Wachiwit

Investment Thesis

Since my previous article on Sea Limited (NYSE:NYSE:SE) was published, I received lots of positive comments as well as feedback, particularly on SeaMoney, or SeaBank, the fintech arm of the company. That prompted me to look further into its progress, and this will also be the content for this article. For those unfamiliar, SeaBank Indonesia and Philippines published their own separate financial statements. Note that throughout this article, I will be using “SeaBank” and “SeaMoney” interchangeably.

As mentioned in my previous article, my primary thesis lies in that, contrary to what most investors are saying, I strongly believe that SeaMoney can become an increasingly meaningful driver of the company’s total revenue in the future. Hopefully, at the end of this article, you can understand why.

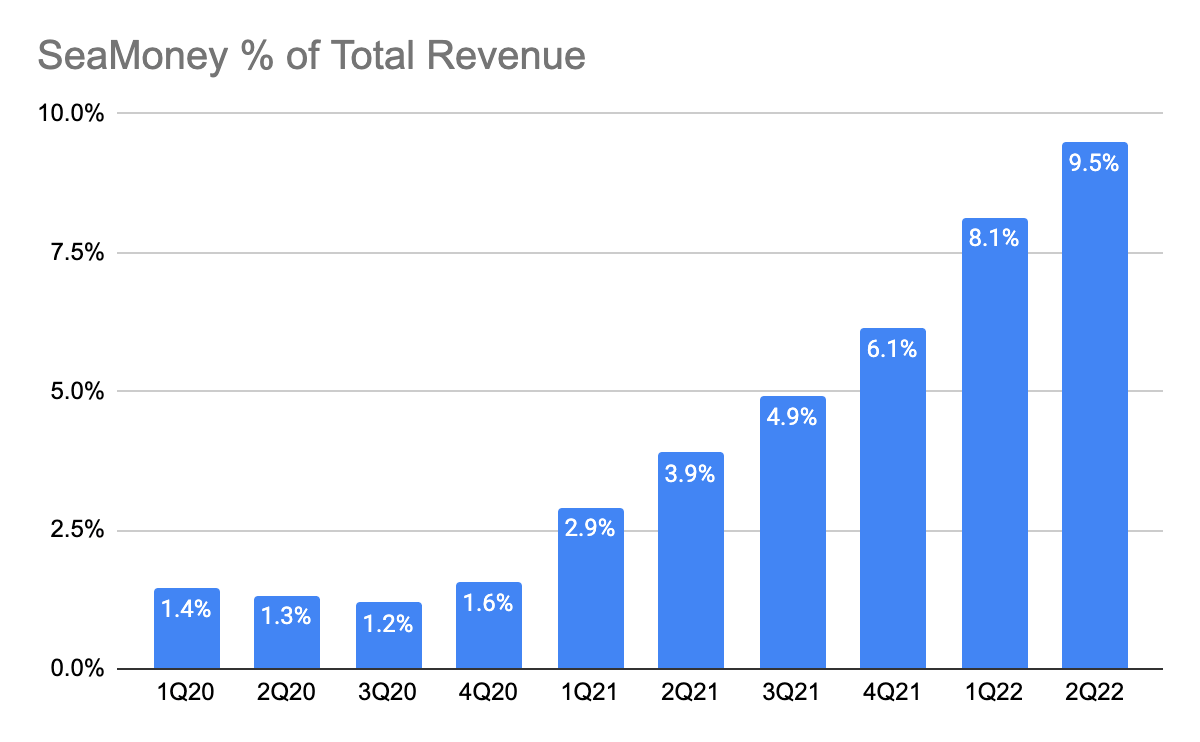

SeaMoney % of Total Revenue

Sea Limited 2Q22 10-Q

In my last article, I pulled out this chart to illustrate how quickly SeaMoney’s revenue has been growing, from 1.3% in 2Q20 to 9.5% in 2Q22. This is within a span of 2 years, which in my view, is a great testament to the management’s execution. However, I failed to dive deeper into what is actually driving this revenue. To do so, it is critical to first understand SeaBank’s products and services and how it is earning its revenue.

Context

Back in June 2019, The Monetary Authority of Singapore (MAS) announced that it will be issuing digital bank licenses, with Sea Group being one of the applicants. Fast forward to Dec 2020, it was successfully awarded the license in Singapore, alongside Grab (NASDAQ: GRAB) and Singtel (SGX: Z74) (Grab-Singtel).

Apart from that, the company has also been making moves in other markets. In Oct 2020, it acquired Banco Laguna and renamed it SeaBank Philippines, and in Jan 2021, PT Bank Kesejahteraan Ekonomi was acquired and renamed SeaBank Indonesia. Most recently, in April 2022, Sea Group was also awarded the digital banking license in Malaysia. As a note, it had not begun its operation in Singapore and Malaysia yet.

From all of these, the management expressed their strong desire to operate (and hopefully succeed) as a digital bank, although competition is heating up with the influx of new entrants and with traditional banks adapting by offering digital financial services to their existing customers. For instance, GoTo (IDX: GOTO) acquired 22% stake in Bank Jago, Bank BTPN (IDX: BTPN) launched Jenius to offer digital bank services to customers, Bukalapak’s (IDX: BUKA) 11.5% stake in Allo Bank, Grab-Singtel acquired 32% stake in Bank Fama International.

SeaBank’s Products and Services

SeaBank Indonesia FY21 10-K

SeaBank has a few core products and services, including deposit and loan products. Whereas GoTo’s Bank Jago, and Latin America (LatAm) peers, such as NuBank (NU) and Mercado Pago (MELI), have additional products including insurance, credit & debit cards, and investments, which I reckon SeaBank will launch in the future. If we were to track its job hiring on LinkedIn, we can see that they are hiring for numerous positions in insurance.

Self-Financing Model

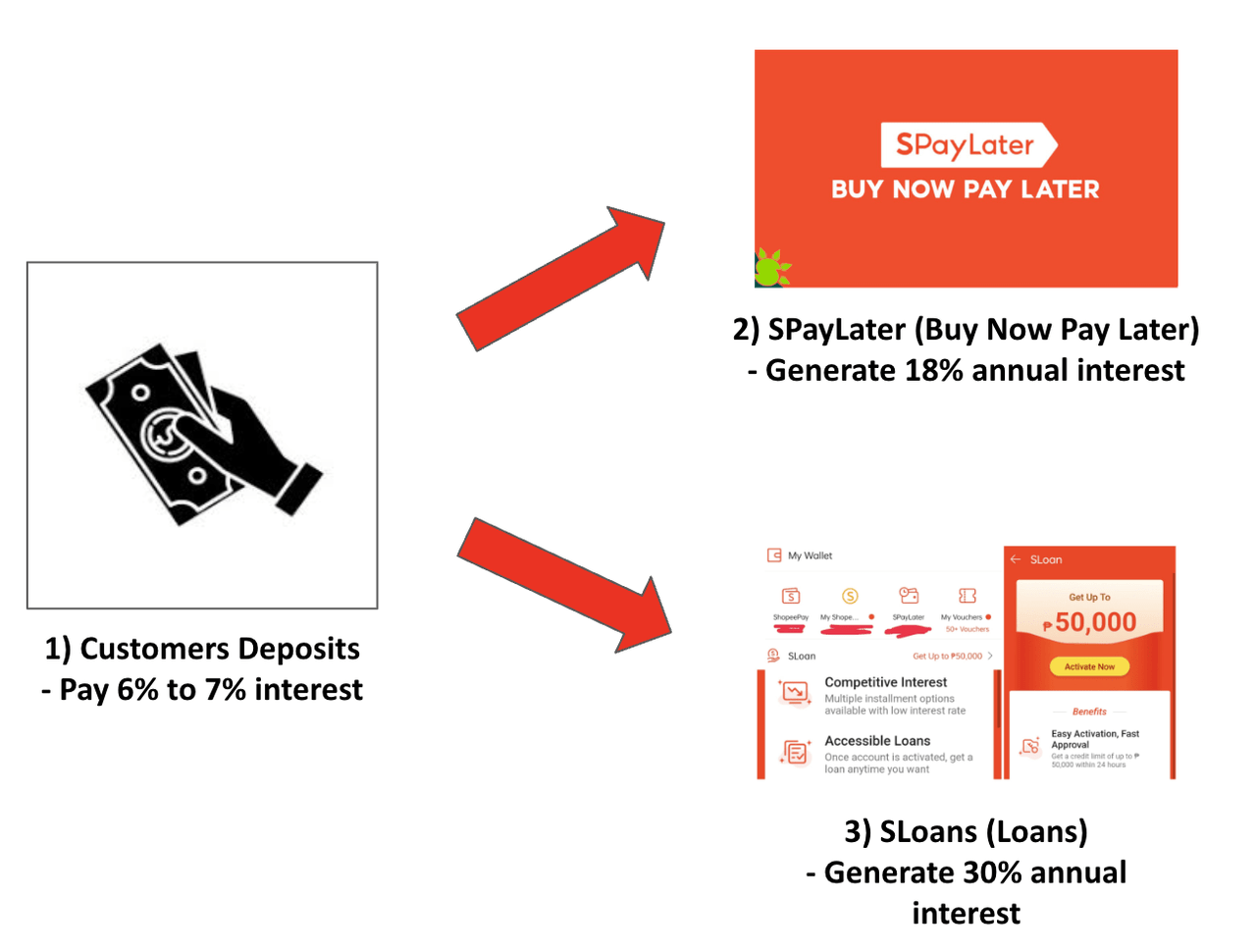

Author’s Image

So, why offer deposits and loan products first? Like most players, SeaBank follows a common playbook. It takes customers’ deposits, pays them an interest of roughly 7% (i.e. interest expense), and packages them into loans to offer to customers at higher interest rates (i.e. interest income). The difference between interest expense and interest income is the net interest income (NII).

SeaBank offers loans through SPayLater, which is Shopee’s Buy-Now-Pay-Later (BNPL) payment method, and SLoan. Referencing SPayLater article here, it charges a 1.5% monthly interest, and annually, that’s equivalent to 18% interest rate (1.5% * 12). And over here, SLoan charges 1% to 5% monthly interest, and that is equivalent to a 30% annual interest rate (2.5% * 12).

This is a very effective self-financing model in which customers are funding its business. Unlike SeaBank, peers such as GoTo and Grab-Singtel do not have full ownership of the banks, and therefore, they are not entitled to 100% of the profits earned. This is one of the few key distinctions between SeaBank and its peers in Indonesia, and it is a powerful competitive advantage.

