Darren415

Gannett Co., Inc. (NYSE:GCI) recently announced a cost reduction program, which will likely help enhance future free cash flow numbers. With this in mind and the fact that GCI’s distribution network is among the largest in the industry, GCI’s subscribers will likely be successful. I designed a few discounted free cash flow models, and obtained a valuation that is significantly higher than Gannet’s stock price. Under a conservative case scenario, I believe that the fair price could stand at $5.5. I dislike the competition from self-publishing tools. Besides, covenant agreements signed by management may limit future options. With that, current risks don’t seem that worrying.

Gannett: Massive Distribution Network And New Cost Reduction Program

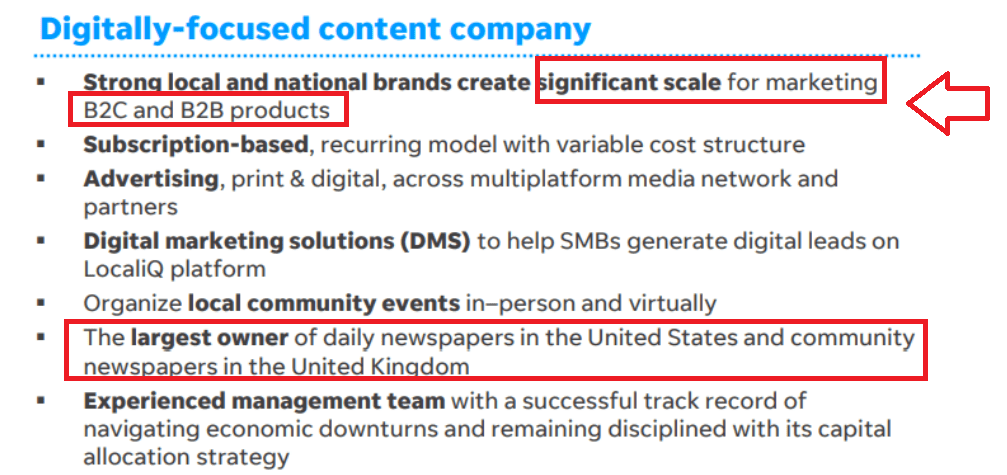

Subscription-led company, Gannett Co. is using know-how accumulated in the traditional print media business to form a digital marketing platform.

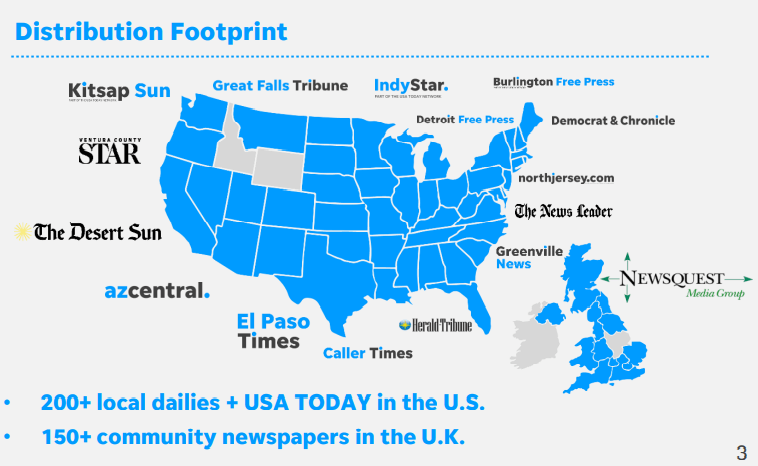

There are two very relevant things that make Gannet quite unique. First, we are talking about the largest owner of newspapers in the United States, which, in my view, would offer significant scale for marketing in the digital area.

Source: Presentation

Keep in mind that new advertising campaigns or subscribers programs, with the current distribution network, could be very profitable. The number of markets that Gannet can target is quite significant.

Source: Presentation

The other relevant news that will likely interest readers is the reaction to the quarterly report. Management recently enacted a significant cost reduction program. In my view, it is very positive that Gannet decided to react quickly to the new deteriorating economic environment. If the company lowers its cost structure and makes it more variable, potential future losses will likely be smaller. Besides, in the long term, future EBITDA margins and free cash flow margins will likely be enhanced.

