sommart

The WisdomTree U.S. High Dividend Fund ETF (NYSEARCA:DHS) is WisdomTree’s entrant in the high dividend category. On the positive side, it has the highest short-term returns due to its extreme sector bet on energy stocks, almost 4x the market weight. It also has minimal weights in technology and consumer discretionary stocks currently. DHS’s complex index methodology produces these lopsided sector bets, which makes the DHS ETF either a ‘hero or a zero’ in any given year, depending if its sector bets are in favour. For investors who are bullish on energy, the DHS may be a good near-term trade. However, I personally prefer a more consistent methodology and performance when it comes to dividend investing.

Fund Overview

The WisdomTree U.S. High Dividend Fund ETF provides targeted exposure to high dividend paying U.S. large cap companies. The fund has $1.38 billion in assets.

Strategy

The DHS ETF achieves its investment objective by tracking the WisdomTree U.S. High Dividend Index (“Index”). The index composition rules are very convoluted, but here is my interpretation of the rules:

From an initial universe of all companies, potential index members are first screened for market cap greater than $200 million and daily trading volumes greater than $200,000. Common stocks, REITS, tracking stocks, and holding companies are eligible for the index, but ADRs, LPs (which presumably excludes MLPs), BDCs, and royalty trusts are not.

Companies eligible for index inclusion must first pass a composite risk score test (composite risk score is equally weighted between a quality score factoring ROA, ROE, gross profits and cash flows and a momentum score factoring trailing returns) where the bottom decile is excluded. Companies that rank in the top 5% by dividend yield and bottom half by composite risk scores are also excluded.

Companies are then ranked by their annual dividend yield, with the top 30% by indicated yield selected for inclusion in the Index (and will be booted from the Index if they fall outside the top 35% by indicated yield).

The index weighting mechanism is designed to magnify the effects of dividends to be paid in the coming year based on the company’s indicated dividend multiplied by shares outstanding. This weighting system reflects the proportionate share of the company’s dividend in the coming year relative to the aggregate expected cash dividends of all the index constituents.

Individual companies are capped at a 5% weight, prior to sector caps. Sector weights are capped at 25%, except for the Real Estate sector, which is capped at 5%. Excess weights are rebalanced to the rest of the index constituents.

Portfolio Holdings

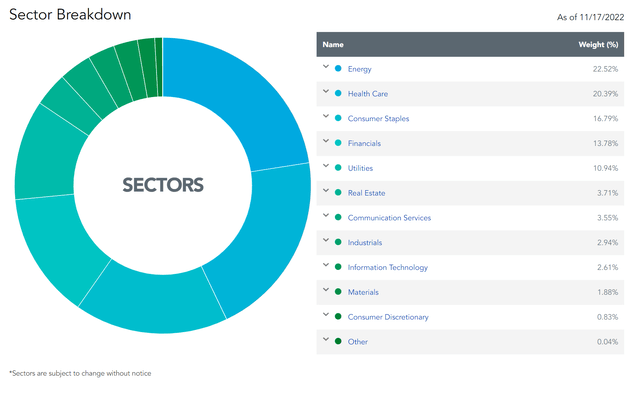

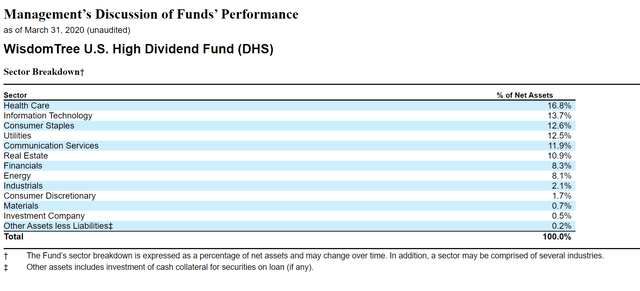

Figure 1 shows the DHS ETF’s portfolio sector breakdown as of November 17, 2022. Relative to the market, the fund is very heavily overweight Energy and Utilities, and very underweight Technology and Consumer Discretionary.

Figure 1 – DHS ETF sector breakdown (wisdomtree.com)

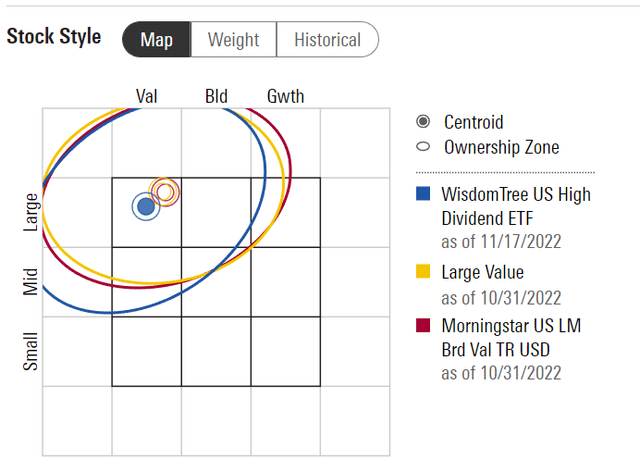

Overall, the DHS portfolio style skews to large-cap value (Figure 2).

