xavierarnau/E+ via Getty Images

Newmark (NASDAQ:NASDAQ:NMRK) has been an impressive business over the past decade, increasing revenues over 13x since 2011, a CAGR of 29%, yet this impressive growth and future targets have this stock trading at single-digit earnings. While the commercial Real Estate market is in flux as work from home and higher interest rates alter the market, NMRK has several growth engines that the market appears to be overlooking.

Background

Newmark is a commercial real estate broker offering services, including leasing, where Newmark acts on behalf of CRE (Commercial Real Estate) owners, sourcing tenants for properties, and on behalf of clients looking for space to lease. Newmark generates fee revenue based on the duration and value of the lease.

Newmark’s Capital Markets business is the traditional brokerage business. They act as intermediaries between owners and lenders. Sourcing multiple lenders, filing appropriate documents, and guiding owners throughout the closing process are the primary jobs of a broker. A traditional developer may establish a relationship with a local bank when starting. However, as a former analyst at a CRE Broker, local banks rarely offer the best terms and prices. Brokers have relationships with Life Insurance companies, Wall Street Banks, Fannie Mae & Freddie Mac, and debt funds. These financial institutions generally offer different terms and conditions. Life Insurance companies tended to offer the lowest interest rate but capped the Loan To Value (LTV) around 65%. Wall Street was typically more aggressive, offering higher LTV, but may have asked for escrows and higher upfront payments. The interest savings, higher debt, and looser covenants make NMRK’s services valuable. Additionally, brokers typically have exclusive relationships, meaning the only way to reach specific lenders is through an NMRK broker. NMRK can also broker sales of properties and can act on either side of the transaction, buyer or seller.

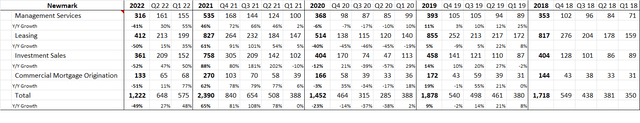

NMRK’s higher margin recurring business segment is its loan servicing portfolio which currently stands at $70.4B. When NMRK brokers a Fannie or Freddie loan, they retain the servicing rights to the loan. Newmark processes monthly P&I payments and yearly check-ups on the property to ensure it’s adequately maintained. NMRK’s servicing portfolio has grown 10% annually since 2015. The table below details NMRK’s revenue by segment since they were spun off from BGC Partners in 2018.

NMRK Revenues (Company Filings)

Thesis

While the commercial real estate market is in a heightened period of uncertainty, the general trend over the past decade has seen the industry grow, with capital consistently flowing into the industry. CRE developers’ core competency is identifying areas underbuilt and needing specific property types. The financial components, day-to-day maintenance, and operations detract from what they do best. Hiring Newmark alleviates numerous tasks and allows developers to focus on their core competencies. It’s the reason you and I don’t fix car problems ourselves. Either it will take several hours to learn and fix the problem, which would have been cheaper to go to a mechanic by the end, or I will damage the car and have to see the mechanic. Sticking to what one does best and outsourcing other aspects can save time and money over the long run. These value add services are NMRK’s specialty, and is why it makes sense for developers and CRE owners to hire them.

While 2020 and Q1 2021 saw a slowdown in business, things have picked up and are returning or exceeding pre-pandemic levels. NMRK’s management services business grew through the pandemic, showing the demand for their services. Many are rethinking their real estate footprint as businesses return to the office. Determining whether they will go complete work from home, hybrid, or fully back in the office should result in above-average leasing activity. Newmark’s leasing business should see an uptick in demand as owners look to lease newly vacant space and employers look to alter and likely downsize. Newmark’s first-hand view of the leasing market should allow them to expedite the leasing process for both parties. An owner that chooses to lease the property themselves risks having the unit stay vacant for an extended period. Hiring a leasing agent that cuts a vacancy from 6 months to 2 months results in net savings for the property owner after factoring in leasing agent fees. As the trend toward outsourcing in the expanding CRE market continues, Newmark’s end-to-end solutions make them a logical choice for CRE owners.

A popular tactic by publicly traded brokers is to poach brokers from smaller firms. A mom-and-pop firm focusing solely on a local area is less appealing than one allowing a broker a larger coverage area. Additionally, the technology and brand recognition with prominent players could bring in larger corporate clients that were once unwilling to partner with smaller shops. The major players CBRE Group (CBRE), Jones Lang Lasalle (JLL), Cushman & Wakefield (CWK), and Newmark have built stellar reputations, carrying weight with potential clients over the years. A company like JP Morgan won’t go with a local broker as they have a global presence. However, they would be far more likely to hire a firm with a global footprint that could offer them a one-stop shop for all their office leasing and maintenance needs.

Reports of Cushman & Wakefield approaching NMRK and acquiring them have surfaced this year. The acquisition makes logical sense. First, the number of repetitive back office jobs that could be eliminated is immense. Second, you would eliminate competition between brokers. One conflict was co-brokering deals resulting in a split fee. Additionally, the servicing costs of a property would decline due to increased regional density. The ability to visit 6-8 properties in a day compared to 4-6 improves the servicing economics. Finally, cross-selling opportunities could exist as brokers offer different services.