Market Estimates Include Free Cash Flow Growth From 2023 And Positive Net Income In 2024.

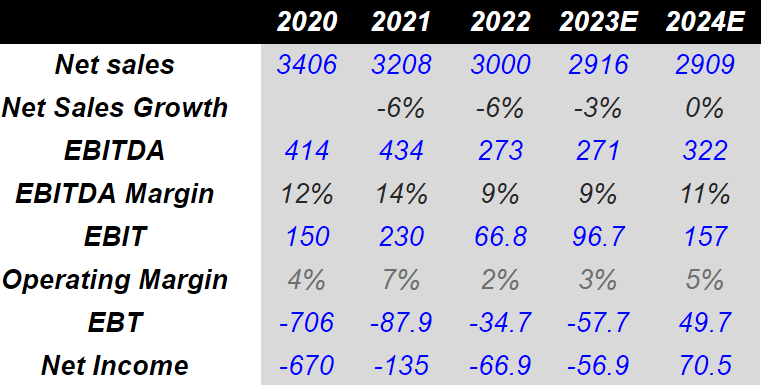

While sales growth is not expected to be that significant, Gannet’s EBITDA margin is expected to remain around 9% and 11% in 2023 and 2024, respectively. Besides, analysts believe that the net income would turn positive in 2024. In my opinion, as soon as more traders learn about the incoming net income, the demand for the stock will increase.

MarketScreener

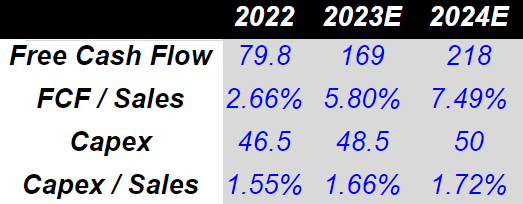

It is also worth noting that the FCF/sales margin is expected to grow from 2.6% in 2022 to 7.49% in 2024. Finally, the capex/sales is expected to represent close to 1.5% and 1.72% in 2022 and 2024, respectively. Free cash flow will not grow because of a reduction in capital expenditures.