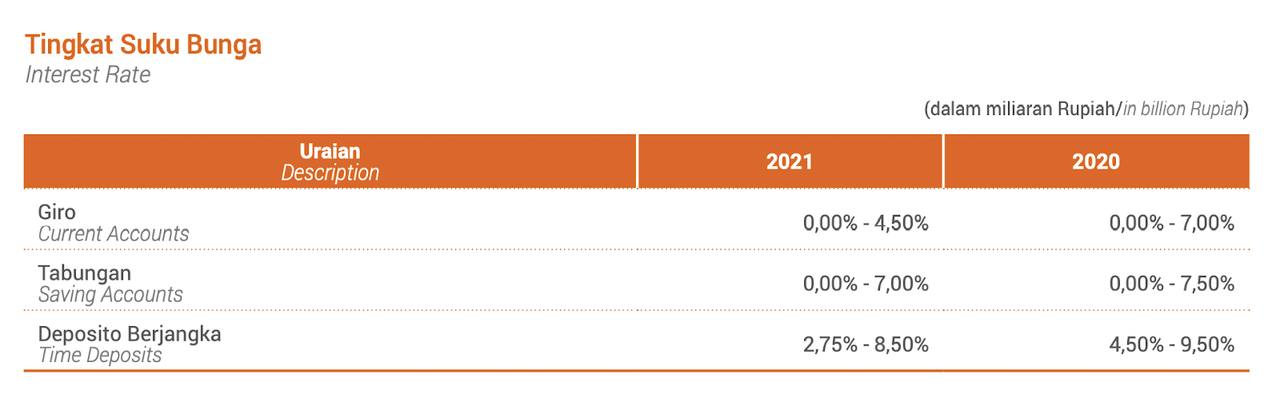

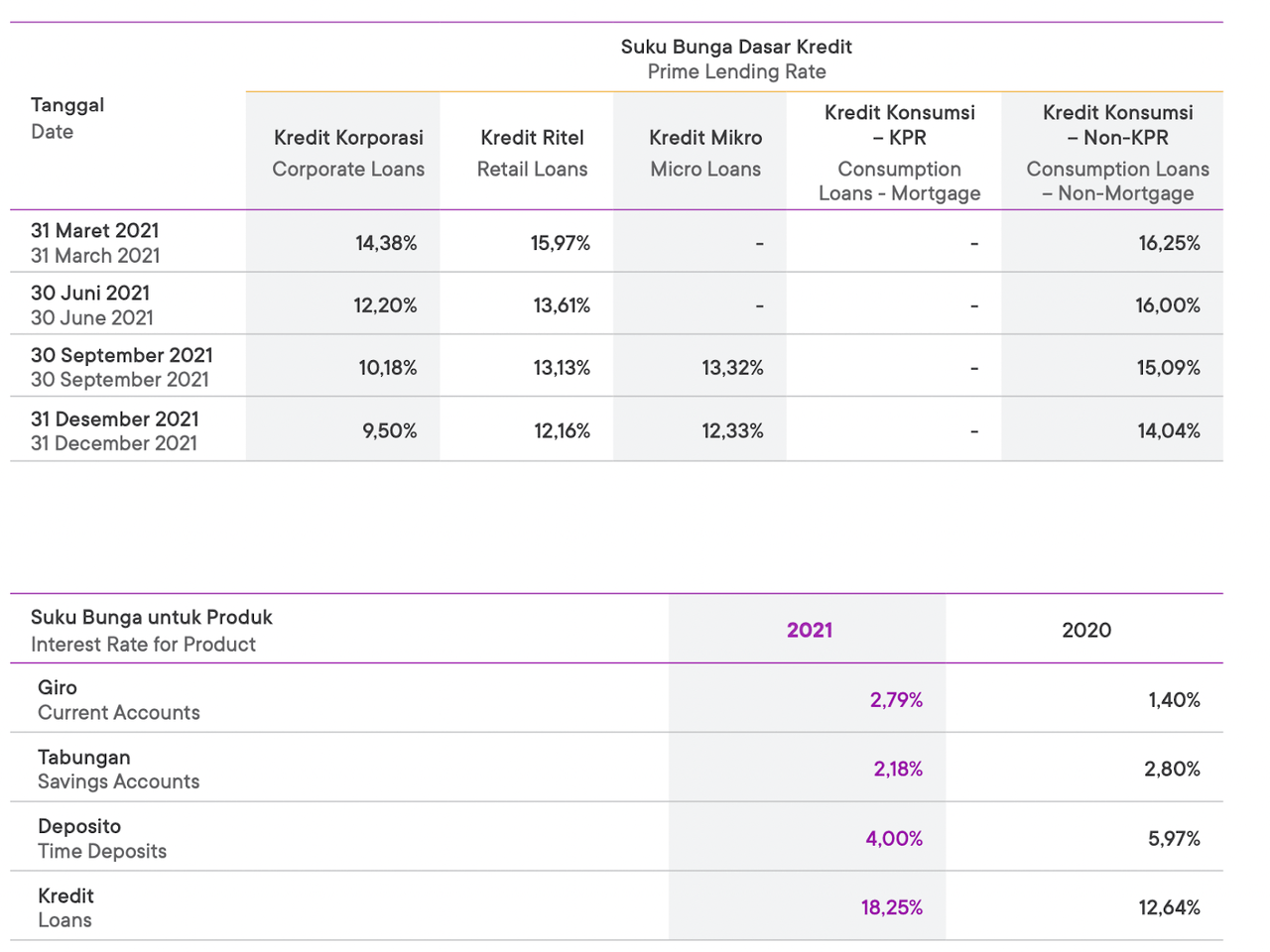

SeaBank Indonesia FY21 10-K

SeaBank Indonesia FY21 10-K

SeaBank has 3 types of customer deposits – current accounts, saving accounts, and time deposits, and they are offered at varying interest rates. SeaBank Indonesia’s current accounts and savings accounts (CASA) account for a higher proportion of its total revenue, primarily because CASA is a cheaper source of financing as the interest rate paid is lower than time deposits, which allows SeaBank to generate higher NII and net interest margin (NIM).

Bank Jago FY21 10-K

SeaBank competes aggressively by offering higher interest rates (as high as 7%) than competitors to acquire and encourage users to store their money in their accounts. Apart from that, they also further entice users through features such as no minimum balance and daily interest payments. In comparison with GoTo’s Bank Jago, its interest rates are lower than SeaBank’s. Bank Jago has responded by offering a promotion in Aug 2022 that is as high as 7%, and in addition, GoTo’s Tokopedia also launched its own BNPL solution.

