Tryaging/iStock via Getty Images

Investors in Prologis, Inc. (NYSE:PLD) have taken a pummeling in 2022. Year-to-date, the S&P 500 is down a bit over 23% while shares of Prologis have fallen by over 38%. Management provided an upbeat earnings call, and the company beat on the top and bottom line, yet the stock fell over 3% in the day after Q3 results were released.

Undoubtedly, investors question whether warehouse demand will suffer in this economic environment. Those fears were buttressed when Amazon (AMZN) and FedEx (FDX) announced their intent to shutter some existing facilities and to abandon plans to open new warehouses.

However, quarterly results were strong. Furthermore, while the firm is taking some steps to prepare for an economic downturn, management expresses confidence in the company’s prospects.

Current And Prospective Headwinds

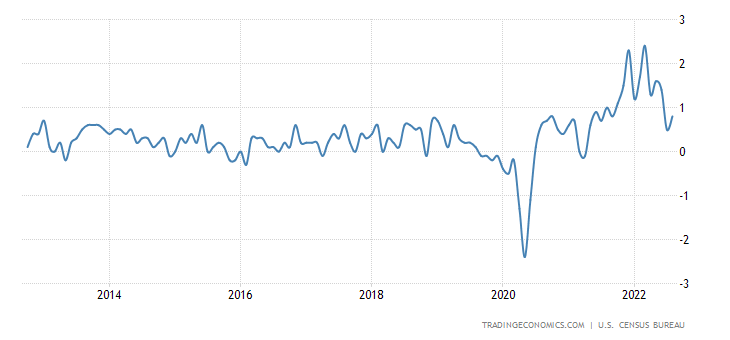

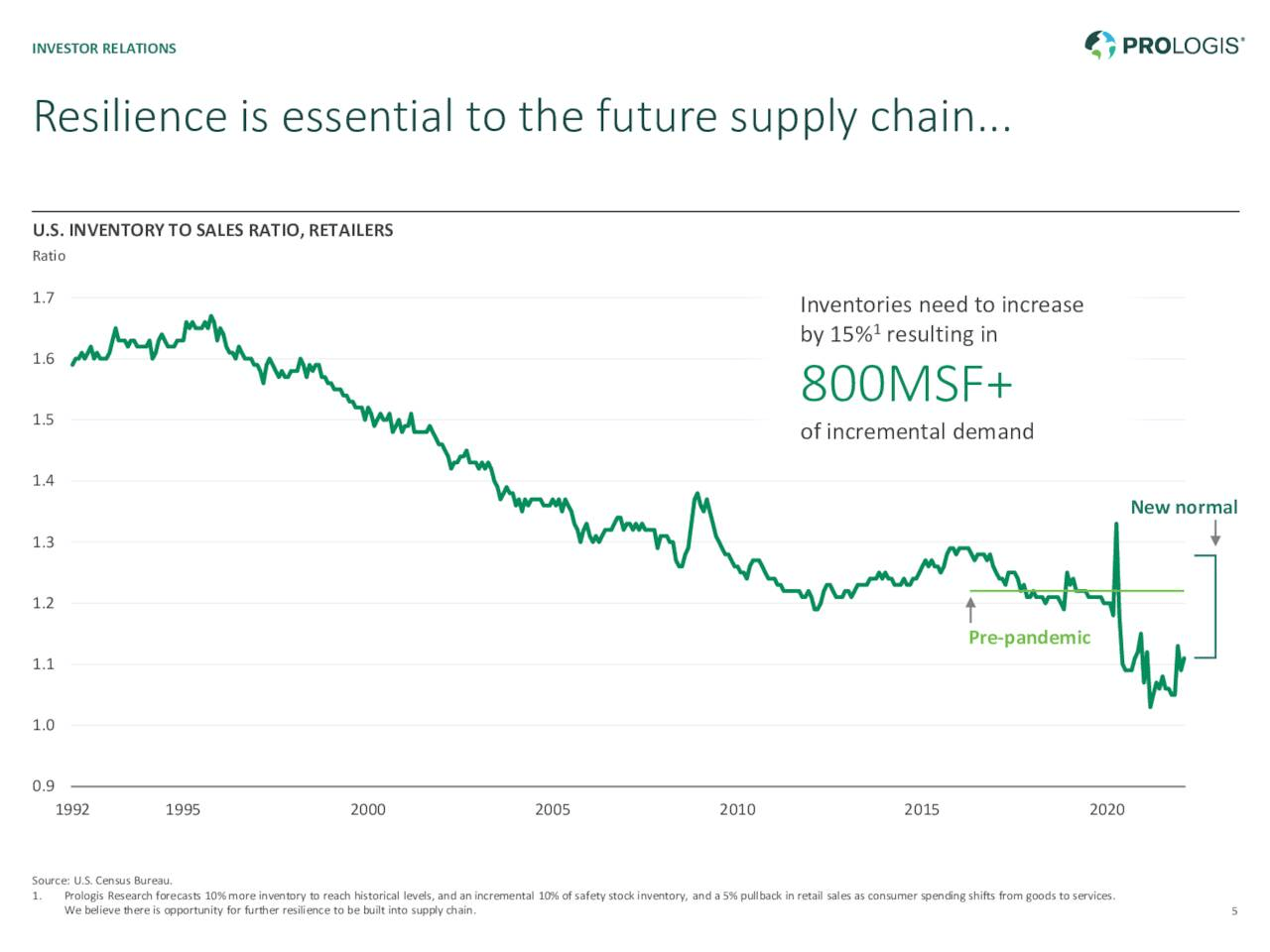

There has been a great deal of focus on the increase in inventories, especially among retailers. Of course, if inventories are too high today, it is logical to assume the need for warehouse space will be lower in the not-too-distant future. However, the following charts place current inventory levels into perspective.

TRADINGECONOMICS Seeking Alpha / PLD Presentation

Although some retailers are reporting excess inventories, others are adapting to supply chain problems by increasing inventory levels.

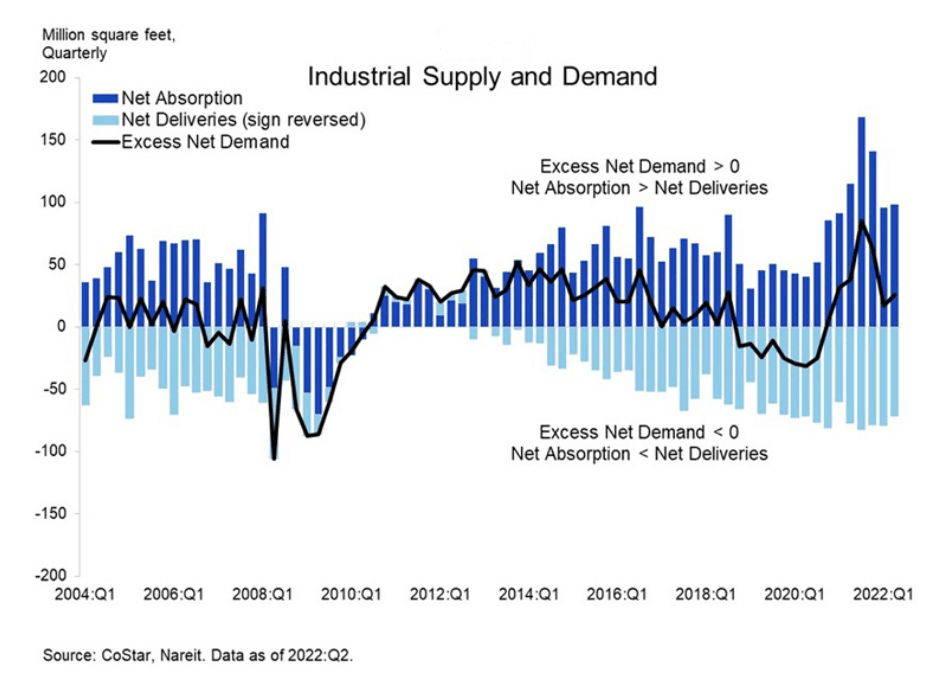

According to a report by Cushman & Wakefield, the quarter that ended in September recorded a net absorption of 108.2 million square feet (MSF) of industrial warehouse space. This indicates there is continuing strong demand.

The industrial market has now posted eight straight quarters in which absorption was above the 100 msf mark. Additionally, new leasing activity hit 163.1 msf in that third quarter, and the U.S. industrial vacancy rate was 3.2%. Those metrics indicate fears that high inventories could increase vacancy are likely unfounded.

I’ll add that closures of FedEx facilities, combined with Amazon’s plans to shutter and/or cancel the build out of 44 facilities and delay the opening of 25 warehouses, also fueled the perception that demand for industrial space was waning. The following exchange between an analyst and the CEO during the Q3 earnings call should put that fear to rest:

Hamid, you mentioned tenants with more mature supply chains have slowed their CapEx spending. Obviously, we’ve seen that in the headlines as well. Are you seeing, though, any givebacks or nonrenewals from those tenants, whether it’s FedEx or Amazon or others? And specifically, what are the tenants or industries that are backfilling this gap in demand?

… We have 0 givebacks on Amazon. Zero. We thought we were going to have 2 out of like 160, we have 0. And they continue to take new space from us. So I don’t know what all this excitement is all about, but we haven’t seen it in the marketplace. They were on a tear in 2020 and ’21, and they probably overcommitted to space, and they just reeled that back a bit. But they talked about 30 million feet coming online. We don’t think it’s even going to be 10 million feet and none of it is in the spaces that we have. So that’s Amazon.

FedEx is consolidating some of its ground operations with airport operations. We’re going to be a beneficiary of that. And we’re not going to lose any FedEx business as a result of that. And we’re in regular conversation with these people. So those 2 customers specifically, no issue, and we have vetted this about as best as anybody can.

A longer term, and in my estimation, a more credible threat lies in the fact that industrial construction hit a record high of 716.9 msf in the third quarter.

Prologis Q3 Earnings Results Reveal A Great Deal

Third quarter results, released on 10/19, beat on the top and bottom line. Core FFO of $1.73 beat consensus by $0.06, and revenue of $1.75 billion, up over 48% year-over-year, easily outpaced analysts’ $1.13 billion forecast. That figure also compares well to the $1.18 billion in revenue PLD reported in Q3 of 2021.

Adjusted EBITDA of $1.61 billion also outpaced the prior year’s quarter EBITDA of $1.1 billion. Cash same-store net operating income (NOI) hit a record 9.3%, and average occupancy was 97.4% for the quarter.

The only negative in the report was a minor change in management’s guidance for core FFO. That figure dropped from a range of $5.14 to $5.18 down to a range of $5.12 to $5.14.

A few highlights from the earnings call indicate demand for logistics space is strong.

In Europe, PLD reported record results with an occupancy rate of 98.6%.

In Mexico and Brazil, occupancy rates were over 98%

Rents are forecast to increase 28% this fiscal year.

The following excerpt from the earnings call addresses e-commerce related demand:

… we’re seeing e-commerce levels in our own portfolio just ahead of where we were pre-COVID. The big difference is Amazon is not a part of that this quarter. They’re temporarily pausing, and we’re seeing 122 other customers, not named Amazon, driving e-commerce leasing at levels we saw pre-pandemic. I think that’s the big driver, the big takeaway for the segments that are supporting this backfill.

Mike Curless, Chief Customer Officer

Revisiting Q2 results provides a bit more color. During that quarter, occupancy, leasing and rent rates all hit record highs.

Prior to COVID, the average rate at which leases expiring within 12 months were pre-leased or were in negotiation was 56%. During Q2, 71% of expiring leases were pre-leased or in negotiations.

It is important for investors to note that overall industrial demand in the U.S. is not necessarily in sync with the supply/demand found within the geographic footprint of Prologis.

For example, in the coastal U.S. markets, where PLD generates over 50% of the firm’s global NOI, vacancies are 1.7%.

Management previously noted the supply/demand of the firm’s industrial properties in Dallas, Indianapolis and Phoenix bear watching. However, the situation there is not of great concern.

A Broader View Of Logistics Real Estate

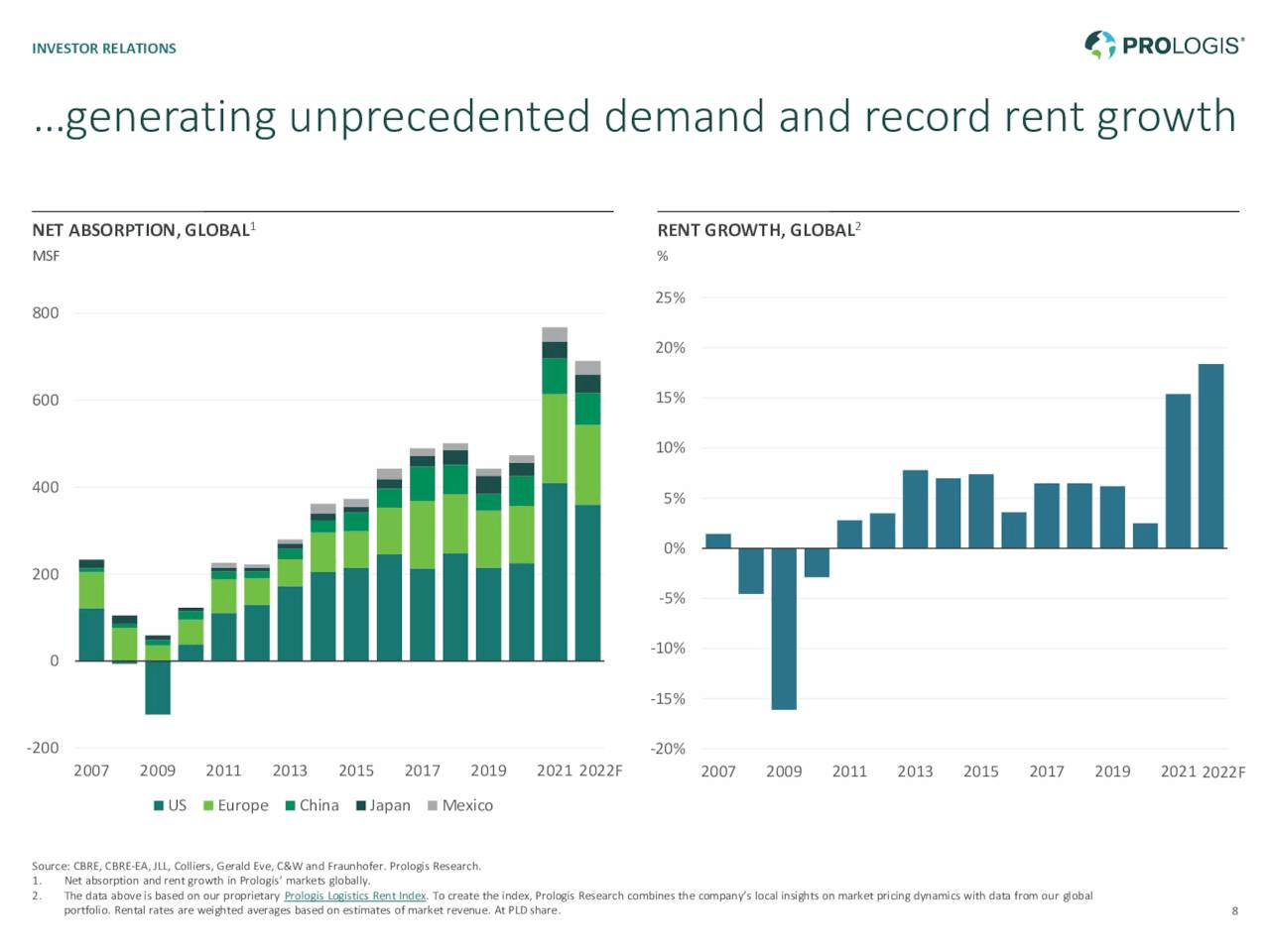

In the calendar second quarter, demand outpaced supply in the industrial REIT space. Net absorption of 98 msf outstripped supply of 72 msf. This was the seventh consecutive quarter that logistics supply has not met demand.

Every region of the U.S. reported vacancy rates below 4%. The western region posted vacancy rates of 2.5%. In the U.S. rental rates for the industry increased at an annual rate of 22%, the strongest year-over-year growth rate ever recorded.

Yahoo!

