JHVEPhoto

Introduction

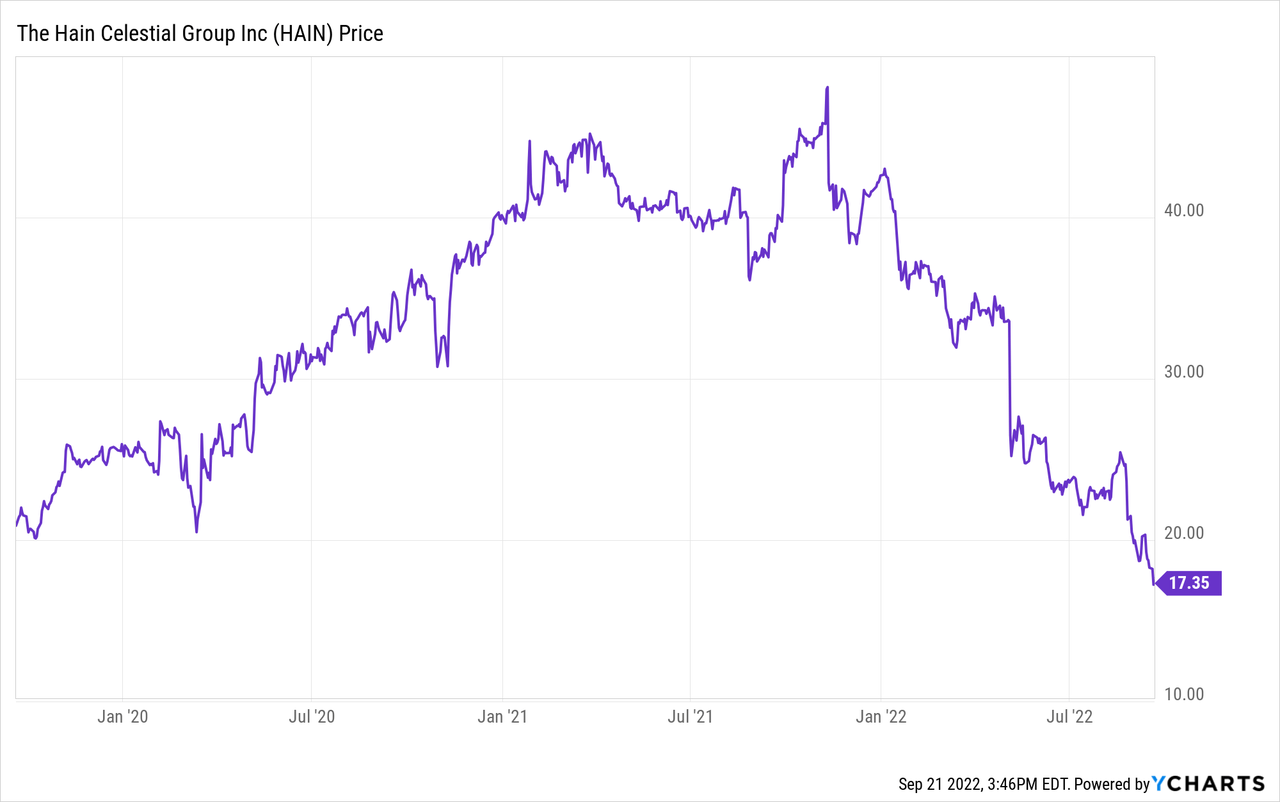

Almost two years ago, at the end of 2020, I turned bearish on Hain Celestial (NASDAQ:HAIN). Although the world economy was pulling itself together as the consumer confidence levels rose on the back of positive vaccine news, I wasn’t sure Hain deserved to be trading at about 40 times the free cash flow level. Although I do believe in the demand for healthy food products, Hain didn’t deserve the premium valuation and its share price has fallen by in excess of 50% since my previous article.

FY 2022 didn’t come even close to the bullish expectations from 2020

Fast forward to September 2022. The company released its full-year results for the financial year 2022 which ended in June, and the financial results didn’t come even close to what was expected based on the longer-term outlook provided two years ago.

