Giselleflissak

Description

I believe Vacasa, Inc. (NASDAQ:VCSA) is worth $7.6 billion, representing ~118% upside from the date of writing (Oct 22, 2022). The business has shown significant stability over the past few years despite the pandemic and competition. Vacations are in high demand again as people are eager to go places. VCSA’s rental management platform is in a good market position, as vacation rentals are becoming more mainstream than hotels, and demand for home rental bookings has been growing across its various multichannel distribution.

Company overview

Vacasa, Inc. is a North American vacation rental management platform. The integrated technology and operations platform of the company optimizes vacation rental income and home maintenance for homeowners; provides seamless, dependable, high-quality service to guests; and provides top-ranked home listings to distribution partners. As of December 31st, 2021, VCSA’s global marketplace has reached approximately 37,000 exclusive listings. These listings could be found in over 400 different locations across North America, Belize, and Costa Rica. Guests of VCSA may search for properties, discover new ones, and make reservations via vacasa.com, the VCSA Guest app, and the booking sites of over a hundred distribution partners, such as Airbnb (ABNB), Booking.com (BKNG), and Vrbo.

The business model of VCSA is straightforward. When a vacation rental is booked directly through any of the previously mentioned booking platforms, VCSA is in charge of collecting the nightly rent on behalf of the homeowners. The vast majority of the company’s revenue comes from homeowner commissions and service fees paid by guests. Because VCSA is vertically integrated, the majority of its listings are exclusive to the company itself. As a result, the company is able to secure all of the bookings for the properties that are listed on its platform and a larger share of each transaction.

Vacation rental is a fast growing vertical within travel accommodations

Looking at VCSA’s total addressable market, I expect the size of the global travel industry to continue increasing as younger generations seek to enjoy more “experience.” In 2020, there was a clear shift in the travel industry from traditional hotel stays to alternative accommodations. This happened because of the pandemic’s effect on remote work and longer stays that combined work and secondary locations.

TPG Pace Solutions and Vacasa Transaction Announcement

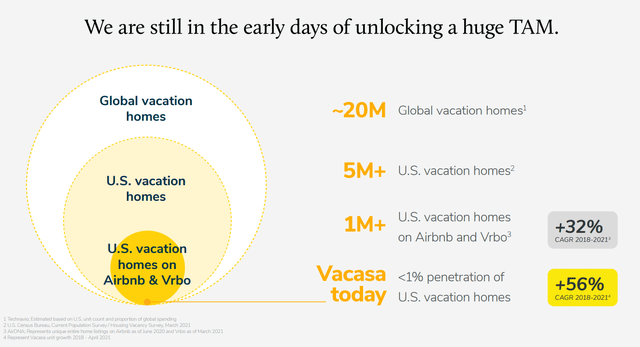

That said, we are still in the very early innings of vacation rental adoption today, and the study confirms that families are flocking to vacation rentals. Numerically, there are about 20 million international vacation homes, of which 5 million of them are in the U.S., and VCSA only has less than 1% penetration of U.S. vacation homes. To put things into perspective, Airbnb and Vrbo collectively have more than 20% of the vacation homes in the US.

TPG Pace Solutions and Vacasa Transaction Announcement

For example, I think that the number of vacation rentals will grow for a number of reasons:

- Vacation rentals are cheaper. Personally, I’ve found many times over that a private home or apartment can be more affordable than a hotel. Our accommodation is almost always cheaper than two rooms in a hotel for the same amount of time.

- Vacation homes have amenities not available at hotels. Wi-Fi, DVD players, game consoles, books, computers, and outdoor toys are typical inclusions in vacation rentals. A few may even provide more enticing perks, like access to a nearby country club or the use of kayaks and canoes. Naturally, this is more than you can expect to find in a standard hotel room.

- Vacation rentals offer extra space. Even if your vacation rental doesn’t have games, I believe another one of the key reasons to stay in a vacation home is the additional space for families to spread out. When we go on a family or group vacation, the additional room is one of the things that we look forward to the most. Airbnb and VRBO offer rentals in all shapes and sizes. Some home rentals outside the city may even include a yard or swimming pool.

