Paper Boat Creative

Intapp, Inc. (NASDAQ:INTA) SaaS offerings are becoming quite successful. In the last quarterly report, Intapp delivered a 36% gross profit increase q/q. I believe that the company’s modular solutions, artificial intelligence capabilities, and the cloud-native and easy-to-use integrations can explain some of INTA’s successes. Under my own financial model, I obtained a valuation of $29.89 per share, which is more significant than the current market price. Even considering potential data breaches and other risks, in my view, the stock is a must-follow.

Intapp: Quarterly Results Delivered Significant Gross Profit Increase And A Lot Of Recurring Revenue

Intapp offers a cloud platform designed to transform the most important business operations for financial companies and professionals.

Source: Company’s Website

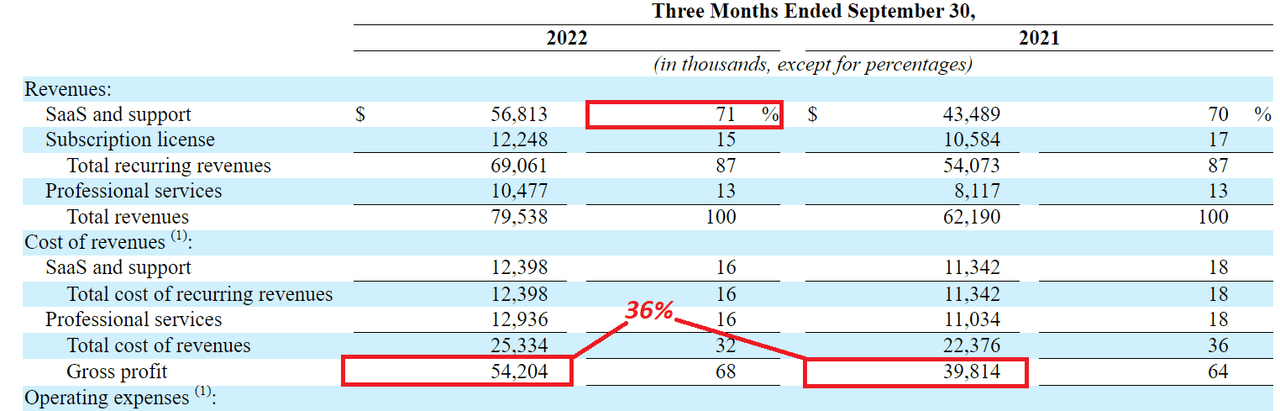

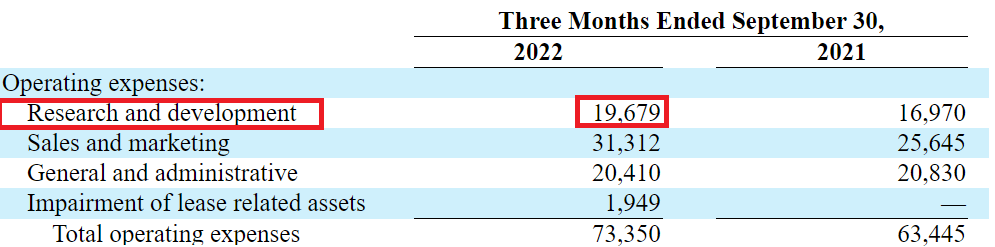

Considering the most recent income statement reported by Intapp, I became very interested in the business model. Let’s keep in mind that in the three months ended September 30, 2022, management reported a 36% gross profit increase.

Source: 10-Q

In my view, Intapp’s SaaS offerings are becoming quite successful. Besides, it is worth mentioning that total recurring revenue represented close to 86% of the total revenue.

