pcess609

Brief Review Of Meta’s Q3 Report

For Meta (NASDAQ:META) shareholders like me, the latest earnings report has proved to be an absolute nightmare. Despite recording slightly better-than-expected revenues ($27.7B) in Q3, Meta’s stock cratered by more than ~24% in a single session on Thursday. In this note, we will discuss Meta’s Q3 results and re-evaluate the business in light of new information attained from this report.

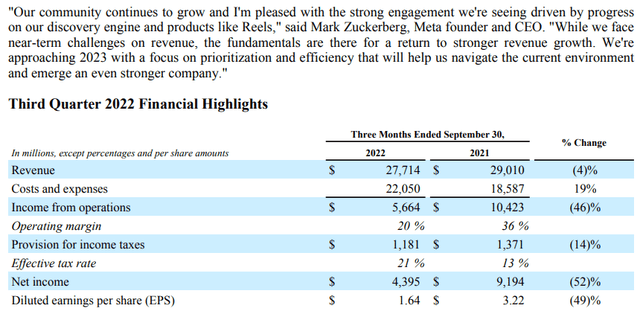

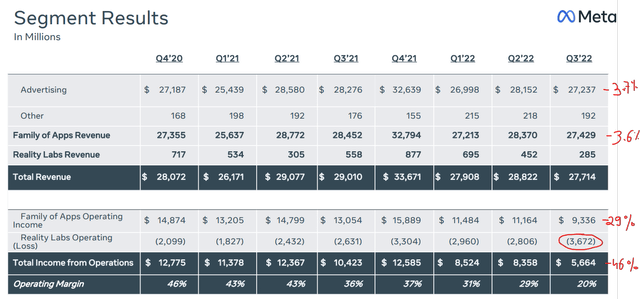

As you can see below, Meta’s revenue continued to decline in Q3 (down 4% y/y), with operating income and EPS plunging significantly. While Meta’s aggressive spending in Reality Labs (metaverse) has been portrayed as the central problem, the weakness in Meta’s core “Family-of-Apps” business is the much bigger issue at hand.

Meta Q3 2022 Earnings Release Meta Q3 2022 Earnings Presentation

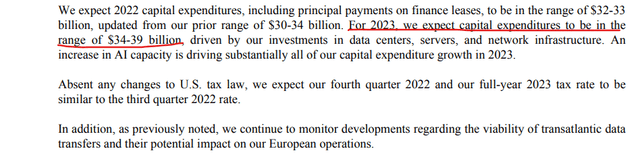

In a tough macroeconomic environment, Meta’s core advertising business is suffering from a vicious margin compression due to Ad prices plunging by 18% y/y. If we look at user and engagement metrics (DAP up 4% y/y and Ad impressions across FoA up 17% y/y), it is clear that Meta’s core social media platforms are still very much robust. The idea that nobody uses Facebook or Instagram, or WhatsApp anymore is simply ridiculous – as nearly 3 billion people are interacting with Meta’s platforms on a daily basis.

As we have discussed in the past, Meta is currently grappling with several headwinds at once – Apple’s IDFA policy changes, greater competitive pressures (from the likes of Tiktok), cannibalization of revenues due to rapid growth of Reels [Meta’s short-form video], and a challenging macroeconomic environment. These headwinds are not just hurting Meta’s top-line numbers (where we have seen two-quarters of negative y/y growth) but also causing immense pressure on the bottom line. Before we discuss the negative reaction to Meta’s Q3 report, I would like you to read TQI’s original investment thesis, where-in we discussed all of the above-mentioned headwinds and their impact on Meta’s near-term financial performance. I think it is fair to assume that the world knew about Meta’s headwinds, and honestly, Q3 numbers were actually stronger-than-expected or at least less worse than feared. Then why is the stock crashing like there’s no tomorrow?

Why Is The Stock Tanking So Hard?