- While similar hotels in the vicinity tend to be double or triple the price, you can rent a villa of your preference. If you’re searching for somewhere more tranquil, you can always rent a cottage by the beach. Often, vacation homes can be found in the heart of the action.

Strong value proposition to stakeholders increases stickiness

The VCSA platform provides comprehensive offerings for both vacation homeowners and vacation rental guests. It serves as a roadmap for the entirety of the company’s local operations to provide a complete package for:

- Homeowners who are interested in renting their vacation homes and

- Guests who are interested in experiencing the perks of vacation rentals.

For homeowners who are looking to rent their vacation homes. VCSA’s platform is designed to be a homeowner-first approach. Its homeowner offering is made up of a number of products and services that help homeowners maximize the rental income they get from their properties and give them peace of mind that their properties are being taken care of properly.

In my opinion, VCSA’s capacity to optimize the listing and increase demand is the most important factor that attracts homeowners. The company asserts it can swiftly conduct all the necessary procedures for listing a homeowner’s rental/s. VCSA provides tools for interior decoration, expertly written descriptions, high-definition photographs, and virtual reality tours (3D Tours) to increase the number of potential guests. In addition, it recommends various features and amenities derived from the company’s stored and reliable proprietary data. As soon as a listing goes live on VCSA, the company also takes care of everything related to advertising, scheduling, and communicating with guests.

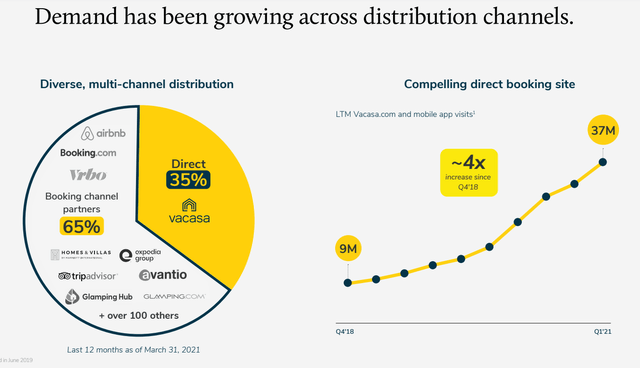

The advantage of VCSA is that, to capture demand wherever it may be, its proprietary software automatically syndicates listings across its own scaled direct booking site and over 100 third-party distribution partners’ booking sites, including Airbnb, Booking.com, and Vrbo. VCSA integrates these listings in a seamless manner throughout both its own website and the websites of its distribution partners. Additionally, the company has developed tools that enable configurable adjustments to listings or prices according to the channel.

VCSA has developed its own system of proprietary universal channel management. This system takes the information associated with a particular home and instantly shares the listing with the appropriate partner websites. It’s important to note that VCSA overlays its partner optimization dashboard. This lets the company run tests for optimization across its entire partner network, figure out how flexible prices are for each partner, and try to optimize contributions no matter what channel they come through.

For guests who are looking to experience the offerings of vacation rentals, when it comes to guests, the services that VCSA offers give a hassle-free approach to searching for, finding, transacting with, and experiencing VCSA listings. The Guest App is the core offering of VCSA. Its powerful design provides a full suite of features for a smooth and hassle-free experience before, during, and after a guest’s stay. With the featured app, guests may look for available rooms, book their stay, and pay the rent. VCSA helps clients get ready for their vacation by emailing them essential information about the home and their visit there before arrival. Furthermore, when the guest arrives at the home, they may use the Guest app to gain access to the property, connect to the Wi-Fi network, and get customer service around the clock. VCSA’s easy-to-use transactions and processes have led to high levels of customer engagement and satisfaction, as well as longer and more frequent stays.

Strong partnership relationships with key players

As part of the multi-channel distribution strategy that VCSA employs, the company has developed partnerships with more than a hundred online booking platforms, such as Airbnb, Booking.com, and Vrbo. As a result of these partnerships, VCSA-listed properties are available for booking by guests via the third parties’ respective online platforms. VCSA’s agreements with its distribution partners typically stipulate either one of the following:

- The partner will get a commission on bookings made through the channel transactions (at a rate that varies by partner), or

- VCSA will pay the partner an annual, per-listing subscription fee. Certain partners may charge guests directly for additional services

TPG Pace Solutions and Vacasa Transaction Announcement

New markets, new growth

VCSA’s principal strategy for penetrating new markets is what it refers to as its “portfolio approach.” The firm has claimed that one of its primary goals is to build footholds in new domestic markets. The portfolio approach that VCSA takes capitalizes on the footprint of diversified, professionally managed local property portfolios. This method also lets the company move dozens of existing vacation rental homes to its platform at the same time. This lets the company grow its presence in the local market more quickly.