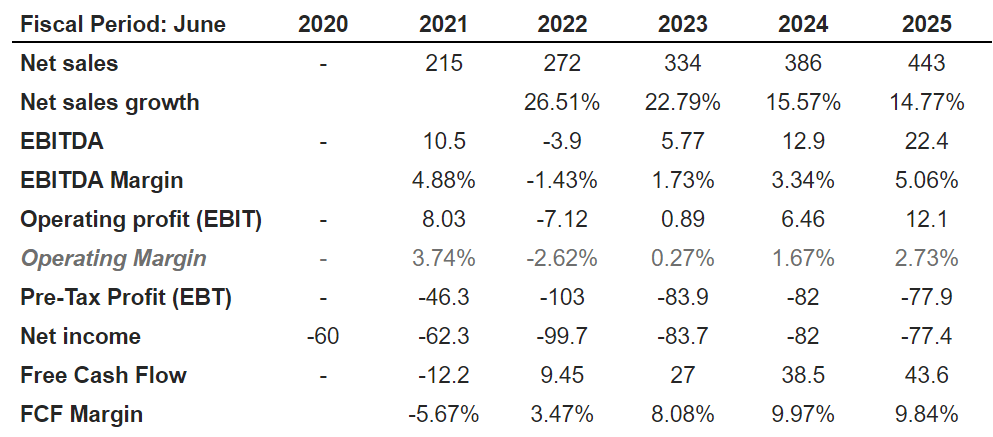

Expectations From Analysts Include Double Digit Sales Growth And Growing EBITDA Margin

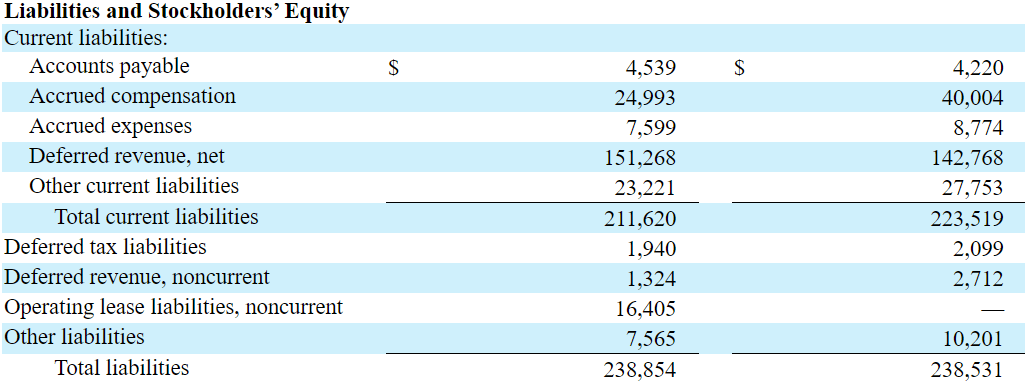

Market estimates delivered by analysts include 2025 net sales of $443 million with a net sales growth of 14.77%. In addition to an EBITDA of $22.4 million and 2025 EBITDA margin of 5.06%, analysts are expecting an operating profit of $12.1 million and an operating margin of 2.73%. Finally, 2025 free cash flow would be $43.6 million, and the FCF margin would be 9.84%.

