skodonnell

“Never confuse a single defeat with a final defeat.” – F. Scott Fitzgerald

While reading about the G7 oil price cap, signifying in effect higher oil prices and therefore inflation, when it came to selecting our title analogy we reminded ourselves of the Charge of the Light Brigade during the Crimean War and the Battle of Balaclava. We already touched on this historical battle in our conversation “The Thin Red Line” in March 2014. The Thin Red Line became an English language figure of speech for any thinly spread military unit holding firm against attack. The phrase has also taken on the metaphorical meaning of the barrier which the relatively limited armed forces of a country present to potential attackers but we are rambling again.

The Charge of the Light Brigade was a failed military action involving the British light cavalry led by Lord Cardigan against Russian forces during the Battle of Balaclava on 25 October 1854 in the Crimean War. Lord Raglan had intended to send the Light Brigade to prevent the Russians from removing captured guns from overrun Turkish positions, a task for which the light cavalry was well-suited. However, there was miscommunication in the chain of command and the Light Brigade was instead sent on a frontal assault against a different artillery battery, one well-prepared with excellent fields of defensive fire. The Light Brigade reached the battery under withering direct fire and scattered some of the gunners, but they were forced to retreat immediately, and the assault ended with very high British casualties and no decisive gains. War correspondent William Howard Russell witnessed the battle and declared:

“Our Light Brigade was annihilated by their own rashness, and by the brutality of a ferocious enemy.”

The brigade was not completely destroyed but did suffer terribly, with 118 men killed, 127 wounded, and about 60 taken prisoner. After regrouping, only 195 men were still with horses. The futility of the action and its reckless bravery prompted the French Marshal Pierre Bosquet to state:

“C’est magnifique, mais ce n’est pas la guerre.” (“It is magnificent, but it is not war.”) He continued, in a rarely quoted phrase: “C’est de la folie” – “It is madness.”

In a similar fashion, we think European leaders have been sent by their “US allies” against a different Russian artillery battery, one well-prepared against “sanctions” with as well, excellent fields of defensive fire (NordStream 1) given that now Russia has decided to stop delivering gas to Europe. This will no doubt trigger a few margin calls in the energy sector, meaning more bailouts, more economic pain and more social tensions. In our last conversation, we mentioned the difference between stocks and flows. Your stock levels are meaningless, if you can’t resume flows.

In this conversation, we would like to look again at the European situation and mounting issues which in our book will no doubt provoke additional “credit events” as pressure mounts on the industrial sector in particular and SMEs in general. Also, we will continue to look at the effect of the murderous rampage of “Mack The Knife” (US Dollar + Real Yields).

Europe is facing mounting credit risks and defaults

While in our previous musing of ours we touched on the importance of stocks versus flows, obviously the current change in the narrative relating to the stop of natural gas flows to Europe is of significant importance when it comes to assessing a potential significant rise in credit risks and defaults.

As such, we found it interesting to read that Deutsche Bank CEO said today that energy crisis hasn’t led to rising credit defaults yet. Still, there are now two German corporate victims, one being toilet tissue maker Hakle and shoe retailer Goertz. Bloomberg data suggest Deutsche Bank is indeed a lender for both entities. As well it was interesting to hear German Minister of Economy and Climate, Robert Habeck on the risk of insolvency for many SMEs:

“We don’t expect insolvencies, we just expect parts of the economy to just shut down. “Bakeries/Flower shops/organic shops will just stop selling. Doesn’t mean they automatically become insolvent though.” – Robert Habeck

Interesting take indeed.

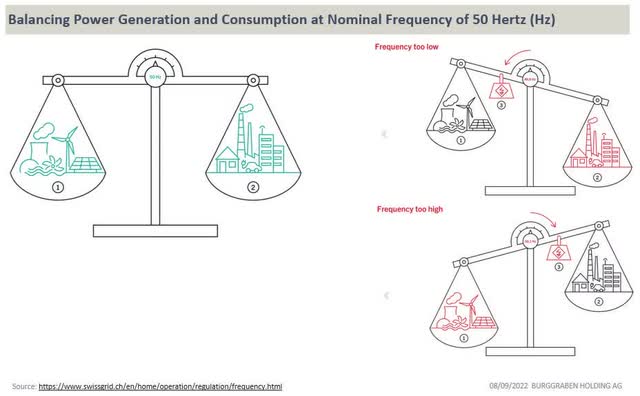

On a side note, we read with great interest on our Twitter feed Alexander Stahel’s take on the electricity crisis and highly recommend reading it in its entirety. In essence, the more renewables you add to your electric grid, the more unstable it becomes.