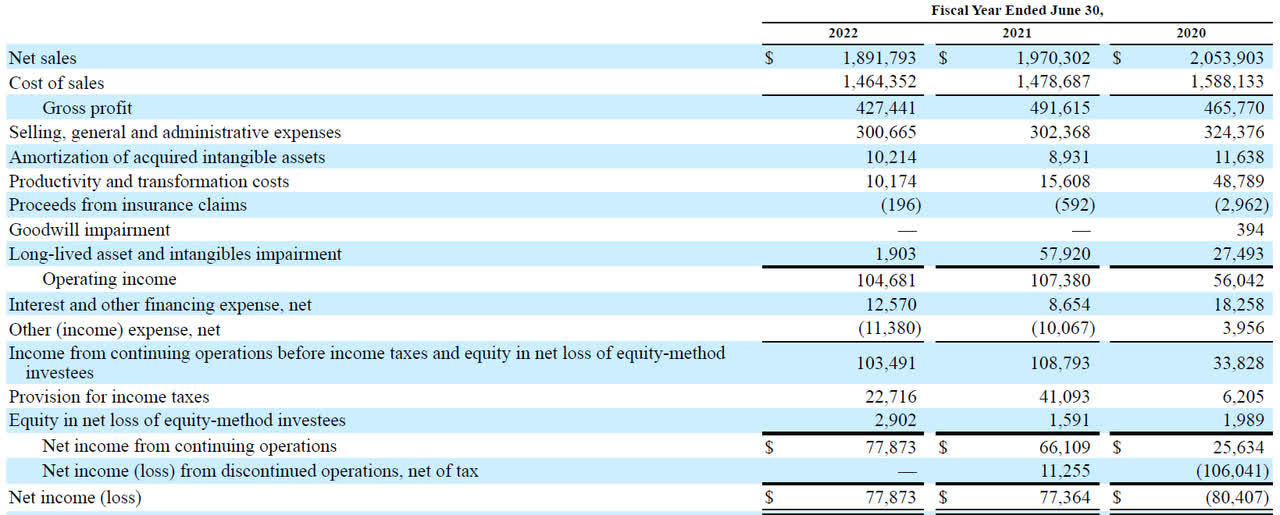

The margins shrunk again in 2022 as the revenue decreased by approximately 4% to $1.89B while the COGS decreased by less than 1%. This caused the gross profit to collapse from almost $492M to $427.4M and that’s almost 10% lower than in FY 2020, a year I wasn’t already impressed with.

Hain Celestial Investor Relations

Despite this disappointing gross profit evolution, the operating income decreased by just a few million dollar compared to FY 2021 mainly due to the lack of impairment charges and lower transformation costs. Excluding these two elements, the FY 2021 operating income would have been $180M while the FY2022 operating income would have come in at $117M. So the rather low decrease in the operating income in FY 2022 wasn’t because Hain was able to keep the damage limited, but because 2021 was a tough year with a lot of non-cash impairment charges.

The net income came in at $78M or $0.84 per share as the per-share result was slightly boosted by a lower share count: The average number of shares outstanding decreased by approximately 7% and as of Aug. 18, the effective share count was an additional 4% lower.

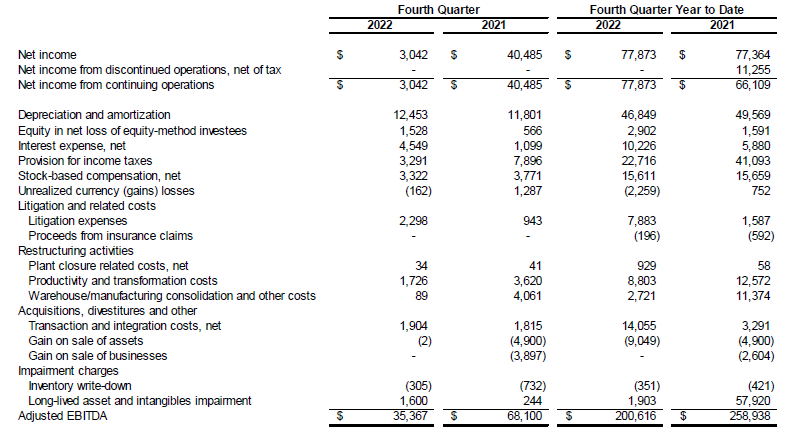

As the company’s income statement contained quite a few non-cash elements in FY 2021 which weighed on the net income result, I think it’s more fair to judge Hain Celestial based on its free cash flow performance as those calculations don’t take the impairment charges into account.