SeaBank Indonesia – Accelerating Growth In Deposits and Loans and Profitability

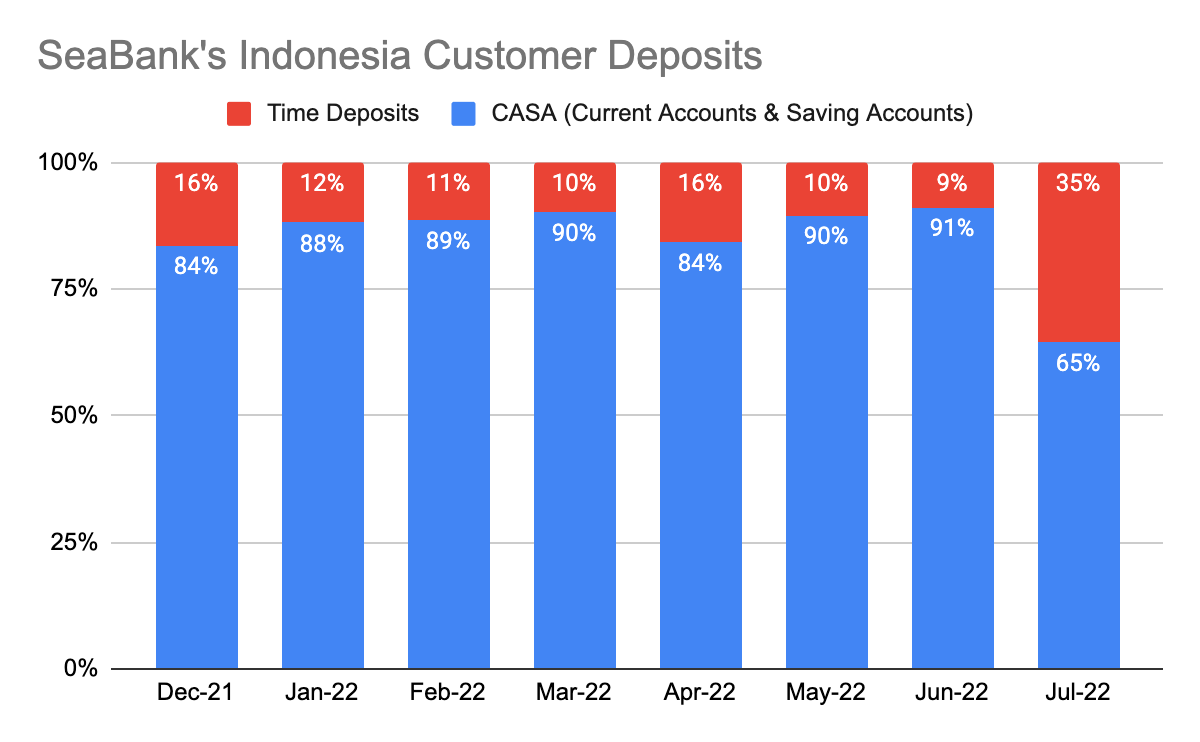

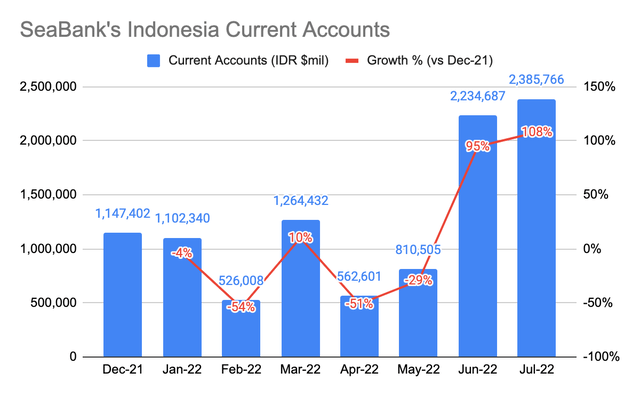

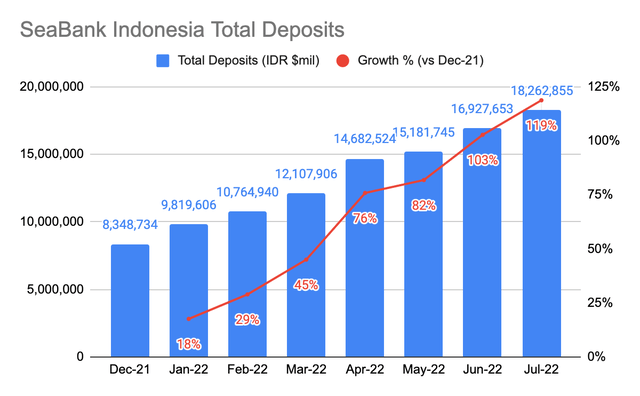

SeaBank’s Indonesia Monthly Financial Statements

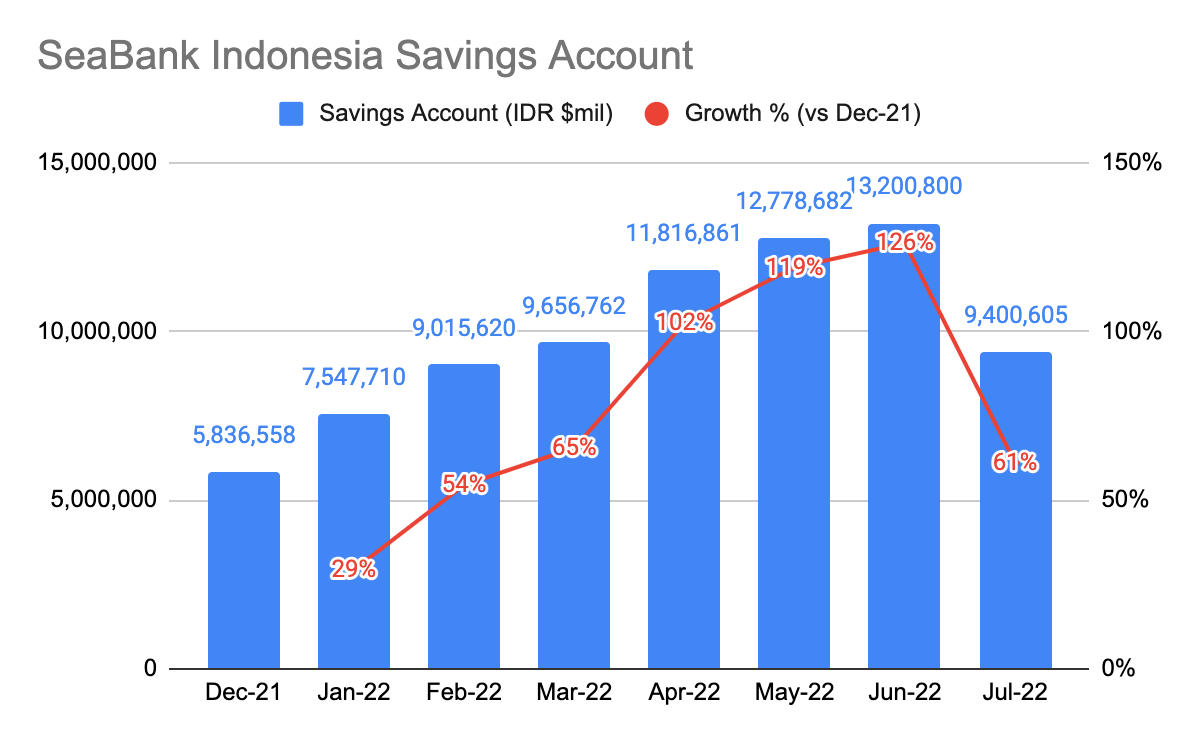

SeaBank’s Indonesia Monthly Financial Statements

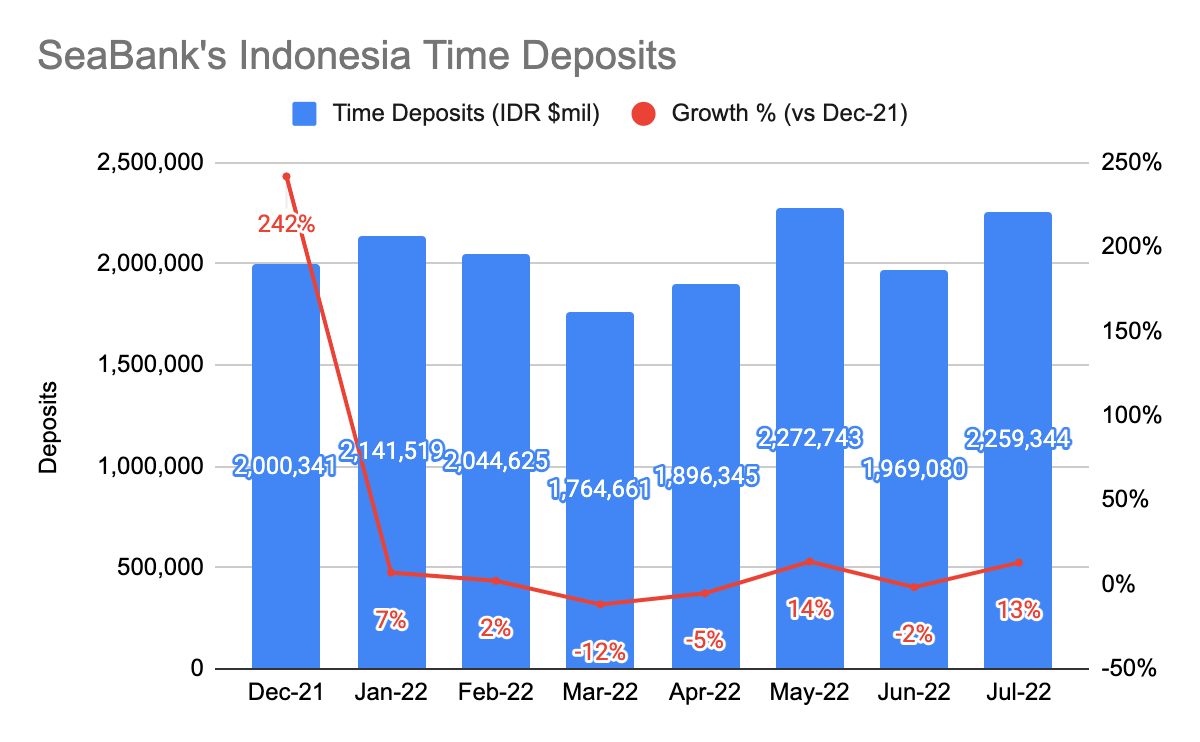

SeaBank’s Indonesia Monthly Financial Statements

SeaBank’s Indonesia Monthly Financial Statements

*SeaBank Philippines does not release its monthly financial statements, hence, I will only be using SeaBank Indonesia.