MarketScreener

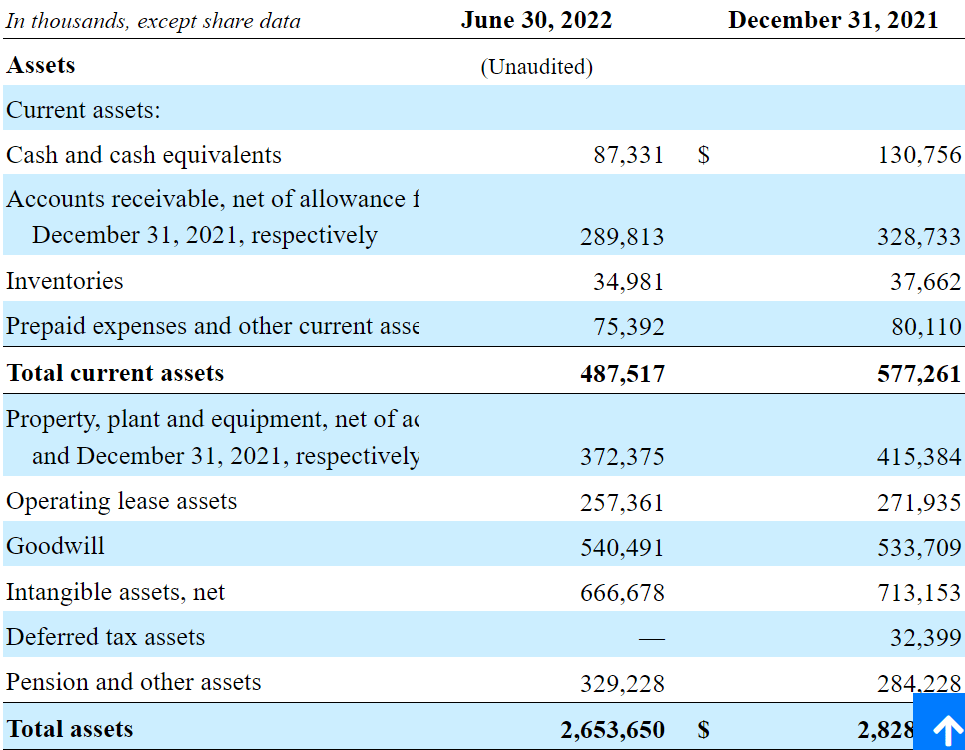

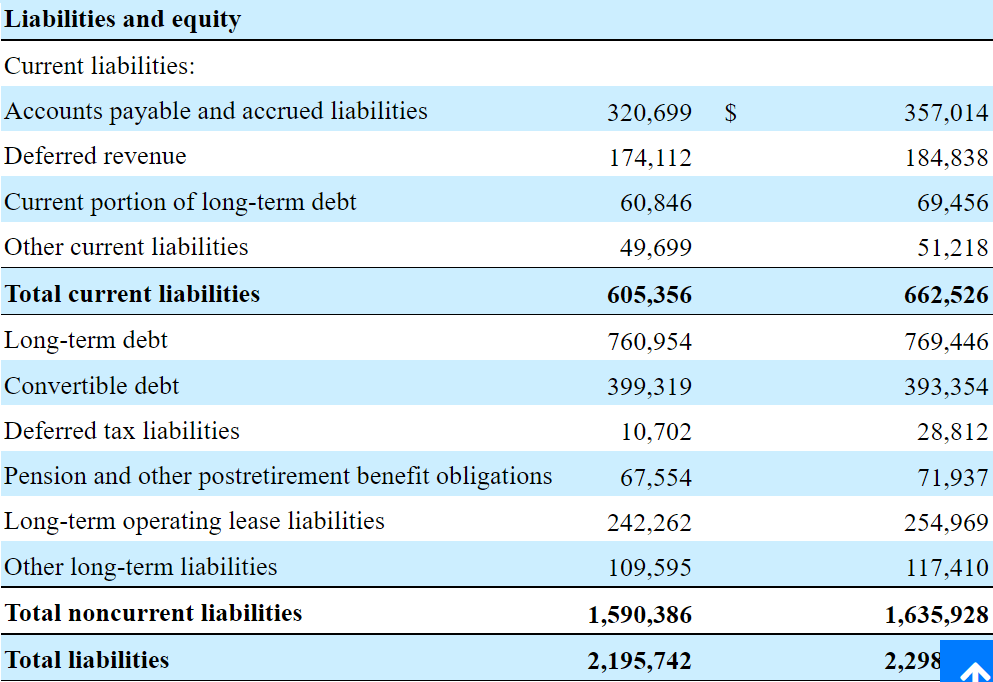

Balance Sheet

Gannet reports $87 million in cash, goodwill worth $540 million, and $2.6 billion in total assets. The asset/liability ratio stands at close to 2x, so I am not really worried about the total amount of liabilities.

10-Q

With that about the asset/liability ratio, let’s note that the total amount of debt is not small, which may not be appreciated by certain investors. Long-term debt stands at $760 million, and convertible debt is equal to $399 million. I obtained net debt close to $1.1 billion, which is close to 3x-4x Gannet’s forward EBITDA. In my view, as soon as new free cash flow increases in the coming years, the total amount of debt will likely decrease. As a result, I believe that Gannet may benefit from a decrease in the cost of capital. The weighted average cost of capital would decrease.

10-Q

More Digital Subscription Offerings And Full Transformation Into A Digit Agency Could Mean A Fair Price Close To $5 Per Share

I do believe that Gannet’s subscription-led business strategy will most likely enhance free cash flow generation in the coming years. Keep in mind that management is transforming the business model from a traditional print media business to a digital marketing platform. In my view, management has a lot of work to do.

Gannett is committed to a subscription-led business strategy that drives audience growth and engagement by delivering deeper content experiences to our consumers, while offering the products and marketing expertise our advertisers desire. The execution of this strategy is expected to allow the Company to continue its evolution from a more traditional print media business to a digitally focused content creator and marketing solutions platform. Source: 10-K

In line with my previous lines, in my view, the more subscription offerings Gannet offers, the larger the target markets. More significant target markets will likely bring revenue growth and perhaps economies of scale.