Source: Marketscreener.com

Balance Sheet

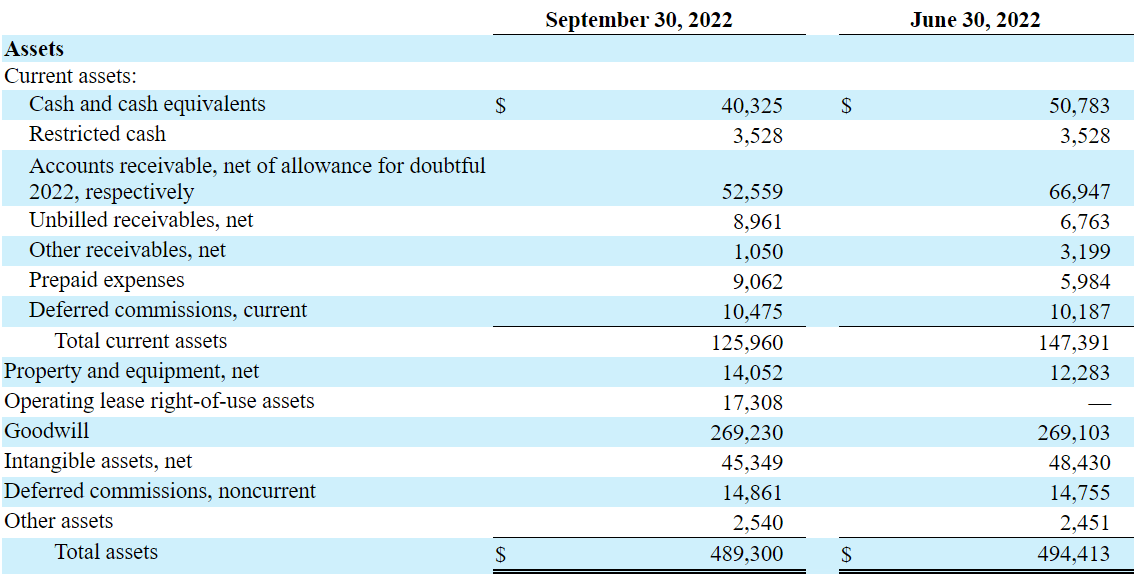

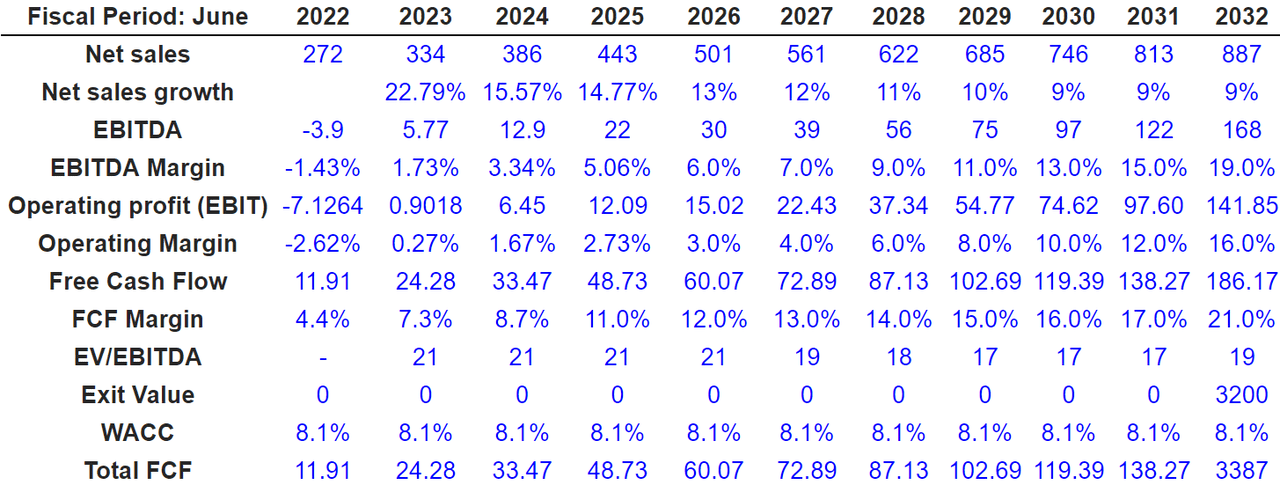

As of September 30, 2022, Intapp reported cash and cash equivalents of $40.325 million with receivable accounts of $52.559 million and deferred commissions of $10.475 million. Total current liabilities are a bit larger than the total current amount of assets, which some investors may not appreciate.

The non-current liabilities include property and equipment worth $14.052 million, in addition to operating lease rights of use assets of $17.308 million and goodwill worth $269.230 million. Total assets stand at $489.300 million, making the asset/liability ratio stand at 1x-2x. In my view, the balance sheet stands in good shape.

Source: 10-Q

Considering that Intapp does not have debt outstanding, I wouldn’t be afraid of the total amount of liabilities. The liabilities include accrued expenses of $24.993 million with deferred revenue of $151.268 million and other current liabilities worth $23.221 million. With an operating lease liabilities of $16.405 million, the total liabilities are equal to $238.854 million.