SeaBank Indonesia’s total deposits, as of Jul 2022, have been growing very quickly at 119%, against FY21, or Dec 2021. They have more than doubled their deposits just 7 months into 2022. This was mainly driven by the 61% growth in the savings account, and 108% in current accounts. For comparison sake, in Jul 2022, GoTo’s Bank Jago grew its deposits by 95% to IDR $7,154,113 million, and Grab-Singtel’s Bank Fama’s deposits of IDR $679,586 has yet to surpass its FY21 amount. Another key point is that SeaBank’s deposits are much larger than its peers, which tells us SeaBank is growing much faster.

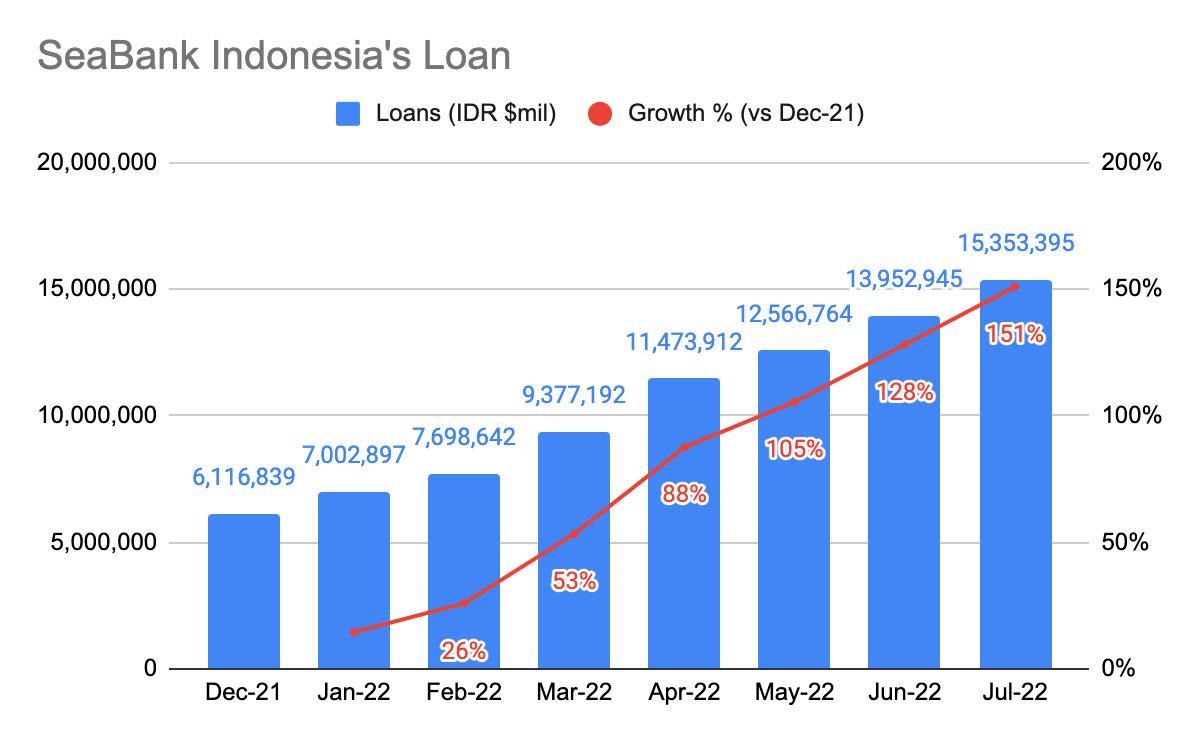

SeaBank’s Indonesia Monthly Financial Statements

SeaBank’s Indonesia Monthly Financial Statements

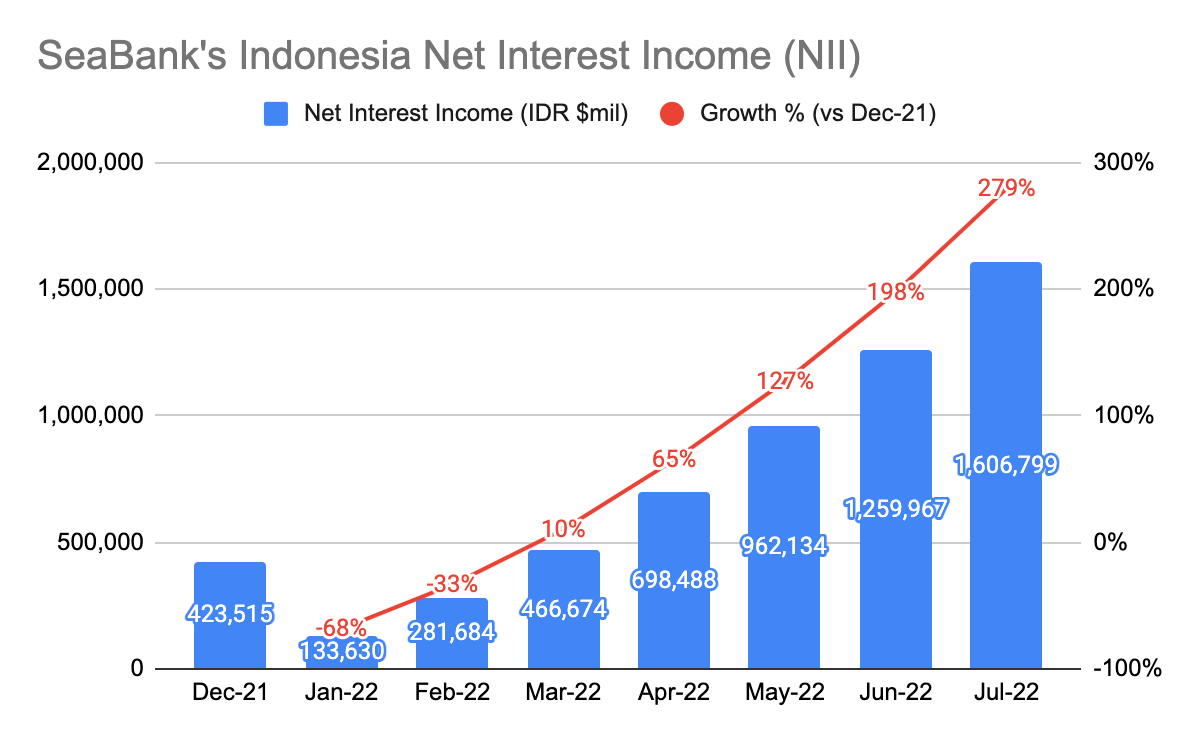

SeaBank’s Indonesia Monthly Financial Statements

Apart from looking at just the deposits, it is also critical to look at how the loans are growing. That is because SeaBank has an effective model to generate multiples of the interest they are paying to customers, and we want to see it growing. As of Jul 2022, its loans are growing by 151% from Dec-21, which is accelerating. The majority of these loans are current assets, which means that it has to be paid back within a year.

