL study were published in the prestigious New England Journal of Medicine. In this study, Pedmark showed a 48% reduction in the risk of hearing loss due to platinum compounds, p=0.002 (see below). It has been awarded Fast Track and Breakthrough designation by the FDA.

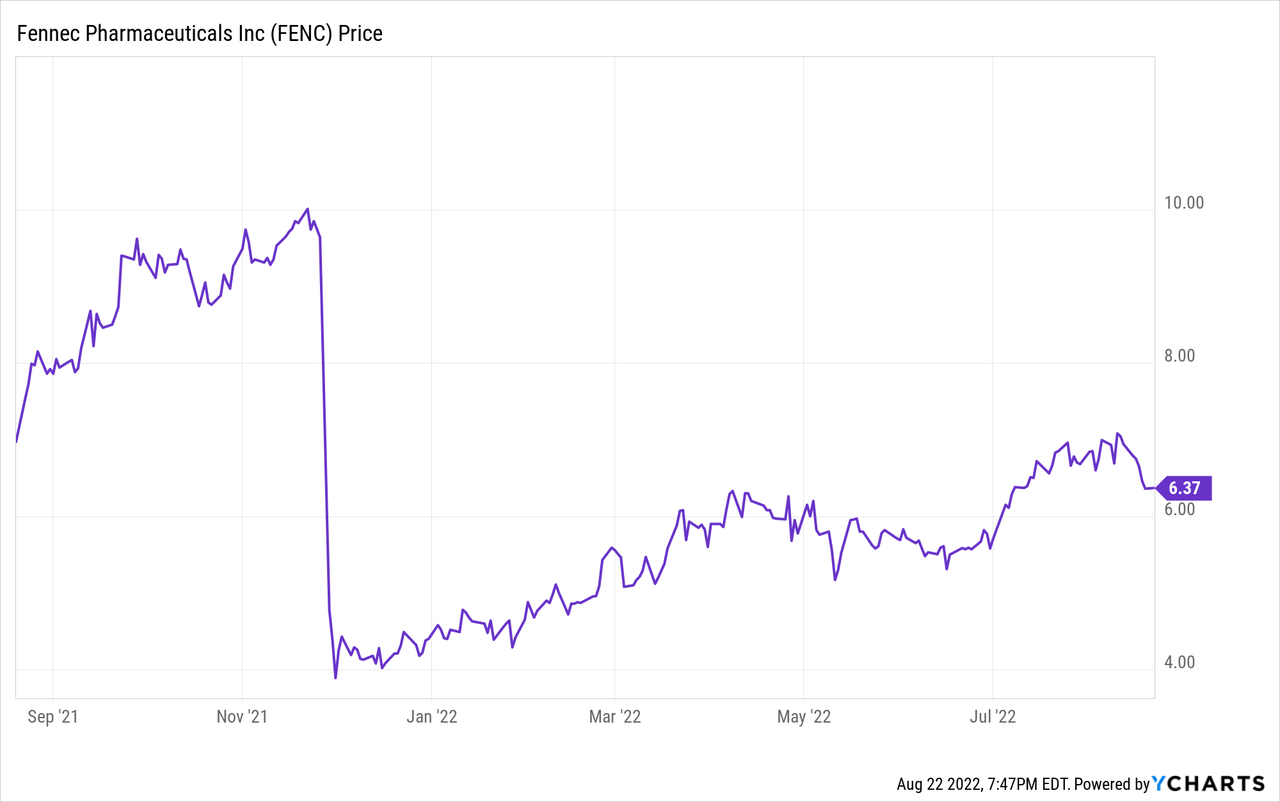

Prior FDA approval submissions for Pedmark were given CRL twice in 2020 and 2021 due to deficiencies with the drug product manufacturer. The company resolved the issues raised in the second CRL within 3 months and announced the NDA acceptance in April this year. The PDUFA is scheduled for September 23 this year.

Cash reserves are expected as $20M after the recent $5M capital raise from Petrichor Health Capital. The company can raise another $20M from Petrichor after Pedmark’s FDA approval. At the current operating cash use rate, this is enough to keep the company funded for 1 year.

The target market is approx. 3000 children with this ototoxicity in the U.S. every year. At a conservative price estimate of $60,000 per patient (similar to a cochlear implant), this could be a $180M/year revenue opportunity just in the U.S. Pharma companies trade at an average enterprise/peak sales of 4. In comparison, the current enterprise value of the company is just $163M. The average sell-side analyst price target on the stock is $14 (118% upside).

The stock has risen 81% since the plunge after the second CRL in November last year, however, is still trading >40% below the $10 mark before the CRL. I expect this gap to be filled before the PDUFA.

Price target = $10 or >40% upside in 4 weeks’ timeframe.

________

Risks in this investment include unexpected CRL which may cause the stock price to plunge though the likelihood of a third CRL is low. Any delay in the PDUFA may cause the stock price to fall. Investing in emerging pharma companies is risky and may not be suitable for all investors. This note represents my own opinion and is not professional investment advice.

Be the first to comment