Nariman Safarov/iStock via Getty Images

One of the most iconic companies in the world has got to be WD-40 Company (NASDAQ:WDFC). This firm, which is named after its flagship product, WD-40, is viewed by many investors as a source of stability even during difficult times. The business is not known for rapid growth or anything close to it. Instead, investors buy into the stock because they want a high-quality operator that they know is going to be around and thriving for the foreseeable future. Recently, the financial performance of the company has been less than ideal. It is highly improbable that the long-term outlook is unchanged at all. But when you factor in the weakness the firm is experiencing with the fact that the stock is very pricey, it’s truly difficult to justify this is a serious prospect for investors at this time.

Not much opportunity here

The last time I wrote an article about WD-40 Company was in early April of this year. In that article, I recognized the company’s historical stability and attractive, though anything but rapid, growth. Weak bottom line results had made times difficult for the enterprise, but management with snow forecasting a modest increase in profits for the 2022 fiscal year. My overall conclusion was that shares looked very pricey, but that this is the price that you pay for a quality player that offers long-term stability. And as a result, I ended up retaining my ‘hold’ rating on the stock, believing that it would likely generate returns that more or less matched the broader market for the foreseeable future. Since then, the company has actually outperformed my expectations rather considerably. While the S&P 500 is down by 13.8%, shares of the enterprise have generated a profit for investors of 7.4%.

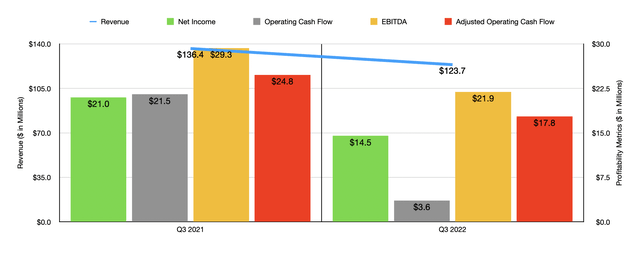

Author – SEC EDGAR Data

Interestingly, this attractive upside came during a time when the company’s overall fundamental condition has shown signs of weakening. Consider how the business has performed in the third quarter of its 2022 fiscal year. This is the most recent quarter for which we have data available as of this writing. During that time, sales came in at $123.7 million. That represents a decrease of 9.3% compared to the $136.4 million in revenue generated in the third quarter of 2021. Although revenue in the Americas grew by roughly 2% year over year, the company saw a 16% decline in sales in its EMEA (Europe, Middle East, and Africa) operations and a 28% decline in sales in the Asia Pacific region. In the EMEA regions, the company suffered from a couple of factors, including reduced demand as renovation and maintenance activities exhibited by the company’s end users during the COVID-19 pandemic resulted in strong demand during the third quarter of last year compared to the same time this year. This weakness was particularly pronounced in the UK, France, and Iberia. The company also suffered on this front from foreign currency fluctuations and it also saw reduced sales in Russia, Poland, and Turkey, largely because of the conflict between Russia and Ukraine. The picture would have been worse had it not been for strong demand growth in Saudi Arabia. Meanwhile, the Asia-Pacific region suffered largely because of supply chain disruptions.

On the bottom line, the company also experienced some pain. Net income went from $21 million in the third quarter of 2021 to $14.5 million the same time this year. Operating cash flow plunged from $21.5 million to $3.6 million. If we adjust for changes in working capital, the picture would have been slightly better, with the metric declining from $24.8 million to $17.8 million. And finally, the company also saw its EBITDA decline, dropping from $29.3 million to $21 million. Naturally, the decrease in revenue had an impact on all of this. But the company also suffered from a decline in its gross margin from 53.1% to 47.7%. That, in turn, was driven largely by higher costs of specialty chemicals and of aerosol cans. Higher warehousing, distribution, and freight costs, as well as higher filling fees related to third-party contract manufacturers, were also at play here. This was, however, somewhat offset by sales price increases that the company enacted.

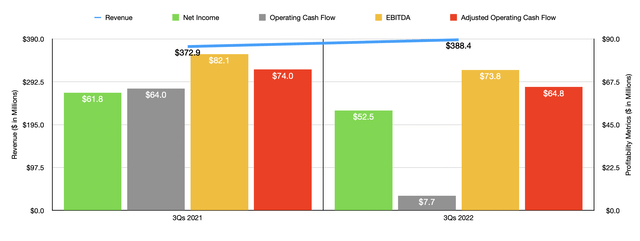

Author – SEC EDGAR Data

Despite this weak performance, the picture for the first nine months of the 2022 fiscal year as a whole is not as bad. Revenue of $388.4 million is slightly higher than the $372.9 million seen the same time last year. Net income, however, did drop from $61.8 million to $52.5 million. And as the chart above illustrates, the other profitability metrics for the company also declined to some degree. Even with this pain, management does think that revenue this year as a whole will climb by between 6% and 9%, with overall sales coming in up between $519 million and $532 million. Net income, at the midpoint, should come in at roughly $69.6 million. If this comes to fruition, it would be only marginally lower than the $70.2 million seen for the 2021 fiscal year. No guidance was given when it came to other profitability metrics. But if we assume that the results they saw during the first three quarters of the year are representative of what they should be for the rest of the year, then we should anticipate adjusted operating cash flow of $74.2 million and EBITDA of $86.1 million.

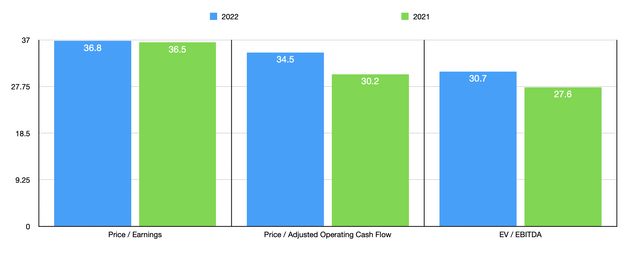

Author – SEC EDGAR Data

Given these figures, we can calculate that the forward price to earnings multiple of the company is 36.8. This is up slightly from the 36.5 reading that we get using data from last year. The price to operating cash flow multiple should rise from 30.2 to 34.5, while the EV to EBITDA multiple of the business should increase from 27.6 to 30.7. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 9.5 to a high of 38.1. Using the price to operating cash flow approach, the range is between 13.9 and 35. And when it comes to the EV to EBITDA approach, the range is between 9.1 and 49. In all three scenarios, four of the five companies are cheaper than WD-40 Company.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| WD-40 Company |

36.8 |

34.5 | 30.7 |

| Spectrum Brands Holdings (SPB) | 18.5 | 13.9 | 49.0 |

| Energizer Holdings (ENR) | 9.5 | 35.0 | 10.9 |

| Central Garden & Pet Company (CENT) | 13.6 | 22.9 | 9.1 |

| Reynolds Consumer Products (REYN) | 21.2 | 14.9 | 14.9 |

| The Clorox Company (CLX) | 38.1 | 22.4 | 21.5 |

Takeaway

The data right now suggests to me that WD-40 Company is hitting a bit of a rough spot. Inflationary pressures and reduced demand caused by one-off things are causing a bit of pain. Having said that, I have no doubt that the company will adjust as it always has. But this doesn’t mean that it makes for a great investment prospect. For investors who want stability and are okay accepting decent returns over an extended timeframe, this might well be a great opportunity to consider. But given how expensive shares are, I have significant doubt that the company can offer strong upside that would be greater than what the broader market should achieve moving forward. Because of this, I have decided to keep my ‘hold’ rating on WDFC stock for now.

Be the first to comment