Currently, VCSA has also made its way into the international market, particularly in the countries of Canada, Mexico, Belize, and Costa Rica. I believe that, over the course of time, VCSA will expand its new market to include selective entry into attractive international markets.

Valuation

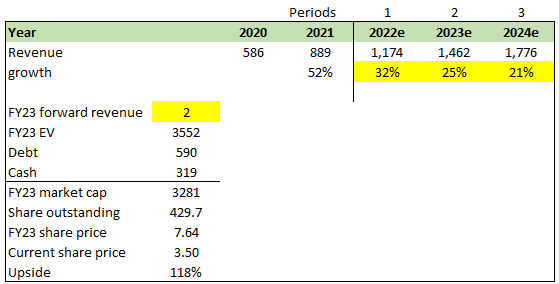

I believe VCSA is worth USD7.6 billion in FY23 representing 118% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s FY22 guidance and consensus estimates until 2024. Something to highlight regarding my expectations here is that management raised its revenue expectations during the 2Q2022 earnings call for FY22, from USD1 billion (in S-1 filings) to a range of USD1.165 billion to $1.185 billion.

- I believe VCSA should definitely trade at a higher multiple than it is today, especially given its expected growth, strong industry tailwinds, and where peers such as Airbnb, Bookings, and Expedia (EXPE) are trading at. However, we do not need a strong inflection in multiples to make good returns here as long as VCSA can continue its growth runway. Hence, I assumed no change in multiple, and any positive re-rating would be great.

GS Investing estimates

Key risks

Constantly refresh and update supply listings

The success of VCSA’s business is contingent on the company’s capacity to entice new homeowners of vacation rentals to join its platform, to cultivate and nurture relationships with its existing homeowners, and to convince those homeowners to give the company permission to list their homes for rent via the service VCSA provides. It is possible that VCSA’s revenue and growth prospects will be considerably and negatively affected if the company’s sales professionals are unable to identify and convert a sufficient number of prospective homeowners accurately. Additionally, homeowners have the power to restrict the number and duration of nights that their properties are available for booking through its services. These procedures are not under VCSA’s direct control at any point. If homeowners do not establish or maintain the availability of their vacation rentals, or if the number of nights sold decreases for a particular period, then I believe that its revenue will decrease.

Travel booking is a competitive business

VCSA’s direct competitors continue to adapt to similar elements of the company’s business model. This may impact VCSA’s ability to differentiate its products and services from its rivals. Because there is a lot of competition, the company may see less demand from homeowners and guests for its platform. This could slow the company’s growth and have a major negative effect on its business operations and finances.

In my assertion, since many of VCSA’s existing and potential competitors are more prominent, they may have significantly more financial, technical, and other resources, which would grant them substantial advantages over their competitors. Larger competitors may also have significantly more resources on hand for the development of their products and services. Because of this, VCSA’s competitors may be able to offer customers a better or more complete product experience and respond more quickly and effectively to new or changing opportunities, technologies, standards, homeowner and guest needs or preferences than VCSA can.

Summary

VCSA is undervalued at its current share price as of the date of this writing. Investors should look into this opportunity to participate in and/or be positive in the bear market while we are still in the last quarter of the year. VCSA’s rental management platform is well-positioned to grow as vacation rentals are becoming more mainstream than hotels. And since pandemic restrictions have been lifted, people have been going places, and demands have rapidly expanded across its diverse multichannel distribution.

Despite stiff competition, Vacasa, Inc. has demonstrated market growth in recent years through a strong value proposition to stakeholders, integrated partnerships with third parties, and expansion into new regions. The business is still in the early days of unlocking a huge total addressable market (“TAM”). Hence, any positive re-rating will be great.

Be the first to comment