Balancing Energy (Alexander Stahel – Twitter)

« Here is the thing. The grid builds on physics, not ideology. One such law says that the alternating current that flows through the grid needs to match generation with consumption – that is 525,960 minutes per year – because electricity cannot be stored in the grid. » – Alexander Stahel

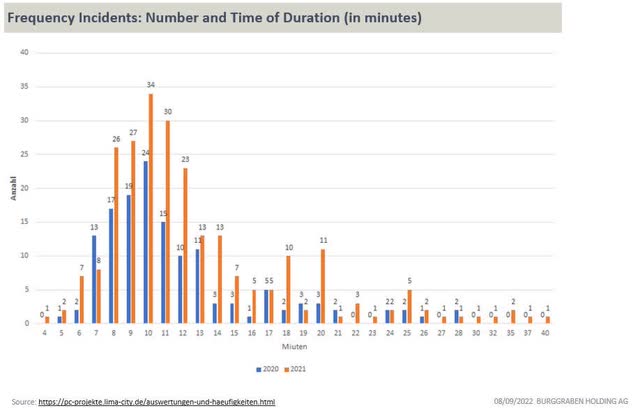

As pointed out by Alexander Stahel excellent Tweeter feed, frequency incidents measured in time have increased to over 52 hours in 2021 versus 33 hours in 2020:

“That is an increase of more than 50% in just one year. You see, by now nothing is “casual” anymore at grid level and I will explain why below.”

Frequency Incidents (Alexander Stahel – Twitter)

End of our side note but, you get the point. The more renewables you add to your electric grid, the more instability you generate.

When it comes to assessing the situation it is fairly simple. The Stagflation is clear in Europe right now with slowing growth and disappointing PMIs pointing towards “recession” on top of surging energy prices. This is leading towards drastic measures such as “energy” rationing by the European Commission. This is the result of many years of misguided energy policies in both Germany and France (shutting down nuclear plants in 2020 as well). You cannot reverse misguided ESG policies overnight. It takes time to build LNG infrastructures and nuclear plants. At the same time, Russia has turned the pain wheel another notch by shutting down gas flows to Europe through NordStream1. Europe decided to wage total economic warfare against Russia through sanctions. Now Russia has decided to retaliate in earnest and Europe is not ready to absorb the pain which is coming. We expect social tensions to rise very significantly during winter. Inflation is already a stealth tax and food prices have risen as well in conjunction with energy prices.

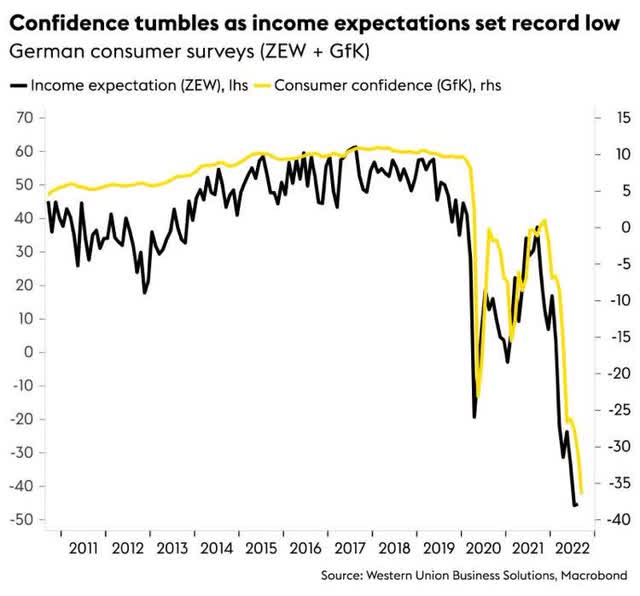

On top of this, consumer confidence is going down the drain very fast which doesn’t support future economic growth and consumption in our book.

