EUR/USD ANALYSIS TALKING POINTS

- Eurozone core inflation surprises higher at 5%.

- EZ GDP echoes dire economic situation in the region.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EURO FUNDAMENTAL BACKDROP

Recent eurozone data has added further complications for the ECB particularly concerning inflation. Core inflation beat estimates (see economic calendar below) hitting the 5% mark, following on from last week’s German inflation print.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EUROZONE ECONOMIC CALENDAR

Source: DailyFX economic calendar

While the December ECB interest rate decision looks to be skewed towards a 50bps hike, rising inflation primarily driven by energy prices which filter down to the core figure make it difficult for the ECB not to consider something more substantial. The opposing argument stems from global recessionary fears, the ongoing energy crisis as well as lesser stimulus making an aggressive monetary policy potential fatal for eurozone consumers. Today’s GDP statistic is reflective of this as both GDP QoQ and YoY show significant declines.

TECHNICAL ANALYSIS

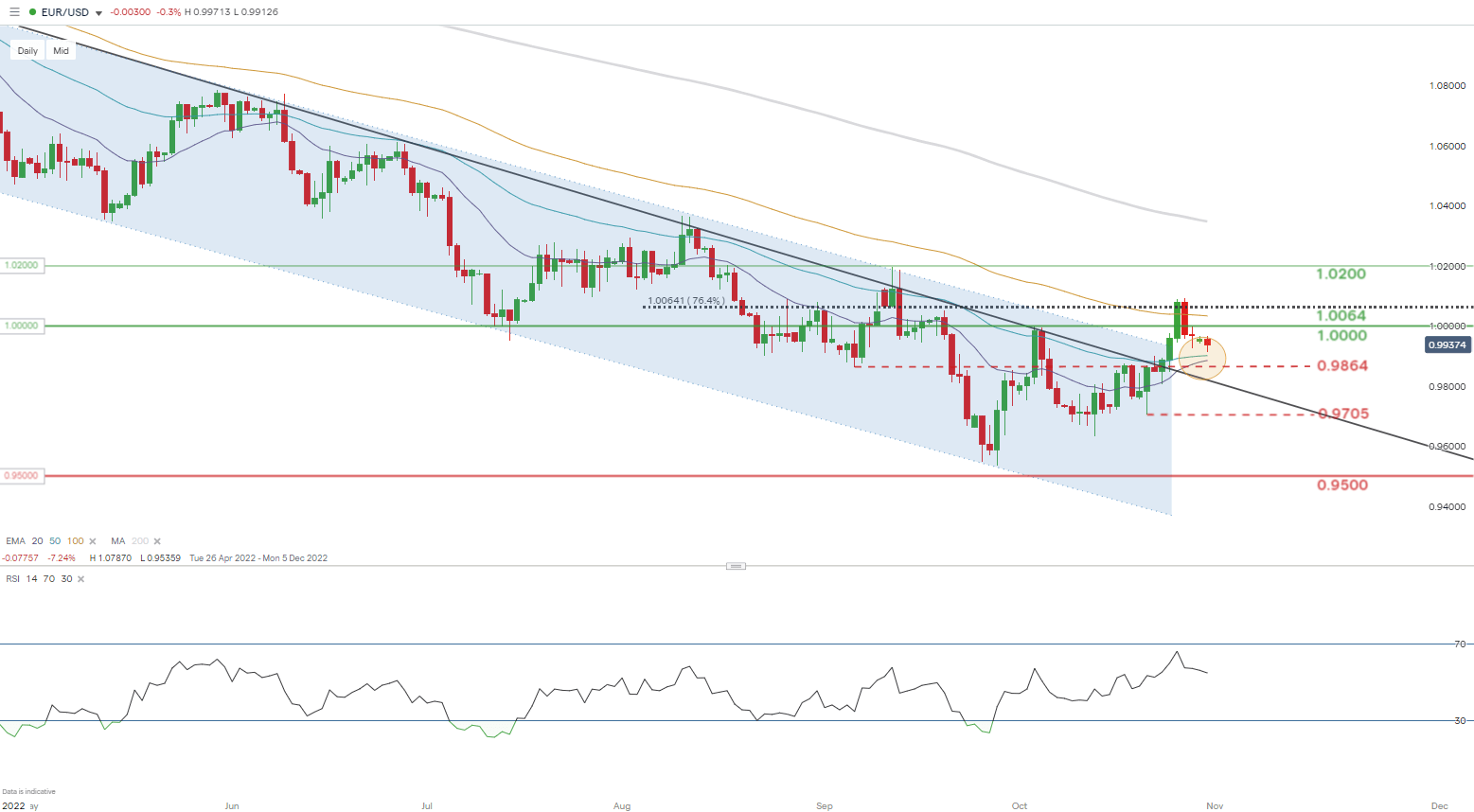

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action showed minimal reaction to the news as markets mull over contrasting viewpoints as outlined above. With greater headwinds facing the region, as well as the inability of euro bulls to maintain prices above parity last week, I favor a downside bias for the pair towards subsequent support zones.

Resistance levels:

- 1.0064 (76.4 Fibonacci)

- 100-day EMA (yellow)

- 1.0000

Support levels:

- 50-day EMA (blue)

- 20-day EMA (purple)

- 0.9864

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 53% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning, we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment