Jean-Luc Ichard/iStock Editorial via Getty Images

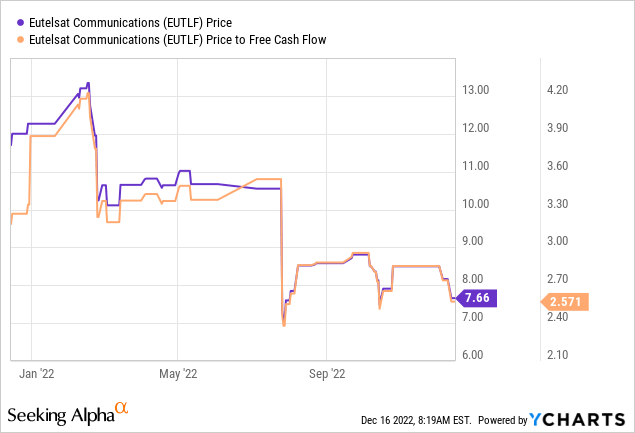

France-based fixed satellite operator Eutelsat (OTCPK:EUTLF) has cleared Board approval for the proposed OneWeb deal, paving the way for a fundamental pivot toward long-term growth. That said, the combination will come at a cost for its shareholders – not only does the all-stock transaction entail significant equity dilution, but on a pro-forma basis, its free cash generation and return profile will fall well short of pre-OneWeb levels, with recovery unlikely through FY30.

Plus, management’s low double-digit growth guidance is subject to significant execution risk. There is no guarantee that OneWeb will scale its revenue base sufficiently nor that it will achieve sustainable profitability; the long track record of satellite bankruptcies is a testament to the challenges ahead. Net, Eutelsat’s decision to use cheaply priced equity (high-teens % FCF yield pre-deal) to fund a high-risk and most likely dilutive venture means the risk/reward is unfavorably skewed here.

OneWeb Deal Gains Board Approval, Headed for Shareholder Approval

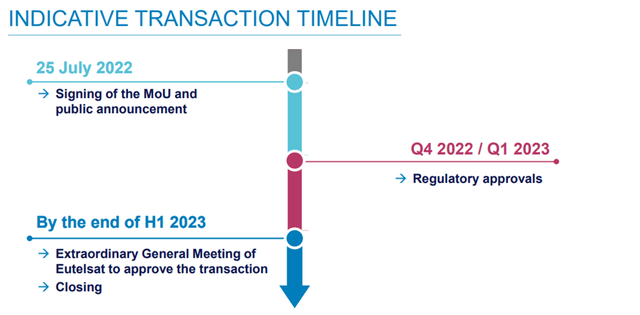

Since announcing its proposed all-share merger with satellite communications company OneWeb in July, Eutelsat has seen a significant drawdown in its market cap, reflecting shareholder skepticism on the deal’s economics. Per the deal terms, the transaction will involve an exchange of OneWeb shares by its non-Eutelsat shareholders for ~230m of newly issued Eutelsat shares (or ~50% of the enlarged share capital). Yet, the Board gave its approval last month, taking the company another step closer to finalizing the deal.

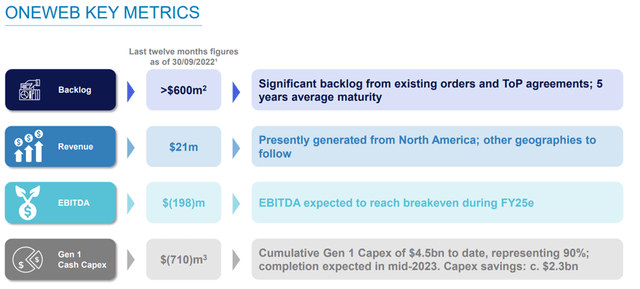

For context, OneWeb is in the ‘Low Earth Orbit’ (LEO) satellite business, which differs from Eutelsat’s ‘geostationary orbit’ (GEO) capabilities. While GEO has the advantage of throughput, LEO offers a broader coverage and better latency, allowing it also to serve latency-sensitive applications like the cloud and 5G. It remains early days in the LEO space, however, as reflected in OneWeb’s ~$21m revenue base and ~$200m of operating losses. To fund the ongoing losses, Eutelsat will suspend dividends for the next three fiscal years. No surprise, then, that the pivot to long-term growth via a OneWeb merger has not been particularly well received by shareholders.

Still, a deal will likely get shareholder approval at the upcoming extraordinary general meeting (EGM). For one, the major shareholders of Eutelsat, French sovereign wealth fund Bpifrance, as well as French investment firm Fonds Stratégique de Participations, and CMA CGM are supportive of the deal. As they control 30-40% of the outstanding shares, the odds of securing a two-thirds approval at the H1 2023 EGM seem high. Plus, the recent selloff has likely seen a shift in the investor base from income-oriented investors to growth-focused investors who are more likely to support the deal. This leaves the anti-trust hurdle, which should be easily cleared given the UK Government’s backing (via its OneWeb stake) and Bpifrance’s support.

Unfavorable Deal Economics

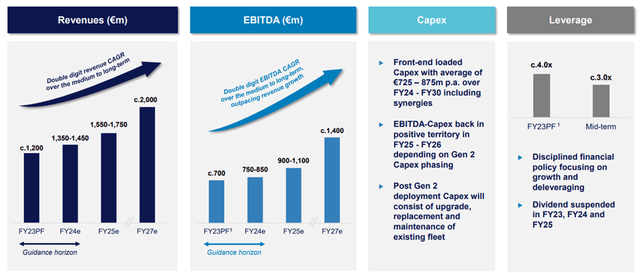

At first glance, the OneWeb deal will be a net negative to the balance sheet. The company will not add any financial debt upfront, but EBITDA-level losses and ~EUR600-700m of additional capex are guided to drive pro-forma leverage to ~4x leverage by FY23. The key issue is that the capex burden isn’t slowing down anytime soon. Management has pegged ~EUR5-6bn of long-term capex for the pro-forma entity (i.e., LEO and GEO assets), but I am concerned about potential upward revisions ahead.

Capex estimates for large constellations like Starlink, for instance, have been pegged at $25-30bn, while the investment needs for Project Kuiper by Jeff Bezos/Amazon (AMZN) were last estimated to run at ~$10bn. The guide doesn’t cover maintenance capex either – given the pace of data usage growth, LEO constellations could see higher-for-longer capex needs relative to GEO.

Eutelsat’s argument is for merger synergies to reduce the cost/capex requirements – combining their respective ground segments, for instance, would allow for a more streamlined cost structure without sacrificing scale. There might be some truth to that, though post-merger integration tends to be a challenging process, and extracting these synergies is not a given. Plus, Eutelsat is paying a steep price by incurring an ~50% dilution at the expense of minority shareholders. With a dividend cut, higher near-term investment needs, and financial leverage, as well as added execution risk on the horizon, it’s hard to see how the merger economics justify the cost.

Credit Ratings on Watch Amid Higher Funding Risks

In the near term, the key concern is around the investment required to build out the GEN 2 constellation (targeted for service in 2028) and the impact on Eutelsat’s cash generation relative to the limited visibility into the potential benefits. At first glance, the company does have a robust liquidity position, with access to committed bank facilities of >EUR1bn available to draw upon if needed. The caveat is that access to this facility is subject to a net leverage covenant threshold of <4x net debt/EBITDA, which the company is poised to cross post-merger.

Hence the recent debt rating revisions – Fitch has revised the Eutelsat outlook to negative, while Moody’s has placed it on review for a downgrade. The suspended dividend and commitment to de-levering the balance sheet will help, but unless EBITDA generation picks up, it’s hard to see how Eutelsat will avoid rating downgrades ahead.

OneWeb Merger Adds Too Much Risk

Having acquired a ~23% stake in OneWeb in 2021, Eutelsat is proceeding with an all-stock merger with its associate. There is a high cost to shareholders, though, with the share count set to double to fund the deal. Whilst management has justified this deal by citing the potential to reignite growth (vs. the modest declines pre-OneWeb), a lot needs to go right for the economics to make sense.

For one, OneWeb is guided to scale its revenues to >EUR1.2bn in the long run, but given the challenging economics of the LEO market, it’s hard to underwrite profitability anytime soon. The exchange of cheaply priced equity (Eutelsat traded at a high-teens FCF multiple pre-deal) to fund a high-risk merger also raises the question of whether shareholders would have been better served with the status quo. For now, though, all roads point to approval at the upcoming EGM in H1 2023, and thus, I remain sidelined.

Be the first to comment