Kkolosov

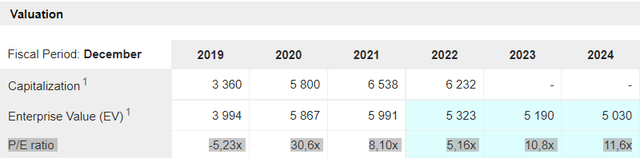

Germany-based specialty chemical manufacturer Wacker Chemie’s (OTC:WKCMF) latest quarterly results fell short of consensus expectations which had already been lowered heading into the print. A weaker end market backdrop and volatility in EU energy prices also do not bode well for the near-term earnings trajectory, and thus, I suspect the updated Q4 guide may be too high a bar. In particular, polysilicon pricing, a source of strength thus far, looks set for a cyclical downswing; thus, I am concerned that management has not been sufficiently conservative here. More broadly, macro headwinds globally are an added concern and could lead to a slowdown in key end markets sooner rather than later. While the stock has pulled back in recent months, the 11-12x fwd P/E may not sufficiently account for more earnings downgrades ahead, in my view.

Signs of Volume Weakness Overshadow Pricing Gains

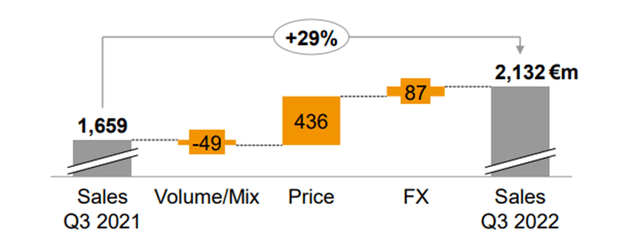

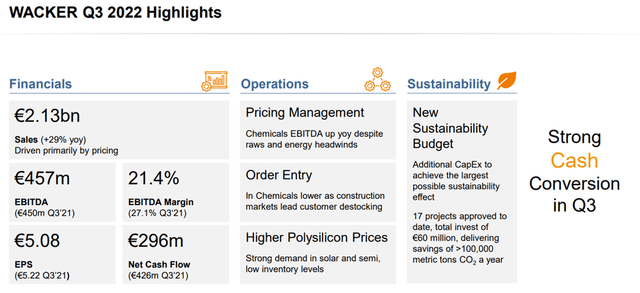

Wacker posted Q3 group sales of EUR2.1bn (+28.6% YoY) on a +26% YoY pricing growth and currency impact of +5% YoY, offset by -3% YoY from volumes/mix. Still, this was short of consensus expectations due to weaker volumes across silicones and polymers. By segment, silicones were a bright spot at +31% YoY on better pricing and a favorable product mix shift towards specialties, while polysilicon (+51% YoY) also benefited from significantly higher pricing and an improved product mix shift toward higher semi-grade silicon volumes. The polymers segment saw less of a pricing benefit and lagged at +8% YoY for the quarter.

Despite the pricing growth, the early signs of end-market declines are concerning – while volume growth was up YoY, silicones and polymers are slowing on a sequential basis. For now, Wacker’s key product segments are being propped up by persistently high prices amid a cyclical upswing. The sustainability of this trend is in question, though, particularly given recent updates from silicone peers like Dow (DOW) calling for weaker demand and pricing going forward. Thus far, polysilicon prices have held up at elevated levels, but with new supply from China coming online, prices look set to turn and weaken significantly through the next year.

Ongoing Input Cost Inflation Weighs on Profitability

Strong pricing and a more favorable product mix helped Wacker’s overall profitability, but it was not enough to negate the impact of more raw material and energy cost inflation. The crux of the issue is Wacker’s concentrated production base in Germany (>60%), which continues to suffer disproportionately from high energy prices. As a result, EBITDA margins contracted ~5.7%pts YoY to 21.4% (down from 27.1% in Q3 2021), as all the segments reported a squeeze in margins for yet another quarter.

By segment, the margin headwinds were most pronounced in polysilicon, as higher sales and volumes failed to offset the substantially higher energy and raw material prices. The EBITDA decline in polymers was also concerning at -29% YoY on similar headwinds, but the drop-off was worsened by a scheduled maintenance shutdown. Silicone EBITDA also suffered, as on a sequential basis, it was down 29% QoQ, while the biosolutions business was weighed down by additional upfront costs incurred for the Halle mRNA site (i.e., a biotech center for messenger ribonucleic acid technology, including mRNA coronavirus vaccines manufacturing).

Guidance Optimism Increases Risk of Future Downward Revisions

Despite the mixed Q3 results, management opted to maintain the sales outlook at EUR 8.0bn–EUR 8.5bn and, more surprisingly, to raise the EBITDA guidance range to EUR 2.1bn–EUR 2.3bn (from EUR 1.8bn–EUR 2.3bn). The key driver for the EBITDA change is a lower energy and raw material cost assumption in the EUR 1.3bn–EUR 1.4bn range (down from EUR 1.5bn) in response to the recent decline in gas prices as well as expectations for German gas storage to remain healthy through the winter (vs. prior fears of a potential EUR200-250m gas rationing cost). Capex was also guided lower at EUR550m for the full year (down from EUR550-600m), moving FCF expectations higher post-quarter.

With the latest guidance update, the implied assumption is that gas rationing is a less likely scenario. While German gas storage levels could well insulate against this risk heading into the winter, I am concerned that energy costs could still see a further increase as existing hedges roll off. Given the sales outlook was retained as well, despite the prospect of a weaker demand environment, the Q4 guide risks being too optimistic, in my view. For now, polysilicon prices look likely to hold firm through year-end, but the price outlook for 2023/2024 remains very challenging amid an expected supply increase. Relative to a weaker demand growth outlook, this likely means an oversupply situation, and thus, I suspect next year’s guidance update could disappoint.

Heading Towards Turbulence

Wacker’s Q3 results were largely a disappointment – volumes were down, and so were EBITDA margins, despite pricing support, as raw material and energy cost inflation continued to weigh on the P&L. Yet, management has decided to raise guidance, upgrading the lower end of the EBITDA guidance range for the full year. Given the prospect of higher energy prices in Europe, as well as a global consumer slowdown through the end of the year and into early 2023, the risk of a downward revision is high, in my view. In addition, the on-and-off China lockdowns present more downside risk, particularly on the silicone side of the business, while a cyclical decline in polysilicon prices could be an earnings headwind over the next year or so. Even after the stock price decline in recent months, the 11-12x fwd P/E valuation remains too pricey.

Be the first to comment