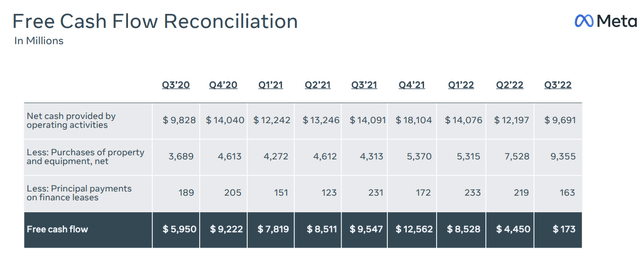

As we know, the single biggest driver of an asset’s price is the discounted value of its future free cash flows. So far this year, Meta’s free cash flow generation has been under pressure, but in Q3, Meta’s FCF nosedived to a meager $173M as the digital ads giant failed to reign in expenses amid a macro-driven slowdown in ad spending. In my view, a shocking drop in free cash flow production is a significant driver of this latest capitulatory move in Meta’s stock.

Meta Q3 2022 Earnings Presentation

That said, a lot of this pain was already priced into Meta’s stock, which was trading at multi-year support levels (from 2018) going into earnings. Here’s what I believe really shook the investor community:

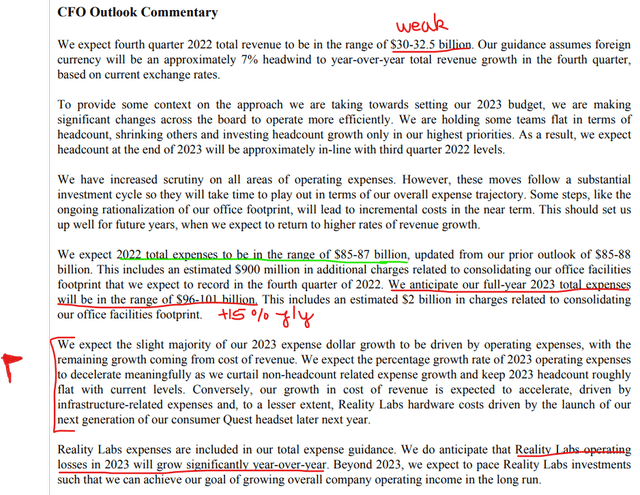

Meta Q3 2022 Earnings Release Meta Q3 2022 Earnings Release

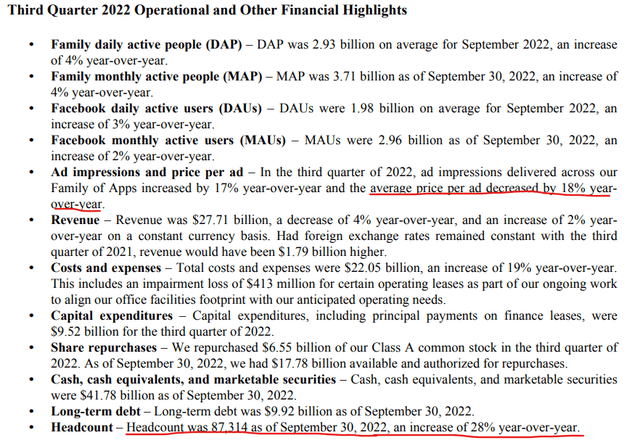

In the face of an impending recession, Meta’s failure to exercise financial discipline is clearly evident in the expense guidance for 2023. Despite recording negative revenue growth for the last two quarters, Meta is about to spend 15% more next year (total expense: $96-101B). This is what shook the investor community. The market was expecting Meta to reduce R&D spending and cut operating expenses (including a reduction in headcount over the coming quarters. However, Mark and his leadership team at Meta are not slowing down their investments.

As an optimist, I like the idea of fighting against the odds, but with its core business struggling to act as a cash cow, Zuckerberg’s metaverse spending spree is a distraction the company could do without. On the earnings call, Mark’s tone was very defensive when questioned on excessive spending, and it seems that he is not bothered with how Meta investors perceive the company’s free-spending ways. Having a strong leader at the helm is good, but with more than 50% voting power, Zuckerberg is virtually untouchable at Meta. The only thing to do here is to get on board with Mark’s vision for Meta and back his executional abilities (buy more and HODL) or sell out and cut losses now.