Income Expectations VS Consumer Confidence (Gianluca – Twitter)

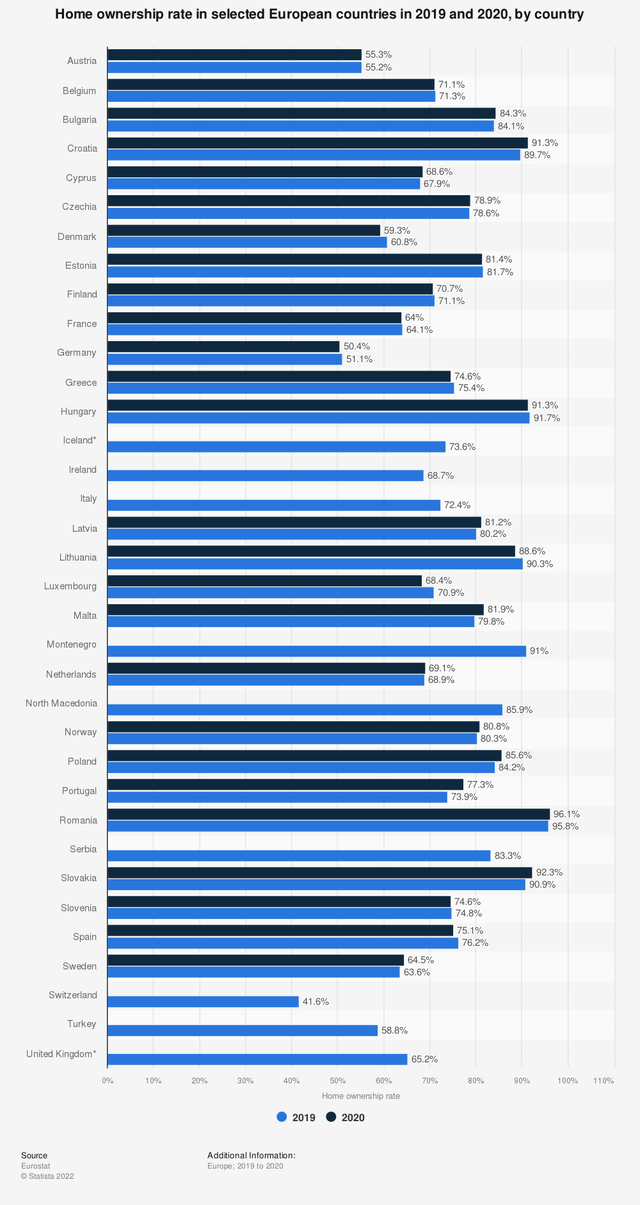

Real negotiated wages in Germany have fallen by 6.7% in June. This has led income expectations for the next 12 months to tumble, dragging down German consumer confidence to the lowest level on record. Germans are not really hedged against inflation because of much lower home ownership rate (around 50%) compared to the rest of Europe which is much higher.

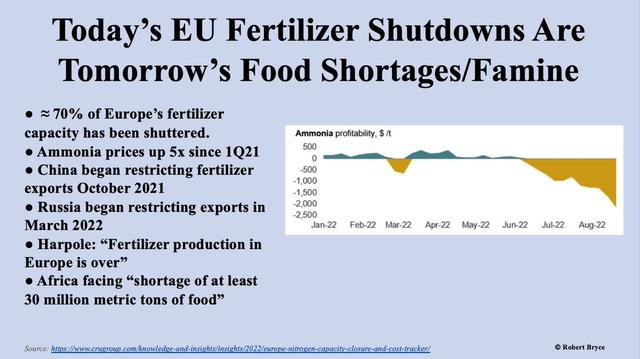

Fertilizer prices rally as an energy crunch in Europe forces factory closures.

Fertilizer prices (Bloomberg – Twitter)

Common nitrogen fertilizer ammonia in the US rose nearly 24% last week.

Over two-thirds (!!!) of European ammonia production is offline due to high natural gas costs.

As indicated by Robert Bryce on Twitter:

Fertilizer shutdowns (Robert Bryce – Twitter)

You can probably understand our “pre-revolutionary” mindset when it comes to assessing “pitchforks risk”.

As we pointed out in our previous conversation, credit growth is a stock variable and domestic demand is a flow variable.