Source: 10-Q

My DCF Model Under Normal Conditions Implies A Valuation Of $29.8 Per Share

Under normal conditions, I would expect AI technologies to bring new customers besides enhancing revenue growth. Let’s note that clients use Intapp’s technologies to make better decisions as well as to assess large sets of data. Intapp provided further information in its annual report.

Industry-specific AI is embedded throughout our platform and solutions to help professional and financial services firms use their vast amounts of data to optimize critical processes and make better, faster decisions. The applications of AI span a wide range across firm operations, from strategy and business development through to risk and compliance and work execution. Source: 10-k

I also believe that under this case scenario, more clients will use Intapp because of the platform’s easy-to-use apps. Let’s keep in mind that according to management, clients don’t require any coding skills, which makes the system much more efficient.

Intapp Integration Service is a core capability of our platform that provides cloud-native and easy-to-use, enterprise class integration to connect applications and data without requiring any code. The solution helps firms overcome data silos and easily move information between systems, including within our platform. Source: 10-k

Finally, I believe that Intapp’ strategy with clients will likely work out in the long run. Management appears to offer some models that seem essential for each client. Once the user has first contact with the organization, Intapp offers more parts of its platform. In my view, revenue growth may be sustained as Intapp may also design new services thanks to new relationships with customers.

Clients typically adopt our modular solution to address a specific use case, and then expand their use by adopting more modules, adding more users, and deploying to other parts of their organization over time. Source: 10-k

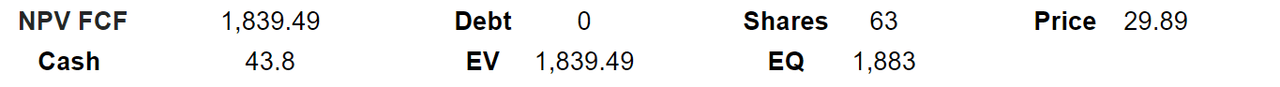

My assumptions in this case scenario include 2032 net sales of $887 million and an EBITDA of $168 million with an EBITDA margin of 19%. The operating profit would be $141.85 million with an operating margin of 16%. 2032 free cash flow of $186.17 million with an FCF margin of 21% is expected. I also included an exit EV/EBITDA multiple of 19x and a WACC of 8.1%.

Source: Arie’s Model

The sum of future free cash flows including the exit value discounted with the WACC results in a total valuation of $1.83 billion. If we also add cash of $43.8 million, the equity would be $1.883 million, and the fair price would be $29.89 per share.

