mikkelwilliam/iStock via Getty Images

The SPAC market has been so beaten up that it’s rare to see a de-SPAC deal trading above $10. Eve Holding (NYSE:EVEX) is one such stock in the urban air mobility sector with a promising backlog of eVTOL orders. My investment thesis is more Neutral on the valuation due to the lengthy certification process and non-binding orders for this eVTOL manufacturer.

Order Boost

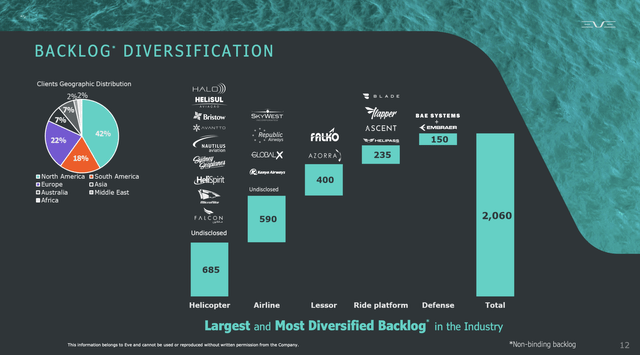

Eve has jumped recently due to some large order announcements with the latest being from Blade Air Mobility (BLDE) to operate in the FlyBlade India joint venture. The JV announced a non-binding order for up to 200 eVTOL aircraft along with Eve’s Urban Air Traffic Management (UATM) software solution.

Eve’s business was formerly part of Embraer S.A. (ERJ), the third largest aircraft manufacturer in the world specialized in the development of regional and executive jets. Eve has a development partnership with Embraer, as the largest shareholder, providing the resources and autonomy to serve the UAM market, but the development program appears behind other industry players.

The key here is that these orders are non-binding, but the deal adds to an already strong backlog of 2,060 eVTOLs. Eve could see a large portion of the orders slip and still hit revenue targets for years with the backlog valued at up to $6 billion.

Source: Eve Aug. ’22 presentation

Just a few weeks prior, Eve announced a $15 million investment from United Airlines (UAL). The airline signed a conditional purchase agreement for 200 four-seat electric aircraft plus 200 options, expecting the first deliveries as early as 2026.

The deal is meaningful in the legacy U.S. airline actually investing cash after being left heavily indebted following the Covid shutdowns. Of course, the deal is conditional and the airline’s financial position could easily leave United unable to push into a flying taxi type service.

Previously, United made an investment in Archer Aviation (ACHR) with a $10 million deposit for 100 eVTOL aircraft. The airline originally announced a deal for up to 400 aircraft likely similar to the deal with Eve.

Valuation Problem

With so many other SPACs trading far below $10 SPAC deal prices, Eve isn’t very appealing trading above $10. The stock has a market valuation of nearly $3 billion before accounting for dilutive warrants exercisable at $11.50 each.

The warrants will provide Eve with much needed cash to fund the development of eVTOLs through a launch targeted for 2026. Other firms like Joby Aviation (JOBY) and Archer Aviation are targeting FAA certification dates in 2024, though any possible difference isn’t holding back customers from making conditional orders with Eve.

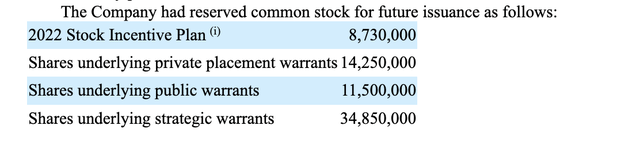

As of the end of Q2, the company has a cash balance of $331 million following the close of the SPAC deal. Eve has a substantial amount of warrants as detailed in the table below. The public and private placement warrants have exercise prices of $11.50 while the strategic warrants have various exercise prices leading to a combined cash boost of over $500 million.

Source: Eve Q2’22 10-Q

Eve produced a minimal loss of $12 million in Q2. The company is burning far less cash than other industry players, but one has to wonder if enough is being invested to hit the markets sooner. The Embraer relationship helps reduce development costs.

Analysts only forecast 2026 revenues of $120 million, though the company has forecast the sale of 75 aircraft and total revenues of $305 million for the year. Of course, the general prediction amongst all of the eVTOL manufacturers is a quick ramp to annual revenues in the billions once global aviation regulators certify new aircraft.

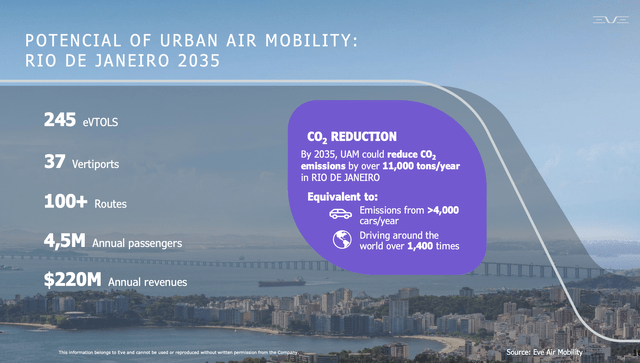

As an example of the scale potential in the UAM market, Eve provided an example of Rio de Janeiro. By 2035, this South American market alone is forecast to support 245 aircraft serving 37 vertiports producing $220 million in annual revenues.

Source: Eve Q2’22 presentation

As the calendar rolls into 2023, the timeline for eVTOL competitors obtaining certification gets closer. As the industry approaches certification and production, the stock market is likely to find these stocks much more intriguing at very low multiples of order books.

For now though, Eve is still far away from reaching production and any of the competitors actually obtaining certification in 2024 will place the company far behind the sector. Eve has the most impressive backlog here, but these non-binding deals could slide when other eVTOL options exist.

Takeaway

The key investor takeaway is that the eVTOL sector remains interesting, but Eve doesn’t offer a compelling investment here above $10 when most industry players trade at a major discount to SPAC deal prices. Investors would be best to wait for time to pass to see if one can acquire shares at a lower price or further de-risked with the certification process farther along.

Be the first to comment