David Ramos

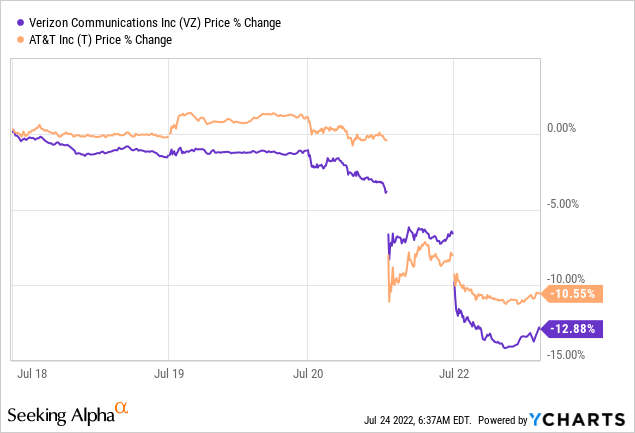

Shares of Verizon (NYSE:VZ) were brutalized after last week’s earnings which I believe creates a buying opportunity for the telecom firm. Verizon skidded 7% on Friday after the company reduced its profit outlook for FY 2022 and indicated that it expected slower growth due to pricing pressures and inflation. Despite weaker free cash flow expectations, I believe the risk profile for Verizon is extremely favorable right now. Since the firm covers its dividend with FCF, I don’t expect Verizon to lower its dividend payments!

Parallels to AT&T, lower free cash flow expectations

AT&T’s (T) shares also skidded last week after the telecom firm lowered its free cash flow outlook for the current year from $16B to $14B due to customers taking longer to pay their bills. Despite the $2B decrease in free cash flow guidance relative to the prior outlook, AT&T’s soaring yield and low FCF valuation factor made AT&T a buy. I explained last week’s events in AT&T: Be Greedy When Others Are Fearful.

Verizon’s earnings card for Q2’22 led to a similar result than AT&T’s: The stock’s bottom fell out.

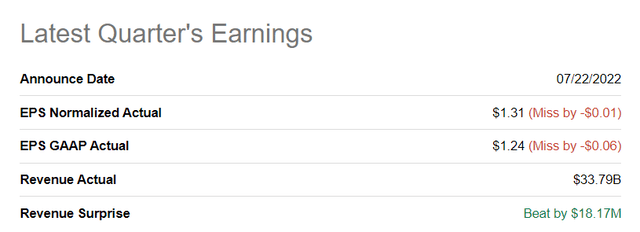

Verizon’s earnings showed a small EPS miss, but the lowered profit outlook for FY 2022 is what set off a major decline in pricing.

Seeking Alpha – Verizon Q2’22 Earnings

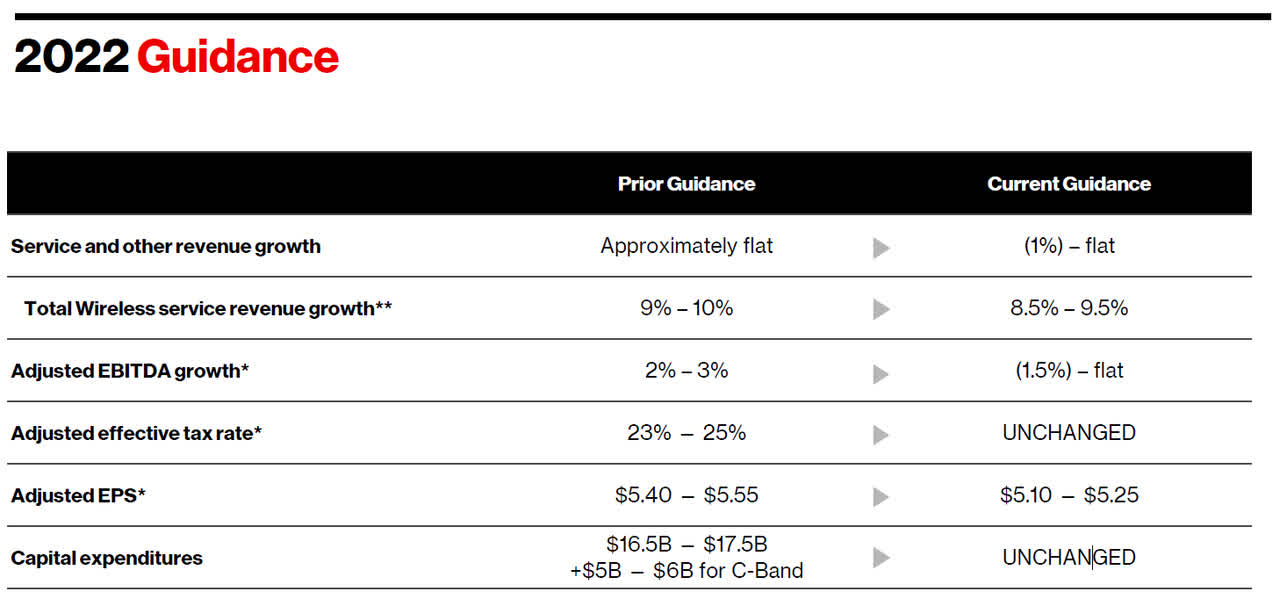

While the US wireless carrier lowered its revenue and adjusted EPS projections for FY 2022, the firm did not give specific free cash flow guidance. What Verizon did give, however, was guidance for its top line growth. Verizon’s previous guidance called for wireless service revenue growth of 9-10% which was down-graded to 8.5-9.5%. Service and other revenue growth is now expected to be slightly negative, (1)% – flat year over year, compared to a flat forecast earlier. Verizon’s adjusted EPS guidance was down-graded by 5.5% to a new range of $5.10-5.25 due to pricing challenges and inflation that is impacting business in a negative way.

Verizon

While Verizon did not give an estimate of free cash flow for FY 2022, we can calculate an estimate based on the down-grade in AT&T’s FCF outlook for FY 2022. AT&T lowered its free cash flow by $2B or 12.5% compared to its previous outlook.

I recently estimated that Verizon has a base level of free cash flow of around $22B with FCF upside coming from Verizon’s 5G roll-out. If we were to apply a (safer) 15-20% discount to this free cash flow estimate — to account for Verizon’s growing top line and FCF risks — than the US wireless carrier could see between $17.6B and 18.7B in free cash flow in FY 2022.

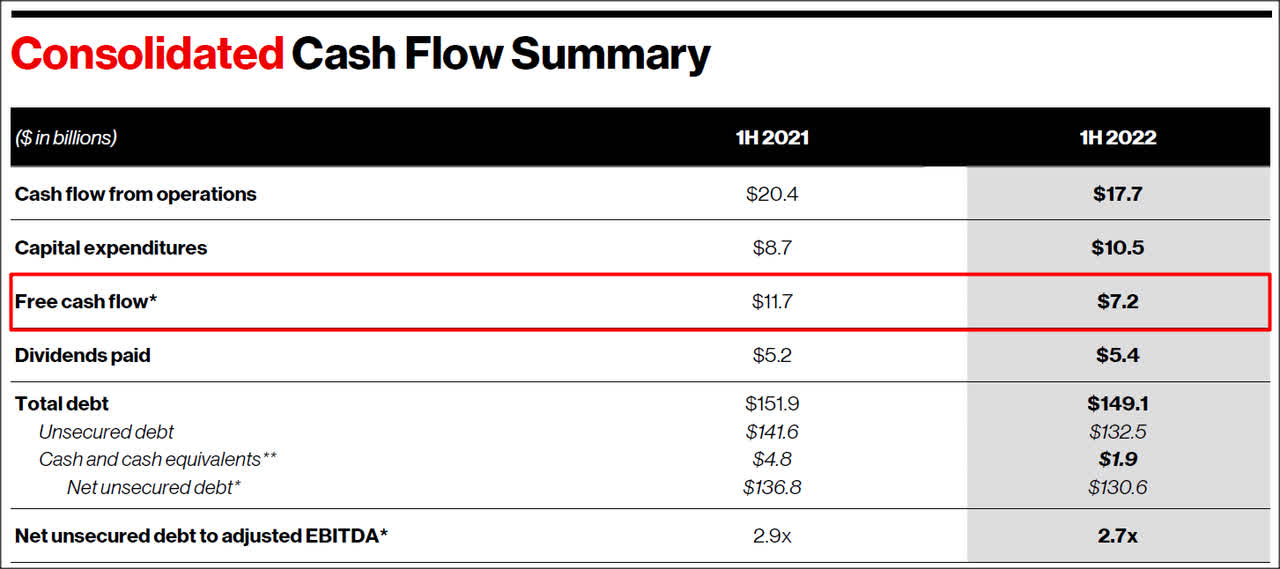

Verizon achieved $7.2B in free cash flow in the first six months of the year, so the wild card is going to be how much free cash flow the telecom firm can secure in the second half of the year.

Verizon

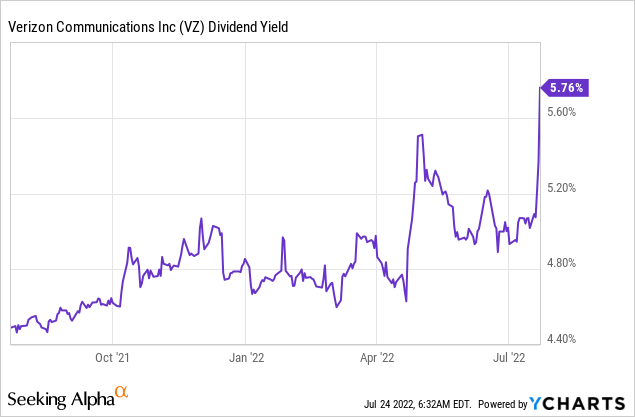

If we were super careful and assumed that Verizon could only about double its H1’22 free cash flow to $15B… even then Verizon would offer a good deal: Based off of low-case estimate of $15B in FCF, Verizon would have a FY 2022 P-FCF ratio of 12.4 X. Because of last week’s decline in pricing, shares of Verizon now have a yield of 5.76%.

Is the dividend at risk?

If free cash flow risks increase then dividend risks also increase, in theory. Because Verizon’s business still generates an enormous amount of free cash flow annually, I don’t see the firm cutting its payout, and a quick calculation supports this: Verizon has 4.2B shares outstanding and pays an annual dividend of $2.56, meaning dividend payments cost Verizon approximately $10.8B annually… which is about 72% of the estimated low-case FCF estimate I derived for FY 2022.

Risks with Verizon

Verizon’s free cash flow risks have slightly increased, but not to an extent that investors have to worry about the dividend. Even with lower expected free cash flow this year, Verizon should be able to cover its dividend payments without any major problems. What I see as bigger commercial risks for Verizon are slowing top line growth and lower margins in the rapidly growing 5G market in the longer term.

Final thoughts

The market lost its mind last week and I believe it totally overreacted to the earnings releases and projections of AT&T as well as Verizon. Both telecom firms were trampled upon with valuations skidding more than 10% last week. The down-graded guidance is a problem for Verizon only in the short term, I believe, and the drop creates a buying opportunity: with a yield of 5.8% and a robust amount of free cash flow set to be generated this year, despite economic headwinds, I believe the stock has become more interesting on the drop, not less!

Be the first to comment