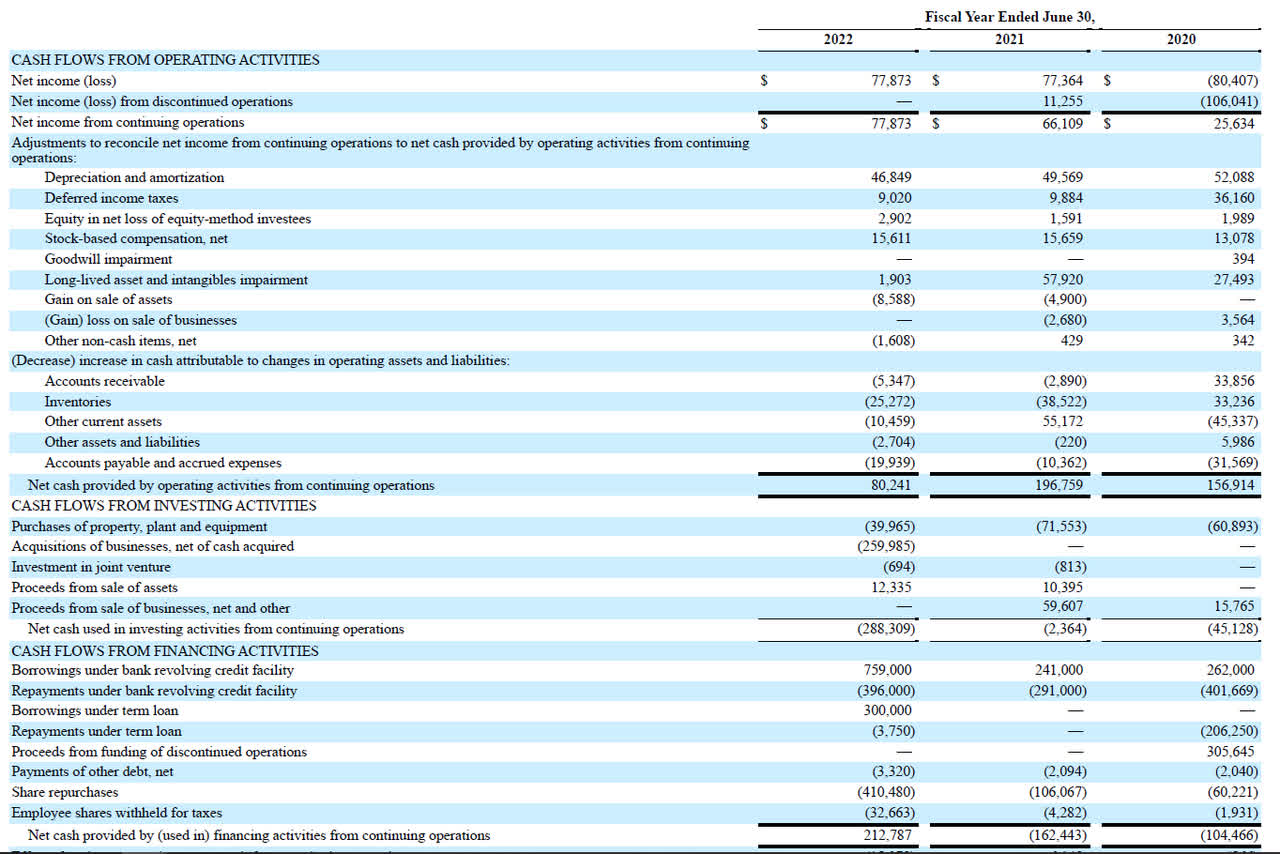

As you can see below, Hain reported an operating cash flow of $80.2M in FY 2022 but this was negatively impacted by a continuous build-up in working capital elements which absorbed about $64M in cash. We see a strong inventory build-up and hopefully Hain will be able to monetize this in the current financial year.

Hain Celestial Investor Relations

The total capex decreased to just under $40M (excluding acquisition-related cash flows) resulting in an adjusted operating cash flow of $104M or $1.16/share. Not as bad as feared but the company clearly didn’t come even close to the $122M in free cash flow generated in FY 2021.