As part of our digital subscriber growth strategy, we expect to continue to develop and launch new digital subscription offerings tailored to specific topics and audiences. Source: 10-k

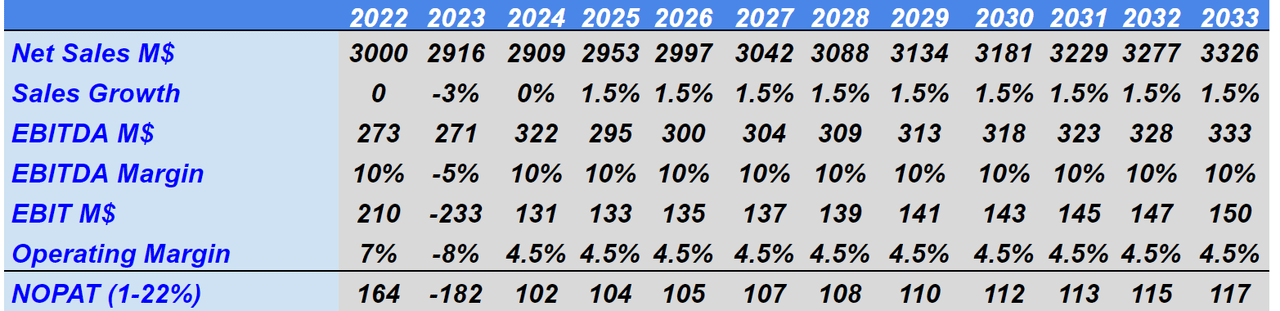

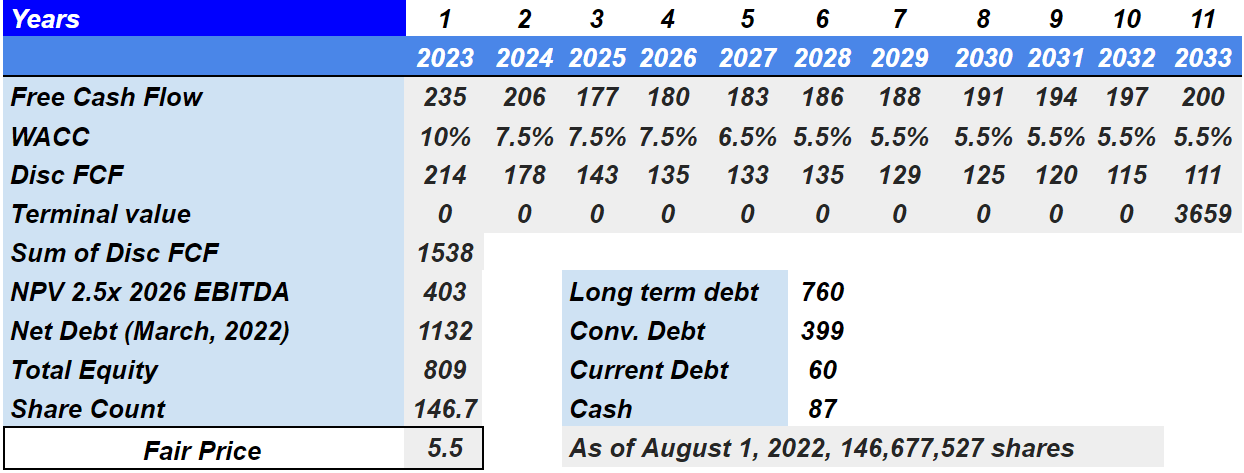

If we remain very conservative about Gannet, sales growth around 1% and 1.5% from 2025 to 2033 would make sense. I also assumed an EBITDA margin of 10% and operating margin close to 4.5%. The results include 2033 NOPAT close to $117.1 million.

