ipopba/iStock via Getty Images

“Canada is not the party. Its the apartment above the party.” – Craig Ferguson

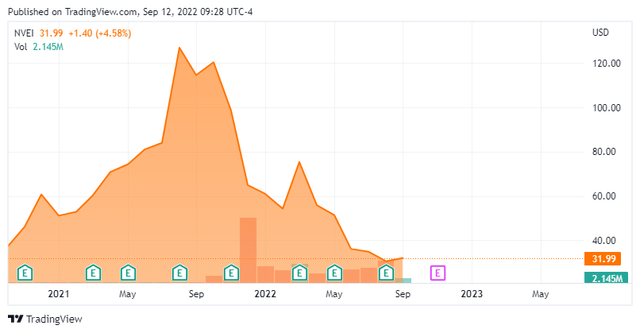

Today, we take our first look at Nuvei Corporation (NASDAQ:NASDAQ:NVEI), a payment solutions provider from north of the border. The company is delivering steady growth and targeting a huge market. However, the equity has declined substantially over the past year. Is the stock now a bargain, fairly priced, or still too expensive at current trading levels? An analysis on this Busted IPO follows.

Company Overview:

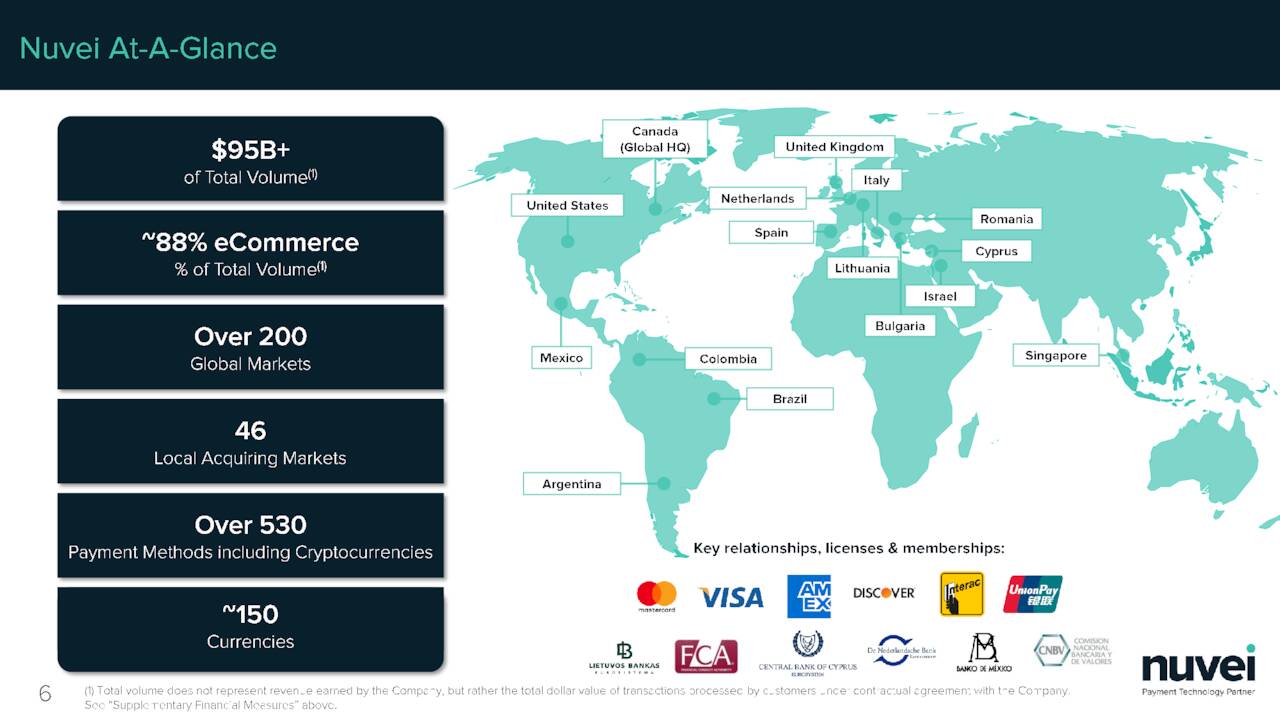

Nuvei Corporation is a payment technology solutions concern based in Montreal, Canada. The company provides a suite of payment solutions to support the life cycle of a transaction across mobile or in-app, online, unattended, and in-store channels to merchants and partners in North America, Europe and across the globe. The company offers a gambit of payment services and has expanded into new markets such as gaming and crypto. The company gets approximately 40% of its overall revenue from North America, with the rest coming from overseas. The shares currently trade around $32.00 a share and sport an approximate market capitalization of $4.5 billion.

March Company Presentation

Second Quarter Results:

On August 9th, the company reported second quarter numbers. The company had a non-GAAP gain of 51 cents a share, a nickel above expectations. Revenues rose over 18% on a year-over-year basis to $211.3 million. That missed the consensus estimate by almost $9 million. However, it should be noted that second quarter revenue was impacted unfavorably by changes in foreign currency exchange rates by $9.4 million.

Total payment volume increased 38% to $30.1 billion from $21.9 billion in the same period a year ago, with ecommerce making up 87% of that total. Free cash flow increased by 11% to $80.8 million from $73.0 million in 2Q2021. Finally, adjusted EBITDA increased 17% to $92.9 million from $79.4 million. Online gaming revenue rose 22% over the same period a year ago and now is at a $25 million annual run rate.