We also see the company spent in excess of $400M on share repurchases and an additional $260M on acquisitions. That’s quite a hefty spending bill for a company that generated just over $120M in adjusted free cash flow and just $40M in reported free cash flow (including the working capital investments). The cash flow statement clearly shows the company added quite a bit of debt to its balance sheet as it repaid just under $400M in debt but raised $1.06B in fresh debt.

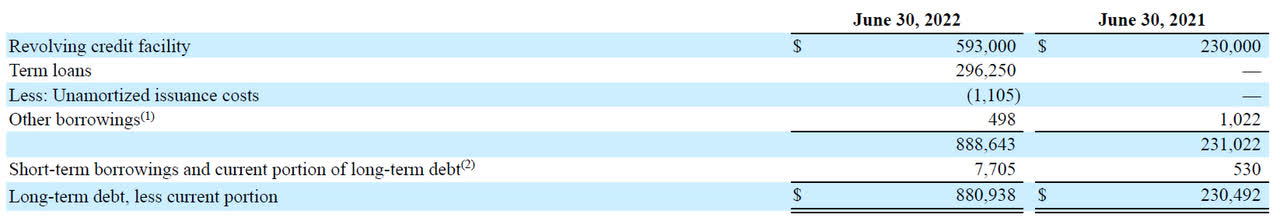

As of the end of June, the company had $66M in cash but almost $890M in debt resulting in a net debt position of in excess of $830M. While we should see a positive EBITDA contribution from the acquired assets this year, I’m a little bit cautious when I see a net debt level of in excess of 5 times EBITDA and even in excess of 4 times the adjusted EBITDA.

Hain Celestial Investor Relations

On top of that, the majority of the new debt on the balance sheet came from a revolving credit facility which has a floating interest rate. A 2% increase in the interest rates will increase the interest expenses by almost $12M, and even on an after-tax basis, the free cash flow would decrease by roughly $9M.

Hain Celestial Investor Relations

The outlook for the current financial year doesn’t really help

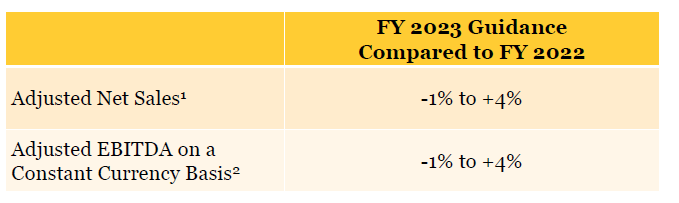

Despite the acquisitions and further streamlining of the operations, we shouldn’t expect Hain to do better this year. According to the official guidance, the company is anticipating both the adjusted revenue and adjusted EBITDA to move in a minus 1% to plus 4% range, and seeing how inflation continues to impact the operating expenses on the producer level and how it continues to erode consumer confidence, we should probably not be surprised if the company comes in at the lower end of guidance.

Hain Celestial Investor Relations

Throw in the fact that the interest expenses will increase, not only because of the increasing interest rates but also because this will be the first full year Hain will have to deal with the increased gross debt level, and I’m not even sure Hain will be able to keep its free cash flow unchanged. That will depend on how the cash restructuring expenses are evolving.

Investment thesis

It will be interesting to see how the company evolves over the next few quarters. As it’s selling a premium product, it’s not unlikely to expect consumers to switch to cheaper products as only the “hardcore” health-minded consumers will stick to the premium products. It looks like Hain Celestial is trying to “buy” itself out of its lackluster performance, but despite spending in excess of a quarter of a billion on acquisitions, the EBITDA growth will be pretty low.

If it wasn’t for the much higher net debt level and the anticipated interest expense increases, I would have turned bullish on Hain based on the current valuation. But buying back stock at an average of in excess of $38/share wasn’t the smartest move, especially not when you’re planning to spend $300M on capex and acquisitions.

At this point, I’m moving to a “neutral” at best. Hain seems to have set the bar pretty low for this year, and if it fails to jump over the hurdle, the market likely won’t react well. I’m still on the sidelines, but no longer very bearish.

Be the first to comment