Chatool’s DCF Model

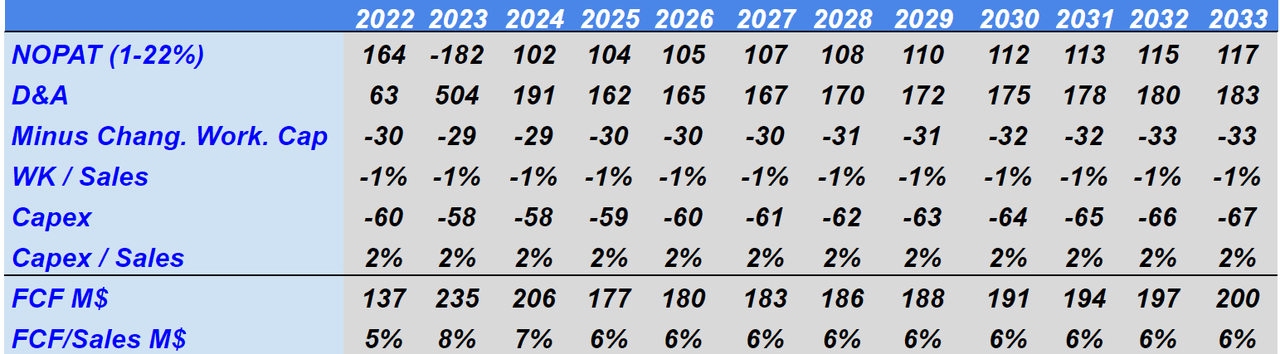

If we subtract changes in working capital around $30 million and capital expenditures close to $60 million, and add D&A, 2033 FCF would be close to $200 million.

Chatool’s DCF Model

Now, with a WACC between 10%-5.5%, an exit multiple of 2.5x EBITDA, and net debt of $1.132 billion, the fair price would stand at around $5.5 per share. With these figures and the recent stock price in mind, I believe that Gannet’s stock valuation could improve significantly.

Chatool’s DCF Model

Risks From Self-publishing Tools, Less Visitors, And Covenant Agreements Could Lead To $1.3 Per Share

Gannet currently suffers from the emergence of user-generated content platforms where distributing content is significantly cheaper. If the company does not find any alternative to compete with these platforms, I would expect a significant decline in Gannet’s pricing. As a result, if profitability declines, the stock price could do so.

Other digital platforms and technologies, such as user-generated content platforms and self-publishing tools, have reduced the effort and expense of producing and distributing certain types of content on a wide scale, allowing digital-only content providers, customers, suppliers and other third parties to compete with us, often at a lower cost. Source: 10-k

The company gives a lot of materials to subscribers, and non-subscribers receive a small amount of free content. If the company continues to do so, perhaps the number of visitors would decline, which may lead to decline in revenue growth. Management made a comment about this possibility in the annual report.

A key element of our consumer strategy is growing our paid digital-only subscriber base, which may lead to declines in our existing advertising revenue. In the short-term, this strategy may reduce the number of unique visitors accessing our content and, in turn, reduce our digital advertising revenue. Source: 10-k

Gannet could also suffer significantly from restrictions imposed by debt investors. Keep in mind that management agreed to sign several debt covenants, which may limit the number of corporate actions of Gannet. The limitations may reduce future sales growth and the free cash flow margins:

The terms of our indebtedness impose significant operating and financial restrictions on us: a requirement to maintain minimum liquidity of $30 million at the end of each fiscal quarter, and restrictions limiting our ability to, among other things, incur additional indebtedness, make investments and acquisitions, pay certain dividends, sell assets, merge, incur certain liens, enter into agreements with our affiliates, change our business, engage in sale/leaseback transactions, and modify our organizational documents. Source: 10-k