European natural gas prices are up over 13-fold since early 2020. The cost increase that this imposes on businesses and households will be realized as energy bills increase markedly. The net impact is much less economic activity, more debt, and even bankruptcies.

As such Corporate Defaults are coming to Europe and the United Kingdom.

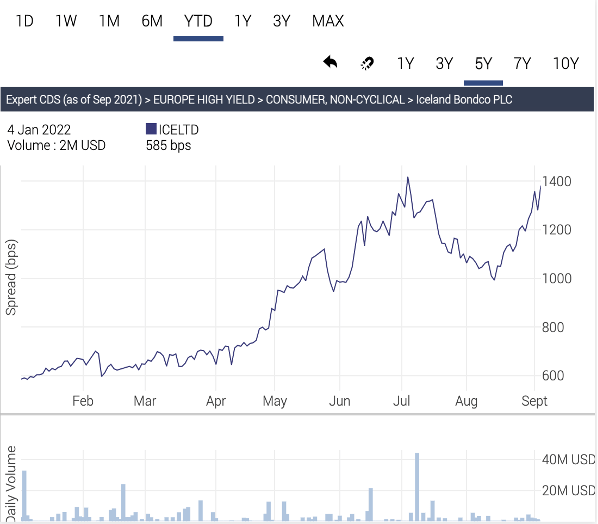

Iceland LTD 5 Year CDS YTD (DataGrapple)

“Iceland [ICELTD] is a British supermarket chain headquartered in Deeside, North Wales. It has an emphasis on the sale of frozen foods, including prepared meals, but also sells non-frozen grocery items. It sells through Iceland and The Food Warehouse shops. The company has an approximate 2% share of the UK food market. Iceland CDS is a constituent of XOver since series s22. Iceland CDS is close to revisiting COVID wides, now at 25% upfront, while 4.625 25 trades below the 75% handle. Last week, ICELTD reported weak Q1-23 results. Sales were £856.5m, stable YoY. EBITDA was £16.9m, down -35% YoY. EBITDA margins contracted -100bps to 2.0%. Margin compression comes as ICELTD experienced an increase in energy costs of £19m in the quarter. Cash was £162.6m at quarter-end, up £7.3m compared to the previous quarter. ICELTD generated £5m liquidity from drawing down additional finance leases. Additional liquidity is the remainder, the £30m of the RCF facility still undrawn. “Energy costs remain volatile, and, as a result, we will be unable to avoid a temporary reduction in profits in FY23, but with our sales and cost saving plans, substantial cash reserves and strong liquidity profile, we are confident we will trade well through the next few months and emerge as a stronger business off the back of these challenges.” The compression of margins at ICELTD highlights a lack of pricing power. ICELTD has c£200m of buffer. Either that liquidity is enough buffer to weather the disruption, or ICELTD will remain one of the main candidates for a credit event, within the XOver s37 index. For reference, ICELTD CDS is currently the 5th widest CDS in the XOver s37 index, after Casino, Boparan, Novafives and Adler.” – DataGrapple.com

We think the below quote is on cue:

“If you don’t have ample liquidity, and it’s not durable, in times of stress, as you’re looking for liquidity, you’re forced to sell assets at declining prices, which then eats into your capital position, so it becomes this very, very negative cycle. There’s no question that liquidity is sacrosanct.” – Ruth Porat

The issue of course is the relationship between energy and economic growth. Highly leveraged companies such as Iceland Ltd or Adler make us wonder if indeed, liquidity will be enough of a buffer to weather the serious disruptions which will be coming from the energy crisis in Europe.

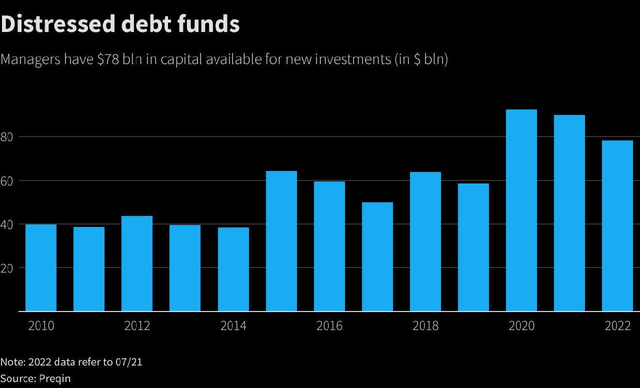

No wonder Distressed Funds are ramping up dry powder in the current context.

Distressed Debt Funds (Bloomberg – Twitter)

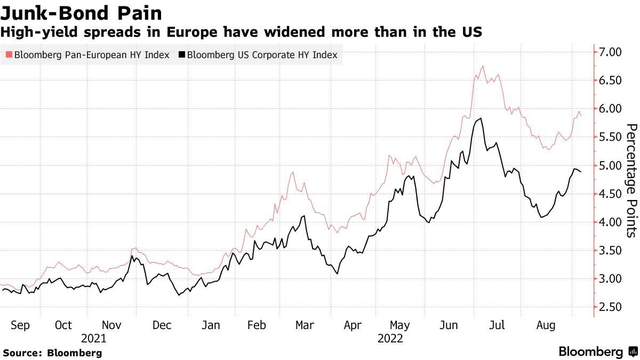

As such no wonder European High Yield is underperforming US High Yield:

HY US vs Europe (Macronomics – Koyfin)

Europe is feeling more the pain in High Yield than the US, helped by the windfall from the Energy Sector:

Junk-Bond Pain (Bloomberg- Twitter)

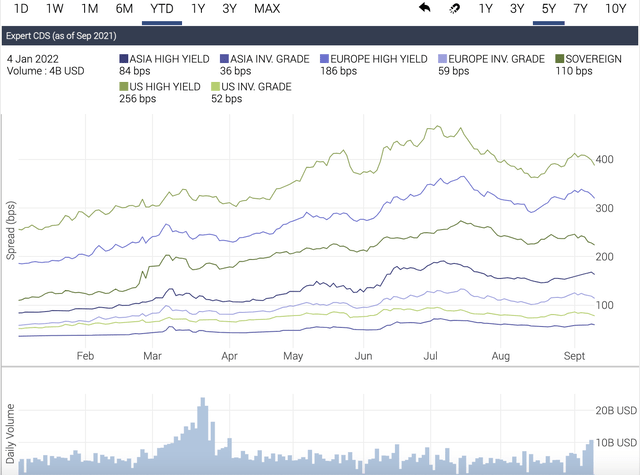

Also of interest is that CDS 5-year indices wise, Europe is still tighter than the US as per below chart from DataGrapple.com:

Global CDS Indices (DataGrapple)

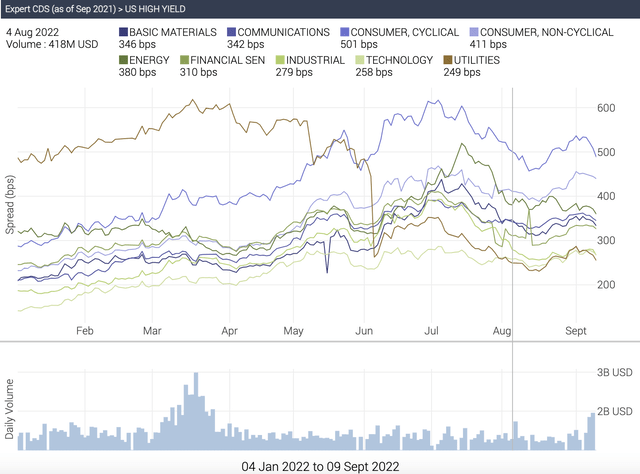

US High Yield is trading around 256 bps vs European High Yield at 186 bps. We think Europe is too tight relative to the US.

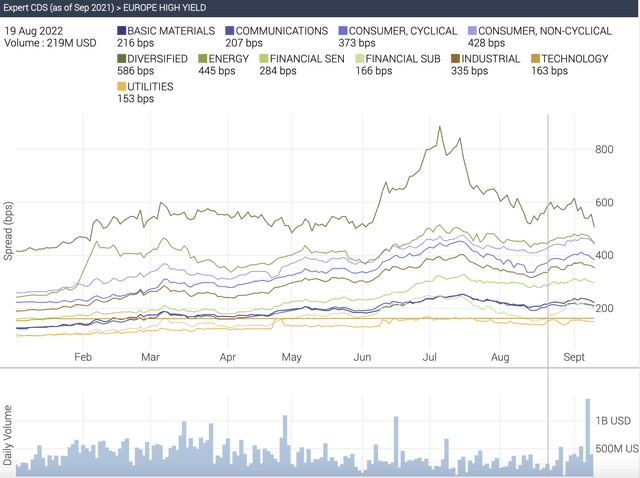

Below is the CDS 5-year sector breakdown YTD for European High Yield:

And here is the CDS 5-year sector breakdown YTD for US High Yield:

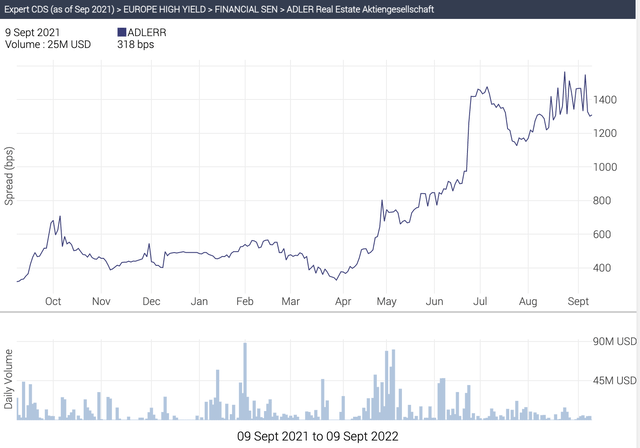

For German giant real estate player ADLER the die has already been cast when it comes to upcoming “credit event” as per the below one-year chart of its 5-year CDS:

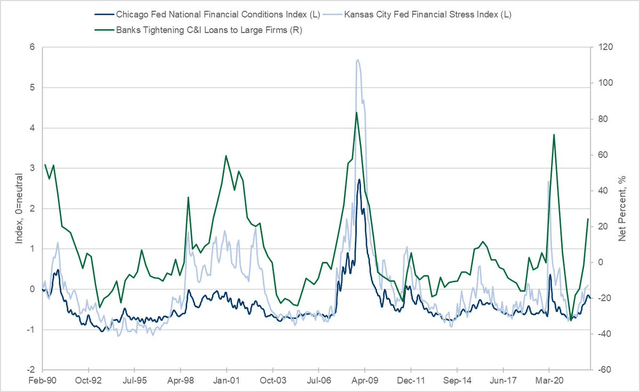

The most predictive variable for default rates remains credit availability. As such, the most recent New York Fed’s Q3 Senior Loan Officer Survey found that a net 14% of U.S. banks are tightening their lending standards.

Lending Conditions (Andrew Davis – Twitter)

So it is not only in Europe that trouble is brewing credit-wise. Tightening financial conditions are a harbinger for things to come in 2023, namely spread widening and a rise in defaults, not only in Europe but in the US as well.

To forecast upcoming High Yield Default Rates, you can use the Bank of America methodology using three main criteria: the Fed’s quarterly Senior Loan Officer Opinion Survey (SLOOS), credit migration rates, and real rates in the economy. When combined, these three inputs have an 85% correlation over the next 12-month trailing default rate at any given point in time.

Why so?

This makes sense because tighter lending conditions, a lower proportion of upgrades, and higher real rates all make it more difficult for an issuer to secure funding and hence maintain balance sheet liquidity, that simple.

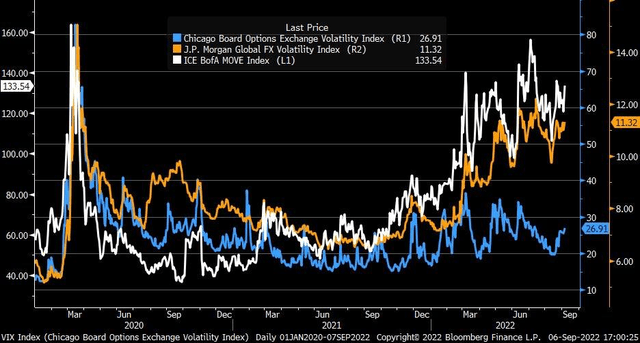

Leveraged players and carry traders do love low risk-free interest rates, but they do love even more low-interest rate volatility. This is the chief reason why over the past couple of years, billions of dollars have poured into high-yielding assets like risky corporate bonds, emerging market currencies, and dividend-paying stocks, driving risk premiums to absurd low levels (as per the levels touched in negative yielding European government bond space…). With rising interest rate volatility, one would expect leveraged players, carry traders and tourists alike to start feeling even more nervous for 2023.

VIX vs MOVE (Ann Liz Sonders – Twitter)

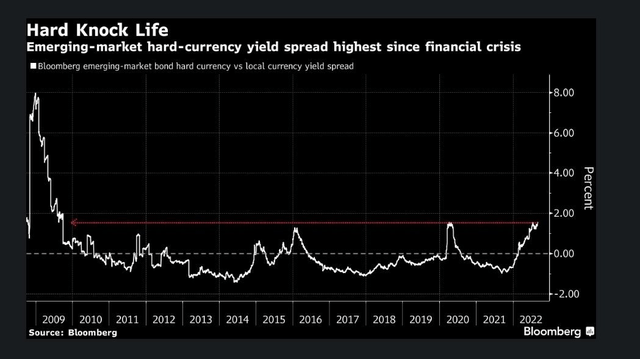

As well, if credit availability in US dollar terms vanishes thanks to “Mack The Knife (US Dollar + Real Yields), it could portend surging defaults down the line for stretched EM dollar-denominated leveraged players.

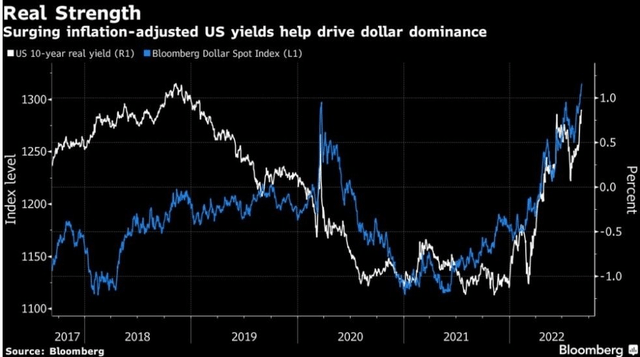

Mack The Knife (US dollar and real yields) is on a rampage

As we pointed out in our previous conversation and our “reverse osmosis” analogy, emerging markets are deeply vulnerable to a surge of Mack The Knife (Positive Real Rates + US Dollar) which can in effect rapidly “wipe out” their hard-earned US Dollar FX Reserves (stocks) leading towards default for some (Sri Lanka and many more):

Hard life for EM (Bloomberg – Twitter)

Stocks versus Flows: Dollar flows matter because of “Mack the Knife”, with rising oil prices and food prices, Emerging Market Economies are rapidly burning through their FX reserves.

Real strength (Bloomberg – Twitter)

Not only is Mack The Knife wreaking havoc against some emerging market countries, but it is also taking its toll on developed markets as indicated by Bloomberg:

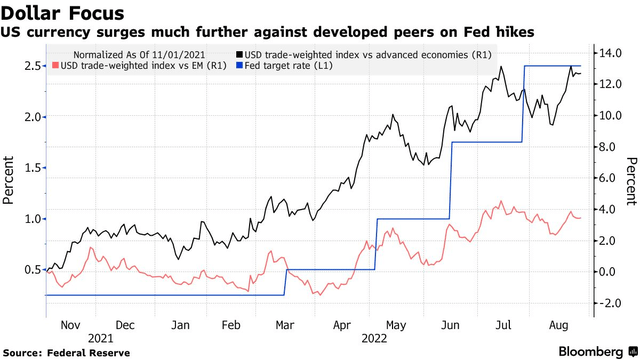

Dollar Focus (Bloomberg – Twitter)

In effect, this is accelerating inflationary pressures on top of energy woes which are particularly acute in Europe. No wonder the European currency is sinking. As such, we expect more pain for developed currencies such as the Euro, the British pound and the Japanese yen (for those who follow us on OHM Research, we have been recommending going short the Japanese yen since the 18th of April via double short ETF YCS). Given the Fed has no choice but to crash the “party”, there is we think, more pain to come from Mack The Knife and the ECB is in a much tricky situation as such.

“Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.” – Ernest Benn

Be the first to comment