For 2023, Meta’s management is seeing positive revenue growth (as shared by their outgoing CFO on the earnings call), and I really hope that we do get that re-acceleration next year. However, you and I can’t predict the macro, and ad spend recovery is directly dependent on it. The metaverse is way out in the future and unlikely to have any meaningful impact on Meta’s revenue for several years to come (if at all). Furthermore, if the macro worsens from here, digital advertising spending may continue to drop lower, hurting Meta in the process. Meta’s spending plan for 2023 is so scary that we could see negative earnings next year! Now, Meta’s social media platforms remain robust assets (with more room for monetization – Reels and WhatsApp), which are trading at dirt-cheap levels. Yes, Meta is about to spend $100B next year, but where is all this money going? Will this heavy investment cycle lead to any rewards for shareholders? What’s the ROI for these investments? In truth, I don’t know, just like Mark and his leadership team don’t at this point in time.

While nothing is guaranteed in investing, let’s try to better understand Meta’s spending spree and potential return on this spending before making any investment decisions.

Demystifying The Big Spending Spree

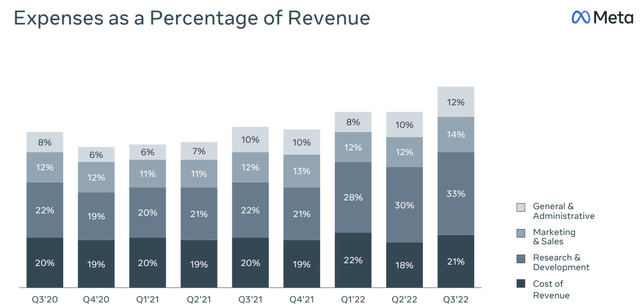

After showcasing scintillating margins in 2021, Meta’s operating margin has dropped from 36% in Q3 2021 to 20% in Q3 2022- ringing the alarm bells for even the most ardent Meta investors. While costs are up across the board, the biggest drag on Meta’s operating margin is the company’s aggressive Research & Development (R&D) spending.

Meta Q3 2022 Earnings Presentation

In order to address its various headwinds, Meta has gone on an insane spending spree. According to Meta’s management, the company is solving for Apple’s IDFA changes and competitors’ (Tiktok’s) rise through the development of a discovery-based AI engine. Honestly, Meta is chucking boatloads of cash at this problem (with major investments coming in the form of infrastructure and people) but has little to show for it thus far. Now, Zuckerberg did say this on the earnings call –

Our AI discovery engine is playing an increasingly important role across our products, especially as advances enable us to recommend more interesting content from across our networks and feeds that used to be primarily driven just by the people and accounts you follow. So this, of course, includes Reels, which continues to grow quickly across our apps, both in production and consumption. There are now more than 140 billion Reels plays across Facebook and Instagram each day. That’s a 50% increase from 6 months ago. Reels is incremental to time spent on our apps. The trends look good here and we believe that we are gaining time spent share on competitors like TikTok.

Furthermore, Meta is focusing its spending on the monetization of WhatsApp and Messenger. And lastly, it is deploying billions of dollars towards the metaverse across four different platforms: 1. Horizons’ World (social metaverse platform), 2. Virtual Reality, 3. Augmented Reality, and 4. Neural interfaces

A lot has been made of Meta plowing billions of dollars into its metaverse (Reality Labs) project, but developing the next-generation computing platform is going to cost a pretty penny. Since the metaverse is unlikely to generate any meaningful results in the foreseeable future, the ROI on these investments is simply unknown. While I don’t know if metaverse is the next big computing platform, I am willing to bet on Mark Zuckerberg due to his excellent history with self-disruption and comebacks.

Contrary to beliefs, Meta’s bleeding is not really down to Reality Labs, which remains a long-term project. A drastic slowdown in core advertising business and margin pressures are driving Meta’s earnings crunch. Now, I found this excerpt from Meta’s Q3 earnings transcript very insightful:

We continue to direct the majority of our investments towards the development and operation of our Family of Apps. In Q3, Family of Apps expenses were $18.1 billion, representing 82% of our overall expenses.