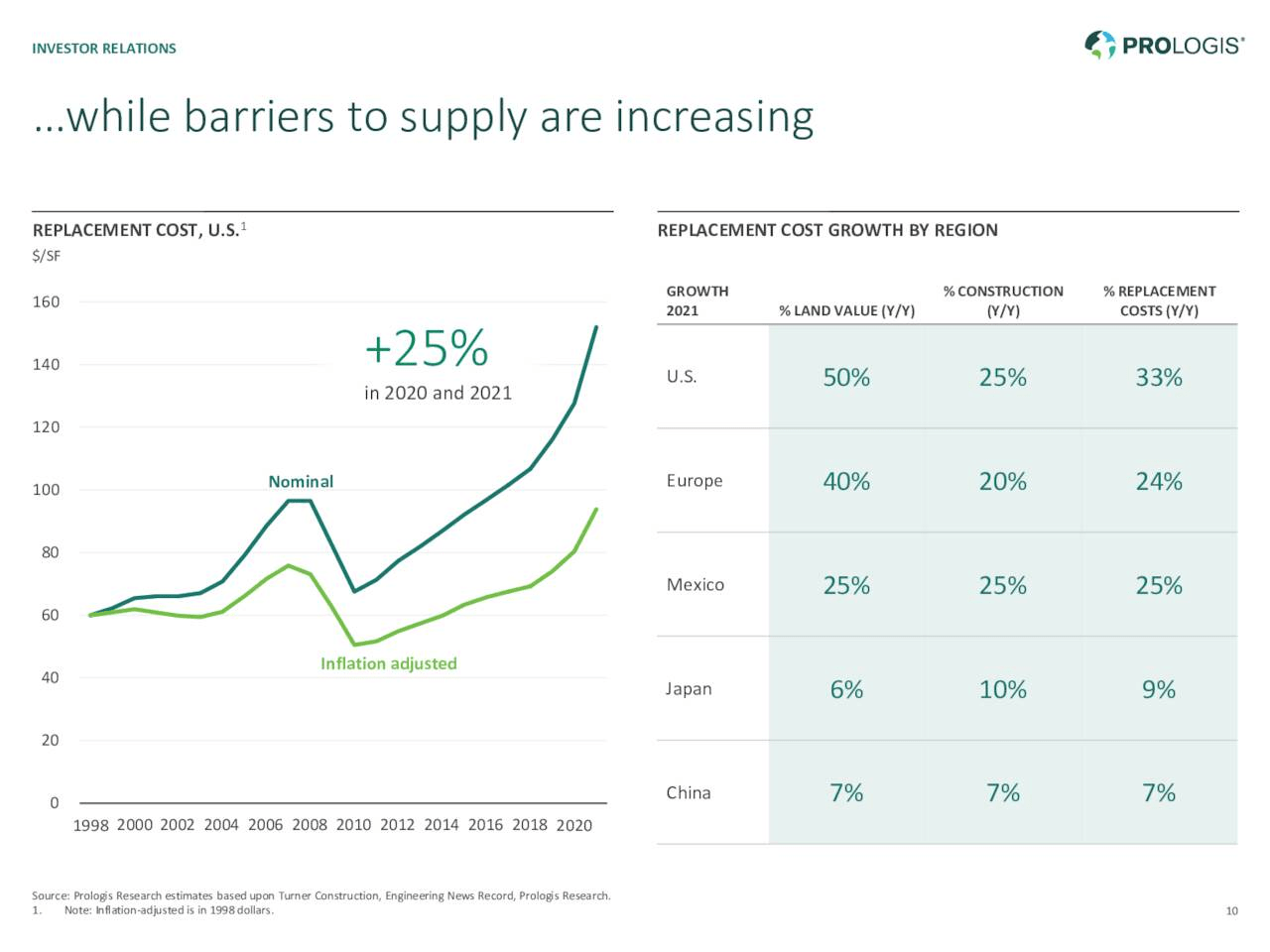

Management has noted construction costs are up roughly 50% and land costs are also escalating. This should act to blunt supply.

PLD Presentation/ Seeking Alpha

Prologis Debt, Dividend, and Valuation

S&P rates the company’s debt as A/ positive. Moody’s has a rating of A3/ positive.

As of the end of September, PLD’s weighted average interest rate on its share of total debt was 1.9% with a weighted average term of 9.6 years. Only 12% of the company’s debt is floating. PLD has no significant debt maturities until 2026.

The current yield is 2.99%. The AFFO payout ratio is 66.69% and the 5- year dividend growth rate is 11.50%.

Prologis currently trades for $102.01 per share. The average one-year price target of the 16 analysts following the REIT is $149.41. The average price target of the 9 analysts that rated the stock during the month of October is $134.33. Every analyst rates the REIT as a Buy or a Strong Buy.

To my knowledge, no analyst has rated PLD since Q3 earnings.

Is PLD Stock A Buy, Sell, Or Hold?

The greatest concern I have regarding an investment in PLD is the economic climate. Investors should note that within the next five years, 56% of the company’s leases will expire. If the economy experiences a prolonged downturn, many of those leases could be locked in at rates well below those that prevail in the current environment.

The flip side of that coin is that roughly 16% of the REIT’s leases are set to expire between now and the end of 2023. It appears likely that the robust increases in rent will continue over the short to medium term. The multiyear nature of the contracts locks in a guaranteed increase in revenues.

Furthermore, current vacancy levels are significantly higher than those that preceded past economic downturns. Because current vacancy rates are very low, if we assume industrial REITs experience the same net absorption rates seen during the Great Recession, vacancy rates would only fall to a mid-nineties level.

Seeking Alpha / PLD Presentation

Furthermore, when considering projected vacancy rates and overall demand, it is important to consider that many of Prologis’ facilities are in areas with constrained supply. In other words, the company’s higher quality properties support greater demand.

The acquisition of Duke Realty also added 153 million square feet of prime industrial space to PLD’s portfolio. The Duke properties ended the quarter with 99% occupancy rates. Management guides for a first year FFO accretion of $0.20 to $0.25 from that deal.

I see long-term upside for Prologis. I note the shares are currently trading less than $3 above those seen in the pre-COVID market. However, PLD is a much stronger company than in early 2020.

While I would not be surprised to see the shares drift lower, I nonetheless view this as an opportunity to invest in an outstanding company at a reasonable valuation.

I rate PLD as a Buy.

I am adding to my position in small tranches.

Be the first to comment