Source: Arie’s Model

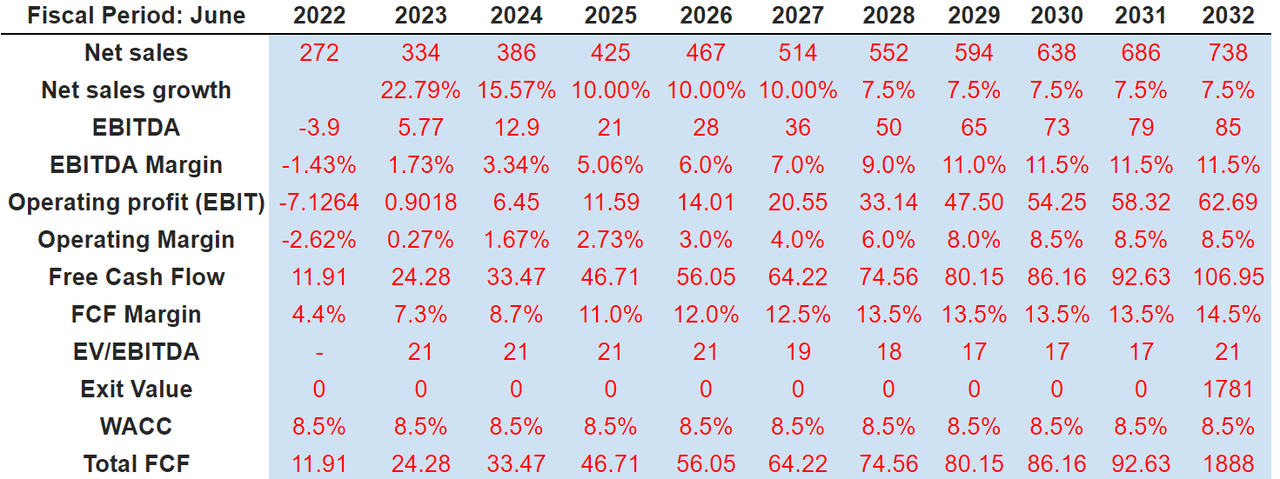

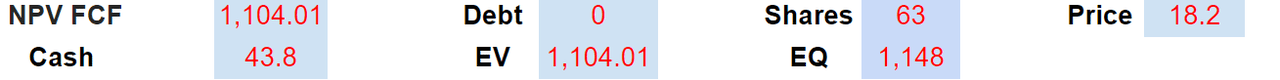

Decrease in Revenue Due To Competitors, Data Breaches, And Failed Research And Development Could Lead To A Price Of $18.2 Per Share

Investors should not rely on previous sales growth. In my view, revenue growth may decline over time due to demand reduction, competitors, or changes in the price of the app. Under this case scenario, I assumed that the decline in revenue growth would be larger than expected.

Our recent and historical growth should not be considered indicative of our future performance. In future periods, our revenues could grow more slowly than in recent periods or decline for a number of reasons, including any reduction in demand for our Intapp Platform, increase in competition, limited ability to, or our decision not to, increase pricing, or our failure to capitalize on growth opportunities. Source: 10-k

Considering the recent increase in data breaches, in my opinion, it is likely that Intapp suffers attacks in the coming months. If hackers gain access to the company’s information, clients may leave the firm. As a result, revenue growth may decline, and the brand may be damaged.

Our solutions involve the storage and transmission of data, in some cases to third-party cloud providers, which may include personal data, and security breaches, including at third-party cloud providers, could result in the loss of this information, which in turn could result in litigation, breach of contract claims, indemnity obligations, reputational damage and other liability for our company. Source: 10-k

In order to offer innovative solutions, Intapp currently invests a lot of money in research and development. In the three months ended September 30, 2022, research and development expenses increased by close to 16% as compared to the same period in 2021. It could happen that new solutions are not as profitable as those in the past. Failed software would bring revenue growth down, and may lead to stock price declines.

If we fail to develop new solutions or enhancements to our existing solutions, our business could be adversely affected, especially if our competitors are able to introduce solutions with enhanced functionality. Source: 10-k

Source: 10-Q

Finally, let’s note that Intapp signs long-term contracts. Current revenue growth may not represent new agreements, but revenue generated in the past. If the company is not signing contracts right now, we may learn about the decline in activity in the near future. It is not great in terms of business visibility.

We generally recognize revenues from our SaaS solutions ratably over the duration of the contract, which typically range from one to three years. As a result, a substantial majority of our quarterly revenues from our SaaS solutions are generated from contracts entered into during prior periods. Consequently, a decline in new contracts in any quarter may not affect our results of operations in that quarter, but could reduce our revenues from our SaaS solutions in future quarters. Source: 10-k

Under this case, 2032 net sales would be $738 million, together with a net sales growth of 7.5% and an EBITDA margin of 11.5%. 2032 Operating profit would be $62.69 million with an operating margin of 8.5%. I also expect free cash flow of $106.95 million with an FCF margin of 14.5%.

Source: Arie’s Model

With an EV/EBITDA multiple of 21.5x, the implied exit value would be $1.78 billion. If we also use a WACC of 8.5%, the sum of discounted FCF would be $1.104 billion. Finally, my results would include an equity valuation of around $1.15 billion and a fair price of $18.2.

Source: Arie’s Model

Conclusion

Intapp offers successful SaaS offerings and double digit quarterly gross profit. I believe that the company’s artificial intelligence capabilities, the modular solutions, and cloud-native and easy-to-use integrations will most likely bring further revenue growth. Under a conservative discounted cash flow model, I obtained a valuation close to $29.89 per share. Even taking into account risks from research and development failure and data breaches, in my view, the stock price appears quite undervalued at the current price.

Be the first to comment