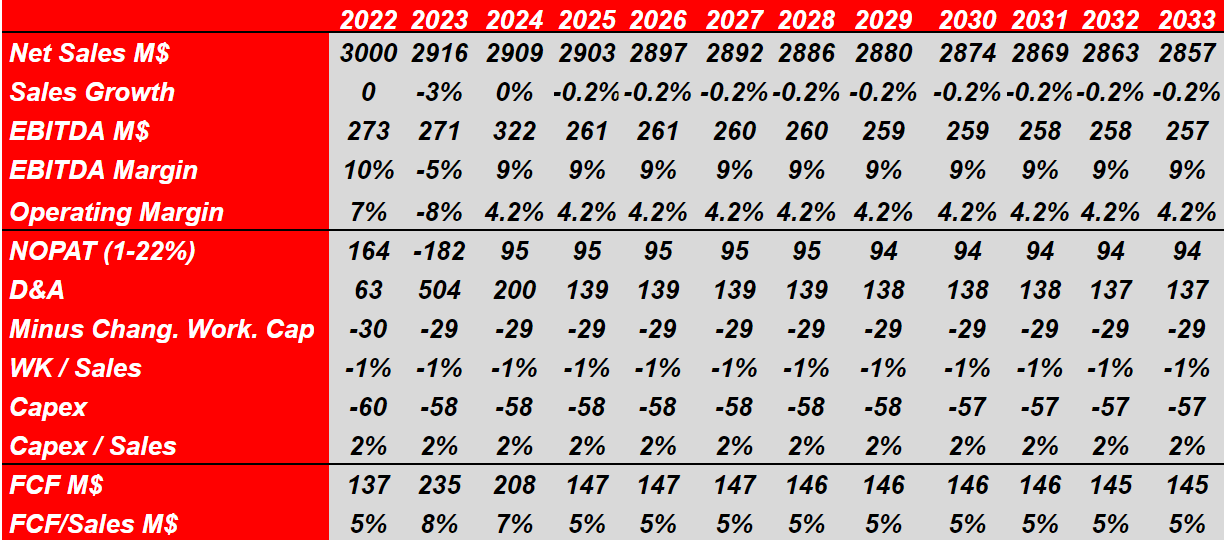

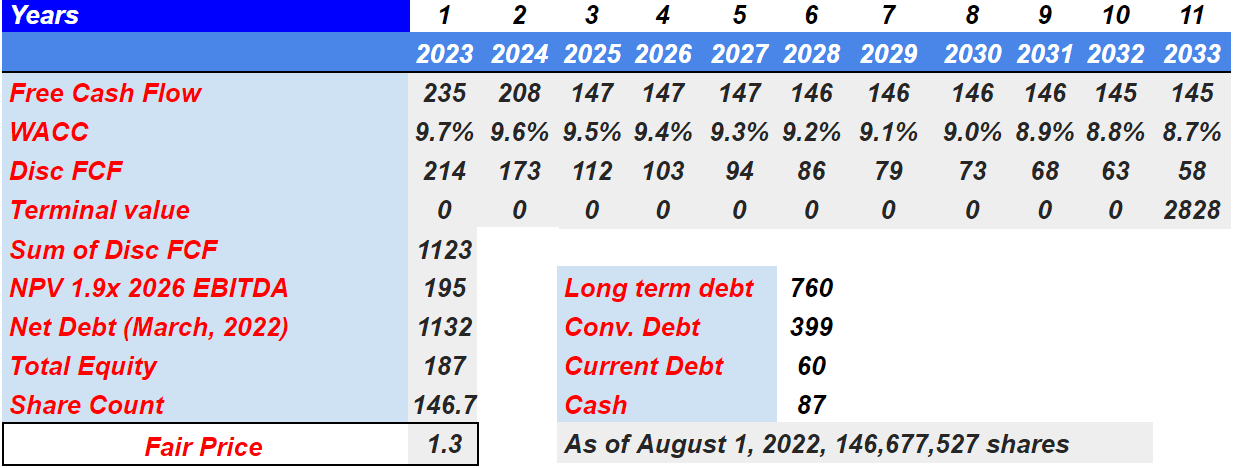

Under the previous risks, I used sales growth close to -0.2% y/y, an EBITDA margin of 9%, and operating margin of 4.2%. Also, with working capital/sales of -1% and capex/sales of 2%, I obtained free cash flow around $137 and $145 million. The FCF/Sales margin would stand at 5%-8%.

Chatool’s DCF Model

With a somewhat declining cost of capital from 9.7% to 8.7%, an exit multiple of 1.9x, and net debt around $1.132 billion, total equity would stand at $187 million. The fair price would be $1.3 per share.

Chatool’s DCF Model

My Takeaways

With a new cost cutting program in place and a massive distribution network, the new Gannet’s subscription-led business strategy could be quite successful. The fact that the company is implementing a new cost cutting program may also enhance profitability in the coming years. Using conservative figures and some future expectations from other analysts, I obtained a fair valuation of $5.5 per share. So, I believe that the stock is undervalued at its current price mark. There are risks from self-publishing tools, less visitors, and covenant agreements, but I wouldn’t worry much about those.

Be the first to comment