Erikona/iStock Unreleased via Getty Images

Thesis

The combination of WarnerMedia and Discovery (NASDAQ:WBD) created a true media giant. However, there’s something the market did not like as the stock sold off approximately 50% since the deal has been announced. Now the stock trades at a very favourable risk/reward ratio. Although I also argue that low multiples are generally justified for WBD stock as uncertainty remains and the company appears over levered at 2:1 debt-to-equity, prices below $15/share are just borderline ridiculous cheap. Based on a residual earnings framework, anchored on EPS analyst consensus estimates, I calculate a base-case target price of $27.51/share, indicating 90% upside. Buy.

Most notably, given the deep-value thesis for WBD, Michael Burry bought the stock already at prices 30% higher. According to the 13F filing for Q1 2022, WBD is Dr. Burry’s third largest equity holding with an investment of $18.7 million.

Seeking Alpha

Warner Bros. Discovery Merger

There are a few things to like about the deal. First, the combination of WarnerMedia and Discovery assets creates one of the largest content libraries with ~200k hours of video content. The assets are also quite complimentary, as Discovery is strong in non-fiction content and WarnerMedia in fiction. Moreover, the deal will support a focused streaming platform that may compete with Amazon Prime, Netflix, and Disney+, as the combined entity supports an ecosystem including Discovery+, HBO Max and CNN+. At the same time, the combined entity will be the US’ largest legacy TV studio with approximately 30% market share (Source: Bloomberg Industry Intelligence Primer).

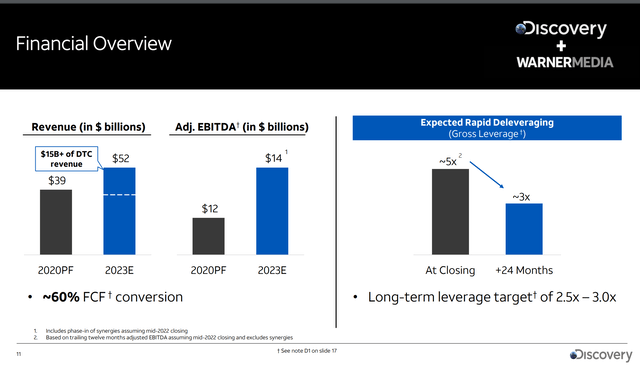

AT&T investor presentation

From a financial perspective, the combined entity is estimated at more than $50 billion in revenues, and a 2023 EBITDA of approximately $14 billion and FCF of $7.8 billion. The company’s guidance for $3 billion synergies might be a stretch as the company indicated $1 billion corporate costs, $1 billion overhead, and $1.5 billion network expenses. Personally, I believe these synergy targets are too ambitious. Or at least I advise investors not to blindly trust the claim, as M&A synergies generally disappoint. It would be prudent to model a $2 billion synergy gain ($1 billion lower).

AT&T investor presentation

The company’s debt position is what I am most concerned about regarding the deal. Total debt is estimated at about $58 billion. With about ~5x gross leverage and ~x2 debt-to-equity fast deleveraging will be key. But in any case, deleveraging will likely take quite some time—perhaps multiple years as the company needs to balance investments in content. That said, as rates are rising, WBD will likely see substantially higher re-funding costs. The company’s cost of debt after-tax, according to Bloomberg Terminal, is currently 3.8%. That said, it is not unthinkable that the company’s funding cost will double. Thus, while the deal sounds great on paper, I see a difficult balancing act for the company to deleverage (1), invest in content (2), meet shareholder expectations/distributions (3).

Although I acknowledge the market’s concerns, WBD’s valuation is just too cheap for investors to not be a buyer. For reference, the one-year forward EV/EBITD is estimated at about x4.5. Most notably, if we compare WBD’s valuation vs company peers, then we find that WBD’s EV/EBITDA multiple is priced at a -63% discount and the P/B multiple is priced at a -60% discount (Source: Bloomberg Terminal, July 22nd).

Recent Developments

Investors should note, however, that the growth and value story has changed significantly for the streaming industry since the Warner Bros / Discovery deal has been announced. Netflix (NFLX) Q1 2022 numbers suggest that the economically addressable market for streaming companies is close to 300 million subscribers, arguably far less than many investors/speculators hoped. Netflix long talked about the potential of 1 billion subscribers, but the company’s current 320 million customer base (adjusted for households sharing passwords) suggests that the market could be only one third of the long-standing target. In that context, NFLX shares sold off significantly and the stock is now down approximately 65% from ATH. Similarly, Disney (DIS) is down about 35%.

Going forward, it will be interesting to monitor how the streaming market is adjusting to the market shifting from growth to value/cash flow. That said, I do trust that the combined entity will eventually reach a 200 million subscriber base by 2025, estimating 70 million Discovery+ users and 130 million for HBO Max. But the profitability and the economics of the streaming vertical remains to be explored.

Residual Earnings Valuation

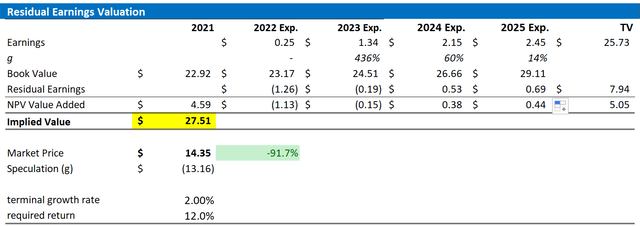

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $0.35, $1.34, $2.15, and $2.45 for 2022, 2023, and 2024, respectively.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 22, 2022. My calculation indicates a fair required return of 12%.

- For the terminal growth rate, I apply 2%, which is conservative given that nominal global GDP growth is estimated at about 3.3%.

Based on the above assumptions, my calculation returns a base-case target price for WBD of $27.51/share, implying material upside of about 90%.

Analyst Consensus EPS; Author’s Calculation

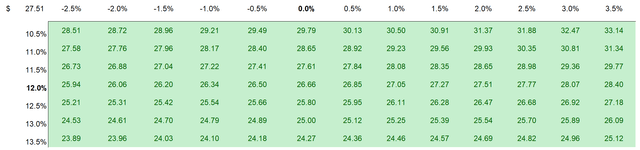

I understand that investors might have different assumptions with regards to WBD’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

As an alternative, investors could also apply a x8.5 EV/EBITDA multiple to WBD’s 2023 EBITDA, in line with industry valuation. If we apply this multiple to an estimated $14 billion, we calculate an EV of $119 billion and an equity value of $61 billion, or approximately $27.75/share (almost 100% upside). If we discount based on a 12% WACC, we calculate a fair valuation of $23/share.

Risks To My Thesis

In my opinion, WBD shares have been significantly de-risked–given that the company now trades at very low multiples and a significant discount to industry peers. However, investors should note a few risks.

First, investors should monitor competitive forces in the streaming industry. While WBD has a strong position in the streaming industry, the company’s competitors including Disney, Amazon (AMZN) and Netflix are arguably equally strong, if not stronger. Moreover, while the “streaming war” may be easing, the economics of the industry are still surrounded by uncertainty.

Second, the integration of the Warner Bros. and Discovery merger is surrounded by significant uncertainty. For example, the integration may be more costly than expected or less successful, meaning that management’s synergy targets might not be met.

Third, arguably most of WBD’s current share price volatility – especially to the downside – is driven by investor sentiment towards stocks and high-debt companies. Thus, it’s likely that WBD stock experiences significant volatility even though the company’s business outlook remains unchanged.

Conclusion

Investing in Warner Bros. Discovery is a deep value play. WBD trades at a 60% discount to an industry that is already trading cheap given negative market sentiment surrounding streaming. Thus, it is no wonder that famed value investor Michael Burry has been attracted to the stock already at levels 30% above current prices. I value WBD stock based on a residual earnings framework, anchored on analyst EPS consensus estimates, and see more than 90% upside. My target price is $27.51/share. Strong Buy.

Be the first to comment