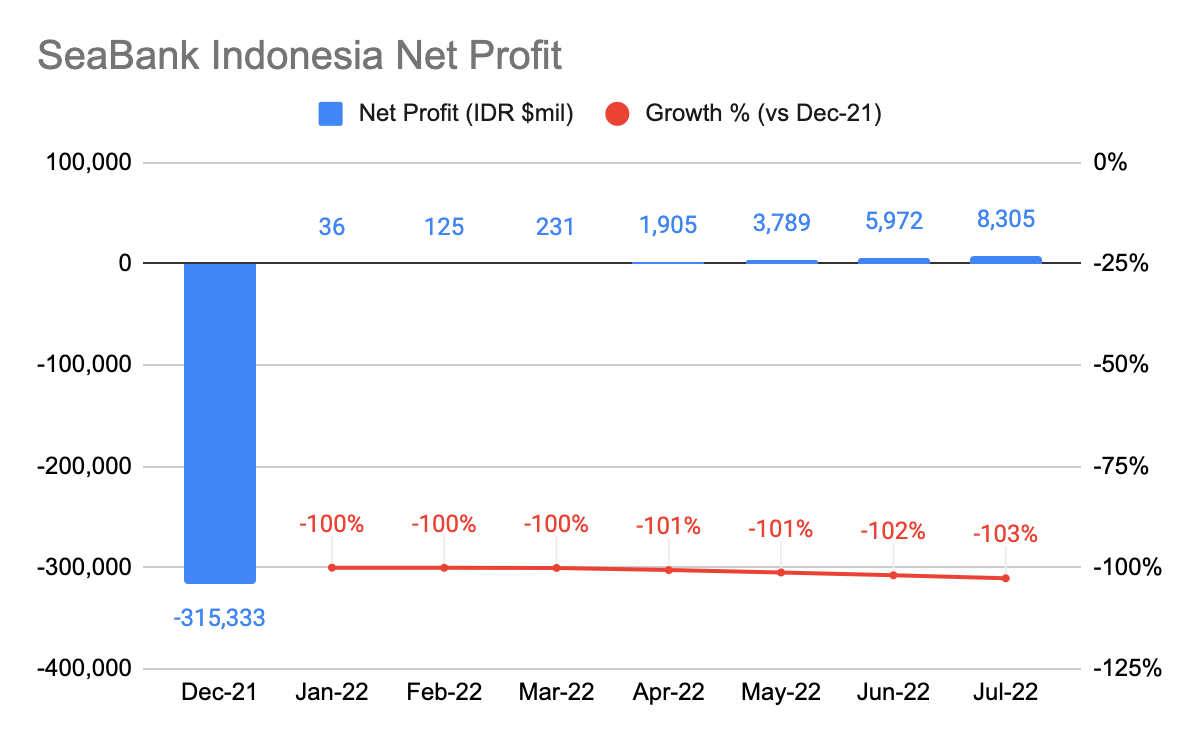

Driven by the growth combination of both deposits and loans, its net interest income (net income – interest expense) increased rapidly by 279%. This helped drove SeaBank Indonesia to net profitability in FY22. SeaBank Indonesia demonstrates to us that it has the ability to self-fund its growth and that more importantly, there is a clear path to profitability. Unlike Shopee, SeaBank does not rely much on external capital once it scales.

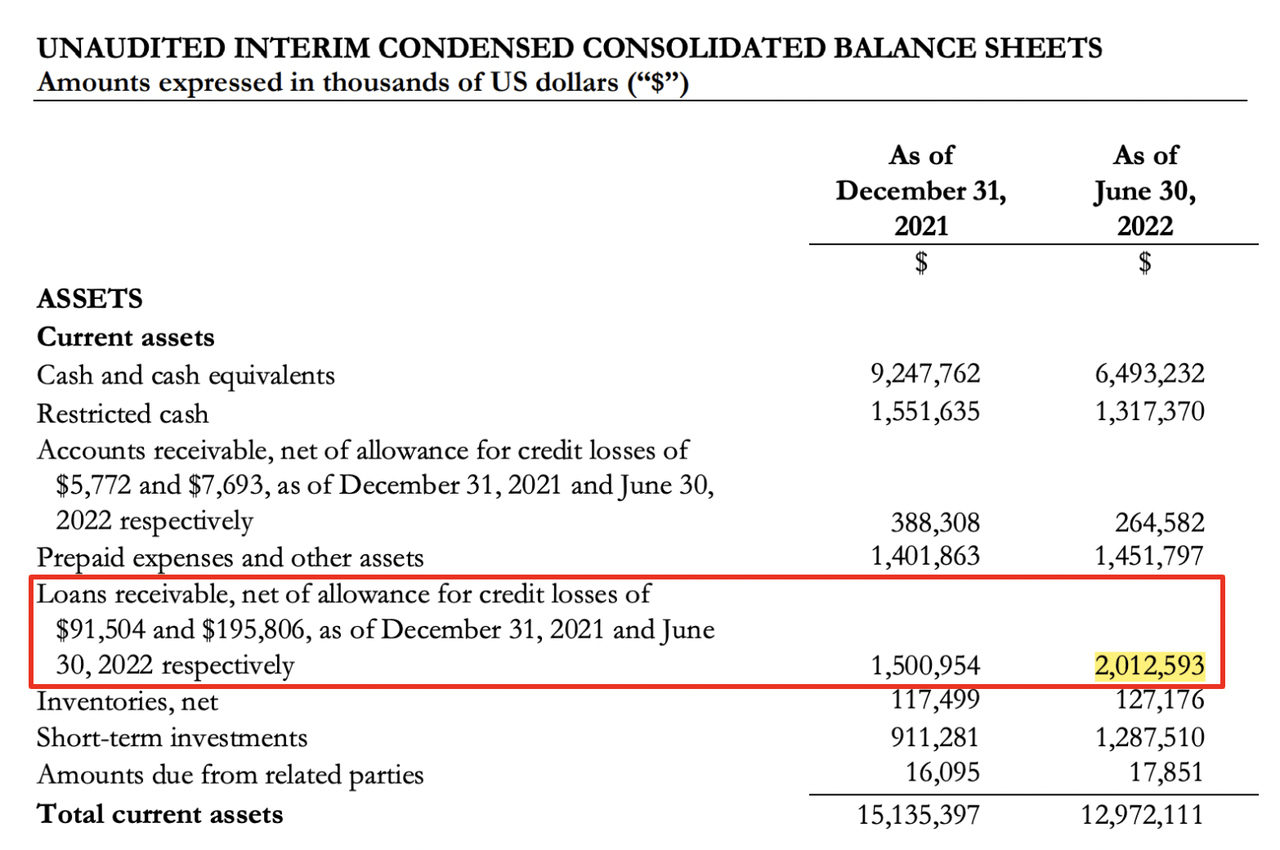

Sea Limited’s FY21 Consolidated Balance Sheet

Sea Limited’s consolidated balance sheet also shows that SeaMoney is growing its loan receivables very quickly as it has already surpassed FY21 loans of $1.5 billion. Assuming that this growth trajectory continues, they are on track to hit $3 billion in loans by end of FY22.