Source: Dave Whener Meta’s outgoing CLO – Meta Q3 2022 ER Transcript

Now, Meta’s spending is probably too much to take for many investors; however, only a small portion of this money is going to Reality Labs (where Meta is building a next-gen computing platform). The funds being allocated to the metaverse project are going to continue to balloon in 2023, and my expectation is that Meta could spend ~$15B on Reality Labs next year.

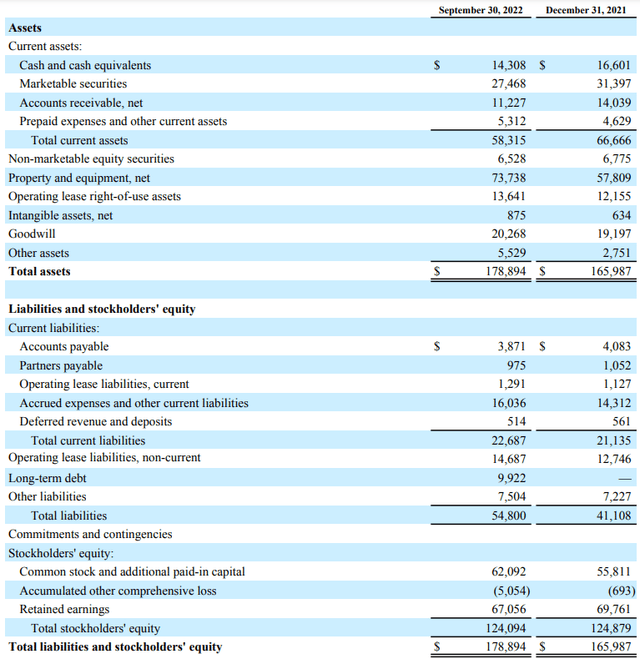

Since Meta’s core business is no longer acting as a cash cow, the company had to dip into the debt market to fund its buyback program. With a net cash balance of ~$31B, Meta’s liquidity positioning looks flawless. I strongly believe that Meta has ample balance sheet strength to survive an economic downturn.

That said, Meta’s buyback is not as solid as it used to be. The biggest issue with Meta’s Q3 report was its expense guidance for 2023, which showed a lack of respect for Meta investors and sheer abhorrence to financial discipline. Now, I know that Meta’s management likes to reduce its expense guide as the year progresses, and we may end up seeing a spend of ~$90-95B. However, even this figure is too high and can only be justified by a re-acceleration in revenues and a strong margin improvement.

Final Thoughts

In my view, Meta’s Q3 report was slightly better-than-expected, and Q4 guidance was not apocalyptic. The biggest issue with Meta right now is its management’s lack of willingness to moderate expenses quickly to protect or boost near-term profitability. Amid a challenging macroeconomic environment, Meta’s aggressive spending plan for next year is scary Poppins, and we could even see negative earnings in 2023 if the macro worsens from here.

With that said, some of Meta’s investments targeted at Reels, WhatsApp, and Messenger monetization should start yielding results in the next 12-18 months. Hence, we may well get a re-acceleration in revenues by the second half of next year or early 2024. Due to heightened business uncertainty, Meta could remain in the penalty box until it shows significant improvement in business fundamentals. After internalizing Meta’s Q3 report, I continue to like their social media assets, and I think we are getting a great deal at these prices. Meta’s products and services are used by 3B+ people on a daily basis, and none of Facebook, WhatsApp, Messenger, or Instagram are going anywhere. Facebook is not MySpace 2.0

The latest downdraft in Meta’s stock looks like a capitulatory move. At ~$250-260B in market cap, Meta is ridiculously cheap. Yes, cheap could get cheaper, as we have seen over the last few quarters; however, the risk/reward situation is still heavily tilted in favor of bulls and too compelling to ignore for long-term-oriented investors.

Key Takeaway: I rate Meta a “Strong Buy” in the $90s.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment