AntonioSolano/iStock via Getty Images

Company Background

In some ways, Eastman (NYSE:EMN) is a difficult company to understand. The 2021 Annual Report describes Eastman as a “global specialty materials company.” The company originally produced chemicals as part of Kodak for photographic applications and was spun out in 1993. “Specialty chemicals” is frequently used by companies to indicate that their products do not compete exclusively based on price. In other words, specialty chemicals have some type of competitive advantage such branding, patent protection, or trade secrets. Commodity chemicals producers, on the other hand, primarily compete on price. Eastman claims to have divested its commodity businesses starting in 2004. However, it is not uncommon for some products to start as specialty chemicals and then become commodities as competition increases over time. To this point, Eastman divested its Adhesive Resins and Tire Additives businesses in the past year for $1.8B.

Eastman is also potentially confusing because: 1) many industries use their products for a wide variety of applications; and 2) their products tend to be ingredients in business-to-business applications. The 2021 Innovation Day presentation demonstrates some applications.

|

Brand |

Application |

|

Tritan |

Consumer and medical applications using clear plastic |

|

BPA-free Tetrashield |

Can coatings |

|

Saflex |

Car windshields and home windows |

|

Cristal |

Cosmetics |

|

Naia |

Textiles |

|

Aventa |

Food Service |

Perhaps the obscurity of Eastman’s business explains the lack of investor enthusiasm regarding plastic recycling technologies. According to Eastman’s website, traditional mechanical recycling can only be applied to two out of the seven types of plastic and degrades the material with each round of processing. Eastman’s molecular recycling methods can handle the remaining five types of plastic and the quality does not degrade. However, molecular recycling emits more greenhouse gas, so it advisable to mechanically recycle plastic when possible. Molecular recycling is particularly applicable to countries and areas with an intense focus on environmental considerations. In 2021, Eastman and French President Emmanuel Macron announced plans to build the world’s largest molecular recycling facility in France. Companies such as LVMH, L’Oreal, Danone, Estee Lauder, and Procter and Gamble have signed letters of intent for multiyear supply agreements. In September, Eastman announced an agreement to provide the Ethicon division of Johnson & Johnson with molecular recycled plastic for medical device packaging. Eastman is building another recycling plant in Kingsport Tennessee that should be operational sometime in 2023 and has announced a second US facility that should be complete in 2025-2026. The company claims that these three molecular recycling projects have the potential to add $450M to EBITDA by 2026.

Recent Events

In a press release on September 13 th 2022, Eastman reduced adjusted EPS to be 19% lower than their previous guidance. The company gave three reasons: 1) demand declined in the consumer durables and construction industries and the European and Asian regions; 2) marine logistics issues on the East Coast prevented exports; and 3) slow recovery from an electric outage at the Kingsport facility caused production constraints. In addition, high natural gas prices combined with the strong dollar also are lowering profitability. All of these negative factors accelerated an already large decline in the stock price.

Historical Data

As a result of the stock price decline, enterprise value is near five-year lows.

As a result of the significant decline in market value, trailing multiples are near 10-year lows. The multiples are likely to expand as near-term earnings decline.

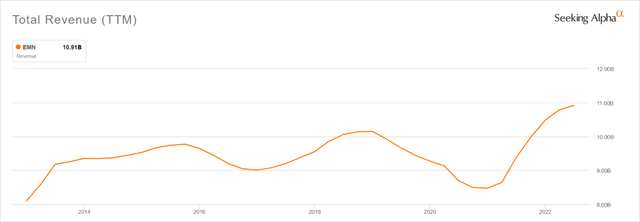

On the other hand, revenue was increasing and trending upwards through the last quarter.

The 2022 Q2 Earnings Presentation showed that each division was able to raise prices by over 10% and suggests that the company has some pricing power to combat declining demand and cost inflation.

Thesis

Even with diminished earnings, Eastman is likely to continue to generate significant free cash flow. Over the past 3 years, the company has used some of this to deleverage: total borrowings contracted by 14% over this period. In addition, the forward dividend yield is over 4% and the free cash flow coverage ratio was 66%. Therefore, the company should be able to continue funding the dividend without raising capital. In the past, Eastman has repurchased large amounts of its stock. As a result of the aforementioned divestitures, Eastman was able to return 22% of the current market capitalization to shareholders in the form of buybacks and dividends over the past twelve months.

Although there are likely to be setbacks in the short term, Eastman has excellent long-term prospects. Eastman’s exposure to many industries and regions is likely to reduce revenue and earnings as global growth stalls over the next year. The low stock price reflects this. However, long-term molecular recycling agreements should provide a significant source of revenue and profit growth possibly starting next year. These growth prospects when combined with the current attractive valuation make the stock compelling.

Be the first to comment