Using SeaMoney FY21 revenue of $470 million, and dividing it by FY21 loan receivables of $1.5 billion will give us an interest rate of 30%. This is in line what the SLoan’s annual interest rate I was mentioning earlier in this article.

Strong Synergies With Shopee

Sea Limited’s 10-K

This also brings me to my next point on SeaBank’s strong synergy with Shopee. As most readers would have already known, back in Covid, Shopee grew really quickly to overtake Alibaba’s Lazada (NYSE: BABA) and GoTo’s Tokopedia as Southeast Asia’s (“SEA”) market leader.

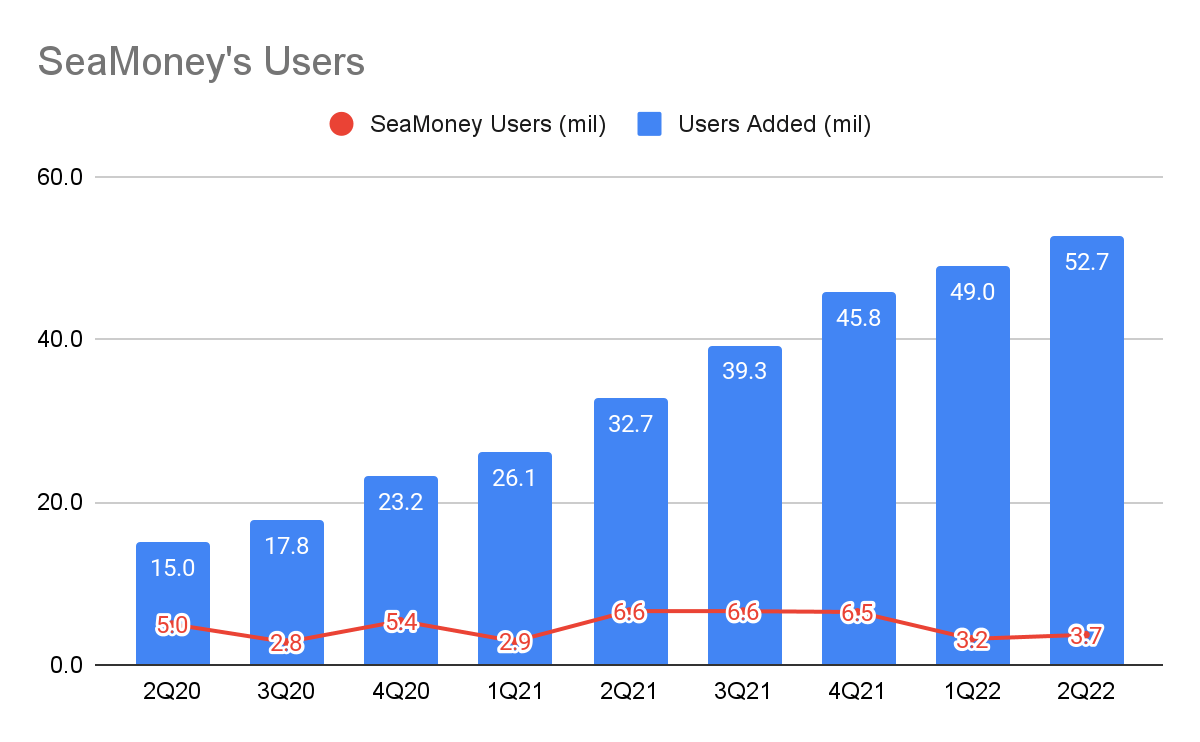

The number of users in SeaMoney, driven by ShopeePay, Shopee’s integrated e-wallet, has also seen tremendous growth, which also acts as a customer acquisition tool for SeaBank. In 2 years, its user base has grown 3.5x to reach a total of 52.7 million users in 2Q22. SeaBank’s growth has benefitted a lot from Shopee as loans are provided to users on the platform, which also explains why they were able to grow so quickly.

Risks

Inability To Grow and Retain Deposits

Customers are funding SeaBank’s operation, and the inability to grow its number of users and deposits may render SeaBank inability to offer loans to its customers, and keep its operation going. That itself will have a huge impact on its net interest income. Not to mention, competitors can also compete by offering similar or higher interest rates, although, the question is if they have a proven self-financing model that is as effective as SeaBank.

Going Beyond Just Loaning To Users

As SeaBank is still relatively early in its lifecycle, the key is growing its number of users and deposits. The more deposits they have, the more cash they have to loan to consumers, which can result in a very cash-generative business.

But beyond that, I like to see SeaBank expanding into loaning to merchants, which is far more challenging as it requires lots of data to evaluate whether a merchant is credit-worthy. Whereas compared to GoTo’s Bank Jago, it can tap into its ecosystem of 19 partners and utilize their data for credit underwriting. NuBank also has a powerful NuX credit engine to underwrite its customers and manage credit risk more effectively, as well as Mercado Credito.

Sea Limited Valuation

I am going to use a discounted free cash flow (FCF) model, and I will be using a 10% discount rate as I am benchmarking against the S&P 500 returns.

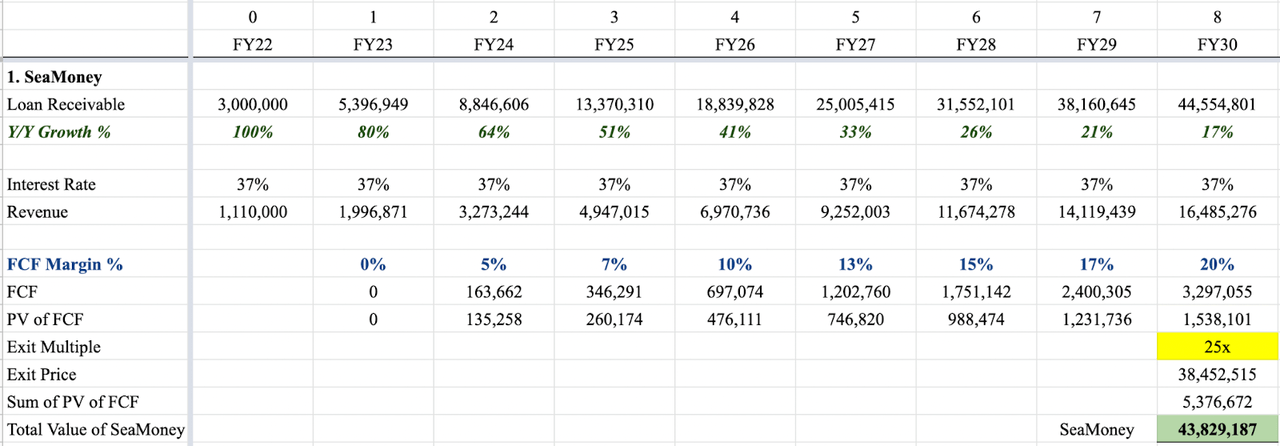

SeaMoney Estimates

Author’s Estimates

I am estimating a 100% forward growth for its loan receivables in FY22, followed by a 20% growth decline till FY30. Taking the management revenue guidance of $1.1 billion by FY22, this gives us an interest rate of 37%. I am maintaining the same interest rate throughout the forecast.