Figure 2 – DHS ETF style skews large-cap value (morningstar.com)

Returns

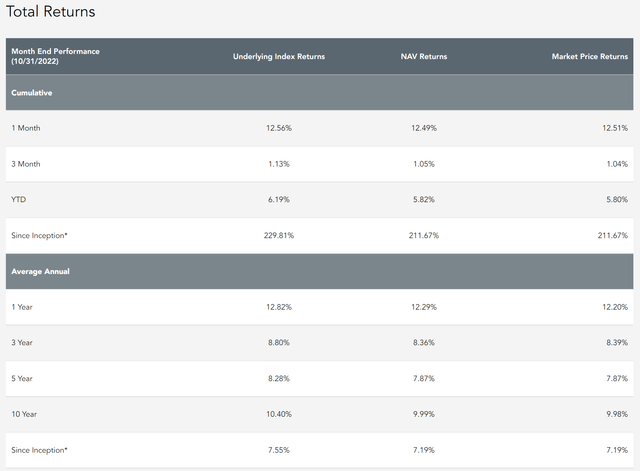

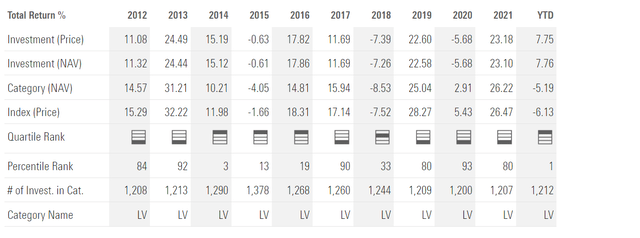

The DHS ETF has had decent returns to October 31, 2022. It has 1/3/5/10Yr average annual returns of 12.3%/8.4%/7.9%/10.0% (Figure 2).

Figure 3 – DHS ETF returns (wisdomtree.com)

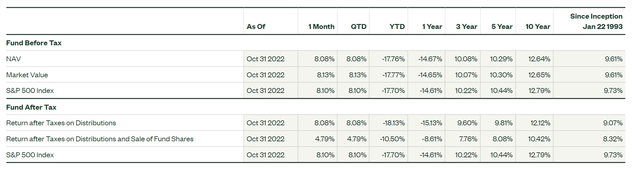

Figure 4 shows the returns of the SPDR S&P 500 Trust ETF (SPY) for comparison. The DHS ETF has outperformed the S&P 500 on a 1-year basis, but has lagged on longer-term time frames.

Figure 4 – SPY ETF returns (ssga.com)

DHS’s strong recent returns can be attributed to its large weight in energy equities and almost non-existent weights in technology and consumer discretionary. The DHS ETF has a 22.5% weight in the Energy sector, 4x the sector’s weight in the S&P 500 currently (5.4%). It has a 2.6% weight in technology vs. 23.7% in the S&P 500, and 0.8% vs. 10.2% for consumer discretionary.

The question is whether the DHS ETF’s index methodology adapts to changing market dynamics, i.e. is the DHS ETF always overweight energy and underweight technology?

Going through historical SEC filings, we can see that the sector weights do change a bit through time. For example, as of March 31, 2020, the fund’s energy weight was only 8.1%, and its technology weight was 13.7% (Figure 5). Although the DHS ETF remained overweight energy and underweight technology, it was not as extreme as it is currently.

Figure 5 – DHS ETF sector weights as of March 2020 (DHS ETF annual report)

Annual Returns Are Either A Hero Or A Zero

Looking at DHS’s annual returns, what is striking is that the DHS ETF is either a top quartile fund or a bottom quartile fund. The inconsistency appears to be tied to the fund’s large sector bets – the DHS ETF is either a ‘hero or a zero’ in any given year (Figure 6).

Figure 6 – DHS ETF annual returns (morningstar.com)

Distribution & Yield

The DHS ETF pays a modestly high distribution yield of 3.3% on a trailing 12-month basis. The distribution is paid monthly.

Fees

The DHS ETF charges a 0.38% expense ratio.

Comparison to Dividend Funds

The DHS ETF is WisdomTree’s entrant in the popular and competitive high dividend category.

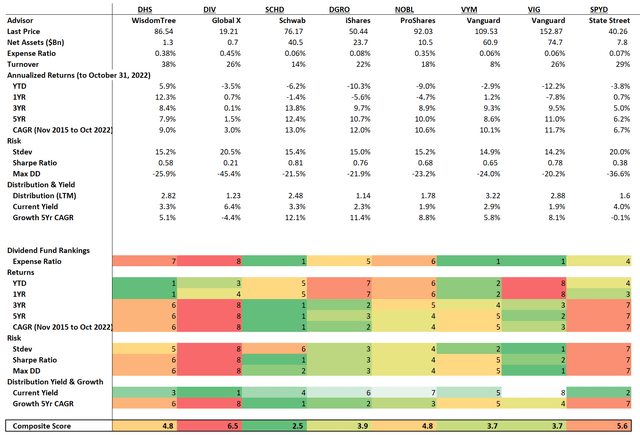

Figure 7 summarizes the key attributes of the DHS fund vs. its peers. On the positive side, out of the 8 dividend funds I have analyzed, The DHS has the highest short-term returns. It also has a high current yield of 3.3%.

Figure 7 – DHS ETF vs. peer funds (Author created with returns and risk metrics from Portfolio Visualizer and distribution and fund details from Seeking Alpha)

On the negative side, it’s longer-term returns have lagged. It is also fairly expensive. From Figure 6 above, we can see that the DHS ETF’s index methodology produces fairly extreme sector bets that causes the fund to either be first or fourth quartile in any given year.

Conclusion

The DHS ETF is WisdomTree’s entrant in the high dividend category. On the positive side, it has the highest short-term returns due to its extreme sector bet on energy stocks, almost 4x the market weight. It also has minimal weights in technology and consumer discretionary stocks currently. The complex index methodology produces its lopsided sector weightings, which makes the DHS ETF either a ‘hero or a zero’ in any given year, depending if its sector bets are in favour. For investors who are bullish on energy, the DHS may be a good short-term trade. However, I personally prefer a more consistent methodology and performance.

Be the first to comment