Less than 5% of revenues are generated internationally compared to peers who generate 30-50% of revenues outside the U.S. This lack of international presence represents a growth opportunity for NMRK. Newmark’s focus is to grow its international presence in 8-10 markets and generate 10% of revenues outside the U.S. by 2025, leaving ample runway for future growth as they catch up to peers. A few recent acquisitions helped them break into the space, and I suspect this is just the beginning. Given the global presence of many clients, the opportunity to deliver services to existing clients remains low-hanging fruit.

At Newmark’s 2021 Investor Day, management outlined a goal to generate $4.5B in revenues and $900m in EBITDA by the end of 2025. These figures represent 11.6% and 13.7% CAGR from 2021. Approximately 4-6% of this growth will be organic; the rest will come from new hires and acquisitions. CBRE has traded 8-11x EBITDA, CWK 6-10x, JLL 8-11.5x, and NMRK 5-8.5x. Utilizing a 5x multiple gives us an E.V. of $4.5B less ~$300m in net debt is a $4.2B market cap compared to the current market cap of $2.1B. Utilizing the lowest valuation that NMRK has historically traded at still results in a double over the next four years. Utilizing the high end of NMRK’s historical valuation yields an E.V. of $7.6B and a market cap of $7.3B. The answer is likely in the middle, but if management can execute its plan, it’s clear that NMRK is undervalued at these levels.

Balance Sheet

NMRK was spun off from BGC Partners in 2018 with ~$400m in net debt. Today, due to the monetization of NDAQ shares, Information about this event can be found in our investor letter here; Net debt is close to $270m. In 2021, NMRK generated ~$600m in EBITDA resulting in less than a 0.5x debt to EBITDA. The variable expense structure results in a business model that can handle some leverage as a lower expense base offsets declines in revenues. I think NMRK is currently underleveraged and should operate around 1-1.5x debt to EBITDA and could go up to 2.5x should an attractive acquisition present itself.

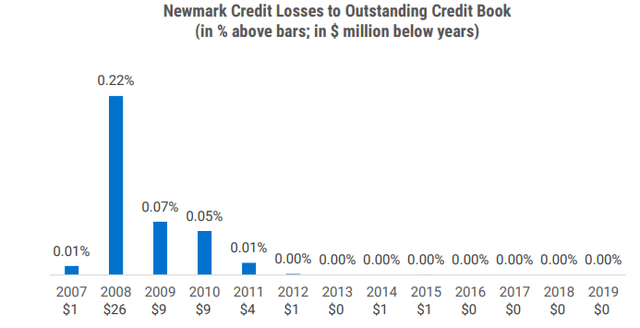

NMRK has almost no credit risk associated with its business. If a mortgage they brokered to Fannie Mae goes into forbearance or foreclosure, Newmark shares credit losses on a pari passu basis with Fannie Mae (weighted average loss sharing is approximately 29%) on its $20.8 billion portfolio (2019 figure). In the event of an actual credit loss, all losses are allocated between the two parties based on the contractual loss-sharing arrangement. The graph below shows the historical credit losses. As you can see, this business has minimal credit risk.

NMRK Credit History (NMRK Investor Presentation)

Risks

A few short-term risks and one long-term risk exist. The near-term risks for the company are apparent. Higher interest rates have a two-pronged effect. First, those with existing debt on a property are unlikely to refinance early as the interest rate on the current debt is lower than what they would receive for a new loan. Second, higher interest rates push up cap rates. Higher cap rates can lower the value of a property. During the sale or financing of a property, the revenue generated by NMRK will be less as NMRK generates a fee based on the value of the loan or sale. An add-on risk is that new brokers brought on by NMRK are coming into a very challenging market. Getting one’s book of business up and running when credit is tightening, and volumes are declining is not an easy market to enter. I suspect the turnover of new hires is elevated compared to historical rates as more leave the industry due to the inability to generate enough business.

The primary long-term risk is one that I have spoken about at length in previous investor letters found here. Howard Lutnick is Chairman of NMRK and has majority voting rights due to his Class B share ownership entitling him to 10 votes per share. Mr. Lutnick holds additional partnership interests in Cantor, which, through its and CFGM’s ownership of Class B common stock shares, controls approximately 57.1% of the total voting power of the outstanding Newmark common stock as of June 30, 2022. Howard essentially has the power to do whatever he wants, which, as we saw with the bonus payment at the end of 2021, is something he takes advantage of. With this risk in mind, and noting that Howard also owns 61m Class A shares, there is only one conceivable way for him to monetize his position: a sale of the business. This potential takeout should put a floor in stock valuation. While on the one hand, it’s challenging to trust Howard, given his history of abusing power. He’s created several billion-dollar businesses. Whether or not he looks out for minority shareholders is one thing. However, I suspect he will maximize the value of his position, which minority shareholders would benefit from as well.

Summary

Newmark’s lack of presence in international markets provides them with a source of revenue growth that other brokers do not have. As consolidation occurs in the space, NMRK is a potential acquisition target as they are the smallest of the big five CRE brokers, and Howard Lutnick’s significant ownership stake is likely only monetizable through a sale. As long as Howard does not exploit minority shareholders and management executes their plan, NMRK seems dramatically mispriced and should perform well over the long term, given the current non-demanding current valuation. Metrics to monitor over time are Revenue Per Broker, International Revenues, and the value of the Loan Servicing Portfolio.

Be the first to comment