SeaMoney is expected to be cash flow positive by FY23 and by FY30, its mature FCF margin will be at 20%. I believe this is achievable given its strong self-financing model. And referencing PayPal (PYPL), a 25x multiple gives us a total value of $43 billion by FY30.

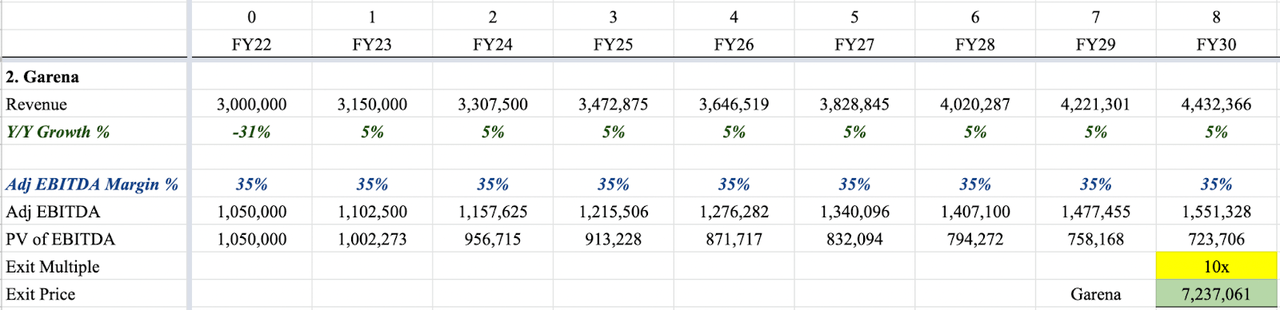

Garena

Author’s Estimates

I am using the management revenue guidance of $3 billion by FY22, and its current adjusted EBITDA margin of 35% (back to pre-Covid). From FY23 and beyond, I am projecting a 5% CAGR and maintaining the same margins till 2030. I am assuming that new self-developed games are going to take time to materialize and contribute to Garena’s revenue. With a 10x multiple, this gives us a total value of $7 billion.

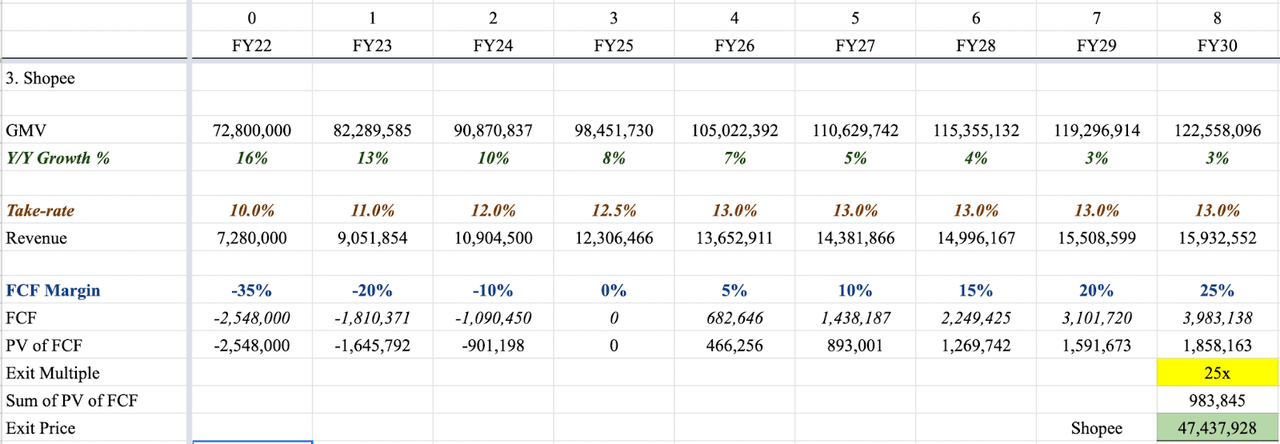

Shopee

Author’s Estimates

Considering that 2H22 is a seasonally stronger quarter for Shopee, I can annualize its gross merchandise value (GMV) in 1H22, and this gives me a total GMV of $72.8 billion by FY22. Moving forward, I am estimating a 20% growth decline, and this results in a low single-teen growth by FY30. This is considering that Shopee commands the major market share in Southeast Asia, and factoring in that Shopee had recently announced its decision to exit all LatAm markets, except for Brazil.

Take rates are going to increase steadily to 13% by FY30, as Shopee monetizes its platform over time. Referencing management guidance that Shopee will be self-funding by FY25, I expect its margin to hit 25% by FY30. With a multiple of 25x, this gives us a total value of $47 billion.

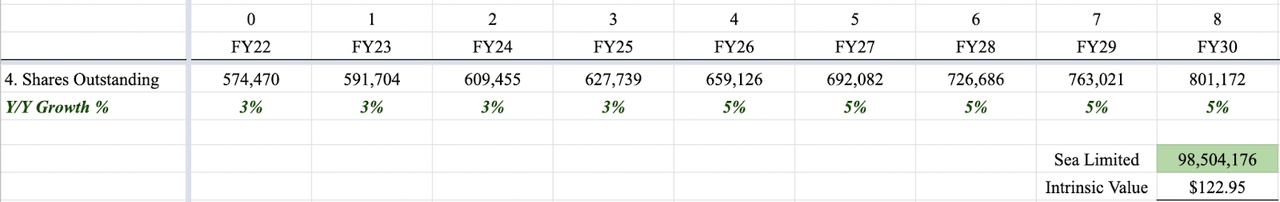

Putting it all together

Author’s Estimates

Unlike in the past, I do not expect heavy dilution to continue moving forward. Although, I will not rule out that the management will raise external capital in the future as the macro improves. Combining the individual segment together will give us a total value of $98 billion for Sea Limited, and an intrinsic value of $122.95.

Conclusion

I have covered lots of things in this article, mainly on how SeaBank self-funds its own business, and how SeaBank Indonesia has been growing its deposits and loans very quickly. If SeaBank can show that it can continue to grow its deposits and loans in a sustainable manner, I believe this can be a future growth driver for the company in the future, which is shown in my valuation model.

Moreover, the management demonstrated that they were able to gain massive traction in Indonesia, the largest and most important market in the region. And there are several markets to go after in SEA as well.

Let me know your thoughts in the comments section below.

Be the first to comment