A solid quarter. However, management significantly took down forward guidance (see below) which is what triggered the latest leg down for the shares.

| Three months ending September 30, | Year ending December 31, | ||

| 2022 | 2022 | 2022 | |

| Forward-looking | Forward-looking | Forward-looking | |

| Previous | Revised | ||

| (In U.S. dollars) | $ | $ | $ |

| Total volume(1) (in billions) | 25 – 26 | 127 – 132 | 117 – 121 |

| Revenue (in millions) | 185 – 195 | 940 – 980 | 820 – 850 |

| Revenue at constant currency (in millions) | 195 – 205 | N/A | 855 – 885 |

| Adjusted EBITDA(2) (in millions) | 70 – 75 | 407 – 425 | 335 – 350 |

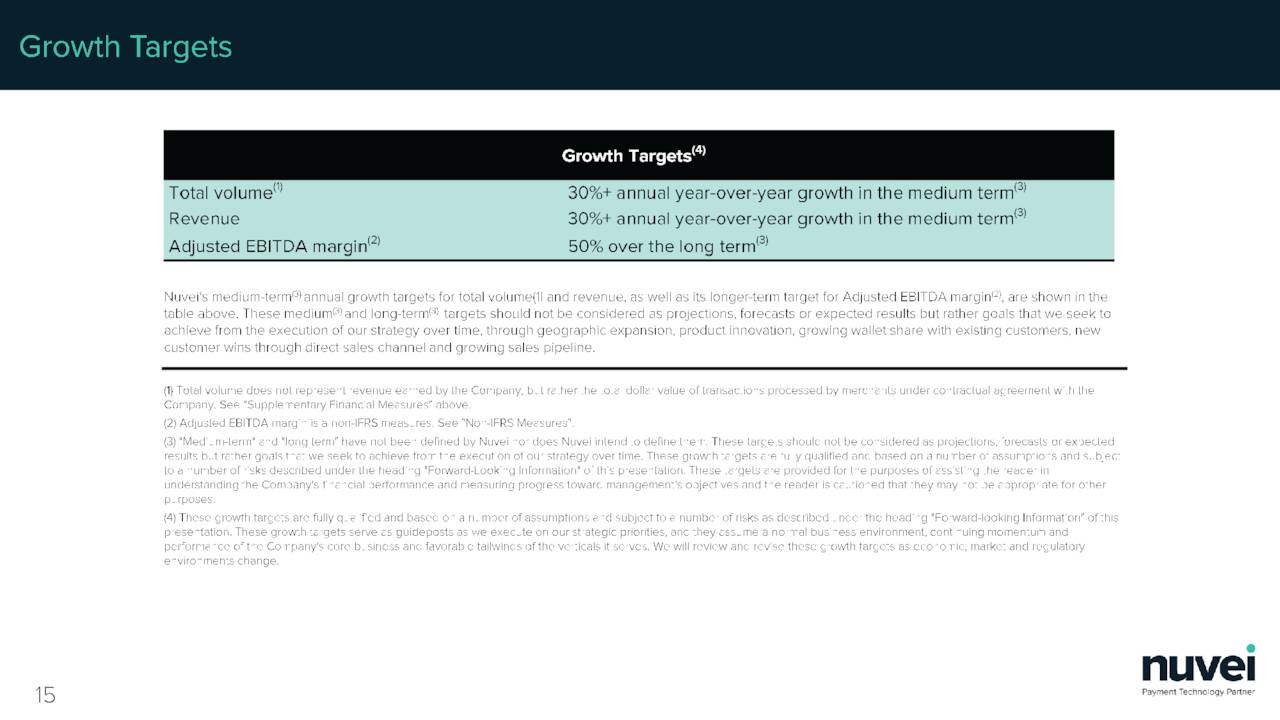

Growth Targets(4)

There are several reasons for these slower growth expectations, which include:

- Lower volume in digital assets and cryptocurrencies than previously anticipated.

- Greater currency headwinds than previously expected from the stronger U.S. dollar.

- The potential impact from higher inflation and rising interest rates, which could increase pressure on consumer spending in the second half of the year.

Analyst Commentary & Balance Sheet:

The analyst community is currently mixed on Nuvei’s prospects. Since its last earnings reports, five analyst firms including JPMorgan and Raymond James have reissued Buy ratings on the stock, albeit three with slight downward price target revisions. Three analyst firms, including Credit Suisse, have maintained Hold ratings on Nuvei. Price targets among the optimists are in the $41 to $83 range and the pessimists in the $37 to $45 a share range.

Just over five percent of the shares are currently held short. At the end of the first half of the year, the company had just over $720 million in cash and marketable securities on its balance sheet. The company has just over $500 million in long-term debt. Free cash flow for the second quarter came in at $163.3 million, up from $133.7 million in the same period a year ago.

Verdict:

The current analyst consensus has Nuvei making just over $1.80 a share in FY2022 as revenues rise a tad over 15% to $838 million. Revenue growth of 18% is projected in FY2023, as earnings rise to $2.30 a share.

March Company Presentation

Revenue growth projections certainly have come down in recent quarters. At the beginning of this year, management and most analysts were predicting 30% sales growth going forward. Those expectations are now in the mid to high teens. As a result of the recent slide in the shares, the stock now is priced at approximately 17.5 times this year’s expected EPS. Equating for the net cash on the balance sheet, the equity is a tad cheaper. The stock based on the second quarter run rate has a free cash flow yield in the high-single digits.

Not quite in the ‘bargain basement‘ yet but not unreasonable. That said, I am not quite ready to nibble on this one yet. However, if the shares dip below $30, I will more than likely establish a small position in this name via covered call orders.

“To survive the Canadian winter, one needs a body of brass, eyes of glass, and blood made of brandy.” – Louis Armand de Lom d’Arce Lahontan

Be the first to comment